Oh yeah. Nothing says class like Binaca! Anyway, all four of the aforementioned products are in HRB’s brand portfolio. That portfolio also includes the Coast, Firefly, LA Looks, Rave, Reach, Salon Grafix, SGX NYC, Thicker Fuller Hair, and the Zero Frizz brands; the most recent portfolio addition was, in late 2016, Dr. Fresh, which sounds like a Marvel superhero but is an oral-care brand focused on value toothbrushes and the like. This acquisition marked an expansion away from HRB’s historical focus on primarily skin cleaning and hair care products in the “value” segment. HRB describes their business model as follows:

“Given their focus on value price points, the goal of the Debtors’ early strategy was to minimize costs, which they did by concentrating supply and optimizing logistics to leverage unit volumes to create a low cost structure with fully outsourced manufacturing and logistics primarily in the United States. Said differently, the Debtors’ original business plan revolved around low-cost, low-margin, and high-volume product distribution.”

Interestingly, the gangbusters economy has not been so gangbusters for HRB and, by extension here, CD&R’s equity. HRB, therefore, has recently pivoted:

Given that the Company’s hair care and skin cleansing brand portfolio was concentrated in product segments (e.g., bar soap and hair spray) and price points (e.g., opening price points and value) that were shrinking due to shifting consumer preferences and a strong economy that led to a reduction in shelf space allotted to value priced products, the Debtors have focused recently on transformative innovation to drive topline growth in growing segments (e.g., natural products, texturizers, and body wash) at slightly higher price points. The company has also invested in capability and capacity across the organization to elevate the speed it can bring products to market, its customer service, and its performance management. These tactics, in conjunction with their recent acquisitions, have positioned the Debtors well for sustainable, profitable growth.

Now, if that last bit about razzle dazzle change and high prospects seems like a sales pitch to you, well, give yourself a pat on the back because that is precisely the point of this chapter 11 filing. And the first day filing papers reflect this: the First Day Declaration is replete with chest-pounding talk about how great HRB’s asset-light model is, how large the total addressable market is for their products, how diversified and recognizable their brands are, and how deep their customer relationships are. With respect to the latter, HRB touts its key customers: “Walmart, Dollar Tree, Dollar General, Walgreens, Kroger, Family Dollar, 99 Cents Only Stores, CVS, HEB, Wakefern and other blue chip retailers.” UM, WOULD THESE BE THE VERY SAME CUSTOMERS WHO ARE TAKING AWAY HRB’S SHELF SPACE? 🤔😜

Someone will have to buy into all of ⬆️ and disregard HRB’s actual recent performance — performance that has sucked sh*t to the tune of $301.1mm in net sales and a $62.5mm net loss (and $35.5mm of adjusted EBITDA…adjusted for what we wonder?). We would love to see the data room: given increased emphasis on higher quality product at affordable prices, among other factors, we bet the numbers are showing disturbing quarterly declines but that’s just a guess.

HRB highlights the following as events that led to its chapter cases:

Increased competition in the personal care industry and a shift away from its value brands;

An inability to account for increasing commodity costs when marketing to value customers;

A late shift to higher-margin products;

An education challenge in that HRB will now need to educate the consumer about its newer, higher-margin brands — something that has and will elevate marketing costs; and

A soap supplier (a) jamming HRB with higher costs and HRB not having replacements at the ready and (b) failing to deliver the supply HRB needed.

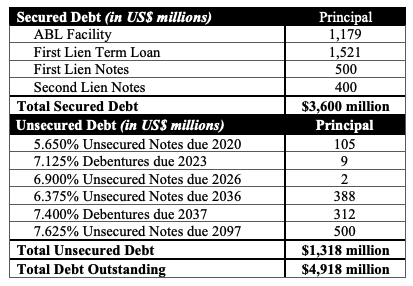

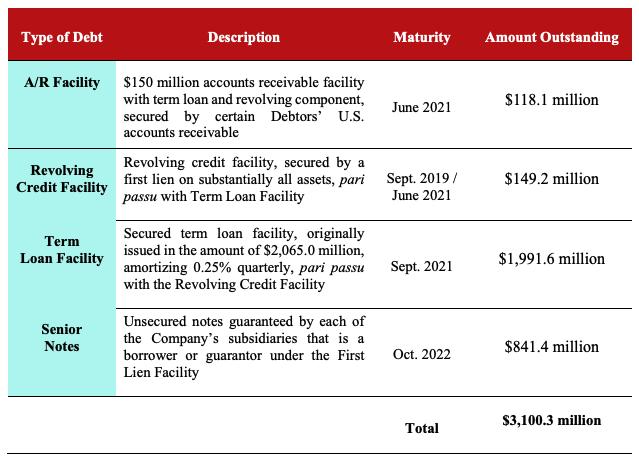

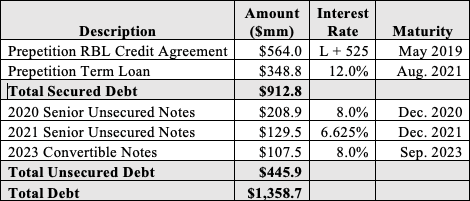

Of course, there’s also the capital structure. HRB has over $500mm of debt split between a $50mm revolving credit facility, a $213.4mm term loan, and $261mm of '25 8.875% senior unsecured notes (as well as $28.7mm of trade debt).

