💥New Chapter 11 Bankruptcy Filing - Multi-Color Corporation💥

Another egregious, insider "prepackaged" chapter 11 filing

On January 29, 2026, Clayton, Dubilier & Rice, LLC (“CD&R”)-owned Multi-Color Corporation (“MCC”), MCC-Norwood, LLC (“MCC Norwood”), and fifty-four affiliates (collectively, together with MCC and MCC Norwood, the “debtors” and together with their non-debtor subsidiaries, the “company”) filed chapter 11 “prepackaged” bankruptcy cases in the District of New Jersey (Judge Kaplan).

Should they have? Filed in Jersey, we mean.

Jones Day’s Bruce Bennett, on behalf of a crossholder ad hoc group (the “crossholder AHG”) reportedly powered by Canyon Capital Advisors LLC, will tell you why:

“The petition for Debtor MCC-Norwood, LLC [], an Ohio limited liability company, lists MCC-Norwood’s principal place of business as being located in Atlanta, Georgia. [] The portion of the petition that requests the ‘[l]ocation of principal assets, if different from the principal place of business,’ is blank. [] Notwithstanding this, section 11 of the MCC-Norwood petition states, ‘Debtor has had its domicile, principal place of business, or principal assets in this district for 180 days immediately preceding the date of this petition or for a longer part of such 180 days than in any other district.’

… The Debtors’ admissions sworn under penalty of perjury prove that venue for the Chapter 11 Cases is improper in this District.”

Mr. Bennett wants the cases dismissed or kicked to where a majority of the US-based debtors reside: Delaware.

Which didn’t happen in the first instance. Judge Kaplan found enough “venue” to hold the first day. We’d bet dollars-to-donuts Mr. Bennett knew that would be the outcome because he had a plan. Here he is at the initial, 5-hour* January 30, 2026 first-day hearing:

“We have to establish a factual record here. I want to establish a factual record here. This is an issue that will absolutely be appealed.”

Frank, and no doubt, what he’ll ultimately have to do. Godspeed, sir.

Anyway, we should back up. The company manufactures “prime” labels, aka primary product labels that showcase the sh*t you’re buying and the brand. We’d give you an illustrative pic, but in a unique development, debtors’ counsel Kirkland & Ellis LLP (“K&E”) didn’t include six-thousand unnecessary pics in former CFO, now CRO Garrett Gabe’s first day declaration. Were they too busy doing actual legal work??

In any event, what Mr. Gabe’s declaration does disclose is that there is nothing unique, at all, about the company’s prepetition history.

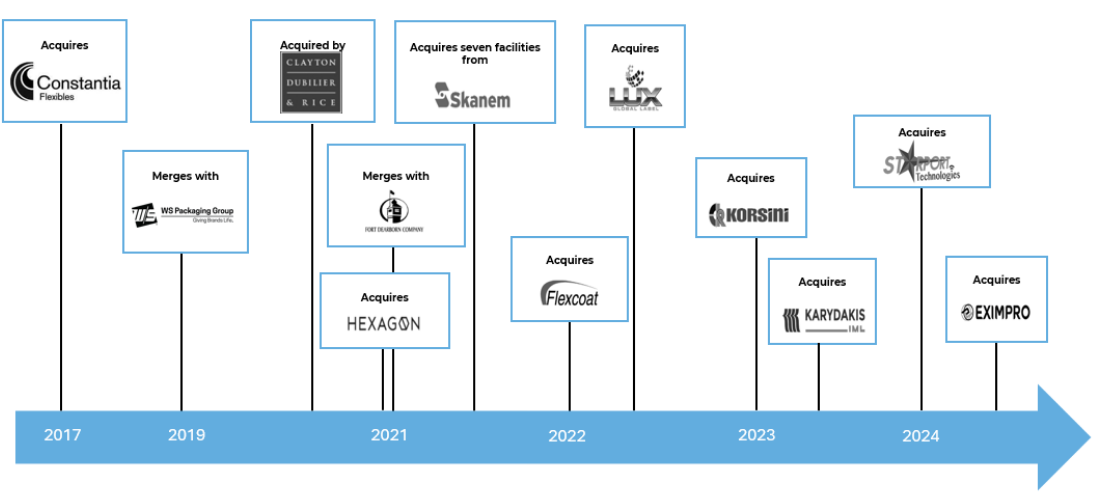

There was a massive prepetition acquisition spree and CD&R’s buyout of the company …

Followed by “… a period of heightened demand at the outset of the COVID-19 pandemic …”

Followed by “… rapid, unanticipated cost inflation and significant raw material and labor constraints …”

Followed by “… a sustained period of customer destocking caused significant and unanticipated volume decline in demand for MCC’s products” made worse by “… uncertainty around tariffs …”

Followed by “… pricing increases between 2022 and 2023 and [] deep reductions to headcount and inventory.”

Holy hell, Johnny only made it four pages into the dec before he’d checked every box on his Bankruptcy Bingo™ card.

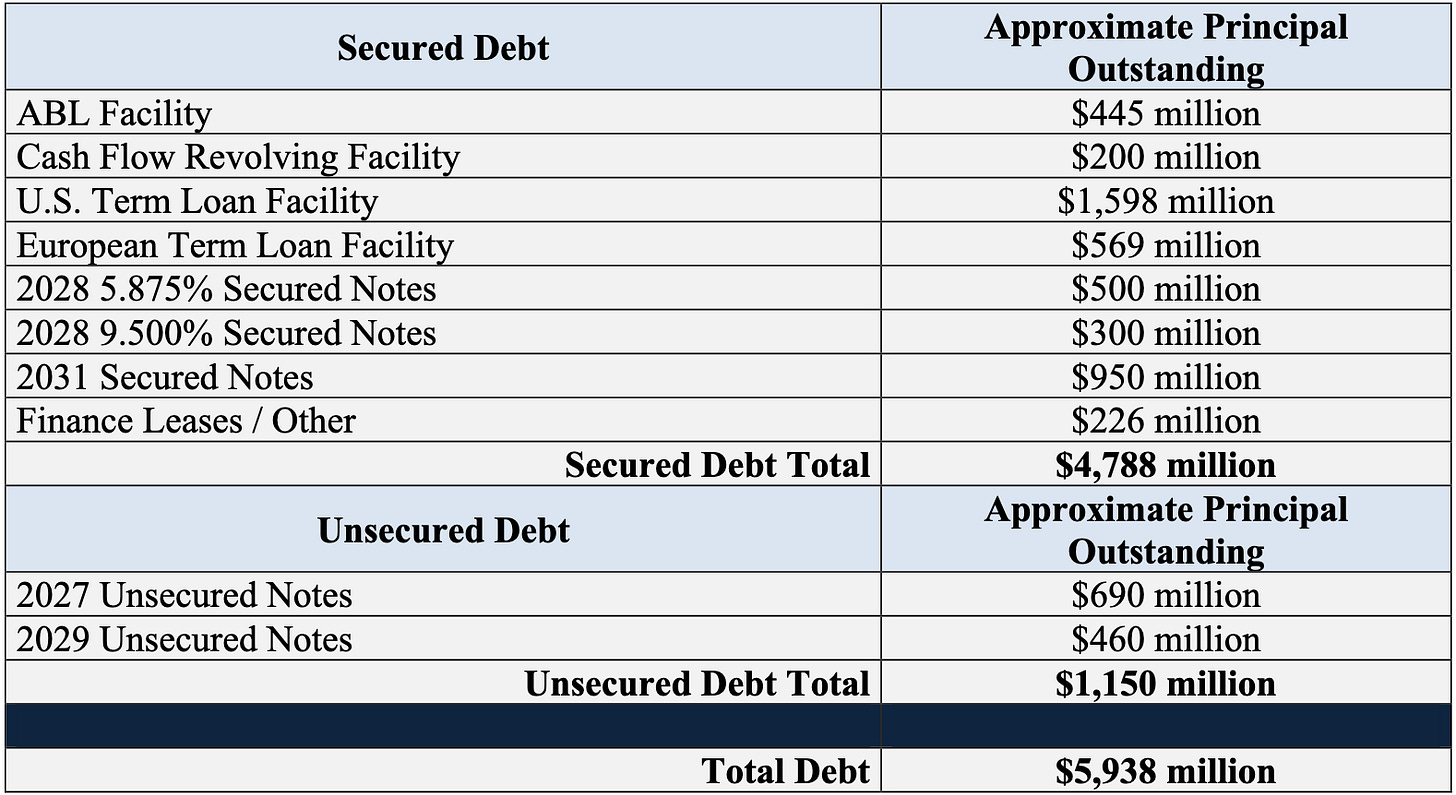

Obviously, there’s heaps of debt the company couldn’t support too. Again, nothing unique; see for yourself👇.

Here’s where the first day dec boilerplate ends.

Out of the cap stack, three groups formed by late October ‘25: (i) a group of ABL Lenders; (ii) an ad hoc group of primarily first lien debt holders (the “secured AHG”); and (iii) Mr. Bennett’s crossholder AHG, which primarily holds unsecured notes.

Then there were negotiations about an out-of-court restructuring for a while, during which the crossholder AHG arguably delivered the best offer. But (i) the debtors are in chapter 11 and (ii) Mr. Bennett is clamoring on about the the propriety of New Jersey venue. Something changed.

