💥Kirkland's Krown💥

Pretium Packaging LLC + Multi-Color Corporation filed prepackaged chapter 11 bankruptcies.

Apologies to those of our dear PETITION readers who aren’t deep into the restructuring (“RX”) world because this intro is gonna be very inside baseball. And that’s because it just seems like everywhere we turn Kirkland & Ellis LLP (“Kirkland”) is influencing RX news, either directly or indirectly.

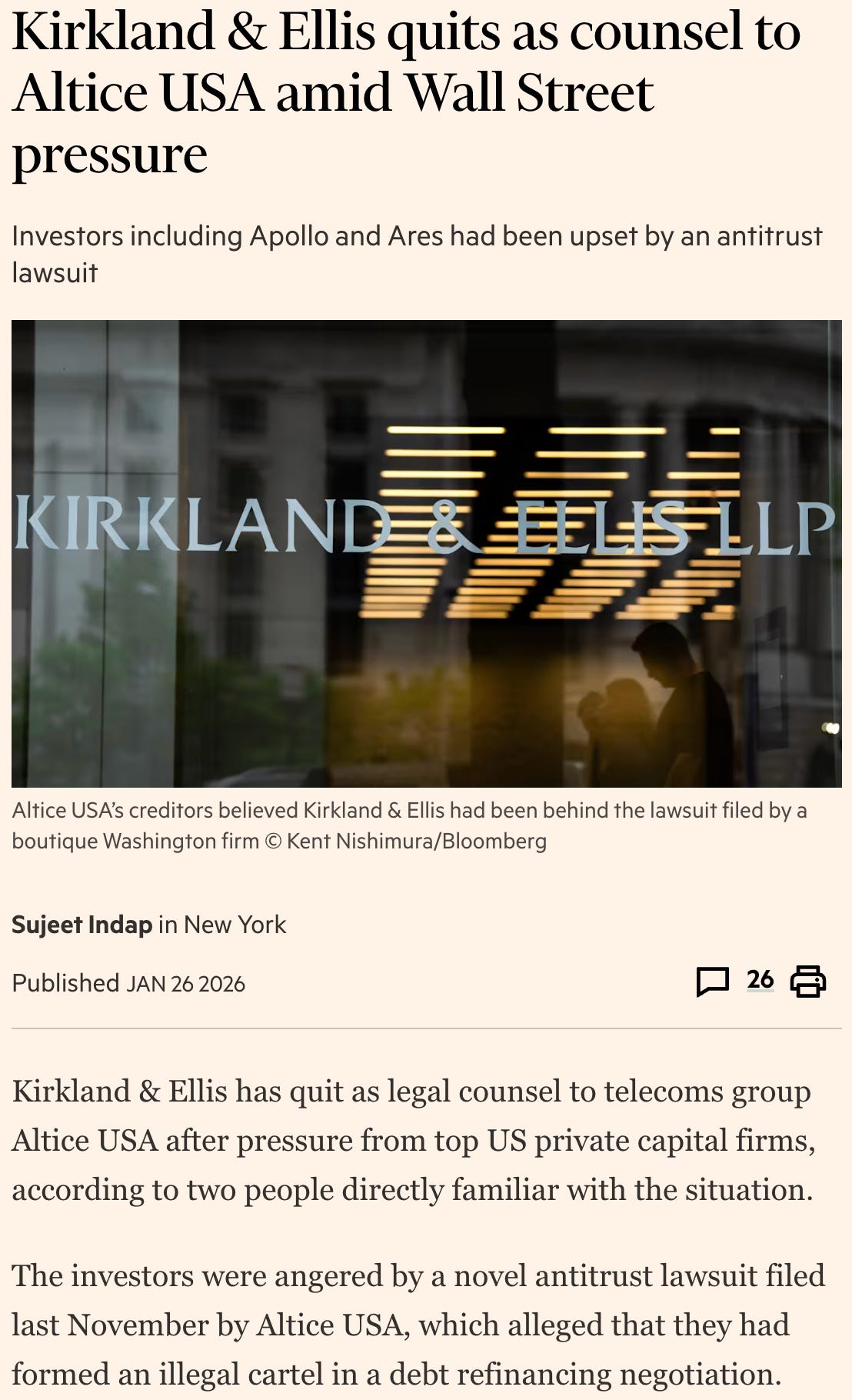

Specifically, there was this …

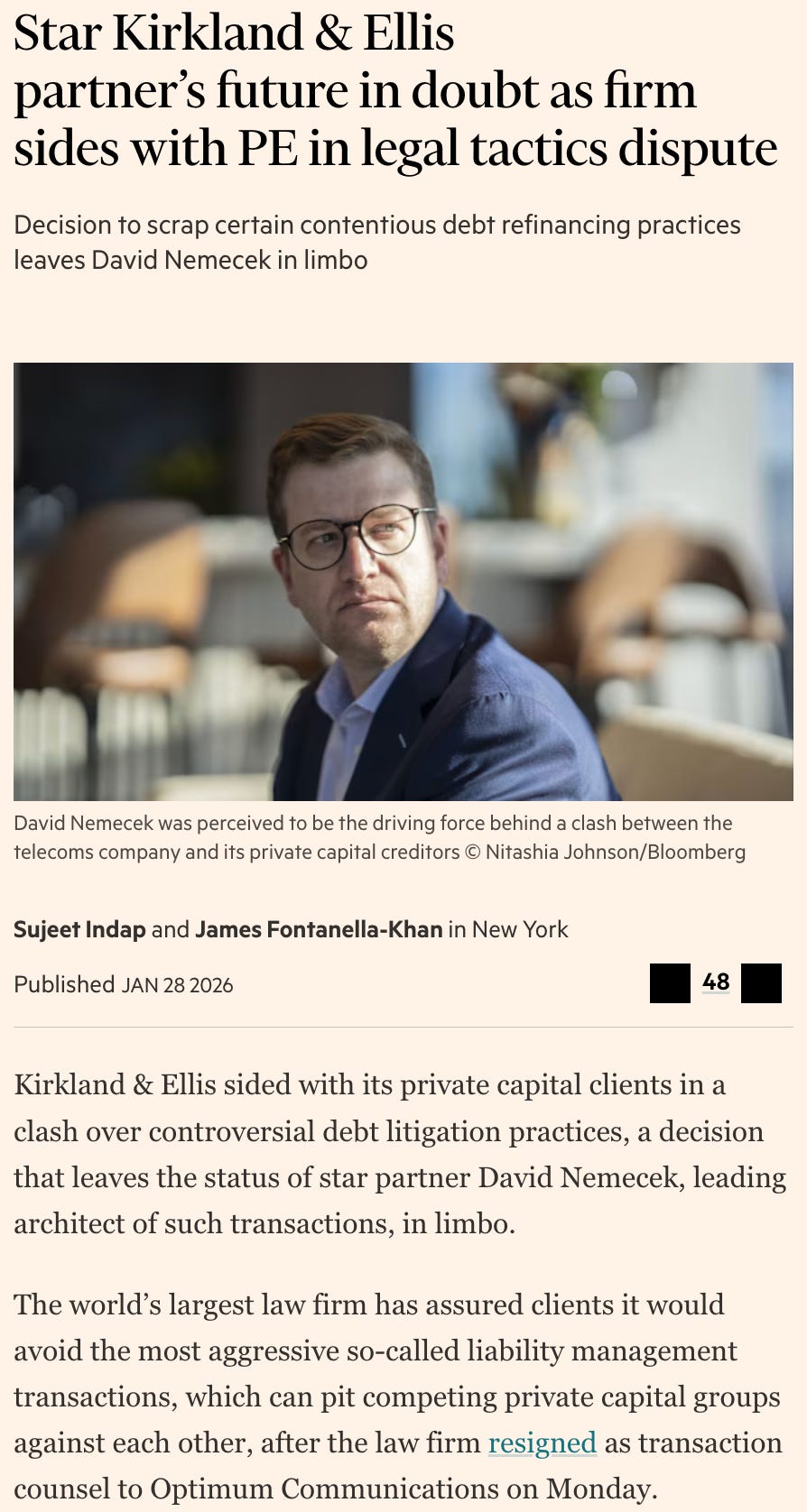

… followed by this …

… which surely has a bunch of finance/restructuring shops salivating at the prospect of adding Mr. Nemecek to their roster … and also surely has a bunch of unconflicted litigation/restructuring shops (and their clients) salivating at the prospect of suing the utter motherf*cking sh*t out of some big time lenders.

Speaking of rosters, the other big news in RX world these days is also related to Kirkland, albeit in a more attenuated manner. Many years ago Ray Schrock and Ryan Preston Dahl departed Kirkland to join Weil Gotshal & Manges LLP (“Weil”). Powered by a desire to do combat with Kirkland, both lawyers spent their time at Weil building their personal brands — in part by leveraging the Weil platform and, in part, by expanding beyond it.* In late ‘20, Mr. Dahl departed for Ropes & Gray LLP (“Ropes”), eventually uptiered in title, and pursued a plan to leverage that firm’s strong middle market private equity practice and usher it to the top of the league tables. Four years after, in late ‘24, Mr. Schrock departed for Latham & Watkins LLP (“Latham”) and became Global Chair of its promising-yet-not-fully-tapped restructuring and special situations practice.

For Mr. Schrock’s part, he had Latham firing away on all cylinders in ‘25 — that much is clear from the data — by, among other things, seemingly sticking his fingers in the holes that previously leaked precious bankruptcy assignments to opportunistic rival firms, e.g., Kirkland, of course.

