Tough is one word for it.

Saturated is another.

There are countless players in the home security and monitoring space including (i) recently-IPO’d ADT Inc. (owned by Apollo Asset Management),* (ii) Vivint Inc., (iii) Guardian Protection Services, (iv) Vector Security Inc., (v) Comcast Corporation, and (vi) SimpliSafe Inc. And there is also the identity-confused schizophrenic Monitronics International Inc., formerly known as MONI Smart Security and now known as Brinks Home Security, which is a wholly-owned subsidiary of publicly-traded holding company Ascent Capital Group ($ASCMA)(did you get all of that?). Nearly all of these companies compete in the market for “alarm monitoring agreements” (AMAs) — contracts pursuant to which these companies provide home monitoring services in exchange for predictable recurring revenue. Predictable in a manner of speaking: with this much competition, the industry is getting a wee bit…less…predictable…?

Ascent Capital Group noted in its most recent 10-K:

Competition in the security alarm industry is based primarily on reputation for quality of service, market visibility, services offered, price and the ability to identify and obtain customer accounts. Competition for customers has also increased in recent years with the emergence of DIY home security providers and other technology companies expanding into the security alarm industry. We believe we compete effectively with other national, regional and local alarm monitoring companies, including cable and telecommunications companies, due to our reputation for reliable monitoring, customer and technical services, the quality of our services, and our relatively lower cost structure. We believe the dynamics of the security alarm industry favor larger alarm monitoring companies, such as MONI, with a nationwide focus that have greater resources and benefit from economies of scale in technology, advertising and other expenditures. (emphasis added).

Make no mistake: ASCMA is purposefully highlighting its monitoring expertise, size and scale. And that is because the market for AMAs is getting increasingly challenged by a number of home security providers. And many of them are of the do-it-yourself (“DIY”) variety. For instance, home owners can get home security devices from Arlo by Netgear.** Or Canary. Or Honeywell ($HON). Or Google (Nest)($GOOG). Amazon Inc. ($AMZN) recently bought Ring Doorbell for $1 billion and that, too, has a home security system. Gadget stores are replete with options for DIY home security systems. Do people even need professional installation and/or monitoring anymore? With property crimes on a nationwide decline, is a self-monitoring system viable enough? Why bother when you can just get alerts to the phone in your pocket or the watch on your wrist? These are the big questions.

Especially for Monitronics.

Monitronics primarily sells its home security and monitoring services through a network of authorized dealers. While it also deploys certain direct-to-consumer initiatives under its DIY-focused subsidiary, LiveWatch Security LLC, the company’s real action is from the recurring fees baked into AMAs. Unfortunately:

In recent years, MONI's acquisition of new customer accounts through its dealer sales channel has declined due to the attrition of large dealers, efforts to acquire new accounts from dealers at lower purchase prices, consumer buying behaviors, including trends of buying security products through online sources and increased competition from telecommunications and cable companies in the market. MONI is increasingly reliant on its internal sales channel and strategic relationships with third parties, such as Nest, to counter-balance this declining account generation through its dealer sales channel. If MONI is unable to generate sufficient accounts through its internal sales channel and strategic relationships to replace declining new accounts through dealers, MONI's business, financial condition and results of operations could be materially and adversely affected. (emphasis added)

Was that a borderline “Amazon Effect” reference mixed in there? 🤔 Wait. There’s more:

As of December 31, 2017, MONI was one of the largest alarm monitoring companies in the U.S. when measured by the total number of subscribers under contract. MONI faces competition from other alarm monitoring companies, including companies that have more capital and that may offer higher prices and more favorable terms to dealers for alarm monitoring contracts or charge lower prices to customers for monitoring services. MONI also faces competition from a significant number of small regional competitors that concentrate their capital and other resources in targeting local markets and forming new marketing channels that may displace the existing alarm system dealer channels for acquiring alarm monitoring contracts. Further, MONI is facing increasing competition from telecommunications, cable and technology companies who are expanding into alarm monitoring services and bundling their existing offerings with monitored security services. The existing access to and relationship with subscribers that these companies have could give them a substantial advantage over MONI, especially if they are able to offer subscribers a lower price by bundling these services. Any of these forms of competition could reduce the acquisition opportunities available to MONI, thus slowing its rate of growth, or requiring it to increase the price paid for subscriber accounts, thus reducing its return on investment and negatively impacting its revenues and results of operations.

