🛢️New Chapter 11 Bankruptcy Filing - Nine Energy Service Inc. ($NINE)🛢️

Oilfield services company files prepack to equitize $300+mm of senior secured notes.

It appears the millennials and Gen Zers were right when they declared that ’26 is the new ‘16 a few weeks ago because, just like ‘16, oilfield services are in bankruptcy, baby!

On February 1, 2026, Houston-based Nine Energy Service Inc. ($NINE) and nine affiliates (collectively, the “debtors”) filed prepackaged chapter 11 bankruptcy cases in the Southern District of Texas (Judge Lopez).

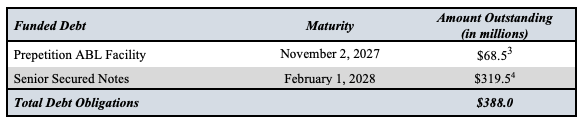

We won’t spend too much time on these debtors because (a) anyone who was alive in ‘16 remembers what these OFS companies are all about, and (b) it’s a simple cap stack with a prepackaged plan (small “p” and large “P”) that’s about as clean as they come. We will highlight, however, that the debtors say they were hindered by their “overleveraged” capital structure …

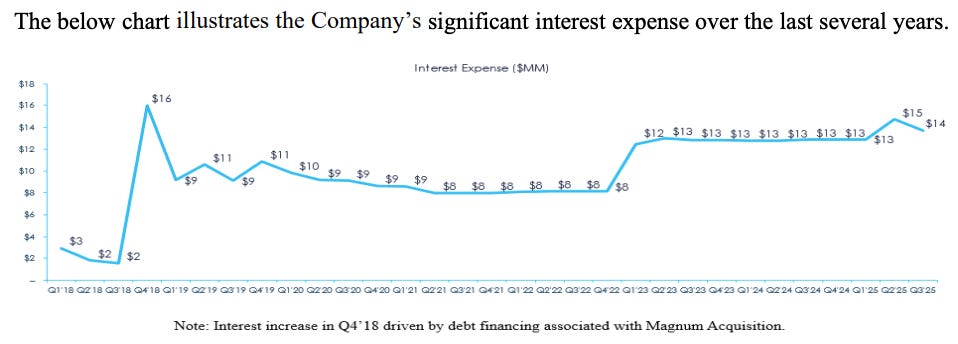

… and attendant high interest expense costs …

… and inability to reinvest in the business and compete (read: make acquisitions!). The fact that the oil and gas industry “…continues to experience challenging macroeconomic conditions, as major oil indexes suffer persistent pricing declines, leading many [Exploration & Production] companies to reduce their drilling completion programs,” didn’t help, especially when you recognize that the debtors’ “…financial success is highly predicated on active drilling rigs and fracturing fleets.” Interestingly, the debtors’ management doesn’t foresee any radical changes for ‘26 so it figured it might as well tackle that suffocating debt rather than crawl through yet another year of struggle. The market seemed to validate this approach:

And so there were talks.