As for Mr. Dahl, we can debate the level of success he had at Ropes. But we won’t. Because it doesn’t really matter. The anti-Kirkland shoulder-chips driving both Mr. Schrock and Mr. Dahl never dulled and the two concluded that there’s strength in numbers and that Latham’s platform gives them a proper gun for the gunfight. We have no reason to believe, despite a slow start, that Mr. Schrock’s robust ‘25 will change for the worse in ‘26. No doubt Mr. Dahl will be additive (👀 Trinseo).

Of course, Mr. Dahl’s departure left a gaping hole for Ropes. That hole has now been filled by Rachel Strickland (and team, see below 👇), who left Willkie Farr & Gallagher LLP (“Willkie”) a mere 18 months ago for Fried Frank and loved it so much (feeling mutual?) that they’re already off to greener pastures.**

Meanwhile, not a day goes by lately without Ms. Strickland’s replacement and former-Kirkland-partner-now-Willkie-RX-Chair Ryan Bennett slapping a welcome post on LinkedIn to associates who’ve opted to leave Kirkland and join him at Willkie (see also below 👇).***

Ok, gossip over because, frankly, while everyone else is playing musical chairs, Kirkland seems to be putting their heads down and doing what they do best: that is, filing motherf*cking chapter 11 cases.

In the past week, they’ve dropped three prepackaged cases — two of them following the previously-filed STG Logistics Inc. onto the New Jersey docket.****

Today we dive into two of those three cases with the third, Nine Energy Service Inc. ($NINE), to follow in Sunday’s paying-subscribers’-only a$$kicking edition.

*We know some will dispute this take but we don’t care, we’re calling it like we see/know it.

**Fried Frank has literally been trying to build a debtor practice for 20 years, no exaggeration — “trying” being the operative word.

***Query to what degree the influx of ex-Kirkland lawyers is sitting well with the legacy Willkie folks. Notably, Mr. Bennett had no compunction about taking a page out of the Sprayragen playbook and slapping his name to the Saks Global first day pleadings, even though he didn’t even show up at the first day hearing. Apparently top billing on pleadings doesn’t get you top billing in public firm announcements, though, LOL. His colleague Allyson Smith crushed that critical vendor motion, tho — just not enough to get billing in public firm announcements, though, LOLOL.

