💥Loads of Retail Liquidation💥

Eddie Bauer LLC files to liquidate + an American Signature LLC (liquidation) update.

On February 9, 2026, Eddie Bauer, LLC and four affiliates (collectively, the “debtors”)* filed chapter 11 “sale” cases in counsel Kirkland & Ellis LLP’s préféré jurisdiction, the District of New Jersey (Judge Meisel).**

The debtors are the exclusive licensee of the Eddie Bauer brand for brick-and-mortar retail in the US and Canada, of which there’s 175 locations as of the petition date. That’s down from 224 as of January 31, 2026,*** but still much, much higher than where the cases will head:

And that’s because the debtors are owned by JCPenney’s (“JCP”) SPARC Group Holdings LLC (together with non-debtor affiliate Catalyst Brands LLC, “SPARC”), which, a little less than a year ago, kicked off Part I of its Adventures in Pretending to Sell a Broke-A$$ Brand.

We just re-read that F21 OpCo, LLC (“F21”) piece 👆, and holy hell, the parallels.

Here’s a list …

1️⃣ The reasons to be in bankruptcy are exactly the same:

The end of COVID ✔️

Inflation ✔️

A “shift” in consumer preferences ✔️

Contracting margins ✔️

The supply chain ✔️

The damage inflicted by the now-canceled “de minimis” exception ✔️

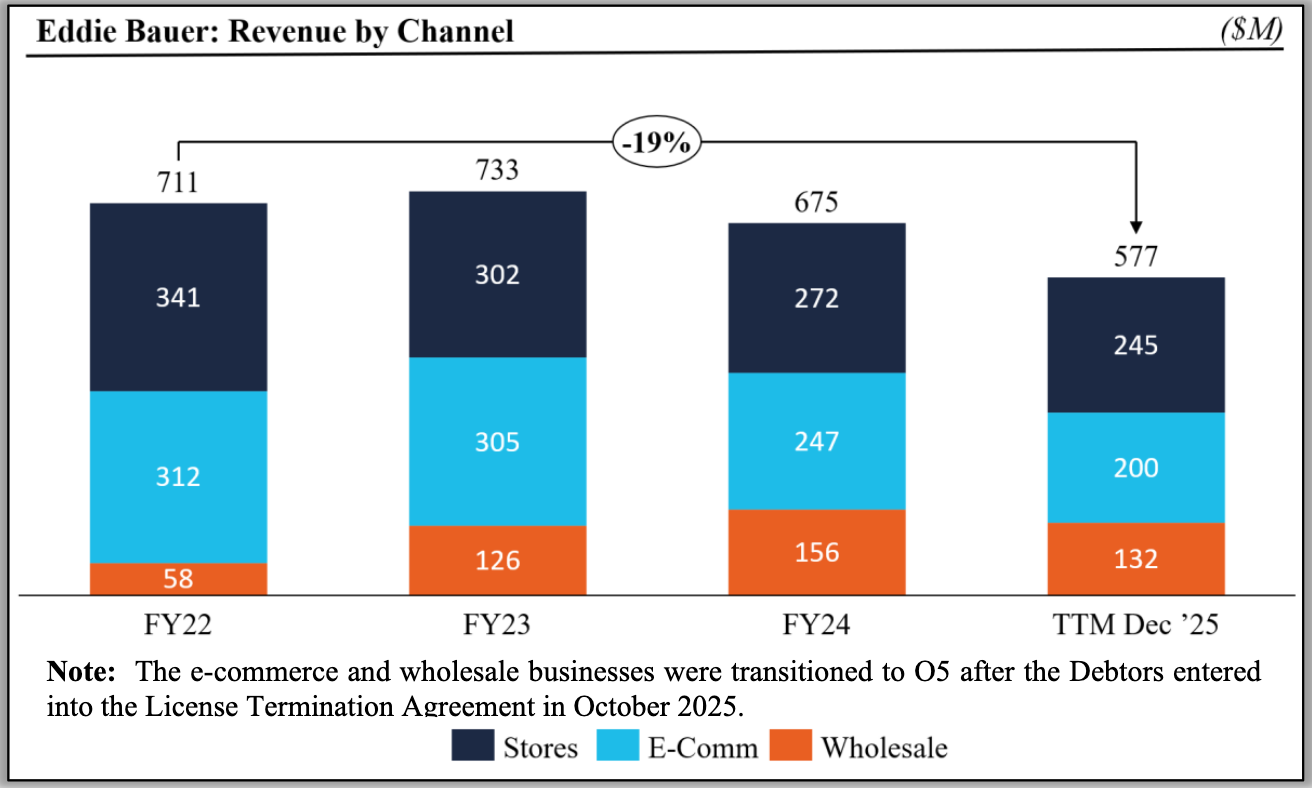

… all of which, in the debtors’ case, led to the shrinkage 👇.

… and “… negative earnings of approximately $2 million in 2022, $10 million in 2023, $82 million in 2024, and $80 million in 2025.”

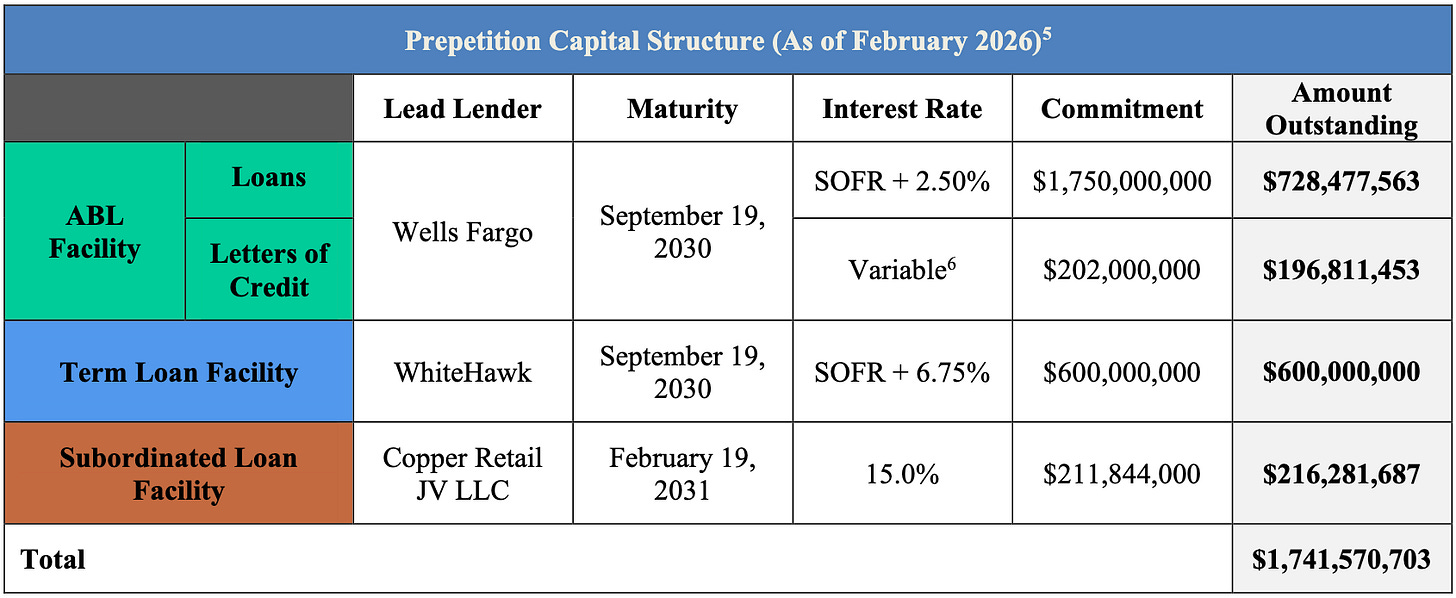

2️⃣ The debt’s more or less the same …

… except (i) the prior term and subordinated loans were refinanced and upsized in September ‘25 and (ii) as a result, the aggregate debt balance has grown ~$160mm (from ~$1.58b to $1.74b) since F21 filed. We understand why sub-lender Copper Retail JV LLC would do that — it’s an affiliate of SPARC — but what did (does?) Whitehawk Capital Partners LP see in SPARC and its brand “portfolio” of obligors, including JCP, Aéropostale, Brooks Brothers, Nautica, and Lucky Brands??

3️⃣ The general bankruptcy process is going to be exactly the same. Go through the motions of “marketing” the assets for sale, sans stalking horse, while Hilco Merchant Resources, LLC (“Hilco”) and SB360 Capital Partners, LLC actively burn down the brick-and-mortar biz, which, naturally, started prepetition on January 26. When it’s all said and done, all of the debtors’ stores will be liquidated.

4️⃣ The initial proposed GUC treatment is just as bad as F21’s. Under the debtors’ (i) restructuring support agreement with 100% of the lenders under the debt facilities above — attached as exhibit B to Berkeley Research Group, LLC’s Stephen Coulombe’s first day declaration, in his capacity as co-CRO (which, for the record, is the same role he had in F21 and, less relevant here though still interesting, has in American Signature LLC 👇) — and (ii) contemplated-but-unfiled chapter 11 plan, GUCs, which are owed tens of millions at a minimum, will take their pro rata of ~$250k … if … cue the Admiral …

… they vote in favor of said plan. Obviously, the debtors’ and RSA parties’ advisors know that the official committee of unsecured creditors (the “UCC”), when appointed, will dig up things to gripe about, so, just like in F21, we expect the recovery to get juiced, after which the UCC will walk.

5️⃣ Meanwhile, holders of the ABL, the term loans, and the subordinated loans agreed to identical F21 treatment: whatever doesn’t go to GUCs, fund a wind-down plan, or pay profs will go to the ABL, and the other loans, which as alluded to above have non-debtor, SPARC-affiliated obligors, will take a 🍩 vis-a-vis the debtors.

6️⃣ The need for speed is approximately the same. The RSA gives 31 days for a sale hearing, 35 days for conditional disclosure statement approval, 70 days for a confirmation order, and 75 days for the effective date, taking us all the way out to April 25, 2026.

The court held a ~1.75-hour first day hearing on February 10, 2026 at which all requested relief was granted, and scheduled the second day for March 3, 2026 at 1pm ET. By then, we’ll have found out who’s buying the biz.

Nobody. Best of luck to the debtors’ ~2.2k employees.

The debtors are represented by Kirkland & Ellis LLP (Joshua Sussberg, Matthew Fagen, Oliver Paré, Nathan Felton, Matt Lazarski, Sarah Osborne) and Cole Schotz, P.C. (Michael Sirota, Warren Usatine, Felice Yudkin) as legal counsel, Berkeley Research Group, LLC (Stephen Coulombe, George Pantelis) as financial advisor and co-CROs, and SOLIC Capital Advisors, LLC (Reid Snellenbarger) as investment banker. Jeffrey Stein and Anthony Horton are the debtors’ independent directors. Wells Fargo Bank, N.A., as prepetition ABL agent, is represented by Otterbourg P.C. (Daniel Fiorillo, Matthew Stockl, Varinder Singh, Antonio Aguilera) and McCarter & English LLP (Joseph Lubertazzi Jr., Jeffrey Testa) as legal counsel. The “consenting term loan lenders” are represented by Ropes & Gray LLP (Gregg Galardi, Michael Wheat, Lauren Knight) and Sill Cummis & Gross P.C. (Andrew Sherman, Gregory Kopacz, Oleh Matviyishyn) as legal counsel. Copper Retail JV LLC, as prepetition subordinated agent, is represented by Choate, Hall & Stewart LLP (Michael Comerford, Alexandra Thomas) and Chiesa Shahinian & Giantomasi PC (Thomas Walsh, Sam Della Fera) as legal counsel. Hilco is represented by Riemer & Braunstein LLP (Steven Fox) and Mandelbaum Barrett PC (Vincent Roldan) as legal counsel.

*Two debtors are Canuck, and they intend to file ancillary proceedings under Canada’s Companies’ Creditors Arrangement Act with Eddie Bauer LLC acting as foreign rep.

**Many moons ago, in March ‘03, Eddie Bauer filed chapter 11 in the Southern District of New York, and among other outcomes that bankruptcy was the spinning out of the brand as a standalone enterprise. That lasted about six years. In June ‘09, our dear Eddie once again sought refuge in the District of Delaware and exited via a sale to Golden Gate Capital. So, you could say these cases are technically 33s, but kids born after the first set are now old enough to drink so whatever.

***That same day, the debtors lost their license to operate Eddie Bauer’s e-commerce and wholesale business. Apparently, e-commerce was only “… marginally …” profitable and wholesale not at all, so to save $220mm in fees over six years, the debtors brokered a deal with IP-owner Authentic Brands Group, LLC, which has also had recent bankrupt brand experience, to transfer those rights back. A good move for the company? Maybe, but it did f*ck all to prevent a liquidation. Per Mr. Coulombe, “[a]lthough the License Termination Agreement alleviated a substantial liability for the Company, the Debtors’ revised financial projections continued to indicate that the Debtors would generate negative cash flow.”

⚡Update 2: American Signature Inc.⚡

As dockets overflow with recent chapter 11 bankruptcy filings (e.g., Saks Global Enterprises LLC, Francesca’s Acquisition LLC just last week and, most recently, Eddie Bauer LLC 👆), we figured we’d check in on late ‘25 fave American Signature Inc. (along with its eight filed affiliates before Judge Stickles in the District of Delaware, the “debtors”) and all of its drama.

You’ll recall from our previous coverage …

… that (i) the situation was incestuous and insider-y as f*ck with the Schottenstein family positioned at virtually every level (e.g., equity, prepetition lender, DIP lender, stalking horse bidder, liquidator, and landlord!) and (ii) both the office of the United States Trustee and the official committee of unsecured creditors (the “UCC”) were angered by how the situation was incestuous and insidery-y as f*ck, and objected to the debtors’ proposed sale process and bought themselves … well, not much, in actuality … so little that Johnny made fun of the mere six days gained for marketing of the assets. Which, as you could imagine for a sale process taking place directly over the holidays, yielded a big fat 0️⃣. And so on January 7, 2026, the debtors — ⚡️SURPRISE!⚡️— announced that no qualified bids had come in, anointed the Schottensteins victorious, and obviously stopped the UCC dead in its tracks. Wait …

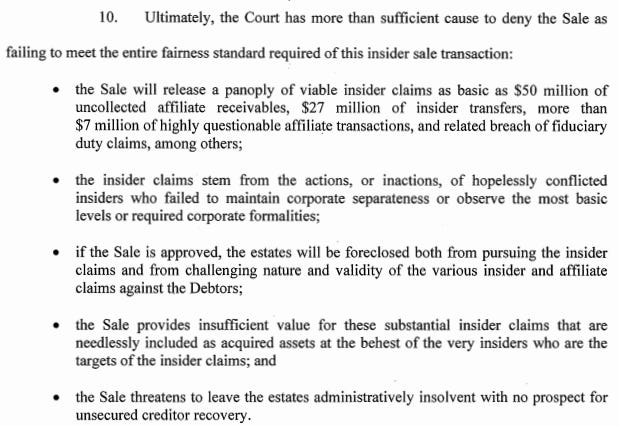

On January 29, 2026, the UCC filed a 1159-page objection(!) to the sale and — suck it Johnny! — the six days of additional time clearly bore fruit. Indeed, that extra time afforded the UCC the opportunity to dive deeeeeeeeep into the debtors’ historical relationship within the Schottenstein empire enterprise and, it seems — yes, “seems,” because we sure AF aren’t spending hours reading through 1159 pages — enabled the UCC to uncover some sordid Schottenstein sh*te. You know, “nothing to see here” type stuff like:

📍Various Schottenstein entities owed and didn’t pay the debtors more than $50mm, some of which is on account of the debtors funding payroll and operating expenses of other non-debtor Schottenstein entities, 😳;

📍The debtors have been funding personal expenses of the Schottensteins, including luxury boxes for Ohio State football (Go Buckeyes!) and personal security details, 😂;

📍The debtors have been funding the entire operations of non-debtor Kroehler Furniture Mfg. Co., Inc.* (“Kroehler”) for several years — to the tune of … well … the UCC hasn’t had time to determine it exactly but it appears to be in the millions of dollars, 🙄; and

📍There were more than $27mm in “purported” unsecured loans paid to various Schottenstein entities in the two years leading up to bankruptcy — much of it done with questionable governance and documentation — and all in lieu of paying other direct creditors of the debtors’ estates, including their secured creditors.

All of which led the UCC to declare that “...the Schottenstein family utilized their dominance of the Debtors and the other Schottenstein entities for their own benefit without regard for the financial ramifications to the Debtors and their creditors,” adding “[t]he inclusion of the Kroehler creditors on the Debtors’ schedules alone provides sufficient grounds to doubt the separateness of the Schottenstein controlled entities.” Significantly, you’ll recall from our prior coverage that among the assets going to the Schottenstein-affiliated entity as part of its bid are causes of actions against the Schottensteins. The UCC be like …

… its counsel Jason Adams at Kelley Drye & Warren LLP be like …

… and the UCC concluded with this banger:

In response, the Schottensteins be like …

… and dialed Wachtell Lipton Rosen & Katz, and Scott Charles be like …

… and, lo and behold, a revised proposed sale order reflecting the terms of a global settlement hit the docket in advance of the February 4, 2026 sale hearing.

The settlement terms include, among other things, the following:

📍A $10.75mm increase in the purchase price;

📍A claim of net cash proceeds from the Schottenstein parties’ sale of acquired real property (subject to hurdles and other qualifications yada yada yada);

📍A waiver by the Schottenstein parties of what amounts to any and all pre-bankruptcy claims against the debtors; and

📍Agreement to move towards a chapter 11 plan of liquidation that provides customary releases, including of the Schottenstein parties, which are acquiring all but some “non-acquired avoidance actions” which will be transferred to a post-confirmation trust provided for in any confirmed chapter 11 plan.

The court entered an order approving the sale (and global settlement) on February 6, 2026, cementing what amounts to not a bad haul for six extra grueling days of work (over the holidays).

Congrats to the UCC and all involved.

*Kroehler is now defunct and its North Carolina facility is on the market for $14mm, none of which will benefit the debtors’ creditors.

🔥Conference Alert: Wharton Restructuring & Distressed Investing Conference on Feb 20!🔥

PETITION is proud to be a media partner of The Wharton School in connection with this year’s Wharton Restructuring & Distressed Investing Conference taking place at The Plaza Hotel in New York City on Friday, February 20, 2026.

While the agenda and speakers haven’t yet been fully set (though some are), this year’s conference theme is “Restructuring in the Age of Private Credit,” and the Wharton folks are excited to host a distinguished group of keynote speakers and panelists who will explore the rapidly evolving dynamics of private credit and its growing influence on the restructuring landscape. Discussions will highlight innovative restructuring strategies, the shifting balance between traditional and private credit lenders, and forward-looking strategies for distressed investing in today’s changing economic environment. Sponsors include Kirkland & Ellis LLP, Weil, Latham & Watkins LLP, Davis Polk & Wardwell LLP, AlixPartners LLP and other top notch shops with massive footprints in RX, so you can just assume that the panelists will come from those firms and kick some a$$.

Interested in going? We’ve got great news: PETITION readers can get 10%-off by using the code PETITION10 at checkout, 💪.

📚Resources📚

We have compiled a list of a$$-kicking resources on the topics of restructuring, tech, finance, investing, and disruption. 💥You can find it here💥.

📤 Notice📤

Jamie Lisac (Group Head and Senior Managing Director, Investment Banking) joined Tiger Capital Group LLC from Capstone Partners.

Lucas Brown (Associate) joined K&L Gates from Ropes & Gray LLP.

Terry Rochford (Managing Director) joined Stretto from Hilco Real Estate to lead a new “Real Estate Services” initiative.

🍾Congratulations to…🍾

Martha Wyrick on her promotion to Counsel at Haynes Boone.

Michael Sorna on his promotion to Co-Head of Research for CLOs at Kennedy Lewis Investment Management LLC.

Michael Galardi on his promotion to Principal at Charlesbank Capital Partners.

Paul Hastings LLP (Charles Persons, Kristopher Hansen, Erez Gilad, Gabriel Sasson, Emily Kuznick, Matthew Friedrick) for securing the legal mandate on behalf of the official committee of unsecured creditors in the FAT Brands Inc. chapter 11 bankruptcy cases.

Province LLC (Paul Navid, Adam Rosen) for securing the financial advisor mandate on behalf of the official committee of unsecured creditors in the STG Logistics Inc. chapter 11 bankruptcy cases.