⛽️New Chapter 11 Bankruptcy Filing - Hornbeck Offshore Services Inc. ($HOSS)⛽️

Hornbeck Offshore Services Inc.

May 19, 2020

Hornbeck Offshore Services Inc. and 13 affiliates (the “debtors”), providers of marine transportation services to petroleum exploration and production, oilfield service, offshore construction and US military customers, filed prepackaged chapter 11 bankruptcies in the Southern District of Texas. Judge Isgur and Judge Jones must be thinking “Thank G-d”: for the judges, “prepackaged” is the operative word here and a quickie case amidst some of these melting ice cubes (e.g., J.C. Penney) must be a welcome breath of fresh air.

Hornbeck is one of those companies that people have been watching ever since 2015 — mostly on account of (i) the idea that offshore drilling had become prohibitively expensive in a falling commodity price environment and (ii) thanks to years of capital-intensive vessel construction programs and vessel acquisitions, an over-levered balance sheet. The good news is that, because of those programs/acquisitions, the company is relatively well-positioned with a nimble and younger fleet (76 vessels in total) — a fact that’s surely recognized by the company’s future equity holders. The bad news is that, with this much debt, even Hornbeck couldn’t postpone the inevitable bankruptcy ad infinitum when oil is where it is. Per the company:

Despite the Company’s relative strengths in its core markets, recent industry trends have had a materially adverse impact on the offshore energy industry and on the Company in particular. While the Company is accustomed to, and built for, the cyclical nature of the oilfield services industry, the recent downturn in the industry has lasted nearly six years, much longer than any previous cycles in the deepwater era, and has put pressure on the Company’s ability to repay or refinance its significant debt obligations.

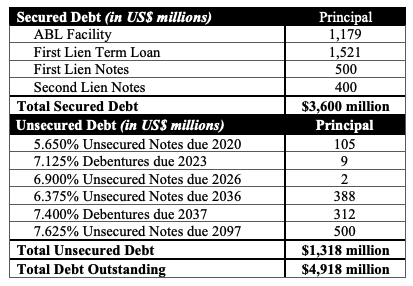

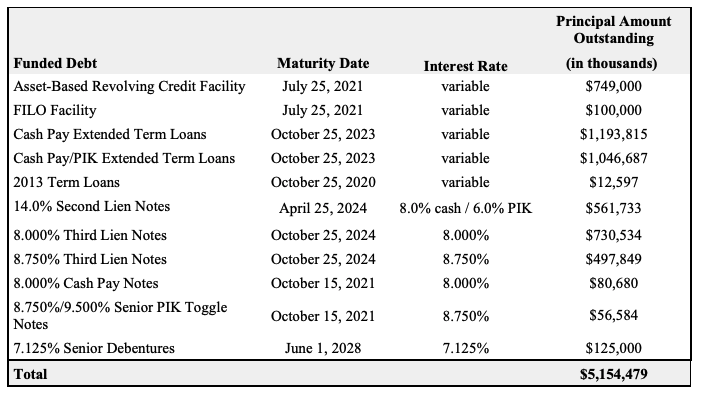

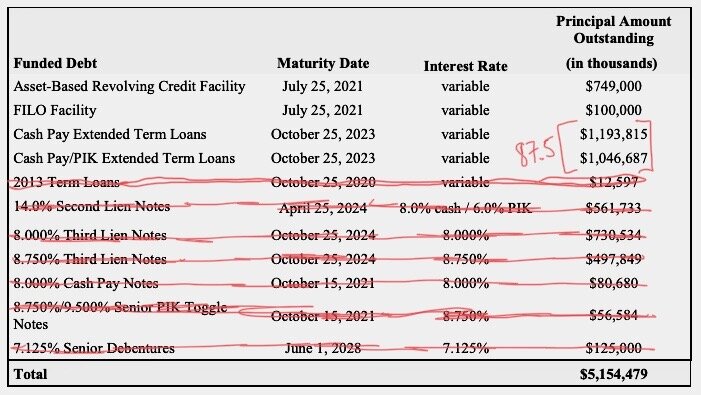

This is what the funded debt looks like:

