🚂Manufacturing (Short the Railroads?)🚂

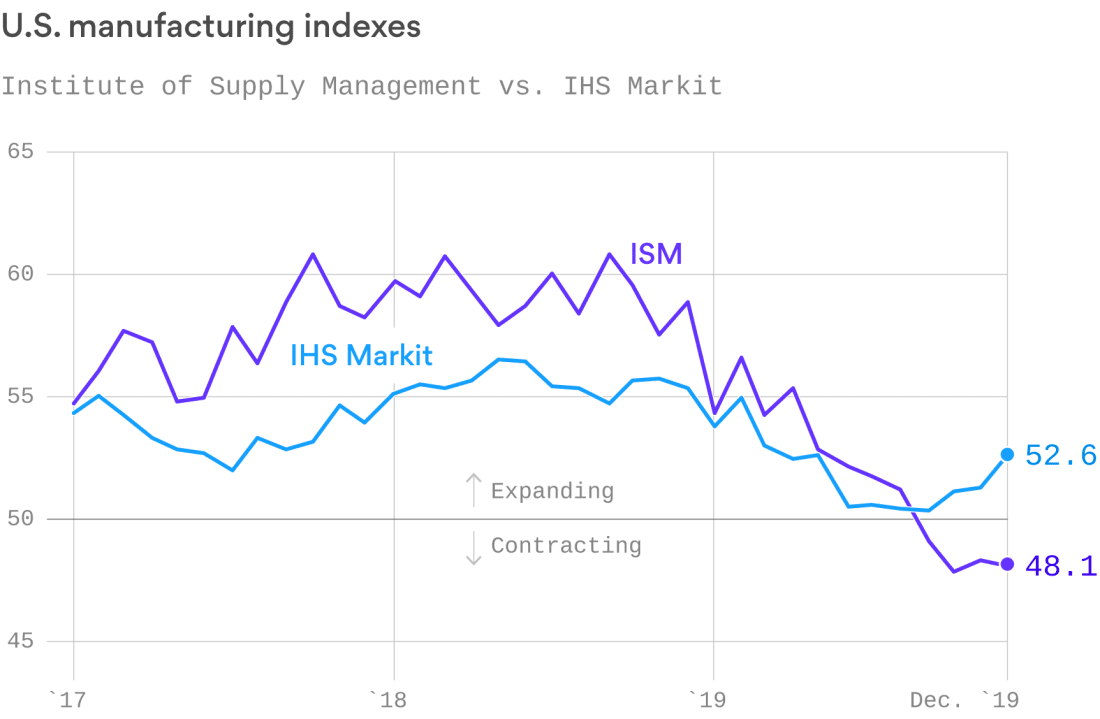

We were surprised to hear certain Representatives boast about US manufacturing growth during the impeachment hearings. We stopped in our tracks: “wait, what?” As we noted on Wednesday, the ISM Manufacturing numbers tell a different story — a contraction story.

But, to be fair, there are other surveys. The recent IHS Markit index painted a different picture. This Axios piece discusses the difference between the two surveys and is worth a quick read. The ISM survey includes fewer participants and “…uses five components, each weighted evenly at 20% — new orders, production, employment, supplier deliveries and inventories.” The IHS survey “…uses a weighted average that gives greater importance to new orders (30%), output (25%) and employment (20%), and lower weighting to suppliers’ delivery times (15%) and stocks of purchases (10%).” The bottom line is that if the former is correct, the US economy may be f*cked; if the latter is more accurate, the economy is expanding.

Now, granted its a small data set but the current trucking situation (see Wednesday’s “🚛Dump Trucks🚛“) seems to reflect, at least in part, a slowdown in manufacturing (among other things, including the effect of tariffs and shipping). But what about the railroads?

In November, rail carloads declined 7.5% YOY, led primarily by coal (⬇️ 14.5%) and primary metal products (⬇️ 15.1%). Per Logistics Management:

TO READ THE REST OF OUR PREMIUM INSIGHTS (AND TO GET THAT EXTRA EDGE) CLICK HERE AND SUBSCRIBE TO OUR PREMIUM NEWSLETTER. YOU (AND YOUR BOSS) WON’T REGRET IT.