That something was a restructuring support agreement (“RSA”) brokered and executed among the debtors, the secured AHG, and CD&R on January 25, 2026, the same day that (i) the debtors first sent DIP solicitation materials to the crossholder group and (ii) the crossholder AHG sent its proposal. Clearly a “good faith” marketing process, guys, 🙄. Here’s a live shot of Mr. Bennett’s crossholder AHG:

If consummated, the RSA would provide:

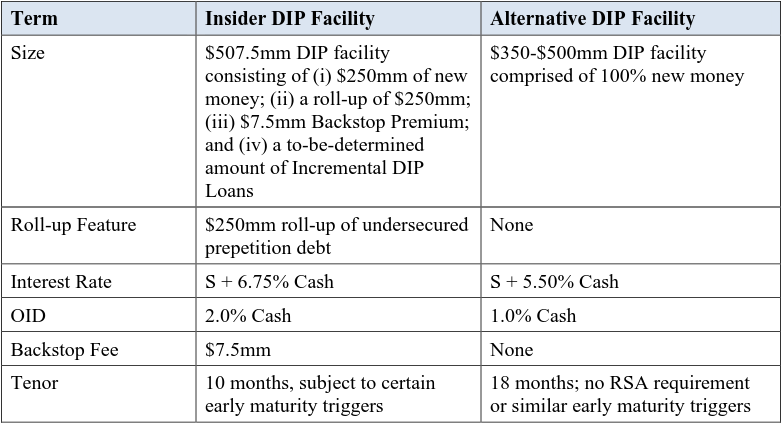

📍DIP Financing. A $500mm, SOFR+6.5% DIP term loan, composed of $250mm in new money ($150mm interim, later ratcheted down at the first day to $125mm interim) and $250mm in roll-up loans solely for DIP funders ($150mm $125mm interim, the rest on final),** 70% of which DIP will be syndicated out to holders of first lien claims if they sign up the RSA. The other 30% is reserved for the DIP’s backstop parties, aka the secured AHG and — now the pivot makes perfect sense — sponsor CD&R, for which they’ll also receive a $7.5mm backstop fee.***

Okay, you can see why Mr. Bennett had an issue here. First, this 👇:

Interestingly, and as the chart 👆 reflects, the crossholder AHG’s 27s were pricing in the low 60s as of early January ‘26. But so were the term loan and the secured 28s. Were investors far too comfortable with the earlier maturity, 🤔?

