💥Sunken SAAS, Bitten BTC💥

Filings! = Nine Energy Service Inc. ($NINE), Francesca’s Acquisition LLC, NFN8 Group Inc., FLOAT Alaska LLC, Shannon Wind LLC and Georgia ProtonCare Center Inc. d/b/a Emory Proton Therapy Center.

What a week.

The markets suddenly woke up from a long hype slumber, realizing that there’s gazillions of dollars being spent to build artificial intelligence-supporting infrastructure with questionable ROI.*

Consequently, key elements of the Mag7 took incoming fire: Microsoft Corp. ($MSFT) fell 6.75%, Alphabet Inc. ($GOOGL) dipped 3.8%, Amazon Inc. ($AMZN) tumbled 11.7%, and Meta Platforms Inc. ($META) dropped 7.5%.

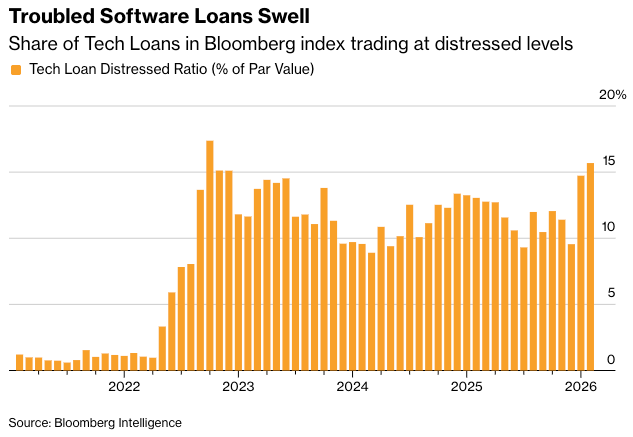

As you can imagine, then, the Nasdaq composite got smoked over the past week, collapsing 12.7% (in contrast, the S&P 500 and Dow ended ⬆️ after a resurgent Friday). That 12.7% capitulation represents more than just the Mag7, of course, and drilling down, it equates to what some are calling the “SAASpocalypse” as fears of AI-sparked disruption of software-as-a-service companies catalyzed widespread reverberations across public equities and credit.

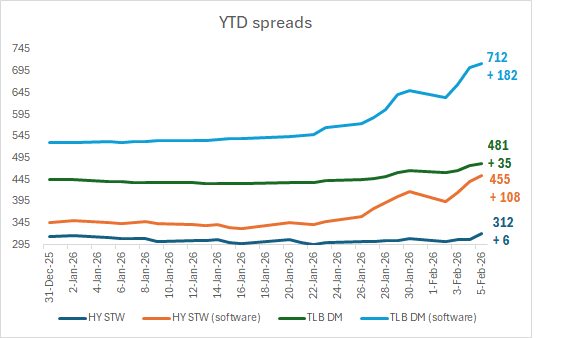

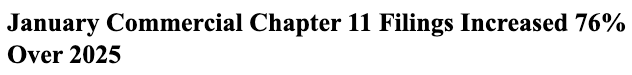

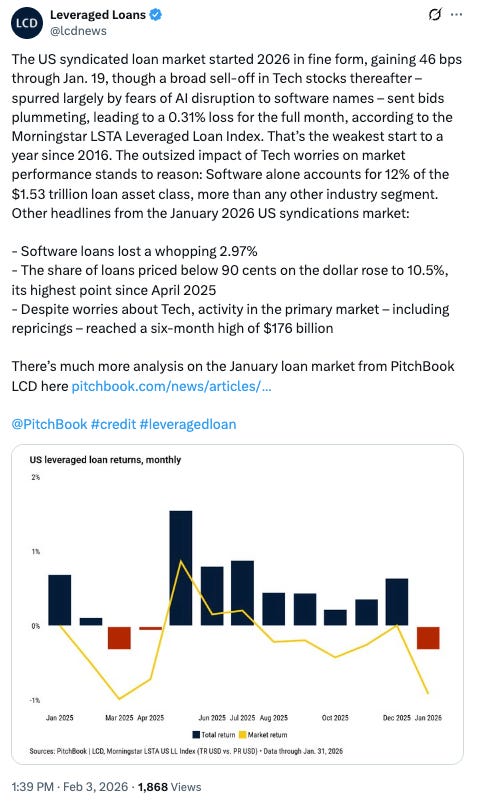

Yes, credit. Credit had already been showing, on a relative basis, a bit of wobble towards the end of January …

… got worse during the middle of the week …

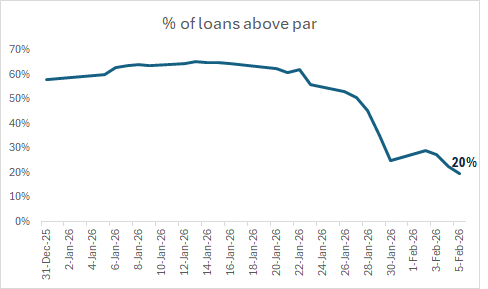

… and even worse towards the end of the week …

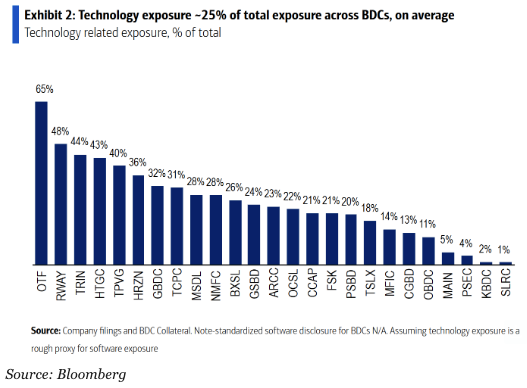

… and not just in the syndicated loan space:

Is it all overblown? The market reaction on Friday suggests yes, to a degree. The commentary from always-willing-to-talk-their-own-books Blue Owl’s Marc Lipschultz and Ares’ Mike Arougheti does too. There’s a lot of cash out there and a lot of well-capitalized lenders. This will all need some time to play out.

Meanwhile, chapter 11 bankruptcies continue to rise:

We covered two of those large January filings in Wednesday’s very-widely-read a$$-kicking edition:

Then on Friday, Johnny, flummoxed by all of the AI talk …

… subsequently released coverage of a February filing (ICYMI):

Today we’ll dive into a full slate of late-January and early February filings. Let’s dig in.

*For a counterpoint on the ROI discussion, read this:

💥New Chapter 11 Bankruptcy Filing - NFN8 Group Inc.💥

Forget about ‘16 vibes, someone apparently short circuited the DeLorean and took us all back to ‘22.