💥Tupperware Update: More than 'A Good Quarter'💥

⚡️Update: Tupperware Brands Corp. ($TUP)⚡️

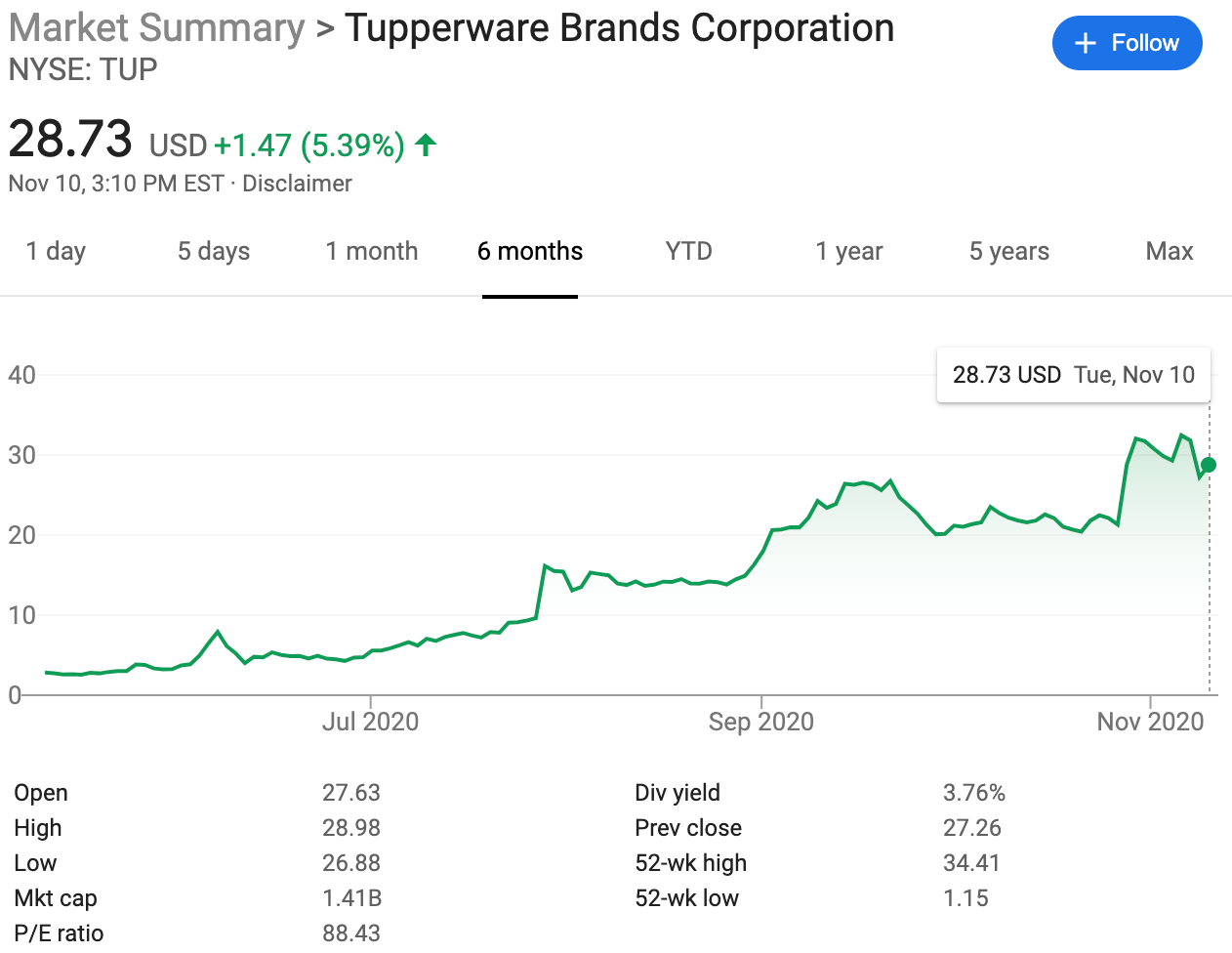

In last Wednesday’s “💥 Royal Caribbean Collapses. Tupperware Thrives. Friendly's Melts.💥,” we provided a brief update on the Tupperware Brands Corp. ($TUP) situation, highlighting how the company has been a clear-cut beneficiary of COVID-19. Profit quadrupled to $34.4mm in the company’s most recent quarter and equity that hovered around $1/share back in March jumped to the high 20s (and even breached $30/share) after the earnings announcement. This is an astounding rebound for a company that, back in February, was i) operating with an interim CEO, ii) struggling in a variety of geographies including Brazil, China, Canada and the US, iii) dealing with accounting issues, and iv) badly missing revenue, EPS, and cash flow targets. On Wednesday, we credited the pandemic with the turn-around. But there was more to the story. A lot more.

In April 2020, Tupperware Brands announced weak Q120 earnings, with sales down -23% YoY and FCF burn of roughly $55mm in the quarter. Already struggling due to changing consumer habits and now also contending with coronavirus lockdowns, management elected to pull their FY20 guidance and increased their previously announced cost reduction target to $75mm (up 50%). But the company needed to do more:

“[Tupperware Brands]…amended its Credit Agreement during [Q120] and agreed to changes to the permitted debt to Adjusted EBITDA ratio, which increases to 5.75 for the first and second quarter of 2020, tightening to 5.25 in the third quarter of 2020, and again decreasing to 4.50 in the fourth quarter…”

For the uninitiated, an increased EBITDA ratio gives a company additional breathing room in a situation like this one where debt (usually) remains static in the face of dramatically decreasing sales and FCF declines. The relief, however, clearly contemplated that the company’s COVID-related problems would be short-lived as the ratio ratcheted down meaningfully in subsequent quarters. Management’s feet were to the fire.

