New Chapter 11 Bankruptcy Filing - Stein Mart Inc. ($SMRT)

Stein Mart Inc.

Man. This story sucks. Stein Mart Inc. ($SMRT), a publicly-traded specialty off-price retailer with 281 stores across the Southeast, Texas, Arizona and California is the latest retailer to file bankruptcy (along with two affiliates).

To set the stage, imagine Han and Lando taking a fun little ride on a desert skiff. Suddenly a riot breaks out and amidst the confusion Lando falls off the skiff. Luckily, Han is able to grab Lando’s hand so that Lando doesn’t plummet into the gnarley tentacles of some strange sand beast that randomly happens to be there. As Han pulls Lando up out of reach of the beast, all of the sudden some crazy space virus flows through the airspace and smacks Han straight in the lungs. As he clutches his throat struggling to breathe, he releases Lando who consequently hurls straight down towards the beast and suffers a horrific death.

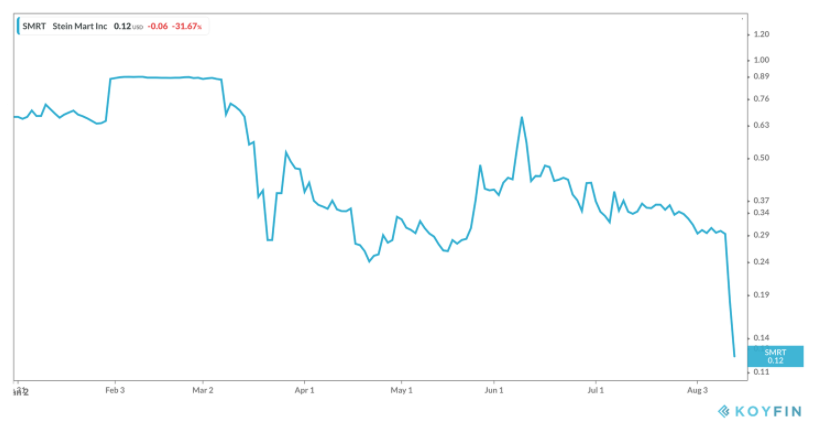

Now replace (a) Han with Kingswood Capital Management LLC, (b) Lando with Stein Mart, and (c) the “crazy space virus” with COVID-19 and you’ve basically got the story of Stein Mart’s collapse into bankruptcy court. Like many other retailers in this macro climate, Stein Mart was teetering pre-COVID. Sales have been on the decline since 2016. But then in January, Kingswood — along with an entity managed by the Chairman of the company — offered a roughly 20% premium over SMRT’s then-stock price ($0.90/share) to take Stein Mart private. Stein Mart, which had been on distressed watch lists around that time, seemed to be on the receiving end of a much-needed and wildly opportune lifeline. Of course, COVID ended that. Take a look at this mind-boggling decline in YOY performance:

Ab. So. Lutely. Brutal. Just brutal.

Kingswood agreed. Per the company:

…on April 16, 2020, the Merger Agreement was terminated prior to closing because the COVID19 pandemic forced the Company to close all of its stores and the Company was unable to satisfy the minimum liquidity closing condition in the merger agreement.

Was that the definitive end of the deal? No! The parties continued to discuss new deal parameters but then we, as a country, couldn’t get our sh*t in order. With the country averaging 1000+ deaths a day and tens of thousands of new daily COVID infections, Kingswood got skittish:

The Company has subsequently engaged in discussions with Kingswood regarding sale of the Company as a going-concern in recent months pursuant to a bankruptcy sale; however, a transaction presently appears unlikely given the COVID-19 resurgence.

The resurgence is notable because the company has a significant number of stores in Florida, Texas and California. Consequently,…

The Company’s updated financial projections, following the July resurgence of COVID-19, indicated that the Company would not have sufficient liquidity to continue operating the business in the ordinary course consistent with past practice.