****We previously covered STG Logistics Inc. here:

Hmmm, wonder if there’s some sort of reason why the cases that have some sort of earlier liability management component are filing in New Jersey while the easy peasy prepack, Nine Energy Service Inc. ($NINE) is in Texas…🤔? See below 👇.

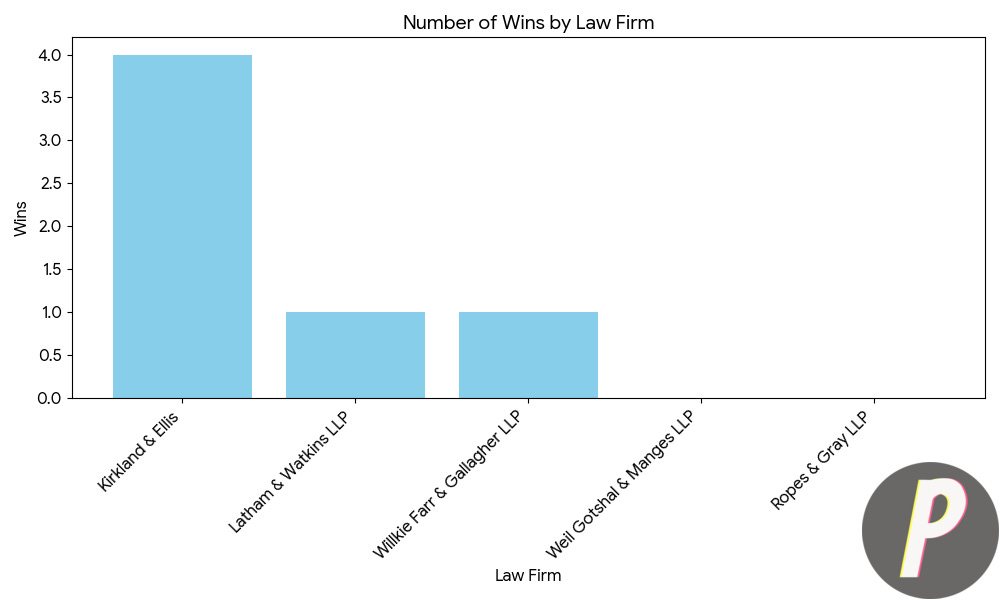

Also for those of you keeping score of filings thus far in ‘26: Kirkland 4, Latham 1, Willkie 1, Weil 0 and Ropes 0.

Lastly, we’re sure we’ll get some hate mail from some of you asking us why we’re kissing Kirkland’s a$$. We’re not. We don’t. We probably make fun of them more than anyone else — just ask Joshua Sussberg — so don’t even bother @’ing us; we’re 100% equal opportunity.

⚡️Announcement⚡️

Speaking of diving in and Sunday’s paying-subscribers’-only a$$kicking edition, it would be very much appreciated if those of you who have been f*cking freeloading off of our free content for years would find it in your heart to dive into your pocket and throw us a little support. We would very much appreciate it.

For group rates, please email Johnny at johnny@petition11.com.

💥New Chapter 11 Bankruptcy Filing - Pretium Packaging, L.L.C.💥

On January 28, 2026, STL-HQ’d Pretium Packaging, L.L.C. and nine affiliates (collectively, the “debtors” and together with their non-debtor affiliates, the “company”) filed prepackaged chapter 11 cases in the District of New Jersey (Judge Gravelle).*

“Prepackaged” makes sense for these debtors. Founded in ‘92, they design and manufacture rigid packaging — plastic bottles, jars, closures, trays, and “… other …” containers too.

It simply doesn’t get more exciting than this, folks. Just 👀 these fine products:

Okay, maybe this excites only Clearlake Capital Group, L.P. (“Clearlake”). It bought the company in ‘20, by which time, it was already up to its elbows in an acquisition tear.

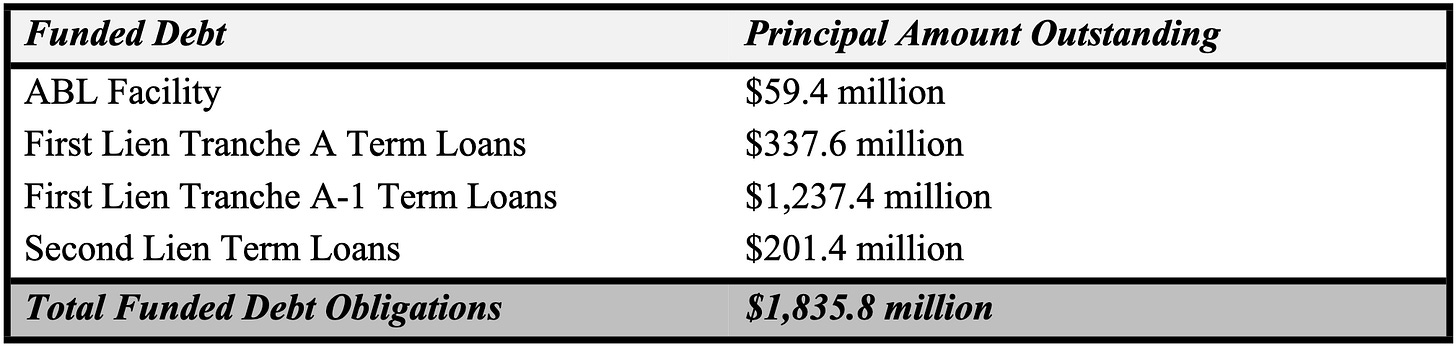

Acquisitions that created a lot of debt. Per CFO Federico Barreto, here’s the petition-date cap stack …

… and here’s a live shot of what is going to happen to the bottom half.