And, second, this 👇. In addition to the proposed DIP wrapping in CD&R, his group’s junior DIP was better across the board:

The debtors ignored it because they allegedly wanted to — to borrow from Mr. Bennett — “… entrench a predetermined restructuring outcome,” which takes us to …

📍The Chapter 11 Plan. The RSA’s prepackaged chapter 11 plan and disclosure statement that (i) pay off ABL claims in full, (ii) pay first lien secured claims 81.6-98.4% through $200mm in cash (PETITION Note: they were pricing in the low 40s as of the petition date), ~$1.6b in takeback debt (or 80% of each creditors’ distribution in cash),**** 13.3% in reorg equity, $62.1mm in pref equity, the right to subscribe to additional pref equity (which includes, in the aggregate, a 10.7% common equity participation),***** and warrants, (iii) pay junior funded debt claims, including plan-class-sharing, 🤔, 1L deficiency claims and the crossholder AHG unsecured notes claims, 2.6-2.8% through $57.5mm in cash and 5% of reorg equity, and (iv) passes GUCs all the way through.

Notice how the reorg equity doesn’t add up to 100%? Here come’s CD&R again …

… which agreed to fund $400mm under the plan in exchange for 64% of the reorg equity. Plus 1.6% more as a commitment premium. Plus a split of another 5.4% with members of the secured AHG for backstopping the pref equity issuance.

That’s the explanation for chucking the 1L deficiency claims and the unsecured notes into a single voting class. K&E be trying to stuff the class’s ballot box on this insidery as f*ck plan and sidestep 203 N LaSalle.

Anyway, let’s get back to the DIP. On February 2, 2026, Judge Kaplan picked the first day hearing back up and ruled on the debtors’ entry into the equally insidery DIP. Obviously, he approved it:

“The court finds that the evidence regarding the debtors’ workforce, global footprint, customer relationships, and capital structure support the conclusion that uninterrupted access to liquidity is essential to preserve going concern value and avoid immediate disruption.”

Then more blah, blah, blah. “Exigent circumstances,” don’t ya know? As a token, he deferred half of the backstop fee to the final hearing, so (i) an official committee of unsecured creditors can be appointed and (ii) if push comes to shove, he can approve it all the same.

The order issued the same day.******

Better, so did Mr. Bennett’s appeal.

The court will take up the crossholder AHG’s motion to dismiss / for a change of venue on February 25, 2026. Mr. Bennett will appeal. The second day hearing will take place on March 3, 2026 at 10am ET, while the combined hearing on the debtors’ plan and DS is scheduled to commence on March 17, 2026 (the order did not provide a time, 🤦). He’ll appeal both of those too.

In the interim, Judge Kaplan is going to send folks to mediation. Unfortunately for Mr. Bennett, a pointless, failed mediation can’t be appealed.*******

