New Chapter 11 Bankruptcy Filing - Parker Drilling Inc.

Parker Drilling Inc.

12/12/18

Back in October, in “Still Work to Do in Oil Country (Short Oil Field Services Companies),” we wrote the following:

Restructuring professionals attempting to extricate themselves from oil and gas work may have to wait a little bit longer. With companies like Houston-based Parker Drilling Corporation ($PKD) continuing to tread water, there may continue to be action in the space in the very near future.

We added:

The signs of a near-term (read: Q4 ‘18) bankruptcy filing for Parker Drilling continue to shine through. Back in July, the company implemented a reserve stock split and adopted a short-term shareholder rights plan. While neither initiative, on its own, is dispositive of a chapter 11 filing, they are indicia. The former increases the market price per share of the common stock, ensuring compliance with NYSE listing requirements. Given a delisting notice received back in the spring, some level of stock split was basically a fait accompli. The latter is intended to “protect the best interests of the Company and its stakeholders”and is meant to preserve certain tax attributes that, if lost, would be tremendous value leakage to the estate…uh, company. The company noted:

“The Company believes these Tax Benefits are valuable assets that could offset potential future income taxes for federal income tax purposes. As of December 31, 2017, the Company had approximately $456 million of federal NOLs and $47 million of foreign tax credits.”

Of course, net operating losses only emanate out of a business that is (or was during a given fiscal year) unprofitable for tax purposes. So, there’s that. Which, putting the aforementioned shenanigans aside, is seemingly the bigger problem here.

For its second quarter ended June 30, 2018, PKD reported a net loss of $23.8mm on $118.6mm of revenue, a loss of $2.56/share. Adjusted EBITDA was $18.7mm. While those numbers aren’t so good, to say the least, they actually include a Q-over-Q increase of 8.1% in revenue (thanks to an increase in gross margin). Of course G&A expenses increased by $2.1mm because…wait for it…there were “professional fees fees related to ongoing capital structure analysis during the quarter.” You bet there were, homies.

We continued:

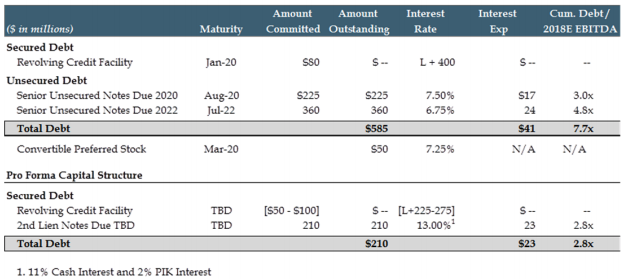

This capital structure isn’t complex and refinancing options, while theoretical, may be difficult given the company’s continued cash burn.

This is the company’s capital structure:

And so we concluded:

The path forward here given the liquidity needed seems pretty obvious: we expect to see a restructuring support agreement on this bad boy sometime soon with an attempted quick trip through bankruptcy court that de-levers the balance sheet, eliminates interest expense, and positions the company to make the capex necessary to capture the growth projected in the business plan.

So, what’s the latest? Well, as predicted, Houston-backed Parker Drilling Company, an international provider of contract drilling and drilling-related services and rental tools, filed an earnest bankruptcy petition and accompanying papers in the Southern District of Texas. Earnest? Why “earnest”? The company stated:

Adverse macro trends, including and especially the sustained downturn in commodity prices, have reduced demand for oilfield services provided by the Debtors, resulting in idle rigs, and placing downward pressure on the prices the Debtors are able to charge. Moreover, the Debtors are facing near term 2020 maturities of their 2020 Notes and ABL (each as defined in the First Day Declaration), for which the borrowing base has been tightened and which may not be re-financeable in the current environment under the existing capital structure.

Rather than hold out hope for a market recovery, or execute an inferior transaction that would at best provide more onerous financing without addressing their capital structure in a comprehensive manner, the Debtors have negotiated a comprehensive balance sheet reorganization to both reduce leverage and increase liquidity.

“Rather than hold out hope for a market recovery.” Those are poignant words that say a lot about the company’s outlook for oil in the near-term. It also says a lot about the company’s capital structure: clearly, there was no chance this company could grow into its balance sheet and/or refinance its upcoming debt. And, so, as we also predicted, the company’s bankruptcy filing is accompanied by a deal in hand with the major players in the company’s capital structure and equity profile: Brigade Capital Management, Highbridge Capital Management, Varde Partners, Whitebox Advisors. These four institutions collectively hold approximately 77% of the unsecured notes, approximately 62% of the outstanding preferred stock, and approximately 15% of the outstanding common stock. They’ve agreed to equitize the notes in exchange for equity in the reorganized company and to participate in a rights offering that will have the effect of capitalizing the reorganized entity with $95mm of new equity. The net effect of all of this will be a $375mm deleveraging of the company’s balance sheet.

The company has a commitment for a $50 DIP credit facility to fund the cases and a $50mm exit facility (with an upsize option up to $100mm) upon its emergence from chapter 11.

Jurisdiction: S.D. of Texas (Judge Isgur)

Capital Structure: $80mm ABL (unfunded - Bank of America NA), $225mm ‘20 notes (The Bank of New York Mellon Trust Company, N.A.), $360mm ‘22 notes (The Bank of New York Mellon Trust Company, N.A.)

Company Professionals:

Legal: Kirkland & Ellis LLP (James Sprayragen, Christopher Marcus, Brian Schartz, Anna Rotman, Matthew Fagen, Jamie Netznik) & (local) Jackson Walker LLP (Patricia Tomasco, Matthew Cavenaugh)

Financial Advisor: Alvarez & Marsal North America LLC (Lacie Melasi, John Walsh)

Investment Banker: Moelis & Co. (Bassam Latif)

Claims Agent: Prime Clerk LLC (*click on company name above for free docket access)

Other Parties in Interest:

Consenting Noteholders: Brigade Capital Management, Highbridge Capital Management, Varde Partners, Whitebox Advisors

Legal: Akin Gump Strauss Hauer & Feld LLP

Financial Advisor: Houlihan Lokey Capital Inc.