By choice.

Before we turn to that, the debtors are in bankruptcy for all the hallmark reasons that’ve been peddled ad nauseum by management teams for years: (i) a COVID-caused shortage of materials, supply chain disruption, and extended-a$$ lead times which led customers to over-order packaging, (ii) a return to normalized demand in ‘22 and ‘23, resulting in an order-volume decline at the company as customers burned through COVID-era excess inventory, (iii) inflation, and (iv) naturally, a liability management exercise (“LME”).

That last one occurred, consensually, in October ‘23. The company raised $325mm (the first lien tranche A loans ☝️), and 99.8% of legacy term loan holders exchanged into the first lien tranche A-1 loans (the “A-1 loans”) at a 6.4% discount to face. The lingering 0.2% was addressed, and no antics came out of it. It was the textbook LME; it raised new money ✅, captured discount ✅, and extended maturity ✅. Subsequently, in ‘24, the company took out some of its second lien term loan at deeply discounted levels.

However, the LME’s additional runway didn’t have much runway.

By the end of January ‘25, the A-1 TL was already pricing distressed; it was the second worst performing leveraged loan the week of January 31, 2025, dipping into the mid-60s. By mid-’25, liquidity was once again a challenge, so — after Clearlake took the uber-aggressive posture of expanding the disqualified lender list to nearly 100 firms affirmatively blocking a third-party from scooping up a meaningful and influential position in the cap stack …

… and plunging the A-1 TL even deeper into distress (low 50s by early June ‘25, sub 40c by October ‘25, etc.) … Clearlake has a HUGE boner for packaging, apparently — the company and its stakeholders gathered back round the table. On December 30, 2025, they arrived at a deal.

What kind of deal? The kind that slashes a whole lot of that LME debt 👆 (and second lien) and is memorialized in a restructuring support agreement (the “RSA”) that carries the support of Clearlake and lenders holding 91%+ of the A-1 loans and 81%+ of the second lien loans. We’d be remiss, however, if we didn’t also point out that while the debt reduction figure is meaningful ($900mm!), the remaining post-reorg debt will also be meaningful. The RSA, which is attached to Mr. Barreto’s declaration, and the corresponding plan and disclosure statement, provide:

📍DIP ABL. The prepetition ABL will roll into a $100mm, SOFR + 3.5% DIP ABL, and on the effective date of the debtors’ plan, will either be paid in full in cash or refinanced.

📍DIP Term Loan. The debtors will raise up to $533.5mm in new money from holders of A-1 loans through a fully-backstopped, syndicated DIP term loan facility, which, under the plan, will roll into a first-lien, first-out exit facility. The DIP term loan carries interest at SOFR + 5.25% and features, to entice lenders to participate and fund their share, a 10% fee, payable in reorg equity and, for backstoppers, another 11.5% fee, also payable in reorg equity, which fees will dilute the plan recovery of A-1 holders (👇).

📍Tranche A Term Loans. The debtors’ ~$337.6mm in tranche A term loans, plus accrued interest and premiums, will be paid in full in cash.

📍Tranche A-1 Term Loans. Under the plan, the A-1 term loans will receive ~$500mm in first-lien, second-out term loans and, prior to the DIP’s dilution, 72.5% of the reorg equity.

📍Second Lien Term Loans. Second lien holders will receive ~$5.7mm in cash and 5.6% of the reorg equity.

📍New Money Investment. Clearlake wants to stay in the packaging game … like we said …

… so it will make a new money investment of $50mm to receive 21.9% of the reorg equity. Normally, we’d expect to see someone b*tch about that — absolute priority and all that — but we doubt it’s going to happen here because …

📍GUCs. GUCs are riding through the bankruptcy entirely.

The court held the first day hearing on January 30, 2026, at which, obviously, all requested relief was granted, and scheduled the second day and confirmation hearing, which should be a total non-event, for February 23, 2026 at 11am ET.

The debtors intend to exit within thirty days of the confirmation date, so we’ll get the clock started on PETITION’s “Two-Year Rule” soon.

The debtors are represented by Kirkland & Ellis LLP (Anup Sathy, Steven Serajeddini, Jordan Elkin, Yusuf Salloum) and Cole Schotz P.C. (Michael Sirota, Warren Usatine, Felice Yudkin) as legal counsel, FTI Consulting, Inc. ($FCN) (Lee Sweigart) as financial advisor, and Evercore Group LLC ($EVR) (Daniel Lakhdhir) as investment banker. An ad hoc group of first lien and second lien holders is represented by Milbank LLP (Evan Fleck, Matthew Brod, Jason Kestecher) and Chiesa Shahinian & Giantomasi PC (Thomas Walsh, Sam Della Fera) as legal counsel and Moelis & Company ($MC) as investment banker. An RSA-supporting minority lender group is represented by Glenn Agre Bergman & Fuentes LLP as legal counsel. Wilmington Savings Fund Society, FSB ($WSFS), as DIP term loan agent, is represented by ArentFox Schiff LLP (Jeffrey Gleit, Matthew Bentley, Justin Kesselman) and Porzio Bromberg & Newman, P.C. (Warren Martin Jr., Christopher Mazza) as legal counsel, while Wells Fargo Bank, National Association ($WFC), as prepetition and DIP ABL agent, is represented by Morgan, Lewis & Bockius LLP (Jennifer Feldsher, Ryan Hibbard, Christopher Carter) as legal counsel.

*We think? The docket and case captions show Judge Gravelle, but Judge Hall signed the first-day orders.

💥New Chapter 11 Bankruptcy Filing - Multi-Color Corporation💥

On January 29, 2026, Clayton, Dubilier & Rice, LLC (“CD&R”)-owned Multi-Color Corporation (“MCC”), MCC-Norwood, LLC (“MCC Norwood”), and fifty-four affiliates (collectively, together with MCC and MCC Norwood, the “debtors” and together with their non-debtor subsidiaries, the “company”) filed chapter 11 “prepackaged” bankruptcy cases in the District of New Jersey (Judge Kaplan).