Despite that ghastly capital structure and the unfriendly market, Hornbeck, unlike other players in the space like Tidewater Inc. and GulfMark Offshore Inc., managed to stay out of bankruptcy. To do so, it pulled every lever in the book:

Stacking of vessels to right-size the size of the available fleet relative to demand? ✅

Defer drydocking costs? ✅

Onshore and offshore personnel pay cuts? ✅

Selectively taking on assignments, avoiding long-term Ks and insurance risk? ✅

This is all great but of course there’s still that monstrosity of a balance sheet. In tandem with the operational restructuring, the company has been pursuing strategic balance sheet transactions since 2017 — some more successful than others. The most recent attempt of out-of-court exchange offers and consent solicitations was in early February and though it got a super-majority of support from holders of the ‘20 and ‘21 notes, it failed to meet the required 99% threshold to consummate the deal. On March 23, the date of the bottom of the stock market (irrelevant…just a fun fact), the company terminated the offers. After a long road over many years, bankruptcy became more of a reality.

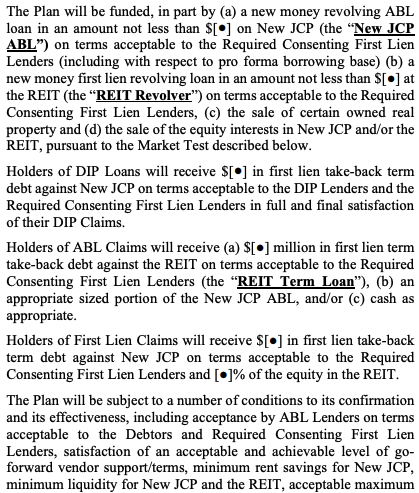

And so here we are. With the amount of support indicated on the offers, this thing set up nicely for a prepackaged plan. Regarding the plan, there’s a whole lot going on there because of the way the exit facilities are contemplated and the fact that there are Jones Act compliance issues but suffice it to say that the plan treats the first lien lenders as the fulcrum security. The second lien lenders will get a tip and the unsecured noteholders essentially walk away with a small equity kiss and warrants. The company will require liquidity on the back end of the chapter 11 and so the plan also contemplates a $100mm rights offering in exchange for 70% of the reorganized equity.

The debtors will fund the cases via a $75mm DIP credit facility which includes $56.25 million funded by certain secured lenders and $18.75 million funded by certain unsecured noteholders.

Jurisdiction: S.D. of Texas (Judge Jones)

Capital Structure: $50mm ABL (Wilmington Trust NA), $350mm first lien facility (Wilmington Trust NA), $121.2mm second lien facility (Wilmington Trust NA), $224.3mm ‘20 unsecured notes, $450mm ‘21 unsecured notes

Professionals:

Legal: Kirkland & Ellis LLP (Edward Sassower, Ryan Blaine Bennett, Ameneh Bordi, Debbie Farmer, Emily Flynn, Michael Lemm, Benjamin Rhode) & Jackson Walker LLP (Matthew Cavenaugh, Kristhy Peguero, Jennifer Wertz, Veronica Polnick)

Financial Advisor: Portage Point Partners LLC

Investment Banker: Guggenheim Securities LLC

Claims Agent: Stretto (*click on the link above for free docket access)

Other Parties in Interest:

DIP Agent ($75mm): Wilmington Trust NA

Counsel to the Consenting Secured Lenders

Legal: Davis Polk & Wardwell LLP (Damian Schaible, Darren Klein, Stephanie Massman)

Counsel to Consenting Unsecured Notes

Legal: Milbank LLP (Gerard Uzzi, Brett Goldblatt, James Ball)

Large equityholders: Cyrus Capital Partners LP, Fine Capital Partners LP, William Hurt Hunt Trust Estate