And here we thought people were shunning the cable companies?

Anyway, can Monitronics circumvent these issues with a superior product? By investing in new technology to ward off the onslaught of newcomers? More from the 10-K:

…the availability of any new features developed for use in MONI's industry (whether developed by MONI or otherwise) can have a significant impact on a subscriber’s initial decision to choose MONI's or its competitor’s products and a subscriber's decision to renew with MONI or switch to one of its competitors. To the extent its competitors have greater capital and other resources to dedicate to responding to technological innovation over time, the products and services offered by MONI may become less attractive to current or future subscribers thereby reducing demand for such products and services and increasing attrition over time. Those competitors that benefit from more capital being available to them may be at a particular advantage to MONI in this respect. If MONI is unable to adapt in response to changing technologies, market conditions or customer requirements in a timely manner, such inability could adversely affect its business by increasing its rate of subscriber attrition. MONI also faces potential competition from improvements in self-monitoring systems, which enable current or future subscribers to monitor their home environments without third-party involvement, which could further increase attrition rates over time and hinder the acquisition of new alarm monitoring contracts. (emphasis added)

Luckily this isn’t an issue because Monitronics currently has the best most technologically-advanced home security offering on the market. Oh. Hmmm. Wait. We spoke to soon…

Here is Wirecutter reviewing “The Best Home Security System.” And suffice it to say, the Monitronics’ product is not the winner. In fact, Wirecutter knocks the “Brinks Home Complete with Video” system on cost.

Here is PCmag reviewing “The Best Smart Home Security Systems of 2018” and the LiveWatch Plug & Protect IQ 2.0 is buried down the list with a 3.5 star rating (out of 5).

And here is Reviews.com’s list of “The Best DIY Home Security” and neither LiveWatch nor Brinks are listed. 😜

To offset all of these current challenges, the company luckily has unconstrained liquidity and a clean balance sheet to invest in marketing to dealers and upgrading its technology for the future. Oh. Hmmm. Wait. We spoke to soon. Again. 😜