Should they have? Filed in Jersey, we mean.

Jones Day’s Bruce Bennett, on behalf of a crossholder ad hoc group (the “crossholder AHG”) reportedly powered by Canyon Capital Advisors LLC, will tell you why:

“The petition for Debtor MCC-Norwood, LLC [], an Ohio limited liability company, lists MCC-Norwood’s principal place of business as being located in Atlanta, Georgia. [] The portion of the petition that requests the ‘[l]ocation of principal assets, if different from the principal place of business,’ is blank. [] Notwithstanding this, section 11 of the MCC-Norwood petition states, ‘Debtor has had its domicile, principal place of business, or principal assets in this district for 180 days immediately preceding the date of this petition or for a longer part of such 180 days than in any other district.’

… The Debtors’ admissions sworn under penalty of perjury prove that venue for the Chapter 11 Cases is improper in this District.”

Mr. Bennett wants the cases dismissed or kicked to where a majority of the US-based debtors reside: Delaware.

Which didn’t happen in the first instance. Judge Kaplan found enough “venue” to hold the first day. We’d bet dollars-to-donuts Mr. Bennett knew that would be the outcome because he had a plan. Here he is at the initial, 5-hour* January 30, 2026 first-day hearing:

“We have to establish a factual record here. I want to establish a factual record here. This is an issue that will absolutely be appealed.”

Frank, and no doubt, what he’ll ultimately have to do. Godspeed, sir.

Anyway, we should back up. The company manufactures “prime” labels, aka primary product labels that showcase the sh*t you’re buying and the brand. We’d give you an illustrative pic, but in a unique development, debtors’ counsel Kirkland & Ellis LLP (“K&E”) didn’t include six-thousand unnecessary pics in former CFO, now CRO Garrett Gabe’s first day declaration. Were they too busy doing actual legal work? Or too busy contending with the Altice fallout (lol, we kid, we kid … we think)??

In any event, what Mr. Gabe’s declaration does disclose is that there is nothing unique, at all, about the company’s prepetition history.

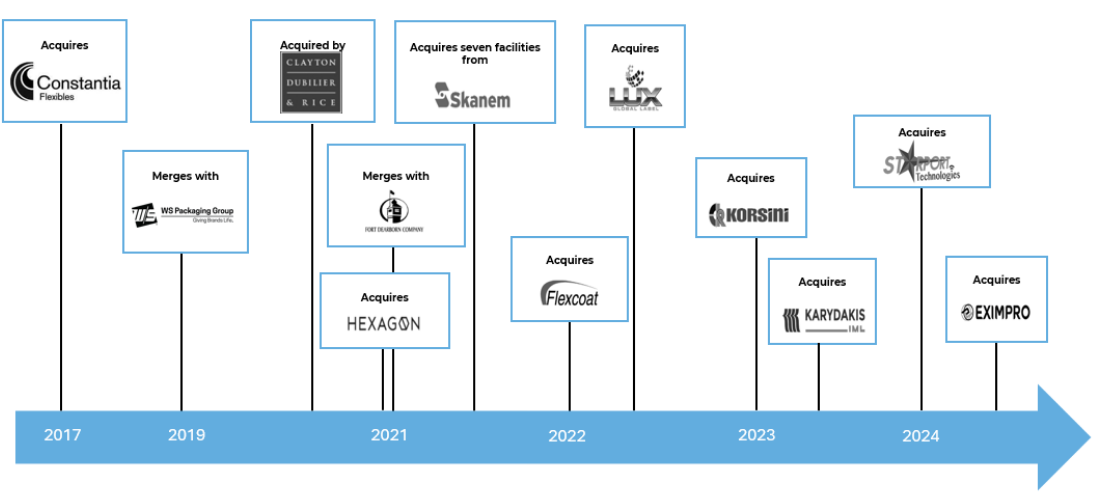

There was a massive prepetition acquisition spree and CD&R’s buyout of the company …

Followed by “… a period of heightened demand at the outset of the COVID-19 pandemic …”

Followed by “… rapid, unanticipated cost inflation and significant raw material and labor constraints …”

Followed by “… a sustained period of customer destocking caused significant and unanticipated volume decline in demand for MCC’s products” made worse by “… uncertainty around tariffs …”

Followed by “… pricing increases between 2022 and 2023 and [] deep reductions to headcount and inventory.”

Holy hell, Johnny only made it four pages into the dec before he’d checked every box on his Bankruptcy Bingo™ card.

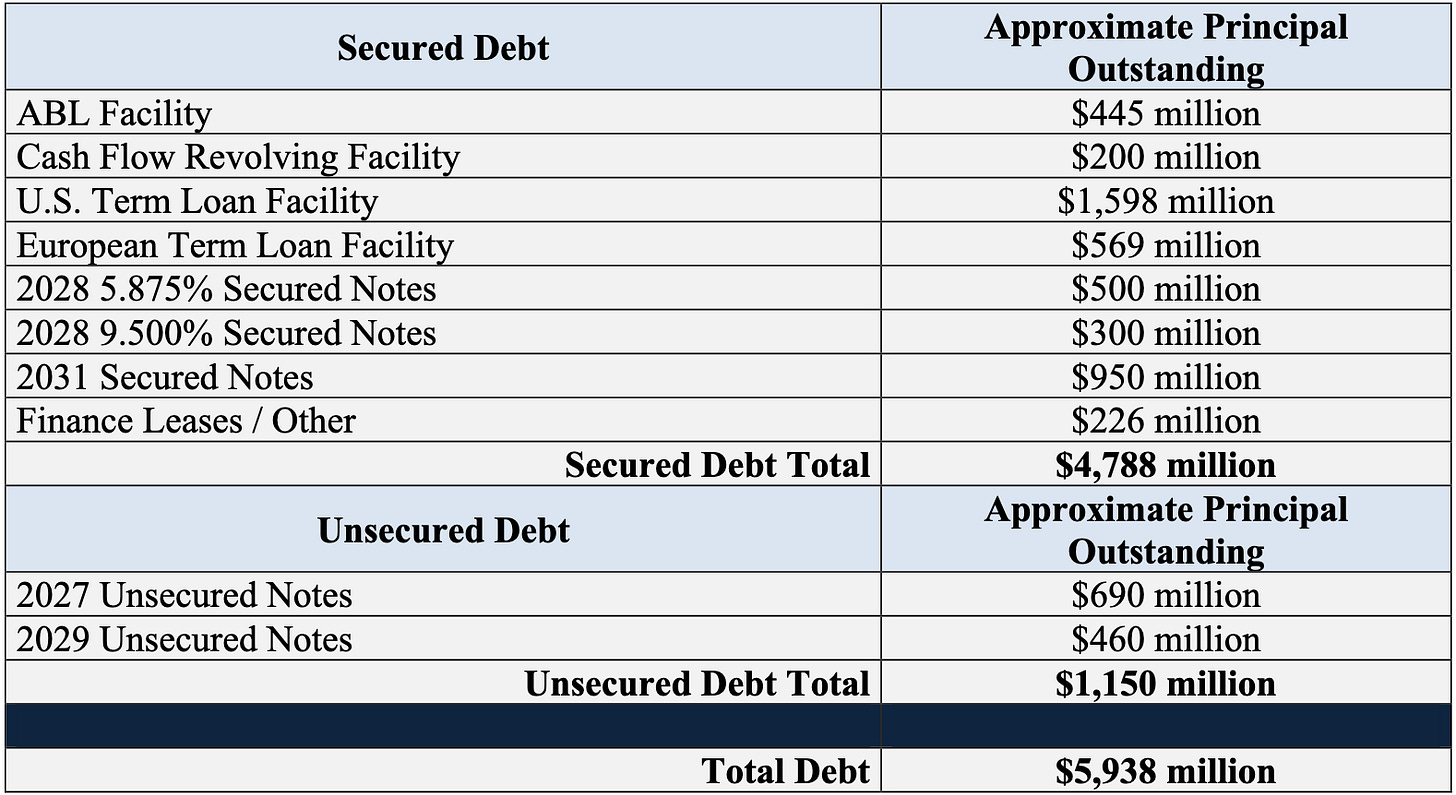

Obviously, there’s heaps of debt the company couldn’t support too. Again, nothing unique; see for yourself👇.

Here’s where the first day dec boilerplate ends.

Out of the cap stack, three groups formed by late October ‘25: (i) a group of ABL Lenders; (ii) an ad hoc group of primarily first lien debt holders (the “secured AHG”); and (iii) Mr. Bennett’s crossholder AHG, which primarily holds unsecured notes.

Then there were negotiations about an out-of-court restructuring for a while, during which the crossholder AHG arguably delivered the best offer. But (i) the debtors are in chapter 11 and (ii) Mr. Bennett is clamoring on about the the propriety of New Jersey venue. Something changed.

That something was a restructuring support agreement (“RSA”) brokered and executed among the debtors, the secured AHG, and CD&R on January 25, 2026, the same day that (i) the debtors first sent DIP solicitation materials to the crossholder group and (ii) the crossholder AHG sent its proposal. Clearly a “good faith” marketing process, guys, 🙄. Here’s a live shot of Mr. Bennett’s crossholder AHG:

If consummated, the RSA would provide:

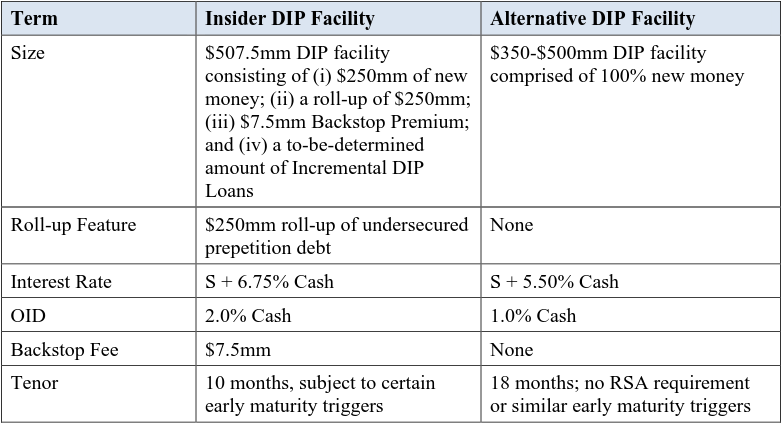

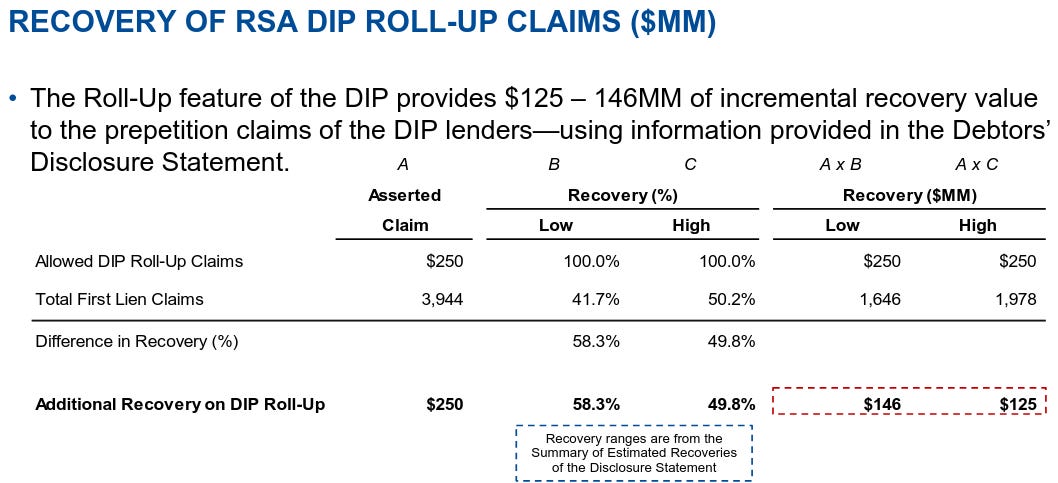

📍DIP Financing. A $500mm, SOFR+6.5% DIP term loan, composed of $250mm in new money ($150mm interim, later ratcheted down at the first day to $125mm interim) and $250mm in roll-up loans solely for DIP funders ($150mm $125mm interim, the rest on final),** 70% of which DIP will be syndicated out to holders of first lien claims if they sign up the RSA. The other 30% is reserved for the DIP’s backstop parties, aka the secured AHG and — now the pivot makes perfect sense — sponsor CD&R, for which they’ll also receive a $7.5mm backstop fee.***

Okay, you can see why Mr. Bennett had an issue here. First, this 👇:

Interestingly, and as the chart 👆 reflects, the crossholder AHG’s 27s were pricing in the low 60s as of early January ‘26. But so were the term loan and the secured 28s. Were investors far too comfortable with the earlier maturity, 🤔?

And, second, this 👇. In addition to the proposed DIP wrapping in CD&R, his group’s junior DIP was better across the board:

The debtors ignored it because they allegedly wanted to — to borrow from Mr. Bennett — “… entrench a predetermined restructuring outcome,” which takes us to …

📍The Chapter 11 Plan. The RSA’s prepackaged chapter 11 plan and disclosure statement that (i) pay off ABL claims in full, (ii) pay first lien secured claims 81.6-98.4% through $200mm in cash (PETITION Note: they were pricing in the low 40s as of the petition date), ~$1.6b in takeback debt (or 80% of each creditors’ distribution in cash),**** 13.3% in reorg equity, $62.1mm in pref equity, the right to subscribe to additional pref equity (which includes, in the aggregate, a 10.7% common equity participation),***** and warrants, (iii) pay junior funded debt claims, including plan-class-sharing, 🤔, 1L deficiency claims and the crossholder AHG unsecured notes claims, 2.6-2.8% through $57.5mm in cash and 5% of reorg equity, and (iv) passes GUCs all the way through.

Notice how the reorg equity doesn’t add up to 100%? Here come’s CD&R again …

… which agreed to fund $400mm under the plan in exchange for 64% of the reorg equity. Plus 1.6% more as a commitment premium. Plus a split of another 5.4% with members of the secured AHG for backstopping the pref equity issuance.

That’s the explanation for chucking the 1L deficiency claims and the unsecured notes into a single voting class. K&E be trying to stuff the class’s ballot box on this insidery as f*ck plan and sidestep 203 N LaSalle.

Anyway, let’s get back to the DIP. On February 2, 2026, Judge Kaplan picked the first day hearing back up and ruled on the debtors’ entry into the equally insidery DIP. Obviously, he approved it:

“The court finds that the evidence regarding the debtors’ workforce, global footprint, customer relationships, and capital structure support the conclusion that uninterrupted access to liquidity is essential to preserve going concern value and avoid immediate disruption.”

Then more blah, blah, blah. “Exigent circumstances,” don’t ya know? As a token, he deferred half of the backstop fee to the final hearing, so (i) an official committee of unsecured creditors can be appointed and (ii) if push comes to shove, he can approve it all the same.

The order issued the same day.******

Better, so did Mr. Bennett’s appeal.

The court will take up the crossholder AHG’s motion to dismiss / for a change of venue on February 25, 2026. Mr. Bennett will appeal. The second day hearing will take place on March 3, 2026 at 10am ET, while the combined hearing on the debtors’ plan and DS is scheduled to commence on March 17, 2026 (the order did not provide a time, 🤦). He’ll appeal both of those too.

In the interim, Judge Kaplan is going to send folks to mediation. Unfortunately for Mr. Bennett, a pointless, failed mediation can’t be appealed.*******

The debtors are represented by K&E (Steven Serajeddini, Rachael Bentley, Peter Candel, Ashley Surinak) and Cole Schotz P.C. (Michael Sirota, Warren Usatine, Felice Yudkin) as legal counsel, AlixPartners, LLP (Eric Koza) as financial advisor, and Evercore Group L.L.C. ($EVR) (Brent Banks) as investment banker. The debtors’ special committee is composed of Roger Meltzer and Peter Laurinaitis and is represented by Quinn Emanuel Urquhart & Sullivan, LLP as legal counsel. The secured AHG is represented by Milbank LLP (Evan Fleck, Matthew Brod, Justin Cunningham) and Chiesa Shahinian & Giantomasi PC (Thomas Walsh, Sam Della Fera Jr.) as legal counsel, Alvarez & Marsal North America, LLC as financial advisor, and PJT Partners LP ($PJT) as investment banker. The crossholder AHG is represented by Jones Day (Bruce Bennett, Benjamin Rosenblum) and Wollmuth Maher & Deutsch LLP (Paul DeFilippo, James Lawlor, Joseph Pacelli) as legal counsel and Guggenheim Securities, LLC (Brendan Hayes) as investment banker. “Excluded” first lien lenders are represented by Willkie Farr & Gallagher LLP (Mark Stancil, Christopher DiPompeo) and Rolnick Kramer Sadighi LLP (Sheila Sadighi, Nicole Castiglione, Frank Catalina) as legal counsel. CB&R, which also owns secured and unsecured debt, is represented by Latham & Watkins LLP (Ray Schrock, Candace Arthur, Ryan Dahl, Deniz Irgi) and Lowenstein Sandler LLP (Jeffrey Cohen, Eric Chafetz, Colleen Restel, Philip Gross) and Debevoise & Plimpton LLP as legal counsel and Moelis & Company LLC ($MC) as investment banker. DIP agent Acquiom Agency Services LLC is represented by ArentFox Schiff LLP (Jeffrey Gleit, Michael Guippone, Justin Kesselman) and Porzio, Bromberg & Newman, P.C. (Warren Martin Jr., Christopher Mazza) as legal counsel. Prepetition agent Barclays Bank PLC is represented by Cahill Gordon & Reindel LLP (Joel Moss, Jordan Wishnew, Amit Trehan, Timothy Howell, Matthew Catone) and Greenberg Traurig LLP (Alan Brody) as legal counsel. Prepetition notes trustee Wilmington Trust, National Association is represented by Kelley Drye & Warren LLP (James Carr, Kristin Elliott) as legal counsel.

*Excluding breaks. It was closer to seven hours when including recesses.

**The crossholder AHP took particular offense with the rollup because (i) the debtors’s manufacturing facilities and associated fixtures, as well as at least one-third of their equity in foreign subs, were unencumbered as of filing and (ii) it will greatly enhance the undersecured 1L recovery:

***There’s also a 2% cash OID fee.

****Good g-d, the amount of juice in this RSA. To fund the 80% distribution option, CD&R and the secured AHG’s steerco are backstopping the exit facility, for which they’ll receive a $125.2mm premium regardless of whether any lenders exercise the option. In fact, most can’t. 72% of first lien lenders signed up to the RSA and therefore are required to take the takeback paper. At most ~$350mm in first lien claims could exercise the right, for which a $125.2mm, 36% fee will be payable. Mr. Bennett summed that one up concisely at the first day hearing: “That is outrageous.” Like it mattered; that also got approved.

*****The total pref equity issuance will be for $600mm. 20% of that is again reserved for CD&R and members of the secured AHG.

******A set of “excluded lenders” objected to the DIP’s non-pro rata roll-up of prepetition first lien claims. The court declined to rule on those claims and “… reserve[d] the respective rights of the excluded and other lenders to pursue available contract rights and remedies” in its February 2 oral ruling.

*******Honestly, we thought Mr. Bennett had retired — it turns out he just got the late-career title demotion to “Of Counsel” which, for a man of his stature, is just wrong, guys. If some sixth-year equivalent at Kirkland can run around with a meaningless “partner” title, we don’t see why Mr. Bennett can’t have one too. Anyway, we haven’t seen or heard his name in a VERY long time but, you know what, we’re loving this late stage re-emergence. He’s like Harrison Ford in Shrinking — clearly in his “I don’t give a rat’s a$$” era (not that he ever really did) and delivering some fine a$$ work in the process.

📚Resources📚

We have compiled a list of a$$-kicking resources on the topics of restructuring, tech, finance, investing, and disruption. 💥You can find it here💥.

📤 Notice📤

Alex Klimowicz (Associate) joined Willkie Farr & Gallagher LLP from Kirkland & Ellis LLP.

Chazz Coleman (Associate) joined Hunton Andrews Kurth LLP from Pillsbury Winthrop Shaw Pittman LLP.

Christopher Samis (Partner) joined Ice Miller LLP from Potter Anderson & Corroon LLP.

Dan Devorsetz (Managing Director), Huy Tran (Director), Kyler Merck (Vice President) and Will Bobear (Associate) joined G2 Capital Advisors.

Gordon Novod (Partner) joined Boies Schiller Flexner LLP from Grant & Eisenhofer PA.

Jack Frisbie (Associate) joined Willkie Farr & Gallagher LLP from Kirkland & Ellis LLP.

Matt Waldrep (Associate) joined Willkie Farr & Gallagher LLP from Kirkland & Ellis LLP.

Rachel Strickland (Partner, Global Chair of Restructuring) joined Ropes & Gray LLP from Fried Frank.

Andrew Mordkoff, Dan Forman and Andrew Minear (Partners) also joined Ropes & Gray LLP from Fried Frank.

🍾Congratulations to…🍾

Aram Ordubegian for being named Managing Partner of the ArentFox Schiff Los Angeles office.

Garret Markey on his promotion to Managing Consultant at Berkeley Research Group.

Isaac Sasson on his promotion to Partner at Paul Hastings LLP.

Lauren Winne on her promotion to Managing Consultant at Berkeley Research Group.

Mark Buschmann and Richard Shinder for starting new advisory firm Ensis Partners.

McDermott Will & Schulte LLP (Darren Azman, Kristin Going, Gregg Steinman, Joel Haims) and Kelley Drye & Warren LLP (James Carr, Connie Choe) for securing the legal mandate on behalf of the official committee of unsecured creditors in the STG Logistics Inc. chapter 11 bankruptcy cases.

Morrison & Foerster LLP (Lorenzo Marinuzzi, Doug Mannal, Theresa Foudy, Raff Ferraioli, Miranda Russell, Benjamin Butterfield, Bryan Kotliar) and Cole Schotz PC (Seth Van Aalten, Justin Alberto, Ian Phillips) for securing the legal mandate on behalf of the official committee of unsecured creditors in the Saks Global chapter 11 bankruptcy cases.

Noah Weingarten on his promotion to Partner at Loeb & Loeb LLP.

Paul Jasper on his promotion to Partner at Perkins Coie LLP.

Robert Klamser on his appointment as Chief Innovation Officer at Stretto.

Robert Clark on his promotion to Associate Director at Riveron.

Tess Sadler on her promotion to Of Counsel at Paul Hastings LLP.

Will Reily on his promotion to Of Counsel at Paul Hastings LLP.