🔥Johnny's Links #6: Scaring up "Capital Structure Solutions"🔥

Artificial Intelligence, Apollo/Ares, Goodwill Industries, Michael's Companies, Wind Power & More.

We came in hot off the holiday with a new initiation and coverage of a recently filed venture darling that crapped out haaaaaaaard. In case you missed it, and since this edition is predicated upon links, well …

Now let’s get after what kept our resident idiot Johnny interested this past week 👇.

But first …

🔥THE Link of the Week🔥

Lateral Recruiting (Long Impact Moves). Call us crazy but something tells us you’ve unquestionably …

… when a top tier law firm like Simpson Thacher & Bartlett LLP (“Simpson”) rearranges its entire corporate practice to make room for you (and agrees to open an entirely new office to accommodate you). On Wednesday, Simpson received a rose from spurned corporate stud David Nemecek — you know, the guy who spent the last two weeks liability managementing himself out of Kirkland & Ellis LLP (“K&E”) because of drama — and gladly sent out a press release so far and wide that the Ewoks on Endor likely received word.

Weil certainly got the message too.

Mr. Nemecek will serve as “Head of the newly created Capital Structure Solutions Practice” which “…integrates Simpson Thacher’s Liability Management and Special Situations and Restructuring capabilities into a single global team of multidisciplinary practitioners.”

We particularly loved this jab at K&E:

“The Practice is designed to provide companies, sponsors and lenders with unconflicted, client-aligned advice across the full spectrum of modern capital structure challenges—from financing strategy and liability management exercises to distressed M&A and chapter 11 restructurings.” (emphasis added).

Of course, K&E be like…

… and unceremoniously be like …

… which we guess is much more serene than when it was like:

Now, though, Kirkland can go back to its bread and butter — sans f*ckery about antitrust lawsuits or “the demise of the US bankruptcy lawyer” — and get back to what it does best.

Venue shopping.

LOL, we kid, we kid.

As we previously stated … “filing motherf*cking chapter 11 cases.”

Ok. Enough of this gossipy nonsense about nerds who make too much $$. To the 🔗⬇️!

🔗What We’re Reading (7 Reads)🔗

1. Artificial Intelligence (Long Unemployment Benefits). Ruh roh, it’s starting. Baker McKenzie recently RIF’d hundreds of people “…across nearly all functions across all offices, including the firm’s IT, knowledge, admin, DEI, leadership & learning, secretarial, marketing, and design teams, among others” leading the heartless wankers at AbovetheLaw to cheekily say “Best of luck to all of the staff members at Baker McKenzie who may have lost their jobs thanks to AI disruption.” Thankfully, lawyers are safe … for now … especially so if they dedicate themselves to the craft a la …

Also:

2. Creditor on Creditor Violence (Short Alligator Tears). From the FT, discussing the response of Apollo Global Management (“Apollo”), Ares Management (“Ares”) and Oaktree Capital Management to Patrick Drahi’s Optimum Communications suing them for antitrust violations:

“Whether co-operation pacts are really anti-competitive is for courts to decide. Meanwhile, borrowers are now adding contractual provisions when taking on new debt that allow them to stop creditors from ganging up, and thus avoid Drahi’s predicament. But it is entertaining to see some of the world’s most influential asset managers express chagrin over a dog-eat-dog culture they and their peers helped to create.”

On the note of dog-eat-dog culture, both Apollo and Ares are part of the secured ad hoc group in the Multi-Color Corporation chapter 11 bankruptcy cases charged with about-facing and sideswiping the crossholder ad hoc group with a restructuring support agreement and plan that would, in cahoots with private equity sponsor Clayton, Dubilier & Rice LLC, give them all of the value in the reorganized enterprise. They’re charged with manufacturing venue, among other things, to get to that result. So much chagrin, 🙄.

3. GLP-1s and Farms (Long Chapter 12). Allow us a bit of stream of consciousness. Here is an article about GLP-1s which serves as a retort of sorts to a recent Free Press article about GLP-1s and the loss of the weight loss “struggle” and how weight loss has come so easy and how in turn that weakens satisfaction for the weight loser because it wasn’t really earned blah blah blah and, well f*ck, we didn’t find either piece all that compelling so we didn’t actually intend to include them in this here edition of “Links” but then we happened to click over to this article about how farms are struggling and we couldn’t help but think that one person’s satisfaction (or not, 🤷♀️, but weight loss!) is another person’s dissatisfaction, because we’re talking about a 46% YOY increase in chapter 12 family farm bankruptcies in ‘25 — particularly in the midwest and the southeast — which, we have to assume, is at least somewhat attributable to GLP-1s cutting into users’ desire to crush a big ol’ bowl of rice or something, all of which is to say the next time you don’t pour one out for yourself perhaps you should pour one out for the poor farmer out in bumf*ck Missouri.