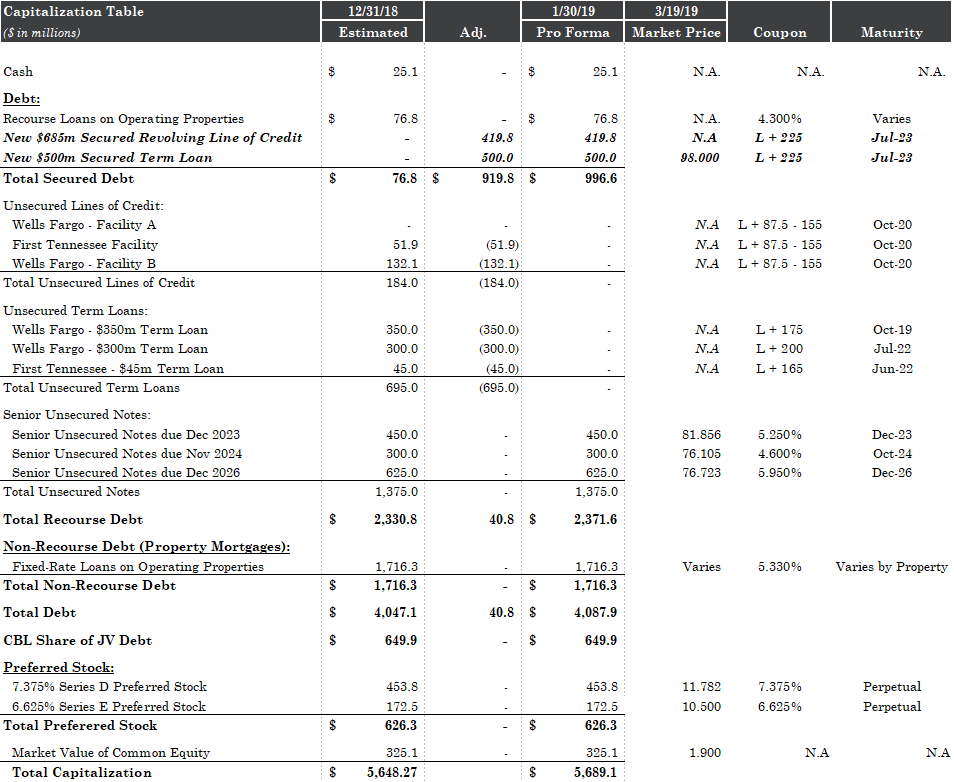

Late last week, Moody’s Investors Service Inc. downgraded Monitronics International Inc.to Caa2 from B3; it also downgraded (i) the company’s $1.1 billion senior secured first-lien L+5.50% term loan due 2020 to Caa1 from B2 and (ii) its 9.125% $585 million senior unsecured notes to Caa3 from Caa2. To complete the capital structure picture, the company also has approximately $68.5 million outstanding on a $295 million L+4% credit facility “super priority” revolver due 2021. So, to make sure you grasp the magnitude here: 1 + 2 + 3 = $1.8 billion of debt. Yup, you read that right. There’s a lot of interest expense attached to that. Oh, and per ASCMA’s last 10-K:

The maturity date for both the term loan and the revolving credit facility under the Credit Facility are subject to a springing maturity 181 days prior to the scheduled maturity date of the Senior Notes. Accordingly, if MONI is unable to refinance the Senior Notes by October 3, 2019, both the term loan and the revolving credit facility would become due and payable.

Hmmm. 🤔 Siri, set an alarm for April 2019‼️💥

Moody’s noted:

The downgrade of Monitronics' CFR and facility ratings reflects strains on the company's liquidity and capital structure caused by impending maturities, as well as its continued lackluster operating performance.

The liquidity rating downgrade to SGL-4 reflects the approaching debt maturities. Moody's views Monitronics' liquidity as operationally adequate, but weak in terms of imminent, likely accelerating debt maturities. As a result of the company's continued lackluster performance, Moody's expects Monitronics to generate barely breakeven free cash flow this year. The (unrated) $295 million, super-priority revolving credit facility is large and has, as of early July 2018, a time of seasonally heavy revolver borrowing, roughly $80 million drawn. Reliance on the revolver also creates liquidity risk because the revolver expiration will spring to October 2019 if the notes are not refinanced. While cash on hand continues to be modest ($30 million at March 31st), Monitronics' parent company, Ascent Capital Group, Inc.("Ascent"), has nearly $110 million of cash, which may be viewed as providing additional implied support. Still, Monitronics' combined sources of liquidity are weak relative to the quantum of debt coming due in the next few years. Reliance on the revolver for operational initiatives and to fund purchases of new subscriber contracts from dealers will also prevent meaningful deleveraging over the next year. Weak operational metrics also continue to shrink the cushion it has relative to covenant limits, and the risk of a covenant violation over the next 12-15 months is elevated.

Ergo, the capital structure is rumored to be advisored up with (a) Houlihan Lokey and Stroock & Stroock & Lavan working with an ad hoc group of unsecured holders and (b) Jones Day and Evercore working with the term lenders. Latham & Watkins LLP reportedly represents the company. Anchorage Capital may be a bit of a wild card here as they allegedly hold a meaningful position in the term loan and the unsecured bonds.

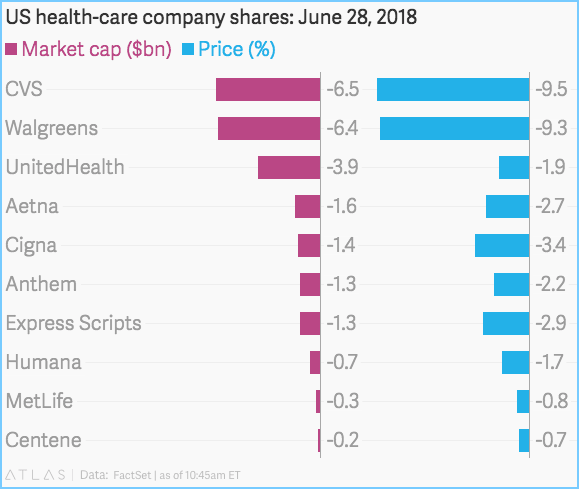

All of this drama has taken its toll on ASCMA’s stock: