🔥F.E.A.R.🔥

⚡️What. The. Hell.⚡️

This week was a complete and utter sh*tshow. There’s no sugar-coating it. As fears about coronavirus rose, the stock market got absolutely annihilated — the S&P dipped over 11% for the week (one of the most severe declines in history) and the Dow dropped approximately 4000 points — precipitating a rabid shift to safety in the markets: the 10-year treasury hit a record low, dipping below 1.2%. Leveraged loans, meanwhile, got napalmed.

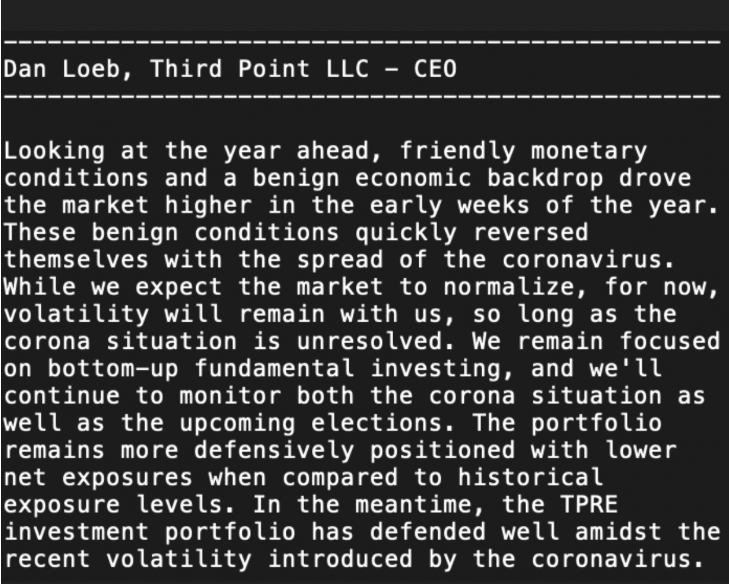

Majors like Apple Inc. ($AAPL), Mastercard Inc. ($MA) and Microsoft Inc. ($MSFT) lowered guidance and Goldman Sachs Inc. ($GS) issued a report indicating lowered growth expectations for the year — to zero. Yep, zero. The VIX “fear index” jumped into the 40s after being virtually catatonic for years. Now there’s widespread speculation that the FED will lower rates to stimulate the market — a controversial strategy given (a) the sheer volume of money already flushing through the system and (b) the fear that the FED will be ill-equipped to then address any subsequent recession.

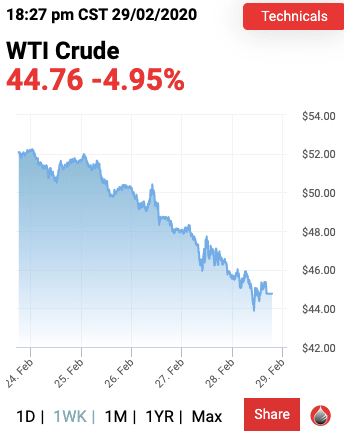

There are a lot of restructuring implications — on both sides of the fence. On one hand, lower interest rates ought to help a number of companies with floating-rate loans. It’s clear that the rising interest rate catalyst that many expected — and the FED quickly shot down last year — is nowhere near becoming reality. Secondly, oil and gas prices are getting smoked and given that those commodities constitute huge input costs, companies will see some savings there. Theoretically, lower oil and gas prices should also help stimulate the consumer which, we all know, had been carrying both the economy and stock prices to recent (clearly inflated) highs.

That is, unless they stay home and do nothing other than watch Netflix ($NFLX) and Disney+ ($DIS) and order bottled water and canned goods from Amazon ($AMZN) and Walmart ($WMT) — assuming, of course, that third-party fulfillment isn’t affected by supply chain disruption. Interestingly, both the consumer staples and discretionary spending ETFs are down over 10%. And the former more than the latter, which, when there’s a flight to safety pushing treasury rates down, doesn’t make much sense. So 🤷♀️. Corporations are, one by one, curtailing business travel, cancelling conferences, and encouraging stay-home work as advisories abound about congregating in mass group settings. This is impacting the airlines and movie theaters, naturally. The MTA ought to see a decline in ridership which ought to dig a bigger budget deficit hole (PETITION Note: Is NYC f*cked?).

Transports are getting smoked too. SupplyChainDive writes:

The COVID-19 outbreak and resulting quarantines have led to a record number of blank sailings, according to the latest figures from Alphaliner. Inactive fleet size has swelled to 2.04 million TEUs or 8.8% of global capacity. The decline is greater than the 1.52 million TEUs of canceled capacity during the 2009 financial crisis, the previous record, 11.7% of the total fleet at the time.

The Ports of Los Angeles and Long Beach are facing 56 canceled sailings over the first three months of the year, the ports told Supply Chain Dive.

Note that we had previously asked “Short the Ports?” in “🚛Dump Trucks🚛” here.

Here is The Washington Post highlighting a world of hurt at the ports:

…shipping container traffic both coming and going from the ports of Los Angeles and Long Beach has been sliding at an average rate of 5.7 percent a month since the beginning of last year….

Pour one out for the shippers.

Of course, none of this is positive for sectors that are already massively struggling, i.e., restaurants. Nor retail. Per CNBC:

If the coronavirus spreads in the U.S., that could mean really bad news for U.S. mall owners, according to a survey taken this week.

The survey by Coresight Research found that 58% of people say they are likely to avoid public areas such as shopping centers and entertainment venues if the virus’ outbreak worsens in the United States. The group surveyed 1,934 U.S. consumers 18 and older.

The survey was taken Tuesday and Wednesday — before California said it was monitoring 8,400 people for COVID-19.

Back to energy. Energy bonds are getting smoked as massive outflows flee the sector.

OPEC meets next week to discuss a massive production cut. From a restructuring perspective, it’s likely irrelevant at this point.

We’re heading into redetermination season for oil and gas explorers and producers and, given the rapid decline in oil and gas prices, banks are likely to take a stern stance vis-a-vis borrowing base levels. That ought to help usher in another wave of oil and gas restructuring.

Hold on to your hats, folks.