🔥Johnny's Links #5🔥

Artificial Intelligence, "Exclusive Opportunism," Michaels Stores, Sleep Number Corp. + Private Credit

As the RX world awaits word as to which firm Kirkland & Ellis LLP’s David Nemecek will hand his rose to this coming Valentine’s Day (it’s a real shame RX isn’t big enough to be on Polymarket) …

… and otherwise watches the Optimum antitrust situation with baited breath (pick your horse, side left or side right?!) …

… we march on.

On Wednesday, we discussed the plight of retail …

… and the team is hard at work on the next a$$-kicking paying subscribers’-only edition of PETITION coming on Sunday. Will you fall victim to the paywall? Well, that would be nonsense so👇:

Let’s dive in to subjects that piqued Johnny’s interest this week ….

🔗What We’re Reading (5 Reads)🔗

1. Artificial Intelligence (Long Speed of Execution). Unfamiliar with “agentic engineering”? You’re not alone but get ready to hear more about it. We like to think of it like Neo sleeping at his desk letting his programs search the darkweb for Morpheus: AI agents coding while the coder sleeps. Read this post from Nikhil Basu Trivedi …

… to understand why “[e]ngineers … are able to do more and more and more, with multiple agents running 24/7 to build features and products — and hence why the feature backlog on the product roadmap may no longer be a backlog for a set of companies” and use your imagination as to how this development could/will reverberate (is reverberating?) throughout markets (and impact software/tech/f*ck-ton-other companies too slow to iterate).

That said, is all of the recent market animosity towards tech/software overdone? Here’s Debtwire featuring a quote from Fortress Investment Group’s Wariz Anifowoshe about the opportunity set that may be appearing due to AI-based fear:

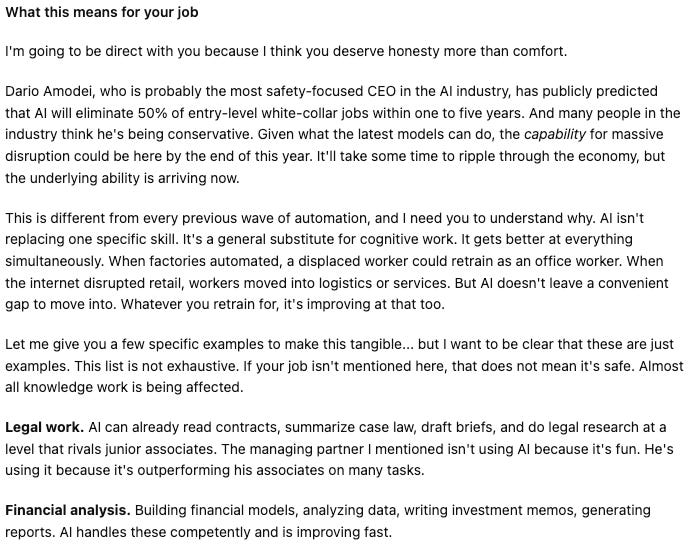

Distressed investors haven’t traditionally been called “vultures” for nothing but they might want to wear some thick a$$ gloves to catch these falling knives. Or, alternatively, they might want to read THIS and slow the f*ck down because it’s downright scary out there ... like hug your kids type scary.* Sh*t, you lawyers and bankers ought to read it too and start formulating a contingency plan.

*Now lest we stir a panic, we’re old enough to remember several disruptive trends that were, the pundits said, sure to disrupt everything and on many occasions they flamed out. This, however, definitely feels different. Perhaps in part because nobody seems to be minding the store.

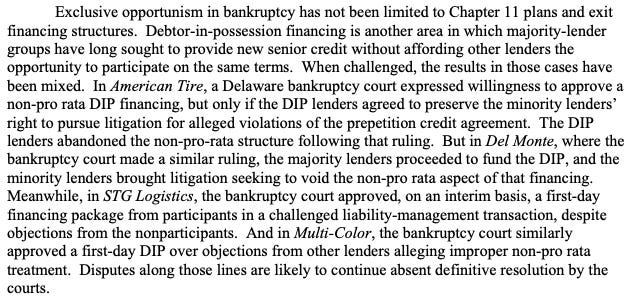

2. Exclusive Opportunism (Long “Increased appellate scrutiny”). Here is another missive from the fine folks over at Wachtell Lipton Rosen & Katz with a synopsis of some of ‘25’s trends and developments and expectations for ‘26. We enjoyed (a) the historical tie-in to the Peabody Energy Corp. ($BTU) chapter 11 bankruptcy case (which ended up a boon for certain lenders) and (b) the pithy synopsis of where things stand with respect to non-pro-rata DIP shenanigans that have been taking place in a variety of cases, see, e.g., STG Logistics Inc. and Multi-Color Corporation.

We completely agree that these disputes will continue.*

We also agree — and we’re not alone (here is Willkie Farr & Gallagher LLP’s Jeffrey Pawlitz with some thoughts) — with the team’s prediction of “increased appellate scrutiny of bankruptcy court decisions.” That is, if cases actually file in the jurisdiction where scrutiny has been on the rise. Posting this again for the short-term memoried:

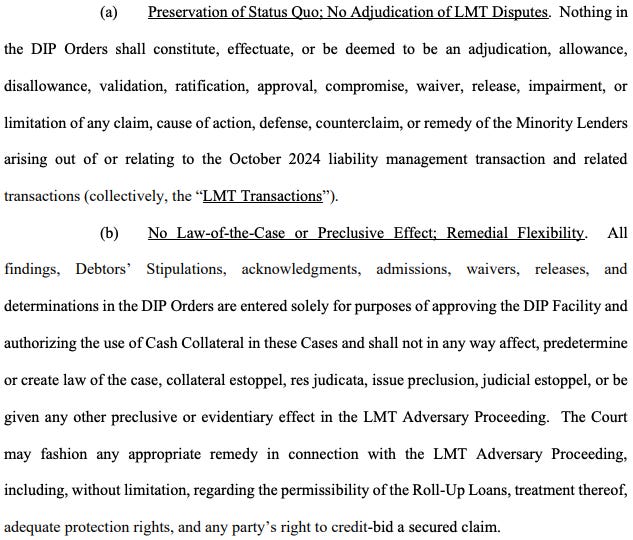

*Note that, after the publication of Wachtell’s memo, the bankruptcy court in STG approved the debtors’ proposed DIP on a final basis (including the proposed roll-up of contested debt), subject to resolution of the prepetition (now adversary) litigation. The relevant text of the order is here:

3. Michael’s (Long Comeback Stories?). Sh*t, it’s retail, so who the hell knows but in the first instance it sure looks like Michael’s Stores (“Michael’s) is capitalizing on the collapse of JOANN’s and Party City and turning itself around. And that’s creating some winners in the corporate credit space 👇.

4. Monetization & Mattresses (Long Sleep). Here is Third Point Capital’s Daniel Loeb with his Q4’25 investor letter. Loeb’s flagship fund underperformed the S&P500 for the quarter and Mr. Loeb delves into what did and didn’t work. What didn’t work? Loeb’s corporate credit book generally. What did work? Michael’s place within that corporate credit book! Per Mr. Loeb:

“As we see it, the corporate credit book marginally underperformed the high yield index in 2025. This performance was disappointing; over the last sixteen years our corporate credit book has beaten the index by 2x net of fees, on average. While we avoided some of the largest disasters like First Brands, New Fortress Energy, and Brightline, we had only one real standout result. Our largest winner was Michaels Stores, which was the best performing bond in the JPM High Yield Index.”

Unfazed, however, he spotlighted corporate credit as an interesting corner to play this year:

“We believe that both private credit and private equity will continue to struggle with monetization. This isn’t due to a mystery force and certainly isn’t due to a lack of capital. Liquidity is always available, although you may not like the price. There are billions of dollars trapped in private equity that in our view cannot be monetized at a price that sponsors can stomach. This was already an issue with the higher interest rates and lower valuations today versus 2020-21, but we believe it will be an even greater issue as we transition from a “preAI” to “post-AI” world. This latter factor may strand even greater pools of invested capital, especially in the enormous software/information technology sector. We believe being able to pivot quickly and deploy fresh capital (without having a huge backlog of underwater investments) will be an advantage.”

