Fast Forward (Beauty). Uh oh. We noted last week that beauty category has been largely e-commerce resistant. Well, maybe not.

Rewind I (Bueller, Bueller). Get on with it already. Takata has become the new Westinghouse. Lots of noise. Just a matter of when. And, shocker! iHeartMedia's proposed subscription service with Napster - YES, NAPSTER - hasn't helped generate enough revenue to counteract $20b of debt.

Rewind II (Literally): We are as guilty as anyone hyping up the potential of autonomous cars but if anything is indicative of the wholesale difficulty to achieve 100% adoption, it's this piece about surviving Blockbuster franchises. Suffice it to say, there won't be driverless cars rocking the streets of Alaska anytime soon.

Rewind III (Shipping): We all know that the shipping industry hasn't been immune to its fair share of troubles the past year or so. Notably, Hanjin, Toisa, Daewoo, Ezra, and International Shipholding have all seen themselves in bankruptcy court. And, of course, Algeco Scotsman restructured as did Modular Space Corporation, as container companies, naturally, have also felt the effects. So, we thought this use case for surplus modular containers was interesting and we're dying for one of our readers in, say, Texas, to get one of these and report back.

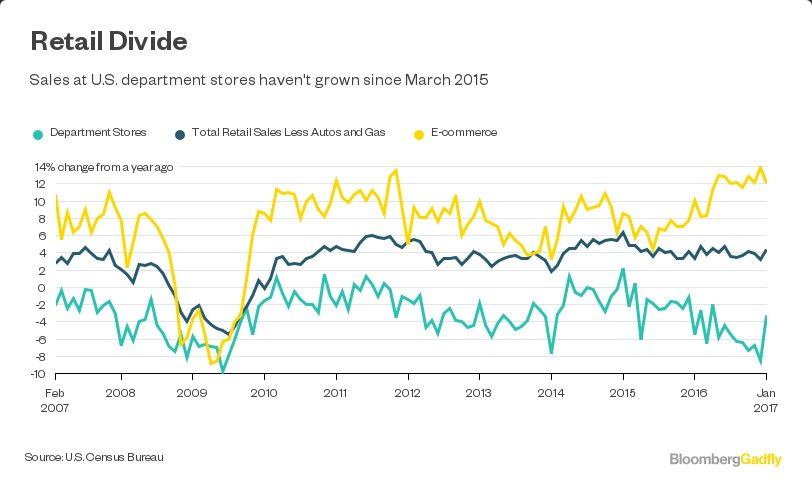

Rewind IV (Apologies...More on the Retail Apocalypse): Last week we highlighted Jeff Jordan's early 2014 call on retail. Subsequently, he dove into the mall scene: you can read it here. The below excerpt should be particularly interesting to PETITION readers as we've been saying for some time that restructuring pros who continue to claim that Bonobos and Warby Parker will fill the retail void are, quite plainly, making a$$es out of themselves. As are, quite notably, REIT CEOs. Nothing has changed since JJ wrote this...