🚁New Chapter 11 Bankruptcy Filing - PHI Inc.🚁

March 15, 2019

It’s pretty rare to see a company affected by macro factors in two industries. And, yet, Louisiana-based PHI Inc. ($PHI) and four affiliates filed for bankruptcy in the Northern District of Texas, marking the fourth bankruptcy fallout in the helicopter services space following Waypoint Leasing, Erickson Incorporated and CHC Group. The company is a leading provider of transportation services to both the oil and gas industry (including, for example, Shell Oil Company, BP America Production Company, ExxonMobil Production Co., ConocoPhillips Company, ENI Petroleum and the recently-bankrupt Fieldwood Energy) and the medical services industry. It operates 238 aircraft, 213 which are company-owned and 119 of which are dedicated to oil and gas operations and 111 of which are dedicated to medical services. The company generated $675mm in revenue in 2018 — with much of that revenue coming from fixed-term contracts.

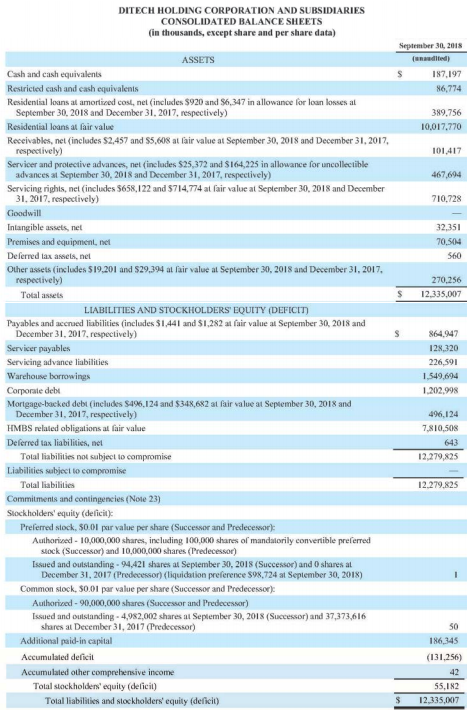

The company strongly asserts that operational failures are not a cause of its bankruptcy — a clear cut message to the market which might otherwise be concerned about safety and reliability. The issue here, the company notes, is the balance sheet, especially a March 15 2019 maturity of the company’s $500mm in unsecured notes. Despite alleged efforts to address this maturity with the company’s (fresh out of the womb) secured term loan holder and an ad hoc group of unsecured noteholders, the company was unable to do so.

The broader issue, however, is that the industry may be ripe for consolidation. Back in 2017, the company acquired the offshore business of HNZ Group Inc. This transaction expanded the company’s capacity to more international geographies. But given the dearth of offshore oil and gas production activity of late and intense competition in the space, there might be a need for more industry-wide M&A. The company notes:

As a result of this prolonged cyclical downturn in the industry, oil and gas exploration projects have been reduced significantly by the Company’s customers. Indeed, many customers have significantly reduced the number of helicopters used for their operations and have utilized this time instead to drive major changes in their offshore businesses, which have in turn drastically reduced revenues to PHI’s O&G business segment in the Gulf of Mexico. And while the price of crude oil slowly began to recover in 2018, the volatility in the market continues to drive uncertainty and negatively impact the scope and volume of services requested from service providers such as PHI.

This is simple supply and demand:

The effect of the downturn in the oil and gas industry has been felt by nearly all companies in the helicopter service industry. The downturn created an oversaturation of helicopters in the market, significantly impacting service companies’ utilization and yields. Indeed, this domino effect on the industry has required helicopter operators, like their customers, to initiate their own cost-cutting measures, including reducing fleet size and requesting rental reductions on leased aircraft.

Had these issues been isolated to the oil and gas space, the company would not have been in as bad shape considering that 38% of its revenue is attributable to medical services. But that segment also experienced trouble on account of…:

…weather-related issues and delays, changes in labor costs, and an increase in patients covered by Medicare and Medicaid (as opposed to commercial insurers), which resulted in slower and reduced collections, given that reimbursement rates from public insurance are significantly lower than those from commercial insurers or self-pay.

Compounding matters are laws and regulations that prohibit the debtors from refusing service to patients who are unable to pay. This creates an inherently risky business model dynamic. And it hindered company efforts to sell the business line to pay down debt.

