MobiTV Inc.

On Monday, Emeryville, California-based MobiTV, Inc. and an affiliated debtor filed for chapter 11 bankruptcy in the District of Delaware. MobiTV is “a creative thinking technology company making TV better.” Which is funny because we’re willing to bet that literally nobody thinks about MobiTV when they think about whether they enjoy their television-watching user experience. Anyway, what that actually means is MobiTV sells a white-label software application to cable providers that allows consumers to stream programming on (i) streaming devices like Roku, Apple TV, Amazon Fire TV, XBox or (ii) a smart TV, without the need for a set-top cable box. Key customers include T-Mobile USA Inc. ($TMUS) and over 120 cable/broadband television providers to deliver content to over 300k end user subscribers. In other words, if you’re streaming HBO via T-Mobile, your experience may very well be powered by MobiTV.

MobiTV has been around since 2000 and had gone through several shifts in its fortunes and business model. In 2020, MobiTV generated $13M in revenue with an operating loss of approximately $34M. That is a long fall from grace for a company that filed for an IPO in 2011 with reported 2010 sales of $67M. At the time, MobiTV was entirely focused on providing licensed TV programming to the personal devices of customers on wireless networks with AT&T Inc. ($T), Sprint, and T-Mobile accounting for almost all of the company’s revenues. MobiTV had raised over $110M from investors like Menlo Ventures, Redpoint Ventures, Adobe Ventures, and Hearst Ventures.

But despite its rosy trajectory, MobiTV withdrew its IPO filing a few months later citing unfavorable market conditions. In hindsight, there were obviously deeper problems with the business model. Broadcast TV viewing on mobile devices failed to take off in the way the company predicted and MobiTV pivoted away from serving wireless carriers.

Its new target customer was midsize cable providers. Set-top boxes have long been at the center of consumers interactions with cable providers. But these boxes have plenty of drawbacks:

Pay-TV providers (and their consumers) are looking for a way beyond set-top boxes, which can be expensive for consumers to buy, costly to maintain for the pay-TV providers and often limited in their functionality. Their clunkiness, in fact, has made them ripe for disruption, and many now opt for lighter options like Fire TV or Apple TV to bypass those services altogether. In other words, pay-TV providers need to find other routes to providing services to customers that can compete better with the newer generation of video services. (emphasis added)

MobiTV saw the shift towards streaming devices and smart TVs and aimed to position itself as a “television as a service provider” to midsized cable providers like C Spire, DirectLink, and Citizens Fiber. These companies lack the R&D budgets of the likes of Comcast Corporation ($CMCSA) to invest in user interface and software applications in their set-top boxes. In 2017, MobiTV raised $21M from Oak Investment Partners and Ally Bank ($ALLY) (at a reported ~$400M valuation!) to develop its MobiTV ConnectTM Platform, “a product for pay TV and on-demand TV providers to stream broadcast TV and offer other services, like catch-up and recording, without the need of a set-top box.”

The idea was to capture some of the “customer ownership” that was slipping from cable set-top boxes to streaming devices and services. In 2019, MobiTV raised $50M more from Oak Investment Partners and Ally Bank as well as Cedar Grove Partners to fund further growth. At the time, MobiTV had about 90 cable providers signed up as customers.

Middlemen can make good money and at first glance it seemed like MobiTV might have been able to carve out a position for itself. MobiTV offered cable providers a small way to stem the tide of cord cutting and the proliferation of streaming services like HBO Max, Netflix Inc ($NFLX), Hulu, and the rest. As TechCrunch laid out, “The pitch that MobiTV makes to pay TV providers goes something like this:”

…set-top-box-free pay TV services gives operators a wider array of channels and potentially more flexibility in how they are provisioned. At the same time, a solution like MobiTV’s potentially lowers the total cost of ownership for providers by removing the need for the set-top boxes.

