Disruption from the Vantage Point of the Disrupted

Disruption from the Vantage Point of the Disrupted

Freemium Briefing - 8/22/18

Read Time = 5.4 a$$-kicking minutes

Twitter: @petition

Website: petition.substack.com

⚡️Announcement #1⚡️

We are nearing the end of PETITION’s beta period. The success of our a$$-kicking newsletters has surpassed our expectations and we couldn’t be more appreciative of your support. Thank you.

We don’t intend to stop here. To help us reach the next level of a$$-kickingness, we will be raising our price sometime shortly after Labor Day. If your firm is considering a group subscription, please prod them forward and have someone email us at petition@petition11.com. Now is the time to lock in the lower rate.

In case you're wondering why we are doubling down on subscriptions, you might want to consider the most recent news from the magazine industry.

🗞News of the Week (2 Reads)🗞

1. Is Tech in Trouble? Part 2. (Short Hefty Seed Rounds)

ICYMI, in “📱Is Tech in Trouble?📱,” we asked whether…well…tech was in trouble. We aren’t alone.

A few weeks ago Brad Feld of Foundry Group wrote the following in a piece entitled, “Early Stage VCs — Be Careful Out There”:

Yesterday, in one of the quarterly updates that we get, I saw the following paragraph.

“Historically, the $10 million valuation mark has been somewhat of a ceiling for seed stage startups. But so far this year, we’ve seen that a number of companies, often times with nothing more than a team and a Powerpoint presentation, have had great success raising capital north of that $10 million level. Furthermore, round sizes continue to tick up, with many seed rounds now in the $2.5 million to $4.0 million range.”

We are seeing this also and have been talking about it internally, so it prompted me to say something about it.

I view this is a significant negative indicator.

It has happened only one other time in my investing career – in 1999.

Man. There’s so much money out there looking for some action.

Read the piece. It’s short. He closes with this:

For anyone that remembers 2000-2003, this obviously ended badly. By 2002 investments at the seed level had evaporated (there were almost no seed financings happening). In 2003 the angels started to reappear (some of the best angel deals of all time were done between 2004 and 2007) and the super angel language started to be used around 2007.

All the experienced finance people I know talk regularly about cycles. If you believe in cycles, this one feels pretty predictable. Of course, there is an opportunity in every part of the cycle. But, be careful out there.

The kinds of companies he’s talking about aren’t in the same zone as those that we wrote about last week. These early stage companies are too early to have any of the characteristics (i.e., public equity, advanced IP, leases, exposed directors) that we noted might qualify a company to leap outside of the sphere of an assignment of benefit of creditors and into bankruptcy court. But still. This piece could just as easily slide into our “What to Make of the Credit Cycle” series.

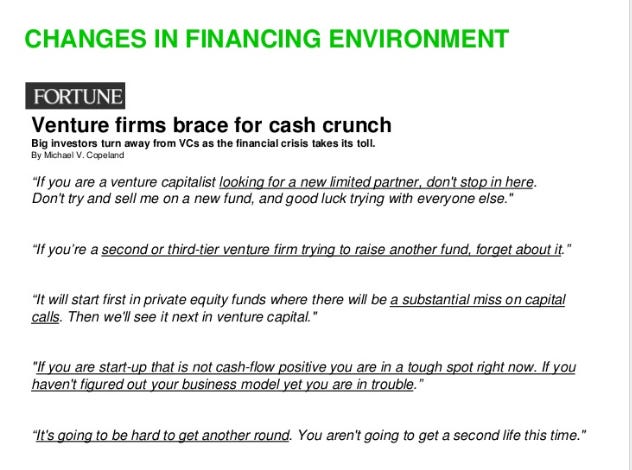

To put a cherry on top, read this piece from Jason Calacanis. We typically think Mr. Calacanis is too high on his own sh*t but this cautionary letter to the founders he’s invested in is, in fact, instructive. We particularly liked his link to a Sequoia Capital presentation circa 2008. It’s a must read for anyone who wants a primer/refresher on what the hell happened back in the financial crisis and some insight into how investors thought about the time.

So, where are we in the credit cycle? The part where a number of folks are starting to exercise and advise a bit more caution.

2. Are Point-of-Sale & Self-Checkout Systems Effed (Short Diebold Nixdorf)?

Forgive us for returning to recently trodden ground. Since we wrote about Diebold Nixdorf Inc. ($DBD) in “💥Millennials & Post-Millennials are Killing ATMs💥,” there has been a flurry of activity around the name. The company…

To continue reading, you must be a Member. Become one here.

📚Resources📚

We have compiled a$$-kicking resources on the topics of restructuring, tech, finance, investing, and disruption. 💥You can find it here💥. A lot of our nerdy finance friends are checking out “Crashed: How a Decade of Financial Crises Changed the World” by Adam Tooze. Also making news this week: Barack Obama recommended “Factfulness” by Hans Rosling, a book previously highlighted by Bill Gates. It’s on our list. Check it out.