The debtors are represented by K&E (Steven Serajeddini, Rachael Bentley, Peter Candel, Ashley Surinak) and Cole Schotz P.C. (Michael Sirota, Warren Usatine, Felice Yudkin) as legal counsel, AlixPartners, LLP (Eric Koza) as financial advisor, and Evercore Group L.L.C. ($EVR) (Brent Banks) as investment banker. The debtors’ special committee is composed of Roger Meltzer and Peter Laurinaitis and is represented by Quinn Emanuel Urquhart & Sullivan, LLP as legal counsel. The secured AHG is represented by Milbank LLP (Evan Fleck, Matthew Brod, Justin Cunningham) and Chiesa Shahinian & Giantomasi PC (Thomas Walsh, Sam Della Fera Jr.) as legal counsel, Alvarez & Marsal North America, LLC as financial advisor, and PJT Partners LP ($PJT) as investment banker. The crossholder AHG is represented by Jones Day (Bruce Bennett, Benjamin Rosenblum) and Wollmuth Maher & Deutsch LLP (Paul DeFilippo, James Lawlor, Joseph Pacelli) as legal counsel and Guggenheim Securities, LLC (Brendan Hayes) as investment banker. “Excluded” first lien lenders are represented by Willkie Farr & Gallagher LLP (Mark Stancil, Christopher DiPompeo) and Rolnick Kramer Sadighi LLP (Sheila Sadighi, Nicole Castiglione, Frank Catalina) as legal counsel. CB&R, which also owns secured and unsecured debt, is represented by Latham & Watkins LLP (Ray Schrock, Candace Arthur, Ryan Dahl, Deniz Irgi) and Lowenstein Sandler LLP (Jeffrey Cohen, Eric Chafetz, Colleen Restel, Philip Gross) and Debevoise & Plimpton LLP as legal counsel and Moelis & Company LLC ($MC) as investment banker. DIP agent Acquiom Agency Services LLC is represented by ArentFox Schiff LLP (Jeffrey Gleit, Michael Guippone, Justin Kesselman) and Porzio, Bromberg & Newman, P.C. (Warren Martin Jr., Christopher Mazza) as legal counsel. Prepetition agent Barclays Bank PLC is represented by Cahill Gordon & Reindel LLP (Joel Moss, Jordan Wishnew, Amit Trehan, Timothy Howell, Matthew Catone) and Greenberg Traurig LLP (Alan Brody) as legal counsel. Prepetition notes trustee Wilmington Trust, National Association is represented by Kelley Drye & Warren LLP (James Carr, Kristin Elliott) as legal counsel.

*Excluding breaks. It was closer to seven hours when including recesses.

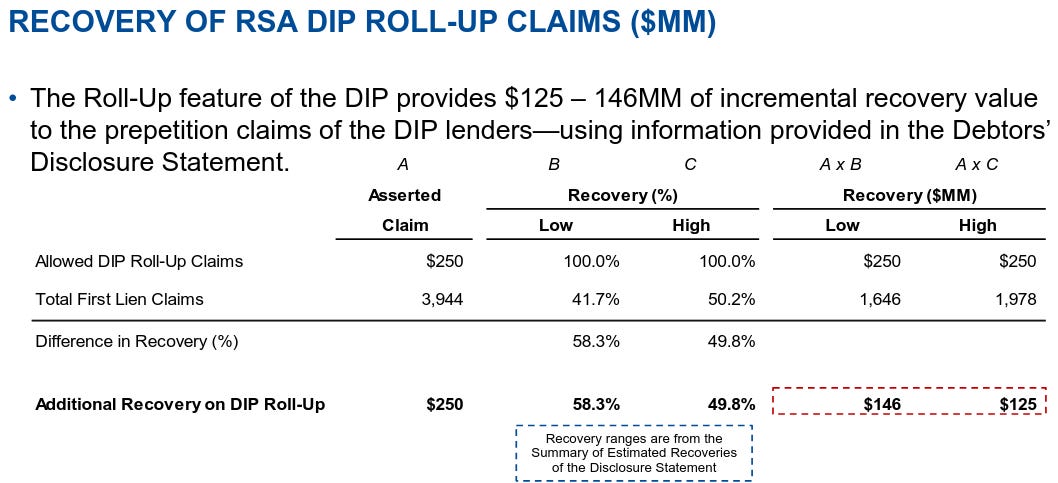

**The crossholder AHP took particular offense with the rollup because (i) the debtors’s manufacturing facilities and associated fixtures, as well as at least one-third of their equity in foreign subs, were unencumbered as of filing and (ii) it will greatly enhance the undersecured 1L recovery:

***There’s also a 2% cash OID fee.

****Good g-d, the amount of juice in this RSA. To fund the 80% distribution option, CD&R and the secured AHG’s steerco are backstopping the exit facility, for which they’ll receive a $125.2mm premium regardless of whether any lenders exercise the option. In fact, most can’t. 72% of first lien lenders signed up to the RSA and therefore are required to take the takeback paper. At most ~$350mm in first lien claims could exercise the right, for which a $125.2mm, 36% fee will be payable. Mr. Bennett summed that one up concisely at the first day hearing: “That is outrageous.” Like it mattered; that also got approved.

