🔥The "Weil Bankruptcy Blog Index," CMBS and how Nine West is the Gift that Keeps on Giving🔥

We’re still clearing through some year-end stuff here at PETITION. This edition will conclude our review of 2020 (parts I and II here and here). Before we get there, this was obviously a momentous week. The Democrats took Georgia and by extension the Senate, the Capitol fell to a siege, unemployment figures underwhelmed (140k job losses with leisure and hospitality getting f*cking napalmed), Saudi Arabia unexpectedly cut oil output, and a new virulent COVID strain is now apparently running wild within our borders. Good times. It’s almost enough, all in, to make us nostalgic for 2020.

Oddly, the stock market took in all of the above and be like 🤷♀️: it had an up week! Mania is sweeping the markets to the point of Elon Musk becoming the richest man on the planet, Bitcoin breaching $40k, sponsors issuing SPACS called Queen’s Gambit Growth Capital (sounds fake: it’s not), and corporates…well…

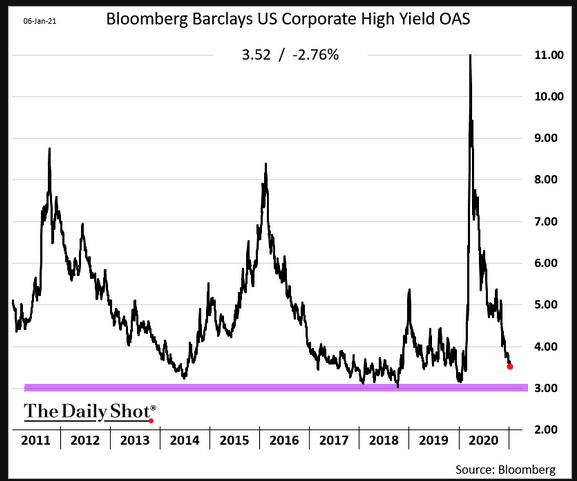

Maybe. Probably not. More likely? They’re seeing the market swallow up ridiculously low rates. This week US high yield rates hit a fresh all-time low. Spreads are back near pre-crisis levels:

Demand is insatiable.

Back in October the PETITION team took a look at (but ultimately opted not to write about) Urban One Inc. ($UONE), a Maryland-based media operator focused on the African-American community. Our interest derived from an 8-K indicating that UONE (a) anticipated COVID-19-induced revenue decreases might trip financial covenants, (b) initiated wholesale cost-cutting initiatives, and (c) drew down $27.5mm on its ABL facility. Thereafter, the company commenced an exchange offer and consent solicitation pursuant to which it exchanged $347mm 7.375% senior secured notes due 2022 for new 8.75% senior secured notes due 2022. The company also pulled off a $25mm at-the-market equity offering. In other words, both the debt and equity markets were willing to play ball and play for some sort of social justice-driven pull-through of demand that would improve business fundamentals.

And as it turns out, the company did pull forward demand — more election related than anything:

"The radio segment benefited from unprecedented levels of political advertising spending targeting African American voters. Bolstered by this revenue, we expect our radio segment fourth quarter revenue to be down a low single-digits percentage year over year, a material improvement from second quarter's decline of -58.4% and third quarter's decline of -31.9%," says CEO Alfred C. Liggins III.

In a pre-market announcement on Thursday, the company indicated that consolidated net revenues for FY20 would be down roughly 13.7-14.6%. But Q420? They reported a net revenue increase of between 3.9-7.7% and adjusted EBITDA up 49-56.2%. That’s all the capital markets needed to see.

On Thursday the company also announced a private offering of $825mm 2028 notes to pay off the relatively new 8.75% ‘22s, the stub 7.375% 22s, and loans outstanding under two separate credit agreements. The issuance priced inside of initial 7.5% talk and got done at 7.375%. Notably, the 8.75% ‘22s were trading below par as long ago as, uh, *checks calendar*, Tuesday (they’re now above 100). This is not the most, uh, optimistic issuance we’ve seen of late — we’ll leave that to the airlines and movie theater chains — but it does highlight the forgiving nature of capital markets: that’s quite a dramatic drop in rate mere months after a previous issuance. And let’s be clear: we’re talking about a company that is, in part, a radio station operator coming off a significant uptick due to election-related ads. But 🤷♀️. That really is the best way to describe all markets these days.

How about the bankruptcy market? Epiq Systems Inc. released its 2020 bankruptcy filing statistics this week and “2020 had the lowest number in bankruptcy filings since 1986 with a total of 529,068 filings across all chapters.” Commercial chapter 11 filings were up 29% YOY but chapter 13 and chapter 7 filings decreased by 46% and 22%, respectively.

TO READ THE REST OF THIS ANALYSIS, YOU MUST BE A PETITION MEMBER. BECOME ONE HERE.