4. Mass Torts (Long non-Hodgkin’s Lymphoma). Ah, yes, here is a heartwarming tale of a major drug company — here Bayer AG ($BAYRY) — entering into a $7+b settlement to resolve current and future (like, 21 years into the future) cancer claims over its toxic-as-all-glittery-f*ck Roundup weed (and human) killer. This is on top of ~$3b of other settlements related to Roundup’s connection to non-Hodgkin’s lymphoma (which includes one massive $2.1b verdict in Georgia). Per Bloomberg:

“Roundup litigation has plagued the German conglomerate since it bought Monsanto for more than $60 billion and inherited a string of suits that have cast a lingering cloud over its shares. The company already has paid more than $10 billion in verdicts and settlements over the herbicide.

After years of fighting Roundup cases in the US, Bayer still faces about 67,000 claims from plaintiffs who allege long-term exposure to glyphosate through Roundup caused their cancer. Bayer officials have steadfastly insisted the weedkiller is safe. The company removed the glyphosate-based version from the US residential market in 2023.”

Almost makes one wistful for the days before In re LTL Management and Purdue Pharma. We reckon the company probably made a valid assessment that with a market cap of $50-ish billion and annual revenue of €45.8 billion (TTM), there might be some judicial pushback had the company attempted to avail itself of the chapter 11 bankruptcy process.

5. Movies (Long Horror Movie Cliches). Today ends in “day” which means AMC Entertainment Holdings Inc. ($AMC) is back out in the market for a balance sheet skullf*ck. With $400mm of 12.75% notes maturing in ’27 and a $2b loan due in ’29, AMC is reportedly looking for a $2.5b refinancing package, which includes a $750mm term loan B at SOFR+6% (or roughly 9.7%) plus OID. As for the box office, through February 18, 2026, the domestic box office is tracking 0.5% ahead of last year (per Box Office Mojo) with Neve Campbell’s return to the Scream franchise in Scream 7 looking promising with a potential $50mm opening based on early pre-sales.

6. Retail (Long Resale). As we watch several brick-and-mortar retailers descend into bankruptcy, close physical stores, and sell for parts, there’s one brick-and-mortar retailer that’s thriving: Goodwill Industries (“Goodwill”). Per The New York Times, Goodwill “…surpassed $7 billion in revenue — a record — from its 3,400 stores in 2025, up roughly 7 percent from the previous year.” Not to turn a positive into a negative, but there are some who take this news as a harbinger of some potential strained consumer times to come.

That said, Goodwill apparently isn’t the only brick-and-mortar retailer feeling confident these days. Last week we mentioned the seemingly successful turnaround story behind Michael’s Companies and now the Apollo-backed retailer is looking to tap the capital markets for a major financing package that would refi out the entirety of the cap stack and push out maturities (while also, presumably, loading the company up with heaps more debt … makes one wonder, what’s the other use of proceeds 🤔).

So while people seem to kinda sorta maybe be shopping at Goodwill or Michaels or whatever the f*ck, they’re certainly not doing as much buying off their televisions as QVC, which seems poised for a restructuring (previously covered in PETITION here), would like them to.

