💥A War is Brewing: Elizabeth Warren vs. Private Equity💥

Scrutiny of Private Equity Increases

It’s hard to take policy positions seriously at this stage in the run-up to Election 2020 but that’s not stopping Elizabeth Warren. Following up on her dead-on-arrival venue reform proposal of last year, Ms. Warren released her “plan” for a “Stop Wall Street Looting Act” in July and it came back again this week in the context of collapsing private equity owned media companies.* Oh boy. EW is about to have the fury of private equity fat cats rain down upon her. That is, if they think it has even the slightest chance of ever becoming reality (it likely doesn’t but…maybe increasingly does?).

Ms. Warren minces no words. She starts broadly:

“To raise wages, help small businesses, and spur economic growth, we need to shut down the Wall Street giveaways and rein in the financial industry so it stops sucking money out of the rest of the economy.”

She then narrows her aim:

“Private equity firms raise money from investors, kick in a little of their own, and then borrow tons more to buy other companies. Sometimes the companies do well. But far too often, the private equity firms are like vampires — bleeding the company dry and walking away enriched even as the company succumbs.”

And:

“…the firms can use all sorts of tricks to get rich even if the companies they buy fail. Once they buy a company, they transfer the responsibility for repaying the debt they took on to the company that they just bought. Because they control the company, they can transfer money to themselves by charging high “management” and “consulting” fees, issuing generous dividends, and selling off assets like real estate for short-term gain. And the slash costs, fire workers, and gut long-term investments to free up more money to pay themselves.”

“When companies buckle under the weight of these tactics, their workers, small business suppliers, bondholders, and the communities they serve are left holding the bag. But the managers can just walk away rich and move on to their next victim.”

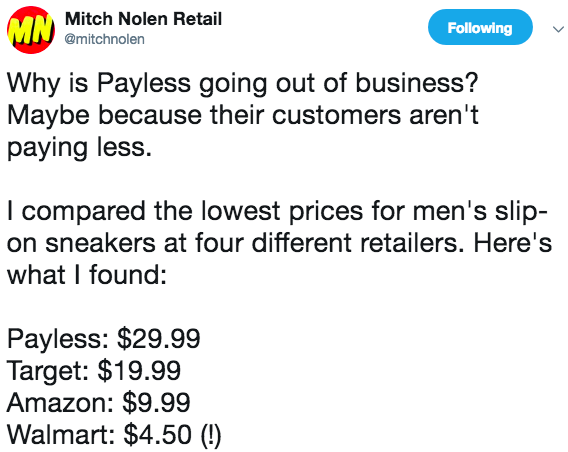

PETITION NOTE: See, e.g., Toys R Us, Payless Shoesource, Gymboree, rue21, Nine West, Shopko. Retail has been a particularly bloodied victim of PE gone awry but there are no limits. She continues:

“These firms are gobbling up more and more of the economy. They own companies that employ almost 6 million people. They own the nation’s second-largest nursing home operator, the largest single-family rental landlord, the second-largest grocery store chain, and one of the nation’s largest payday lenders. But some of the hardest-hit industries are retail and local news.”

Insert the likes of Sun Capital Partners and Alden Global Management here. At this point in her diatribe, Warren unleashes some hellfire with a vicious summary of the Shopko bankruptcy case and current state of affairs of Denver Post. You have to read it.

And she doesn’t stop there: she then EW unleashes a fury of napalm all over the PE model. For example, she wants PE firms to guarantee the debt put on the balance sheet of acquisition targets. Yup, you read that right: GUARANTEE the debt.

Think about this: PE firm XYZ takes Jesse Pinkman Media private. It puts $200mm of equity behind $1b of secured debt split between a revolving credit facility and two term loans. XYZ then engages in the usual PE playbook: within two years the company issues two new tranches of unsecured notes, the proceeds of which are used to pay dividends to XYZ. The company sells real estate, the proceeds of which are used to pay dividends to XYZ, and then leases back the real estate to the company. The company RIFs 150 employees, the cost savings of which are used to pay dividends to XYZ. The company then struggles to generate revenue, has very little cost cutting flexibility, no non-core assets to sell, and ends up in default. Noteholders can then go after the company AND XYZ?!? And not just for fraudulent conveyances in bankruptcy which, as we all know, hasn’t exactly played out so well?!? POP US THE GREATEST TASTING POPCORN OF ALL TIME. SH*T WOULD GET JUICY.

