Almost exactly a month ago we asked “Is Brookstone Headed for Chapter 22?” and wrote the following:

Go to Brookstone’s website for “Gift Ideas” and “Cool Gadgets” and then tell us you have any doubt. We especially liked the pop-up asking us to sign up for promotional materials one second after landing; we didn’t even get a chance to see what the company sells before it was selling us on a flooded email inbox. Someone please hire them a designer.

On Friday, Reuters reported that the company has hired Gibson Dunn & Crutcher LLP(remember them?) to explore its restructuring options. What’s the issue? Well, retail. Need there be any further explanation?

The company has roughly 120 stores (20 are in airports), approximately $45mm of debt and a Chinese sponsor in Sanpower Group Co Ltd.

This is a big change from when it first filed for bankruptcy in April 2014. At the time of that filing, the company had 242 stores and approximately $240mm in debt. The company blamed its over-levered capital structure for its inability to address its post-recession challenges. It doesn’t appear to have the same excuse now.

Upon emergence, it reportedly still had 240 stores. Clearly the company ought to have used the initial bankruptcy for more of an operational fix in addition to its balance sheet restructuring. While this could be a costly mistake, the company’s sponsor is a bit of a wild card here: Chinese sponsors tend to be more disinclined to chapter 11 proceedings than American counterparts. Will they write an equity check then?

Well, we now have our definitive answers. Yes. The company filed for bankruptcy earlier today. And whether Sanpower was disinclined to file or not, well…it’s in bankruptcy. And, it will not, at least not as of now, be writing an equity check.

The New Hampshire-based company describes itself as “a product development company and multichannel retailer that offer a number of highly distinctive and uniquely designed products. The Brookstone brand is strongly associated with cutting-edge innovation, superior quality, and sleek and elegant design.” Which is precisely why we plastered a “videocassette” emoji in our title. Because that description comports 100% with the way we view the brand. But we digress.

The company has clearly engaged in some downsizing since emerging from bankruptcy a few years ago; it notes that it currently operates 137 retail stores across 40 states with 102 of those stores located in malls and 35 in airports; it also carries 700 SKUs, the majority of which fall in one of three product categories (wellness, entertainment and travel). It sells across four product channels: mall retail, airport retail, e-commerce (brookstone.com and Amazon.com), and wholesale (including TV shopping which, we believe, means home shopping network sort of stuff). For fiscal year 2017, the company had net sales of $264mm and negative EBITDA was $60mm. For the first half of 2018, net sales were $74mm and negative EBITDA was $29mm. Annualize that first number and you’re looking at a pretty precipitous drop in revenue!

The company highlights the juxtaposition between its mall and retail sales channels. Whereas the former generated ‘17 net sales of $137.9mm and negative EBITDA of $30mm, the latter generated net sales of $37.7mm and “adjusted” EBITDA of $1.4mm. We haven’t seen the numbers but we’re guessing the adjustment takes this statement into account:

Moreover, the net sales and adjusted EBITDA figures do not tell the whole story with respect to the productivity of the Airport retail outlets. As described further below, supply chain issues have limited the sales potential that would otherwise be captured with a healthy network of suppliers. The Debtors believe that through the bankruptcy they can correct the supply chain issues and allow the airport stores to greatly increase their profitability.

🤔🤔 Seeing a lot of adjustments on the basis of “belief” these days.

Likewise, the company claims that aberrational externalities affected its e-commerce operations as well. There, the company claims $55.2mm in net sales and negative adjusted EBITDA of $1mm. The company believes that the discontinuation of its catalog mailings had a detrimental impact on its e-commerce (and store retail) numbers. It notes:

As with the airport retail segment, the net sales and adjusted EBITDA associated with the Debtors’ ecommerce segment is not reflective of its true potential due to supply chain difficulties. In addition, and as described further below, technology issues and a turnover of senior level management at the e-commerce segment led to underperformance at a segment that should be performing at a significantly higher level. The Debtors believe that the bankruptcy filing will afford the Debtors the opportunity to right the operational defects that have artificially stymied the overall profitability that should be incumbent to the Debtors’ online presence.

Finally, the company claims its wholesale business has a lot of demand and has been under-utilized due to the same supply chain issues affecting its other channels.

In other words, when we said earlier that “[c]learly the company ought to have used the initial bankruptcy for more of an operational fix,” we hit the nail on the head. The company notes:

Following the 2014 Bankruptcy, sales continued to lag almost immediately. For the years ended 2014 and 2015, net sales were pegged at approximately $420 million and $389 million respectively, while adjusted EBITDA was booked at negative $38 million and negative $24 million respectively. While a number of factors contributed to the underperformance, sourcing of products and supply chain difficulties were the major drivers.

But of course there’s an overall macro overlay here too:

The drop in net sales in 2016 and 2017 was further exacerbated by the decline in the mall model as a means for consumers to buy products of the type sold by Brookstone. During this time, foot traffic at mall locations decreased drastically, as consumers continued to seek out products online as a replacement for traditional brick and mortar shopping.