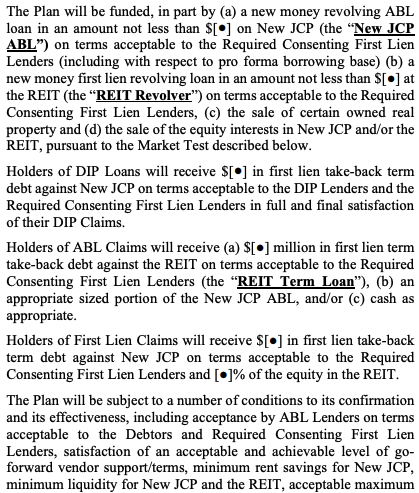

Tellingly, HRB wasn’t able to get its lenders on board with a restructuring transaction. Per HRB:

…the Debtors explored (1) a consensual restructuring among the Debtors, the Prepetition First Lien Lenders, and the Noteholders; (2) a plan of reorganization sponsored by the Prepetition First Lien Lenders; (3) a toggle plan with a focus on a sale of the Debtors’ assets with a reorganization backstop; (4) a chapter 11 sale process with the Prepetition First Lien Lenders acting as a stalking horse bidder; and (5) a chapter 11 sale process funded by a debtor-in-possession facility provided by the Prepetition First Lien Lenders or some subset thereof.

The Debtors’ initial goal was to effectuate a consensual restructuring out of court, and the Debtors engaged with both the Prepetition First Lien Lenders and the Ad Hoc Group to explore this possibility prior to commencing the Sale Process … in September of this year. As part of this, the Debtors provided the Ad Hoc Group with a significant amount of due diligence and held a number of meetings with the Ad Hoc Group’s professionals. Although the initial discussions did result in the Ad Hoc Group providing the Debtors with an initial set of potential terms for a restructuring, negotiations ultimately dwindled such that the Debtors decided they needed to pivot to other restructuring alternatives.

Now, it’s hard to say, from the outside looking in, what this all means. Getting this kind of deal done out-of-court was — depending on how concentrated the debt holdings are — probably unrealistic. It sounds like the lenders lacked not only the numbers to get something done but the conviction. There’s no restructuring support agreement here. There’s not even a stalking horse bidder. So, none of that is great.

On the plus side … maybe?… an earlier DIP commitment for $70mm has been decreased to $40mm ($20mm of which is a roll-up of prepetition amounts). HRB claims that this a reflection of the “liquidity position and forecasted liquidity needs over the course of the…cases” which would suggest that liquidity has improved since first discussing DIP financing back in August. Alternatively, it could mean that the DIP lenders are skittish given what appears to be a significant gap in the perception of value. The DIP matures in four months — presumably enough time to allow a sale process to play out through the beginning of February. Now the pressure is on PJT Partners Inc. ($PJT) to deliver a potential buyer.

*****

One final thing to note here: the petition lists HRB’s top 50 creditors and, of that 50, only a handful are trade creditors. Typically you’d see the indenture trustee listed as the top creditor, subsuming the entirety of the outstanding debt issuance outstanding. Here, HRB individually listed each of the noteholders. This could mean that the company has, for the most part, kept its trade current, relegating a very small subset to unpaid status. Indeed, those few creditors listed are owed more than 50% of the outstanding trade debt.

Furthermore, the company filed a critical vendor motion seeking to pay $26.5mm in critical vendor, shipper, 503b9 and foreign vendor claims. That conveniently wouldn’t leave much of an unsecured creditor body outside of the notes.

Capital Structure: $50mm RCF & $213.4mm TL (BMO Harris Bank NA), $261mm '25 8.875% senior unsecured notes (Wilmington Trust)

Professionals:

Legal: Young Conaway Stargatt & Taylor LLP (Robert Brady, Edmon Morton, Ian Bambrick, Allison Mielke, Jared Kochenash) & Debevoise & Plimpton LLLP (M. Natasha Labovitz, Nick Kaluk III)

Financial Advisor/CRO: Ankura Consulting Group LLC (Benjamin Jones)

Investment Banker: PJT Partners LP (John Singh)

Claims Agent: Prime Clerk LLC (*click on the link above for free docket access)

Other Parties in Interest:

Equity Sponsor: Clayton Dubilier & Rice LLC

DIP Administrative Agent & Agent under the Prepetition First Lien Credit Agreement: BMO Harris Bank NA

Legal: Winston & Strawn LLP (Daniel McGuire, Gregory Gartland, Dov Goodman) & Womble Bond Dickinson US LLP (Matthew Ward, Morgan Patterson)

Indenture Trustee for the 8.875% ‘25 Senior Notes: Wilmington Trust NA

Ad Hoc Group of 8.875% ‘25 Senior Noteholders