That’s not to say that some of its customers are not using both, though: they can provide a certain set of channels directly through boxes, and the MobiTV service gives them the option of having another set that are offered on top of that.

By 2020, MobiTV’s customer base had grown to about 120 midsize cable TV operators as well as legacy T-Mobile customers. Revenue was growing and its subscribers and customers bases were both increasing. So what the hell happened here? 🤔

An agnostic software solution for cable providers to capture some of the shift towards streaming? Coupled with more people stuck at home from a pandemic? If this product were ever going to work, one would think it would have been during the last year. From the First Day Declaration:

That’s the entirety of section D. Maybe we are dense but it would be interesting to know what exactly about the COVID-19 pandemic and related stay-at-home orders materially impaired the Company’s growth opportunities. Seems like that should have been good for business, no?

But we can speculate.

As every content provider has rolled out their own streaming service over the last twelve months, MobiTV was probably in the worst position in the entire television streaming value chain. On the supply side, content providers are focused on promoting their own streaming services and have little reason to give any sort of pricing concessions to a niche service provider like MobiTV. This surely kept MobiTV’s licensing costs at an elevated level.

On the demand side, consumers likely were not calling in to their cable providers demanding MobiTV considering they could get the same content with a $30 Roku, their streaming subscriptions, and their broadband bill. Cable providers apparently were willing to pay for the service, but not enough to keep the company from losing money.

After 20 years of trying to figure out what its business model was, MobiTV finally threw in the towel and management took COVID cover.

The “tell” that the business issues were more elemental than COVID? The fact that the company has been operating under a series of 17 amendments and forbearance agreements.

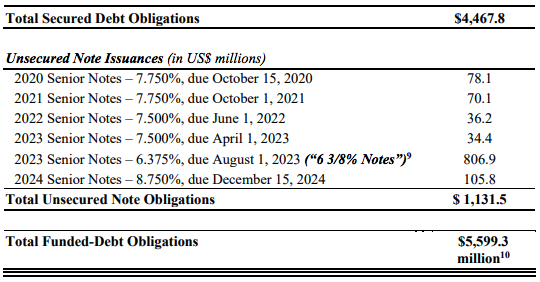

At the time of its Ch. 11 filing, MobiTV had ~$25M of debt obligations, owed entirely to its sole pre-petition secured lender, Ally Bank.

In 2017 Ally Bank provided MobiTV a $10M term loan as well as a $5M revolving credit facility which was fully drawn. The original maturity of these loans was February 3, 2019, but following the aforementioned amendments and forbearance agreements, the maturity date was pushed back to January 2021. To fund the business in the interim, Oak Investment Partners threw good money after bad, underwriting three Subordinated Convertible Promissory Notes on August 6, 2020 ($4mm); December 14, 2020 ($1mm); and December 30, 2020 ($0.3mm). As a condition to one of Ally Bank’s credit amendments, MobiTV engaged FTI Capital Advisors LLC to evaluate strategic alternatives. A subsequent marketing effort came up empty: the “alternatives” were non-existent.

Consequently, on January 29, 2021, MobiTV and Ally Bank entered into another amendment and forbearance. T-Mobile — the customer most reliant upon the MobiTV’s services — provided $2.5mm in bridge financing lest they upset thousands of customers right around Super Bowl time. On February 12, 2021, T-Mobile agreed to provide an additional ~$2.3mm and Ally Bank agreed to forbear until February 26, 2021.

Following negotiations with Ally Bank and T-Mobile, the interested parties concluded that a sale process should be implemented through the filing of chapter 11. An affiliate of T-Mobile, TVN Ventures, LLC, has committed to a $15mm DIP credit facility (12%), junior to the pre-existing pre-petition Ally Bank position. As of this writing, management is still seeking a stalking horse bidder to backstop the sale process.

At $13mm of revenue with an operating loss that high, there’s a very good chance that T-Mobile knows it’s buying this thing with that DIP commitment.