🇲🇽New Chapter 22 Bankruptcy Filing - Maxcom USA Telecom Inc.🇲🇽

Maxcom USA Telecom Inc.

August 19, 2019

We’re all for a reprieve from retail and energy distress but, sheesh, couldn’t have been more interesting than this?

Maxcom USA Telecom Inc. is a telecommunications provider deploying “smart-build” approaches to “last mile” connectivity (read: modems, handsets and set-up boxes) for enterprises, residential customers and governmental entities in Mexico — which is really just a fancy way of saying that it provides local and long-distance voice, data, high speed, dedicated internet access and VoIP tech, among other things, to customers.* It purports to be cutting edge and entrepreneurial, claiming “a history of being the first providers in Mexico to introduce new services,” including (a) the first broadband in 2005, (b) the first “triple-play” (cable, voice and broadband) in 2005, and (c) the first paid tv services over copper network using IP…in 2007. That’s where the “history” stops, however, which likely goes a long way — reminder, it’s currently the year 2019 — towards explaining why this f*cker couldn’t generate enough revenue to service its ~$103.4mm in debt.** Innovators!!

And speaking of that debt, it’s primarily the $103.4mm in “Old Notes” due in 2020 that precipitated this prepackaged bankruptcy filing (in the Southern District of New York).***

The Old Notes derive from a prior prepackaged bankruptcy — in 2013 (PETITION Note: not a “Two-Year Rule” violation) — and were exchanged for what were then outstanding 11% senior notes due in 2014. These Old Notes have a “step-up interest rate,” which means that, over time, the interest rate…uh…steps up…as in, increases upward/up-like. The rate currently stands at 8%. Unfortunately, the company doesn’t have revenue step-ups/upwardness/upseedayzee to offset the interest expense increase; rather, the company “…incurred losses of $4.9 million for the three months ended June 30, 2019, as compared to losses of $2.9 million for the three months ended June 30, 2018, and losses of $16 million for the year ended December 31, 2018, compared to losses of $.8 million for the year ended December 31, 2017….” Compounding matters are, among other things, the negative effects of decreased interest income and foreign currency exchange rates (the dollar is too damn strong!).**** The closure of the residential segment also, naturally, affected net revenue.

To make matters worse, the company’s debt actually has limitations (remember those?). Per the company:

In order to expand its network and strengthen its market share, the Debtors require additional capital. But, the Old Notes Indenture prohibits Maxcom Parent from incurring additional indebtedness (other than permitted indebtedness) unless certain leverage coverage ratios are satisfied, and the increased interest burden under the Old Notes seriously constrains the Debtors’ ability to take the actions required under its business plan to strengthen and expand their operations.

The purpose of this bankruptcy filing, therefore, is to effectuate a consent solicitation and exchange offer whereby the Old Notes will be swapped (and extinguished) for new “Senior Notes,” new “Junior PIK Notes” and cash consideration. The cash consideration will be covered by a new equity injection of $15mm. This transaction will bolster the company’s liquidity and shed approximately $36mm of debt from the balance sheet (PETITION Note: carry the one, add the two, that’s roughly $2.88mm in annual interest savings before taking into account the PIK notes, which won’t be cash-pay, obviously).

Prior to the bankruptcy filing, the company obtained the requisite amount of support to jam non-consenting creditors (PETITION Note: in bankruptcy, a debtor needs 2/3 in amount and half in number of a particular class of debt to bind a class. Here, the company nailed down acceptances of the plan from 84.75% of the holders of Old Notes holding 66.73% of principal amount in Old Notes). And there is one large group of non-consenting holders, apparently. Cicerone Advisors LLC, a financial advisor to three holders of the Old Notes, Moneda Asset Management, Megeve Investments and UBS Financial Services, Inc., attempted to engage the company on better terms than that offered under the plan. It did not, however, ultimately provide a proposal; instead, it demanded terms, including confidentiality and an agreement to pay fees and expenses of financial and legal advisors. Here’s the thing, though: they miscalculated their leverage: with only 30% of Old Notes represented, they don’t have a “blocking position” that could thwart the company’s proposal. Absent an additional 4%, these guys are dead in the water.

