New Chapter 11 Bankruptcy Filing - Things Remembered Inc.

Things Remembered Inc.

2/6/19

This has been a rough week for "out-of-court" restructurings in the retail space. On the heals of Charlotte Russe's collapse into bankruptcy after an attempted out-of-court solution, Things Remembered Inc. filed for bankruptcy in the District of Delaware on February 6, 2019. We recently wrote about Things Remembered here. Let's dig in a bit more.

The 53-year old retailer filed with a stalking horse purchaser, Ensco Properties LLC, in line to purchase, subject to a tight 30-day timeframe, a subset of the company's store footprint and direct-sales business. The company writes in the most Trumpian-fashion imaginable:

"Although stores not acquired will need to close, the going-concern sale wills save hundreds of jobs and potentially many more and provide an improved, and significantly less risky, recovery to stakeholders." What does "potentially many more" mean? Don't they know how many people are employed at the locations being sold as well as corporate support? Seems like a Trumpian ad lib of corresponding inexactitude. But, whatever.

What caused the need for bankruptcy?

"Like many other retailers, the Company has suffered from adverse macro-trends, as well as certain microeconomic operational challenges. Faced with these challenges, the Company initiated multiple go-forward operational initiatives to increase brick-and-mortar profitability, such as store modernization through elimination of paper forms and the addition of iPads to streamline the personalization and sale process, and by shuttering a number of underperforming locations. The Company also sought to bolster the Debtors’ online-direct sale business, including aggressive marketing to loyal customers to facilitate sales through online channels, attracting new customers via an expanded partnership with Amazon, and increasing service capabilities for the business-to-business customer segment."

Read that paragraph and then tell us that retail management teams (and their expensive advisors) have any real clue how to combat the ails confronting retail. Elimination of paper forms? Ipads? Seriously? Sure, the rest sounds sensible and comes right out of today's standard retail playbook, i.e., shutter stores, bolster online capabilities, leverage Amazon's distribution, tapping into "loyal customers," etc. We're surprised they didn't mention AR/VR, Blockchain, "experiential retail," pop-ups, advertising on scooters, loyalty programs, and all of the other trite retail-isms we've heard ad nauseum (despite no one actually proving whether any or all of those things actually drive revenue).

The rest of the story is crazy familiar by this point. The "challenging operating environment" confronting brick-and-mortar and mall-based retail, specifically, led to missed sales targets and depressed profitability. Naturally there were operational issues that compounded matters and, attention Lenore Estrada (INSERT LINK), "…vendors have begun to place pressure on the supply chain cost structure by delaying or cancelling shipments until receiving payment." Insert cash on delivery terms here. Because that's what they should do when a customer is mid-flush.

Anyway, shocker: negative cash flows persisted. Consequently, the company and its professionals commenced a marketing process that landed Enesco as stalking horse bidder. Enesco has committed to acquiring the direct-sales business (which constitutes 26% of all sales in 2018 and includes the e-commerce website, hq, fulfillment and distribution center in Ohio and related assets) and approximately 128 stores (subject to addition or subtraction, but a floor set at 50 store minimum). Store closings of approximately 220 stores and 30 kiosks commenced pre-petition. A joint venture between Hilco Merchant Resources LLC and Gordon Brothers Retail Partners LLC is leading that effort (which again begs the question as to how Gymboree is the only recent retailer that required the services of four "liquidators"). The purchase price is $17.5mm (subject to post-closing adjustments). $17.5mm is hardly memorable. That said, the company did have negative $4mm EBITDA so, uh, yeeeeeaaaaah.

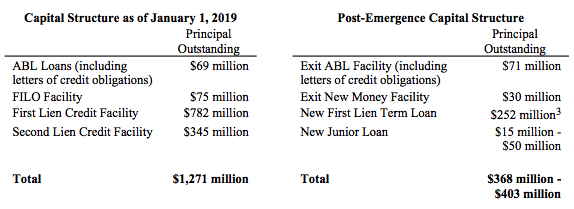

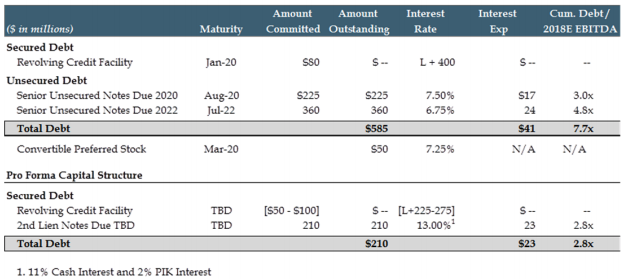

$18.7mm '19 revolving credit facility (Cortland Capital Markets Services LLC); $124.9mm 12% '20 TL.

The capital structure represents the result of an August 30, 2016 out-of-court exchange that, let's be honest here, didn't do much other than incrementally lessen the debt burden, kick the can down the road and get some professionals paid. If this sounds familiar, it's because it's not all that different than Charlotte Russe in those respects.

Jurisdiction: D. of Delaware (Judge Gross)

Capital Structure: $mm debt

Company Professionals:

Legal: Kirkland & Ellis LLP (Christopher Greco, Derek Hunger, Angela Snell, Spencer Winters, Catherine Jun, Scott Vail, Mark McKane) & (local) Landis Rath & Cobb LLP (Adam Landis, Matthew McGuire, Kimberly Brown, Matthew Pierce)

Legal (Canada): Davies Ward Phillips & Vineberg LLP

Financial Advisor/CRO: Berkeley Research Group LLC (Robert Duffy, Brett Witherell)

Investment Bank: Stifel Nicolaus & Co. Inc. and Miller Buckfire & Co. LLC (James Doak)

Liquidators: Hilco Merchant Resources LLC and Gordon Brothers Retail Partners LLC

Legal: Pepper Hamilton LLP (Douglas Herman, Marcy McLaughlin)

Claims Agent: Prime Clerk LLC (*click on company name above for free docket access)

Other Parties in Interest:

Stalking Horse Purchaser: Enesco Properties LLC (Balmoral Funds LLC)

Legal: Pachulski Stang Ziehl & Jones LLP (Jeffrey Pomerantz, Maxim Litvak, Joseph Mulvihill)

Lender: Cortland Capital Market Services LLC

Legal: Weil Gotshal & Manges LLP (David Griffiths, Lisa Lansio) & (local) Richards Layton & Finger PA (Daniel DeFranceschi, Zachary Shapiro)

Sponsor: KKR & Co.

Official Committee of Unsecured Creditors (Jewelry Concepts Inc., Gravotech Inc., Chu Kwun Kee Metal Manufactory, Brookfield Property REIT, Inc., Simon Property Group LP)

Legal: Kelley Drye & Warren LLP (Eric Wilson, Jason Adams, Kristin Elliott, Lauren Schlussel) & (local) Connolly Gallagher (N. Christopher Griffiths, Shaun Michael Kelly)

Financial Advisor: Province Inc. (Carol Cabello, Sanjuro Kietlinski, Jorge Gonzalez, Michael Martini)