But they had levers to pull:

The Company has taken certain measures in response to the COVID-19 situation, designed to enhance its liquidity position, provide additional financial flexibility and maintain forecasted financial covenant compliance, including reductions in discretionary spending, revisiting investment strategies, and reducing payroll costs, including through organizational redesign, employee furloughs and permanent reductions. Additionally…on March 30, 2020, the Company drew down $225 million under its Credit Agreement, $175 million of which was drawn as a proactive measure given the uncertain environment resulting from the COVID-19 pandemic. In addition, the Company has approximately $600 million of Senior Notes outstanding with a maturity date of June 2021 and is proactively working with advisors to evaluate its options relative to this maturity. (emphasis added)

Tupperware’s $600mm 4.75% Senior Notes due June 2021 were increasingly becoming a problem for the company. Given the rapidly declining earnings and elevated leverage, junior bondholders were (understandably) concerned how their principal might get paid. The trading price on the bonds reflected those concerns, with the notes trading well into distressed territory at below 50 cents on the dollar.

This is where the governing credit docs had a role to play. Tupperware realized an alternative “use of proceeds” for its revolver draw: under the credit agreement, the company could use the monies to permissibly tender the market for an early redemption of the outstanding notes. Per the WSJ:

The publicly listed company launched on May 26 an offer to repurchase at a deep discount about one-third of a $600 million bond that falls due a year from now. The strategy is to ease financial pressure on the company, increasing its chances of repaying the bond on time and helping it meet guidelines for its various bank loans, a person familiar with the matter said.

Tupperware offered to buy back $175 million face amount of the debt at a price of 45 cents on the dollar and gave bond investors a June 22 deadline to take part in the deal. If it achieves full participation, the company would spend about $79 million to retire the debt early.

But the company didn’t stop there. It subsequently launched a second tender to take out even more of the notes. When all was said and done, the company (a) struck a deal with a large percentage of its disillusioned junior creditors for cents on the dollar, (b) deleveraged the balance sheet by $220mm of debt principal for only $164mm of (the revolving lenders’) cash, and (c) prevented any equity dilution (including, of course, that held by management). Significantly, this maneuver also cured the company of a potentially serious financial maintenance covenant issue. Talk about “robbing Peter to pay Paul”!

Consider: if the revolver lenders had their way, the company would have engaged in a full-blown restructuring pursuant to which the bondholders would be forced to swap their bonds for equity and wipe out the equity. The company would come out with less leverage and, in turn, lower interest expense. This would obviously lower the risk profile. But even better, the banks could have used the restructuring to provide a DIP and ultimately slither into a much higher yielding piece of exit paper. Alas, not.

Having survived their covenant concerns, Tupperware approached its remaining junior bondholders. Those noteholders, who had not cashed out their bonds in the prior two tenders had organized with their own advisors, and were attempting to use the upcoming maturity and their holdout status as a negotiating ploy to exchange into structurally senior, high coupon rescue financing. We don’t know all the details of those negotiations, but given most COVID-driven rescue financing deals are somewhere in the 12-15% area, we imagine it would have been a very expensive deal for Tupperware.

But then the company cancelled those negotiations! Performance saved them. As we noted on Wednesday, the company reported absolute blowout Q3 earnings, with sales up 14% (up 21% in local currency), $60mm of positive FCF, and commentary that Tupperware had realized 2/3, or $120mm of its $180mm cost-reduction target. Management also entered into a binding commitment for a sale leaseback of its corporate HQ for $86mm, further improving liquidity. Tupperware’s newly minted CEO Miguel Fernandez provided his thoughts on the stellar quarter:

“The 21 percent growth in local currency revenue reported today reflects a rapid adoption of digital tools by our sales force to combat the social restrictions surrounding COVID-19, and the increased consumer demand for our innovative and environmentally friendly products, as more consumers cook at home and are concerned with food safety and storage…The improved performance of both top and bottom line these past two quarters are a positive sign that our Turnaround Plan is working.”

CFO Sandra Harris’ comments indicated the company wasn’t stopping there:

“We are pleased with the rate of improvement in right sizing the business, improving our liquidity and making permanent structural changes that will ensure the success of our Turnaround Plan…These efforts, including sales of non-core assets, will help us continue to improve the health of our balance sheet as we pursue the refinancing of [the remainder of their] June 2021 obligations.”

On Monday, November 2nd, while we at PETITION were fretting over the possibility of an election-induced civil war, Tupperware came to market with a refinancing of its remaining junior 2021 bonds. The company entered into a commitment letter with Angelo, Gordon & Co., L.P. and JP Morgan Strategic Situations Initiatives for a two tranche secured term loan facility, consisting of a $200mm “Parent Term Loan” facility and a $75mm “Dart Term Loan facility.” Based on the commitment papers, the new loans are priced at 7.75%, but future interest rate is determined on a leverage-based grid. The loans can step down to L + 7.25% if leverage is below 2.75x, or step up to L + 8.75% if leverage is above 2.75x. Use of proceeds of the new loans will be used to fully repay the junior 2021 notes.

The market has certainly rewarded new management for their efforts ⬇️.

In “💥Oaktree's Howard Marks: "I don't think of it as 'screwing'"💥,” we highlighted the TriMark USA situation, quipping “Long Creditor-on-Creditor Violence”. We subsequently discussed the theme in the ongoing adventures of Revlon Inc. ($REV). Here, though, instead of senior creditors getting primed by structurally senior debt, the company and its consenting bondholders inflicted violence – TupperWAR, if you will -- on the revolving banks.

You gotta love restructuring!