*****The total pref equity issuance will be for $600mm. 20% of that is again reserved for CD&R and members of the secured AHG.

******A set of “excluded lenders” objected to the DIP’s non-pro rata roll-up of prepetition first lien claims. The court declined to rule on those claims and “… reserve[d] the respective rights of the excluded and other lenders to pursue available contract rights and remedies” in its February 2 oral ruling.

*******Honestly, we thought Mr. Bennett had retired — it turns out he just got the late-career title demotion to “Of Counsel” which, for a man of his stature, is just wrong, guys. If some sixth-year equivalent at Kirkland can run around with a meaningless “partner” title, we don’t see why Mr. Bennett can’t have one too. Anyway, we haven’t seen or heard his name in a VERY long time but, you know what, we’re loving this late stage re-emergence. He’s like Harrison Ford in Shrinking — clearly in his “I don’t give a rat’s a$$” era (not that he ever really did) and delivering some fine a$$ work in the process.

Company Professionals:

Legal: Kirkland & Ellis LLP (Steven Serajeddini, Rachael Bentley, Peter Candel, Ashley Surinak) and Cole Schotz P.C. (Michael Sirota, Warren Usatine, Felice Yudkin)

Financial Advisor: AlixPartners, LLP (Eric Koza)

Investment Banker: Evercore Group L.L.C. ($EVR) (Brent Banks)

Special Committee: Roger Meltzer, Peter Laurinaitis

Legal: Quinn Emanuel Urquhart & Sullivan, LLP

Claims Agent: Verita (Click here for free docket access)

Other Parties in Interest:

Secured Ad Hoc Group

Legal: Milbank LLP (Evan Fleck, Matthew Brod, Justin Cunningham) and Chiesa Shahinian & Giantomasi PC (Thomas Walsh, Sam Della Fera Jr.)

Financial Advisor: Alvarez & Marsal North America, LLC

Investment Banker: PJT Partners LP ($PJT)

Cross-Holder Ad Hoc Group: Canyon Capital Advisors, LLC

Legal: Jones Day (Bruce Bennett, Benjamin Rosenblum) and Wollmuth Maher & Deutsch LLP (Paul DeFilippo, James Lawlor, Joseph Pacelli)

Investment Banker: Guggenheim Securities, LLC (Brendan Hayes)

Excluded First Lien Lenders

Legal: Willkie Farr & Gallagher LLP (Mark Stancil, Christopher DiPompeo) and Rolnick Kramer Sadighi LLP (Sheila Sadighi, Nicole Castiglione, Frank Catalina)

Sponsor, Secured and Unsecured Creditor: Clayton, Dubilier & Rice, LLC

Legal: Latham & Watkins LLP (Ray Schrock, Candace Arthur, Ryan Dahl, Deniz Irgi) and Lowenstein Sandler LLP (Jeffrey Cohen, Eric Chafetz, Colleen Restel, Philip Gross) and Debevoise & Plimpton LLP

Investment Banker: Moelis & Company LLC ($MC)

DIP Term Loan and Notes Agent: Acquiom Agency Services LLC

Legal: ArentFox Schiff LLP (Jeffrey Gleit, Michael Guippone, Justin Kesselman) and Porzio, Bromberg & Newman, P.C. (Warren Martin Jr., Christopher Mazza)

Indenture Trustee: Wilmington Trust, National Association

Legal: Kelley Drye & Warren LLP (James Carr, Kristin Elliott)

Prepetition ABL and Cash Flow Revolving Agent: Barclays Bank PLC

Legal: Cahill Gordon & Reindel LLP (Joel Moss, Jordan Wishnew, Amit Trehan, Timothy Howell, Matthew Catone) and Greenberg Traurig LLP (Alan Brody)