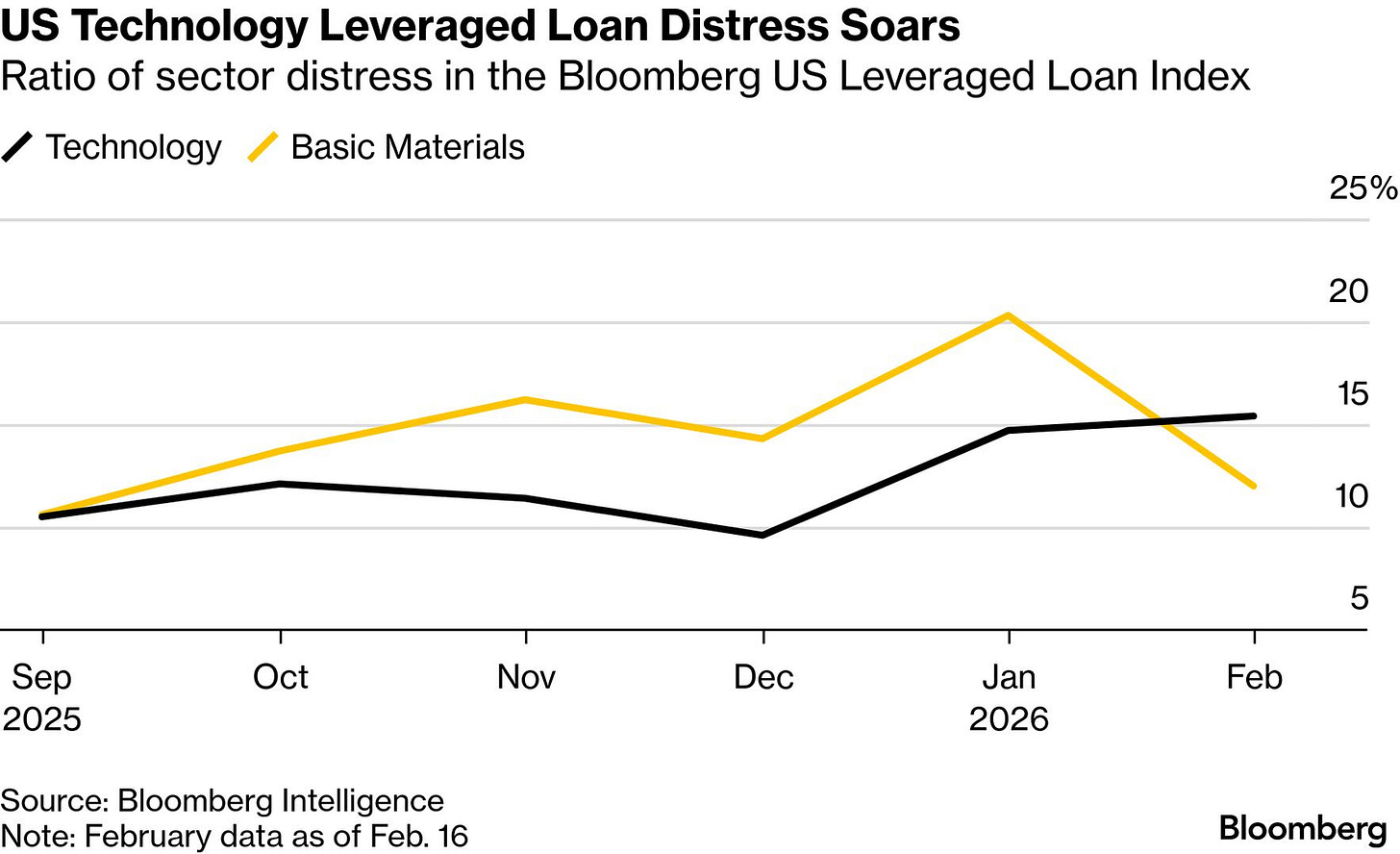

7. Wind (Long Legal Pathways). Back in October we queried whether the Trump administration’s efforts to block (nearly) every offshore wind project might lead to restructuring activity:

To date? It hasn’t. Not because the administration has stopped being a thorn in the industry’s side but, rather, because the industry has hired lawyers and fought back. Here’s the Financial Times:

Of course, this begs an obvious question: where will the funding to develop come from? It looks like the states caught in this intricate web, e.g., New York, Maryland, Rhode Island, even Virginia, are looking at state assistance in addition to outside funding. Whoever jumps into that fray will have to get some meaningful — and we mean MEANINGFUL — return on capital to take on this level of risk. More from the FT:

“The administration has signalled it will continue using the courts and its own authority to disrupt projects, running up costs for developers further. Dominion said in its filing that the delay was costing it $5mm per day, while Revolution and Sunrise Wind accrued $1.44mm and $1mm in daily losses.”

Recall that Ørsted A/S owns both Revolution Wind and Sunrise Wind and, back in Q3’25, raised capital via a rights offering to sure up finances and give it a war chest with which to fight back. After consummating the offering in October ‘25 — getting the support of the Danish government and Equinor SA ($EQNR) — the Ørsted’s stock soared to $21.50, leaving Johnny very perplexed. Where is today? Take a look:

📈 Chart of the Week📈

📚Resources📚

We have compiled a list of a$$-kicking resources on the topics of restructuring, tech, finance, investing, and disruption. 💥You can find it here💥.