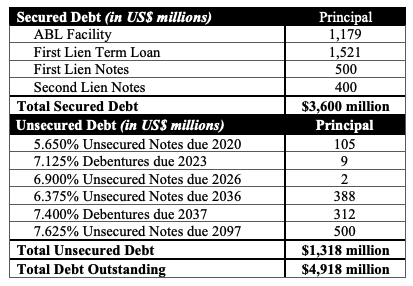

So now the company is liquidating. The company projects $250mm in gross recovery from the liquidation of inventory, equipment, fixtures, leases IP and other assets. As of the petition date, it owes its senior secured lender, Wells Fargo Bank NA ($WFC), $84mm; it also owed its term lender, Gordon Brothers Finance Company, $35mm. Tack on administrative expenses for the professionals administering the case and recoveries for those creditors owed a sum total of $770mm in total liabilities begins to look a bit bleak.

*****

A couple of additional notes:

First, this company appears to have been addicted to factoring. Among the companies top six general unsecured creditors are CIT Commercial Services, Wells Fargo Trade Capital Services, and White Oak Commercial Finance.

Second, you can add SMRT to the list of companies that tapped PPP funds yet couldn’t avoid a bankruptcy filing. It received $10mm from Harvest Small Business Finance LLC.

Third, we’re back to borderline collusion among the liquidation firms. The company’s financial advisor issued RFPs to five liquidation consultants. It received two bids back: one from SB360 Capital Partners LLC and one from a Hilco Merchant Resources-led joint venture that included three — that’s right, three — competitors. Per the company:

The Debtors are of the view that in the current environment, where numerous large retailers are being simultaneously liquidated, joint venture liquidation bids are common because a single liquidation firm may not have the resources to staff and manage the entire project. (emphasis added)

Said another way, the retail industry is such an utter dumpster fire right now that liquidators simply don’t have the bandwidth to manage mandates like these on their own (or so the story goes).

While liquidation sales launch, the company will also seek to sell its leases and IP. Except…

…substantial doubt exists as to whether any buyers will be found for leases given the current depressed condition of the retail real estate market.

And they…

…do not anticipate the sale of intellectual property will produce substantial value.

Right. In case you haven’t noticed, the rubber meets the road with these retailers with the IP. That’s why there was the law suit in the Neiman Marcus matter. That’s why there was the asset stripping transaction in the J.Crew matter. But Stein Mart? IP? Brand? Hahahahaha. The company’s bankers tried selling this turd for over 2.5 years. The only buyer was Kingswood, a small LA-based PE fund with a portfolio of four companies and, well, Stein himself. The IP only had value to him. Go figure. And this is after three — yes, three — separate sale and marketing processes.

Is there a chance a buyer emerges from the shadows? Sure. Miracles happen. If not, Wells and Gordon Brothers will be fine. The professionals will get paid. The unsecured creditors will get hosed. Equity will…well forget about it. At least the equity market is finally getting these right (though reasonable minds could certainly question why the stock is trading as high as it is):

The greater likelihood is that this sucker ends in structured dismissal or a conversion to chapter 7.

It’s crazy. Eight months ago the company was headed for a new chapter. Instead the book shut closed.

August 12, 2020

Jurisdiction: M.D. of FL (Judge Funk)

Capital Structure: see above

Company Professionals:

Legal: Foley & Lardner LLP (Gardner Davis, John Wolfel, Neda Sharifi, Richard Guyer, Mark Wolfson, Marcus Helt)

Financial Advisor: Clear Thinking Group (Patrick Diercks)

Liquidators: Hilco Merchant Resources LLC, Gordon Brothers Retail Partners LLC, Great American Group LLC, Tiger Capital Group LLC, SB360 Capital Partners LLC

Claims Agent: Stretto (Click here for free docket access)

Other Parties in Interest:

RCF Lender: Wells Fargo Bank NA

Legal: Otterbourg PC (Daniel Fiorillo, Chad Simon) & Smith Hulsey & Busey (John Thomas, Stephen Busey)