Warren also wants to hold PE firms responsible for pension obligations of the companies they buy. Ooof. That would eliminate PE backing of a lot of industrial companies. Given that Warren would also like to regulate banks more stringently, where would these businesses get financing to grow and expand their businesses? How, then, would they be able to make pension contributions?

She also wants to eliminate management fees and limit PE firms’ ability to pay themselves dividends (which would presumably include eliminating dividend recaps). This, in effect, completely redefines equity risk.

She also wants to modify the bankruptcy rules so that workers get paid and management teams can’t pocket special bonuses. She’s basically saying that the Bankruptcy Code is doing a poor job of guarding workers rights and enforcing restrictions on incentive plans. Remember Toys R Us? Those clowns paid themselves bonuses on the eve of bankruptcy and then had the audacity to pursue another round of bonuses immediately after filing. Bold a$$ mofos.

She also wants to prevent lenders and investment managers from making “reckless loans” and then passing along the danger to outside investors without maintaining any of the risk. In other words, she’s got her eyes on the syndication market too.

She also wants to eliminate carried interest which lets money managers pay lower capital gains rates rates rather than ordinary income tax rates. We’re old enough to remember when President Trump also said he’d go after this. Somehow, nobody ever does. Will Warren buck the trend?

She concludes:

“These changes would shrink the sector and push the remaining private equity firms to make investments that help companies rather than stripping them down for parts.”

Said another way, these changes could decimate the PE market.** 💥

*****

A recent study of private equity by researchers at Harvard University, University of Chicago, University of Michigan, University of Maryland, and the U.S. Census Bureau may or may not help matters. The study demonstrates that private equity does, in fact, lead to increased employment in certain scenarios while resulting in decreased employment in others. In a nutshell, within two years of a transaction, employment:

⬇️13% in buyouts of listed companies;

⬇️16% in carveouts (i.e., deals for a part of a company);

⬆️13% in buyouts of private companies; and

⬆️10% in private-to-private sales from one PE shop to another.

These contrasting outcomes call into question sweeping proposals like Ms. Warren’s — and y’all know we’re not exactly apologists for private equity. Indeed, the authors write:

In his presidential address to the American Finance Association, Zingales (2015) makes the case that we “cannot argue deductively that all finance is good [or bad]. To separate the wheat from the chaff, we need to identify the rent-seeking components of finance, i.e., those activities that while profitable from an individual point of view are not so from a societal point of view.” Our study takes up that challenge for private equity buyouts, a major financial enterprise that critics see as dominated by rent-seeking activities with little in the way of societal benefits. We find that the real-side effects of buyouts on target firms and their workers vary greatly by deal type and market conditions. To continue the metaphor, separating wheat from chaff in private equity requires a fine-grained analysis.

This conclusion cast doubts on the efficacy of “one-size-fits-all” policy prescriptions for private equity. Our results also highlight how buyouts can lead to large productivity gains on the one hand and job and wage losses for incumbent workers on the other. This mix of consequences presents serious challenges for policy design, particularly in an era of slow productivity growth (which ultimately drives living standards) and concerns about economic inequality. (emphasis added)

🤔

*The news that sparked Ms. Warren’s renewed fire was the announcement that Splinter, a digital media company, was shutting down. G/O Media, backed by private equity firm Great Hill Partners, purchased the the news site from Univision back in April after Univision acquired the property post-Gawker dismantling. Ironically, as Dan Primack points out, the transaction was financed with all equity, not debt, which calls into question whether Warren’s plan even applies.

**Ms. Warren has already started targeting PE-owned for-profit colleges and prison service companies.