DO. NOT. MESS. WITH. DAISY. CHAPTER 1 of 3 (Short Pet Suppliers) 🔫

🐶 Phillips Pet Food & Supplies: "Outlook Negative" 🐶

We have covered a lot of ground since our inception and, for the most part, the path has been trodden with depressing stories of disruption and destruction. The root causes of that run the gamut - from (i) Amazon ($AMZN) and other new-age retail possibilities (e.g., resale and DTC DNVBs) to (ii) busted PE deals to (iii) fraud and mismanagement. Through it all, nothing has really gotten us too fired up — not the hypocrisy surrounding Bank of America’s ($BAC) loan to Remington Outdoor or the hubris around Toys R Us. But, once you start effing with our dogs’ diets, that’s when we have to start getting all-John-Wick up in this mofo.

Enter PFS Holding Corp., otherwise known as Phillips Pet Food & Supplies (“PFS”). PFS is a distributor of pet foods, grooming products and other useless over-priced pet gear. It is private equity-owned (sponsor: Thomas H. Lee Partners) and has $450+ million of LBO-vintage debt spread out across a recently-refinanced $90 million revolving credit facility (pushed to 2024 from January 2019), a cov-lite ‘21 $280 million term loan, and a cov-lite ‘22 $110 million second lien term loan.

The company recently got some breathing room with a freshly refi’d revolver but still has some issues. While quarterly sales increased in Q4 from $293 million to $327 million, gross margins were down — a reflection of price compression. EBITDA was roughly $62 million on a consolidated adjusted basis clocking the company in at right around a 7.4x leverage ratio. The ‘21 and ‘22 term loans both trade at distressed levels, reflecting the market’s view of the company’s ability to pay the loan in full at maturity. Upon information and belief, the new revolver includes a 90-day springing maturity which means that the company is effed if it is unable to refi out the term loan prior to its maturity (which, admittedly, seems lightyears away from now).

All in, S&P Global Ratings appears to think that the Force is weak with this one; it issued a corporate downgrade and a term loan downgrade of the company on April 10, 2018. Why? Well, S&P doesn’t pull any punches:

“The downgrade reflects our view that, absent significantly favorable changes in the company’s circumstances, the company will seek a debt restructuring in the next six to 12 months, particularly given very low trading levels on its second-lien debt, between 30 and 40 cents on the dollar. It also reflects our view that cash flow will not be sufficient to support debt service and maintain sufficient cash interest coverage, resulting in an unsustainable capital structure. We forecast adjusted leverage in the mid-teens. PFS recently lost a substantial portion of business with one of its largest customers, which we believe represented over half of the company’s EBITDA. Management implemented several cost savings initiatives last year, but we do not believe savings achieved will be sufficient to offset this dramatic profit loss. Further, we expect the company will continue to be pressured by a secular decline in the independent pet retail market, which we view as PFS’ core customer base. Independent pet shops continue to lose market share to e-commerce and national pet retailers, as consumer adoption of e-commerce for pet products purchases grows.”

There’s a lot there. But, first, who writes these dry-as-all-hell reports? If any of you has a connection at S&P, consider putting us in touch. We could really spice these reports up.

Here’s our take:

“The downgrade reflects the fact that this business is turning into garbage. The company was hyper-correlated to one buyer, is over-levered and is, in real-time, succumbing to the cascading pressures of e-commerce and Amazon. In the age of the internet, nobody needs a distribution middleman. Particularly at scale. The lost customer reflects that. Godspeed, PFS.”

Just saved like 1,382,222 words.

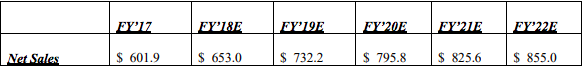

S&P further predicts a double-digit sales decline and negative free cash flow in 2018 and 2019, “with debt service and operating expenses funded largely with asset-backed loan (ABL) borrowings.” Slap a mid 5s multiple on this sucker and it looks like the first lien term loan holders will eventually be the owners of a shiny not-so-new pet food distributor! Dogs everywhere lament.