This should be…should be…a very quick trip through bankruptcy.*****

*The company is shutting down its residential segment, which “involves the gradual closure of residential clusters and mass disconnection of residential customers.” Apparently, people don’t need the company’s services anymore. At least not when they’re carrying $1,000 telecommunications systems in their pants pockets? 🤔

The disruption is real. Indeed, the company’s residential segment operates through an outdated copper network that doesn’t comport with the latest in fiber network technology.

**U.S. Bank NA is the indenture trustee under the Old Notes.

***Oh man, the venue on this one is just quaint. There are two debtors, Maxcom Telecomunicaciones, S.A.B. DE C.V., a Mexican entity and Maxcom USA Telecom Inc., which is 100% owned by the former. What does the latter do? According to Exhibit A of the First Day Declaration it does “[Assorted services in the USA].” Hahaha. This sh*t is so suspect that nobody even bothered to remove the brackets. It might as well say, “[Kinda sorta maybe some random sh*t within US borders and down the street from the SDNY for purposes of ginning up venue”]. Is it a guarantor on the notes? “[Yes].” HAHAHA. Like, is it, or not?? The listed highlight? “Recently created.” Damn straight it was. This year. The service address? “c/o United Corporate Services, Inc., Ten Bank Street, Suite 560, White Plains, NY 10606.” Conveniently happens to fall right in Judge Drain’s lap.

We mean, seriously, folks? People AREN’T EVEN TRYING to be slick about manufacturing venue anymore.

Apropos to the point, Duane Morris LLP’s Frederick Hyman highlights the trend of foreign borrowers with little to no assets in the U.S. filing for chapter 11 to take advantage of the automatic stay here, describing the slippery-slope-creating case of TMT Shipping (which established venue by funding professional retainers in the US).

****Interestingly, people have been voicing concerns about the foreign exchange rates and US-dominated debt in emerging markets. It seems those concerns may be warranted:

…from 2013 to date, the value of the Mexican Peso, as compared to the U.S., has decreased by 53%. Because of such devaluation, Maxcom Parent’s repurchase of the $74.3 million in principal amount of the Old Notes did not decrease the amount that Maxcom Parent’s books and records reflect is owed to the holders of the Old Notes given that Maxcom Enterprise’s revenues are mostly in Mexican Pesos. In other words, while the amount that Maxcom Parent owes on account of the Old Notes has decreased in U.S. Dollars, because the majority of Maxcom Enterprise’s revenues are in Mexican Pesos and the Old Notes are denominated in U.S. Dollars, Maxcom Parent’s liability on account of the Old Notes remains roughly the same on its books and records.

Ruh roh. 🙈 We expect to see many more mentions of exchange-related issues going forward. Mark our words.💥

*****Small victories. The dissenting bondholders were able to successfully push the debtors’ timeline by a week or so at the first day hearing.

Jurisdiction: S.D. of New York (Judge Drain)

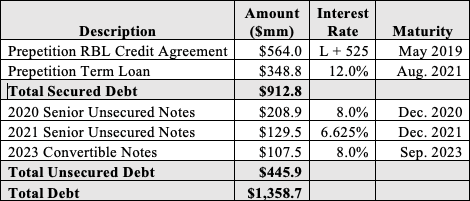

Capital Structure: $103.4mm old notes

Professionals:

Legal: Paul Hastings LLP (Pedro Jimenez, Irena Goldstein)

Financial Advisor: Alvarez & Marsal Mexico

Claims Agent: Prime Clerk LLC (*click on the link above for free docket access)

Other Parties in Interest:

Indenture Trustee: US Bank NA

Legal: Thompson Hine LLP (Jonathan Hawkins, Curtis Tuggle)