He predicted that the private credit market will become more liquid, that liability management exercises will continue unabated in ‘26 (bold call!) and that Somnigroup International Inc. ($SGI) will thrive in part because Sleep Number Corp. ($SNBR), a name we noted late last year as “one to watch” …

… will continue to sh*t the bed (😝).

5. Private Credit (Short EBITDA Growth). Ruh roh. If you think the SaaStruction in public markets was bad this week, imagine what sh*t looks like for the private credit market. The fine folks over at Lincoln International (“Lincoln”) have some insights. In a newly published report, they raise some red flags:

“The percentage of private companies with EBITDA growth in the fourth quarter remained consistent at around two-thirds and the magnitude of EBITDA growth for the full year of 2025 of 4.7% was favorable to 2024 of 3.5%. However, looking back across 2025, the magnitude of EBITDA growth steadily slowed since the beginning of the year as year-over-year, last 12 months EBITDA growth declined from 6.5% in Q2 to 5.2% in Q3 and 4.7% in Q4. While EBITDA growth remains positive, this slowing growth may explain why Lincoln observed leverage increases of ~0.5x from deal inception to today across all vintages, likely driven by a combination of lower realization of synergies and limited free cash flow generation due to years of high rates.” (emphasis added)

Ours eyes opened wider upon reading this:

“‘We have seen a steady slowing of EBITDA growth during 2025 and companies not being able to organically deleverage,’ noted Ron Kahn, Managing Director and Global Co-Head of Lincoln’s Valuations and Opinions Group. ‘Notably, of the loans that remain outstanding from the 2019 and 2020 vintages, that growth in leverage is closer to 1.0x, the exact opposite of what you would expect. Many of these deals likely mature in the next two years and we estimate that around 30 to 40% of the deals maturing in the next two years have already extended their maturity once meaning that lenders either need to provide an incremental extension or potentially explore a restructuring if these deals cannot otherwise be refinanced.’” (emphasis added)

While private credit isn’t exactly storming bankruptcy courts just yet, there is nevertheless a flurry of activity — it’s just out of court. Lincoln continues:

“While the covenant default rate remained flat since Q3 at 3.2%, amendment activity increased 13% quarter-over-quarter, with maturity extension and covenant holiday activity increasing 14% and sponsor infusion activity increasing 31%. Conversely, repricing amendment activity, often a sign of positive company performance, increased just 6%. This trend suggests that although lenders and sponsors remain supportive of portfolio companies, the signs of distress amongst underperforming portfolio companies are growing.

The covenant default rate is only one measure of stress and, to dig deeper into the health of the direct lending market, Lincoln did an analysis of PIK activity and determined that 11% of loans valued by Lincoln paid PIK interest in 2025. Importantly, this represents any magnitude of PIK interest (i.e., it may be a small partial PIK toggle or a full PIK election). The 11% represents an increase from 7% in 2021.”

There’s more:

“Further analysis showed that, of the 11% of loans with PIK interest, Lincoln determined that 58% of those companies had “bad PIK” interest, meaning these companies did not pay any PIK interest at initial transaction close (including loans that had a PIK toggle that was not utilized at inception), but now had some component of PIK interest, up 1% from Q3 and 23% since Q4 2021. Putting this all together, of the total population of loans in Lincoln’s proprietary private market database, 6.4% of loans had “bad PIK”, an increase from 6.1% in Q3 and 2.5% in Q4 2021. This “bad PIK” percentage can be viewed as a “shadow default rate” or a proxy for situations wherein there may have otherwise been a default if not for a PIK election given such elections are often made due to liquidity tightness.”

Let’s close with this:

“One final trend Lincoln observed in 2025 was a meaningful increase in instances of lenders taking control of a business from the sponsor, clocking in at $24.1 billion of debt foreclosed relative to just $13.6 billion in total in the preceding three years. Of those change of control transactions, nearly 75% related to 2021 and 2022 vintage deals.”

Repeat: $24.1b in ‘25 versus “…just $13.6 billion in total in the preceding three years”!

The way things are currently looking we’ll take the over for ‘26.

📈Charts of the Mid-Week📈

🎧What We’re Listening To🎧

For some fun reading before the first one …

📼What We’re Watching📼

📚Resources📚

We have compiled a list of a$$-kicking resources on the topics of restructuring, tech, finance, investing, and disruption. 💥You can find it here💥.