Taken together, these issues are challenging enough. Tack on $700mm of debt, the inability to refi out its maturity, AND the inability to corral lenders to agree on a consensual deleveraging (which included a failed tender offer) and you have yet another freefall helicopter bankruptcy. Now the company will leverage the bankruptcy “breathing spell” and lower voting thresholds provided by the Bankruptcy Code to come to an agreement with its lenders on a plan of reorganization.

*****

That is, if agreement can be had. Suffice it to say, things were far from consensual in the lead up to (and at) the first day hearing in the case. To point, the Delaware Trust Companyas trustee for the senior unsecured notes, filed an objection to the company’s CASH MANAGEMENT motion because…well…there is no DIP Motion to object to. “Why is that,” you ask? Good question…

The debtors levered up their balance sheet in the lead-up to PHI’s well-known maturity. The debtors replaced their ABL in September with the $130mm term loan provided by Al Gonsoulin, the company’s CEO, Board Chairman and controlling shareholder. Thereafter — and by “thereafter,” we mean TWO DAYS BEFORE THE BANKRUPTCY FILING — the company layered another $70mm of secured debt onto the company, encumbering previously unencumbered aircraft and granting Mr. Gonsoulin a second lien. This is some savage balance sheet wizardry that has the effect of (a) priming the unsecured creditors and likely meaningfully affecting their recoveries and (b) securing Mr. Gonsoulin’s future with the company (and economic upside). Making matters worse, the trustee argues that the company made no real effort to shop the financing nor actively engage with the ad hoc committee of noteholders on the terms of a financing or restructuring; it doesn’t dispute, however, that the company had $70mm of availability under its indenture.

So what happened next? Over the course of a two day hearing, witnesses offered testimony about the pre-petition negotiations and financing process (or lack thereof) — again, in the context of a cash management motion. We love when sh*t gets creative! The lawyers for the company and the trustee hurled accusations and threats, the CEO was called a “patriot” (how, even if true, that is applicable to this context is anyone’s guess), and, ultimately, the judge didn’t care one iota about any of the trustee’s witness testimony and blessed the debtors’ motion subject to the company providing the trustee with weekly financial reporting. In other words, while this routine first day hearing was anything but, the result was par for the course.

Expect more fireworks as the case proceeds. Prospective counsel to the eventual official committee of unsecured creditors is salivating as we speak.

Jurisdiction: N.D. of Texas (Judge Hale)

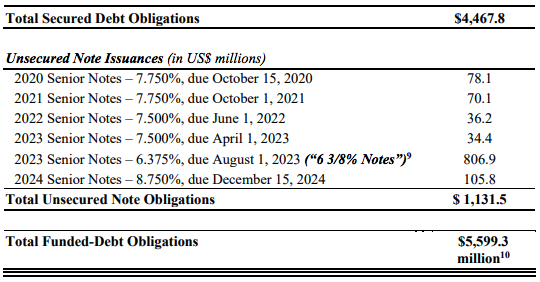

Capital Structure: $130mm ‘20 senior secured term loan (Thirty Two LLC), $70mm secured term loan (Blue Torch Capital LP), $500 million ‘19 unsecured 5.25% senior notes

Professionals:

Legal: DLA Piper US LLP (Daniel Prieto, Thomas Califano, Daniel Simon, David Avraham, Tara Nair)

Legal (corporate): Jones Walker LLP

Financial Advisor: FTI Consulting Inc. (Robert Del Genio, Michael Healy)

Investment Banker: Houlihan Lokey Capital Inc.

Claims Agent: Prime Clerk LLC (*click on the link above for free docket access)

Other Parties in Interest:

Prepetition TL & DIP Lender: Blue Torch Capital LP

Ad Hoc Committee of unsecured noteholders & Delaware Trust Company as Trustee for Senior Notes

Legal: Milbank LLP (Andrew LeBlanc, Dennis Dunne, Samuel Khalil) & (local) Norton Rose Fulbright US LLP (Louis Strubeck Jr., Greg Wilkes)

Financial Advisor: PJT Partners LP (Michael Genereaux)

Indenture trustee under the 5.25% Senior Notes due 2019 (Delaware Trust Company)

Thirty Two LLC

Official Committee of Unsecured Creditors (Delaware Trust Company, Oaktree Capital Management LP, Q5-R5 Trading Ltd., Regions Equipment Finance Corp., Helicopter Support Inc.)

Legal:

Official Committee of Equity Security Holders

Legal: Levene Neale Bender Yoo & Brill LLP (David Golubnik, Eve Karasik) & (local) Gray Reed & McGraw LLP (Jason Brookner)

Financial Advisor: Imperial Capital LLC (David Burns)