⚡️Announcement #2 ⚡️

We love seeing the restructuring community wield its mighty influence for good causes. On September 24, 2018 from 6-9:30pm, the community will gather to support the Citizens Committee of New York City at an Evening on the Lake at the Central Park Boathouse honoring Holly Etlin, Managing Director of AlixPartners. The organization’s mission is simple: “to help New Yorkers—especially those in low-income areas—come together and improve the quality of life in their neighborhoods.”

TEN lucky PETITION subscribers will be eligible to receive complimentary tickets to the event ($195 value) simply by filling out this a$$-kicking survey by August 31. Even if you cannot attend the event, we’d appreciate you filling out the a$$-kicking survey anyway. It will help us ensure that PETITION keeps living up to the community’s lofty standards. Cheers!

⚡️Update: Black Box Corporation ($BBOX)⚡️

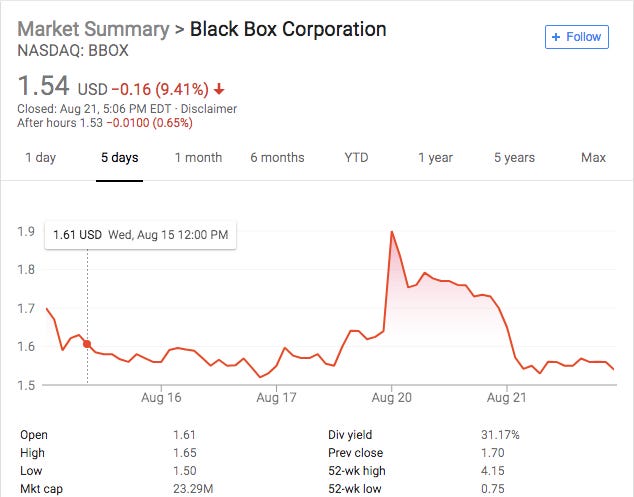

In our July 22 Members’-only briefing, we discussed the efforts of Black Box Corporation ($BBOX) to sure up liquidity. As we indicated then, the company still isn’t out of the woods and merits continued watching.

The company reported earnings earlier this week and indicated that (i) it is in line to close the sale of its federal business unit to a private equity firm for $75mm, the proceeds of which to be used for paying down its relatively new $10mm LIFO line and other debt; (ii) the aforementioned sale “does not solve [its] financing issues;” (iii) the company has “experienced issues” with certain vendors and customers related to its June 29th 8-k filing (which included a going concern warning); (iv) revenue decreased by $3.2mm from the prior quarter and $0.8mm YOY; (v) product and services revenue both declined while maintenance revenue increased; (vi) interest expense continued to increase due to higher interest rates; and (vii) working capital declined by $2.7mm compared to last quarter. Net debt is now $134.4mm. To address that debt, the company continues to explore asset sales. The stock initially reacted positively to the report but has since retraced downward to a point below where it was when we first wrote about it. It was down 9% yesterday, August 21.

‼️Feedback‼️

One reader, a senior professional with decades of experience in the tech space (including assignments for the benefit of creditors) disagrees with our thesis that they’ll be an increase in tech bankruptcies. He wrote:

I continue to believe that the use of non-bankruptcy alternatives will continue at or a greater rate than even in the dot.com bubble. The reason tends to be the desire to have the portfolio company failure(s) be less public than bankruptcies. Add the disclosure issues with being on the Board of a company that files a bankruptcy case and the venture backed startups are a prime example of why ABCs have been used routinely since the early 2000s.

Time will tell.

💰New Opportunities💰

SierraConstellation Partners seeks a Director for its Los Angeles office. For experience requirements and other specifications, please contact SCP at info@scpllc.com.

SierraConstellation Partners seeks a Senior Director for its Los Angeles office. For experience requirements and other specifications, please contact SCP at info@scpllc.com.

SierraConstellation Partners seeks a Director for its Houston office. For experience requirements and other specifications, please contact Drew McManigle at SCP at dmcmanigle@scpllc.com.

SierraConstellation Partners seeks a Director for its Boston office. For experience requirements and other specifications, please contact Tom Lynch at SCP at tlynch@scpllc.com.

PETITION is looking for a unicorn who wants to help build something from scratch. We are a revenue generating startup with a lot of vision for what comes next. If you have a background in finance, law, or consulting and want to be a utility player helping us build out our content, sales/marketing infrastructure, partnerships, ops, and whatever else we conjure up in our big domes, ping us. All inquiries will be handled on a strictly confidentialbasis. Preference will be given to MEMBERS. How else can you be educated about what we’re doing and how we’re doing it if you’re only seeing part of the picture?!

If your firm has job opportunities, please email us at petition@petition11.com.

Nothing in this email is intended to serve as financial or legal advice. Do your own research, you lazy rascals.