Waypoint Leasing Holdings Ltd.

Waypoint Leasing Holdings Ltd.

November 25, 2018

“Get to the Choppa!” - Arnold Schwarzenegger

It has been a tough couple of years for companies in the helicopter business (see, e.g., Erickson Aircrane and CHG Group, not to mention PHI Inc. and Bristow Group, both of which restructuring professionals continue to watch and salivate over). So tough, in fact, that even Thanksgiving weekend wasn’t sacrosanct and even some big name sponsors couldn’t keep this thing out of court. Over the weekend, helicopter leasing company, Waypoint Leasing Holdings Ltd., “facing imminent liquidity constraints and potential defaults under their secured loan facilities,” filed for bankruptcy with a goal of imminently selecting a bidder for the sale of substantially all of its assets (or equity) through a 363 sale or via a chapter 11 plan of reorganization. The company leases helicopters to providers in the emergency medical, search and rescue, and utility sectors but the majority of its lessees are in the offshore oil and gas industry. In other words, the oil and gas downturn of a few years ago continues to rear its ugly head. Imagine what will happen if oil prices dip back down into the low $50s. Oh. Wait.

Tellingly, the company notes the following relating to the oil and gas downturn:

The cyclical downturn in the oil and gas industry beginning in 2014 led to a significant decline in offshore oil exploration, cost reduction measures for production operations, and a substantially decreased demand for offshore drilling services by upstream, exploration and production companies (“E&P Companies”). Although the price of crude oil had slowly begun to rebound, the effects of this protracted downturn are still evident. The severe reductions in capital spending and cost-cutting measures implemented by the offshore oil and gas industry during the downturn have resulted, in turn, in decreased demand for helicopter services from the Debtors’ primary customer base, the oil and gas helicopter operators (the Debtors’ lessees).

Due to this negative impact on the helicopter service industry, helicopter operators have employed their own cost-cutting measures, including reducing their fleet size, engaging in fewer lease extensions or renewals, demanding rental reductions, and, in some cases, filing for reorganization under the Bankruptcy Code.

Indeed, on that last point, the company’s largest customer, CHC Group Ltd., was a May ‘16 bankruptcy participant (and Weil Gotshal & Manges LLP was counsel there too…Waypoint 0, CHC Group 0, Weil 2). CHC ended up rejecting 15 of 44 aircraft leases (and renegotiating the rest), dinging company revenues to the tune of $45mm. The company has also incurred millions of dollars of “unexpected transition and maintenance costs on account of the rejected CHC aircraft.”

Compounding matters is the fact that “[t]he oil and gas industry downturn has created an oversupply of available helicopters in the market, which has significantly impacted the Debtors’ utilization and yields.” Fleet utilization is approximately 78%, as compared to 94-100% from 2013-15. Brutal.

As a result, the company has been engaged in restructuring negotiations with its relevant lenders since the beginning of the summer. These negotiations are complicated by the fact that the company has multiple credit facilities with varying collateral packages. Now, though, the company, as we noted above, hopes to sell itself — a challenge given the oversupply of helicopters — in an effort to maximize value. Oddly, the company filed without having a DIP in hand (nor, it seems, consent to use cash collateral) and, we surmise, a first day hearing has not yet been scheduled as a consequence.

Jurisdiction: S.D. of New York (Judge Bernstein)

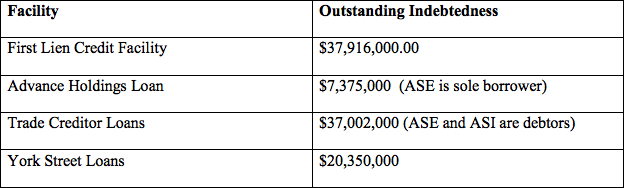

Capital Structure: $1.1b debt

Company Professionals:

Legal: Weil Gotshal & Manges LLP (Gary Holtzer, Robert Lemons, Kelly DiBlasi, Matthew Goren)

Financial Advisor: FTI Consulting Inc. (Robert Del Genio)

Investment Banker: Houlihan Lokey Inc.

Claims Agent: KCC (*click on company name above for free docket access)

Other Parties in Interest:

Administrative Agent under ‘13 and ‘17 credit agreement: SunTrust Bank

Legal: Alston & Bird LLP (John Weiss, William Hao, David Wender)

Administrative Agent under ‘14 credit agreement and ‘15 Note Purchase Agreement: Wells Fargo Bank, National Association

Legal: Mayer Brown LLP (Frederick Hyman, Christine Walsh)

Agent under Euro Term Loan Facility Agreement: Airbus Helicopters Financial Services Limited

Administrative Agent under ‘14 credit agreement: BNP Paribas

Administrative Agent under ‘15 credit agreement: Bank of Utah

Legal: Norton Rose Fulbright US LLP (Howard Beltzer, James Copeland)

Administrative Agent under ‘16 credit agreement: Lombard North Central PLC

Administrative Agent under August ‘17 credit agreement: Sumitomo Mitsui Banking Corporation, Brussels Branch

Steering Committee of WAC Lenders

Legal: Milbank Tweed Hadley & McCloy LLP

Financial Advisor: Alvarez & Marsal LLC

Sponsors: MSD Capital, L.P., Quantum Strategic Partners Ltd., and Cartesian Capital Group LLC

Updated 11/26/18 at 4:03 CT