The company’s e-commerce efforts could not pick up the slack. It blames leadership changes, a new platform (and a loss of data and indexing that resulted), and the discontinuation of the hard copy catalog for this. The company notes:

Because the catalogs were directly responsible for a significant portion of the web traffic on the Debtors’ e-commerce site, the negative impact on the Debtors’ online sales was dramatic.

Anyone who thinks that e-commerce can survive independent of paper mailings ought to re-read that sentence. It also explains the fifteen Bonobos catalogs we get every week and the 829-pound Restoration Hardware calalog we receive every quarter. Remember the buzzword of the year: “multi-channel.” Case and point.

To make this already (too) long story short, Sanpower kept sinking money into this sinking ship until it finally decided that it was just throwing good money after bad. Callback to July when we said they’re disinclined to chapter 11…well, lighting millions of dollars on fire will make you a little more inclined. 💥💥

Powered by a $30mm DIP credit facility (not all new money: some will be used to refi out the ABL) from its prepetition (read: pre-bankruptcy) lenders, the company intends to use the bankruptcy filing to execute an orderly store closing process and market and sell the business. This is clearly why it went to great lengths to pretty up its e-commerce, mall and wholesale businesses in its narrative. Still, the company has been marketing the business for a month and, thus far, there are no biters. Per the agreement with its DIP lenders, the company has until September 2018 to effectuate its sale process. You read that right: a company that bled out over a period of years has two months on life support.

Major creditors include Chinese manufacturers and, as you might expect, the usual array of landlords, General Growth Properties ($GGP), Simon Property Group Inc. ($SPG), and Macerich Co. ($MAC). Given the positioning of the respective businesses, we wouldn’t expect much of a mall business to survive here regardless of whether a buyer emerges.

Jurisdiction: D. of Delaware (Judge Shannon)

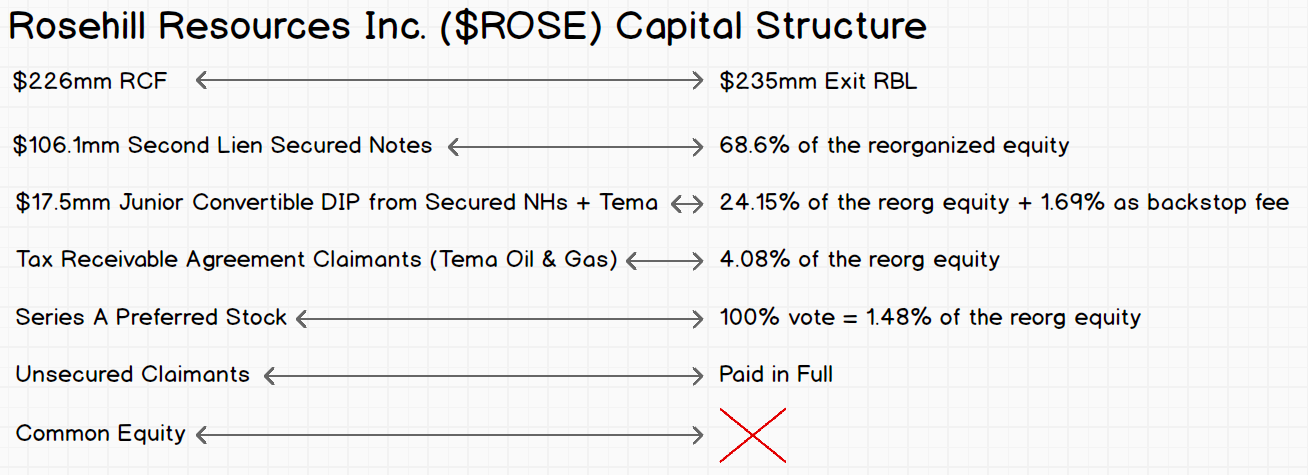

Capital Structure: $70mm ABL Revolver (Wells Fargo NA) & $15mm Term Loan (Gordon Brothers Finance Company), $10mm second lien notes (Wilmington Trust), $39.4mm Sanpower Secured Notes, $46.6mm Sanpower Unsecured Notes

Company Professionals:

Legal: Gibson Dunn & Crutcher LLP (David Feldman, Matthew Kelsey, Matthew Williams, Keith Martorana, Jason Zachary Goldstein) & (local) Young Conaway Stargatt & Taylor LLP (Michael Nestor, Sean Beach, Andrew Magaziner)

Financial Advisor: Berkeley Research Group LLC

Investment Banker: GLC Advisors & Co. (Soren Reynertson)

Liquidator Consultants: Gordon Brothers Retail Partners LLC & Hilco Merchant Resources LLC

Claims Agent: Omni Management Group (*click on company name above for free docket access)

Other Parties in Interest:

DIP Agent: Wells Fargo NA (Morgan Lewis & Bockius LLP, Glenn Siegel, Christopher Carter & Burr & Forman LLP, J. Cory Falgowski)

DIP Term Agent: Gordon Brothers Finance Company (Choate Hall & Stewart, Kevin Simard, Jonathan Marshall & Richards Layton & Finger PA, John Knight)

Indenture Trustee: Wilmington Trust NA