💥PJT Partners is Busy💥

Recent sale cases see robust bidding in bankruptcy (e.g., CareerBuilder + Monster & Everstream Solutions LLC)

🏆Midseason Awards. Part III🏆

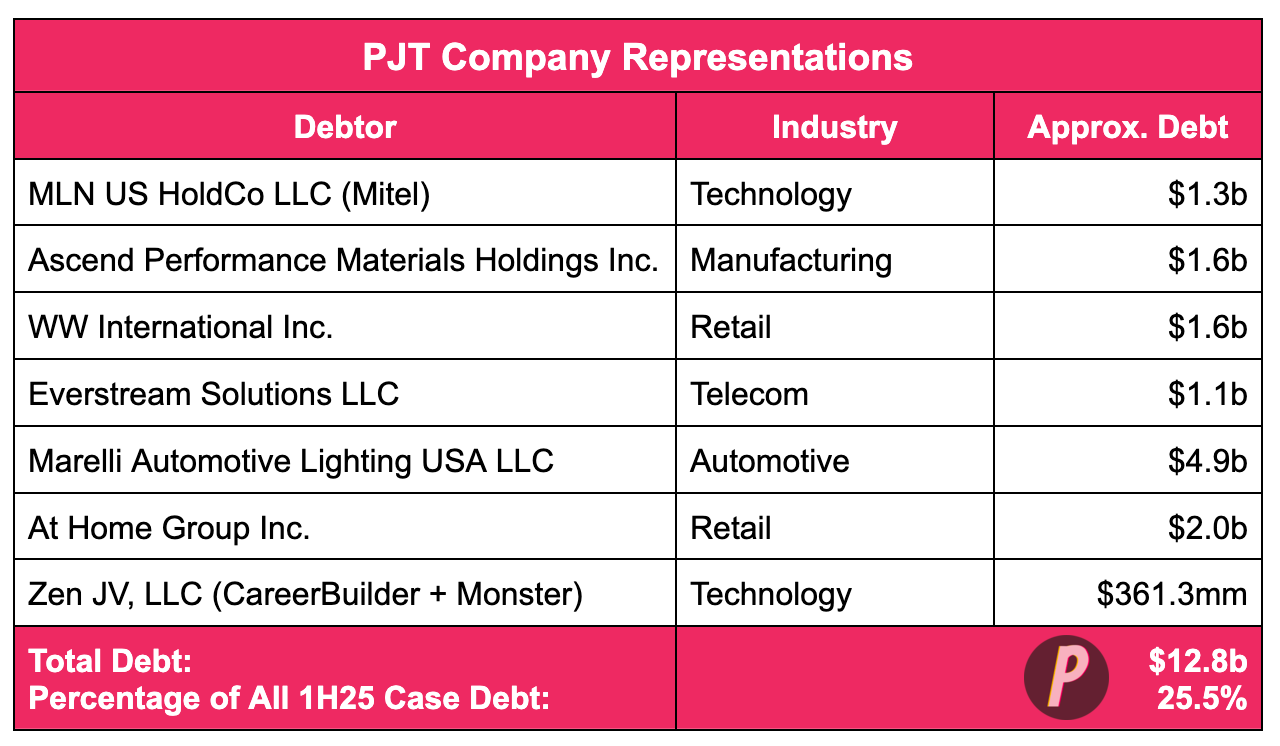

After previously dropping our “midseason” accolades on Kirkland & Ellis LLP and FTI Consulting Inc. ($FCN) here and here, it’s time to turn our attention to the top investment banker of 1H’25. Here’s to you PJT Partners LP ($PJT).

By our count, PJT racked up the most company-side mandates — taking down some high quality wins too, like MLN US HoldCo LLC (Mitel), WW International Inc. (a/k/a WeightWatchers), At Home Group Inc., and Marelli Automotive Lighting USA LLC. Take a look for yourself 👇:

With Del Monte Foods Corporation II Inc. and Lifescan Global Corporation already in the can for July, it’s no wonder CEO Paul Taubman pounded his chest on PJT’s recent 2Q’25 earnings call:

“This morning, we reported record-setting results as revenues, adjusted pretax income and adjusted EPS all set record highs for both 3- and 6-month periods. Second quarter revenues were $407 million, up 13%. Adjusted pretax income was $80 million, up 22% and adjusted EPS was $1.54, up 29% from year ago levels. For the 6 months, revenues increased 6%, adjusted pretax income increased 13% and adjusted EPS increased 19% from year ago levels.”

Everything’s up. Everything, that is, other than volatility. Back to Mr. Taubman:

“Since our last earnings report, the market backdrop has improved appreciably. Equity valuations have come up. Market volatility has come down. Business confidence has rebounded, capital is more readily available. Last quarter's tariff uncertainties sparked concerns about the potential for such dislocations to chill investment, trigger an economic slowdown and fan inflationary pressures. Today, market concerns regarding these risks are much diminished.”

And yet RX is powering forward nevertheless — primarily on sustained liability management activity:

We continue to experience elevated levels of liability management activity as an expanding quantum of outstanding debt, elevated interest rates and increasing economic and technological dislocations have increased demand for best-in-class liability management and restructuring advice. In this period of heightened activity, our restructuring team continued its market leadership, ranking #1 in announced and completed U.S. and global restructurings for the first half of 2025. Our restructuring team also continued its track record of exceptional financial results with first half revenues bettering last year's record performance. Our current expectation is for full year restructuring results to at least match last year's record levels.”

“At least match” … 🤔.

Cue the obnoxious slide — PJT always has the slide.

We hope their next quarterly earnings presentation reflects this distinguished award as well, 😜.

Honorable Mention(s): Jefferies Financial Group Inc. ($JEF) and Houlihan Lokey Inc. ($HLI).

⚡️Update: Zen JV, LLC (CareerBuilder + Monster)⚡️

Y’all notice Zen JV, LLC, CareerBuilder LLC, MonsterWorldwide LLC in that PJT Partners LP ($PJT) chart 👆? You may recall that they and their seven other affiliates (collectively, the “debtors” and together with their non-debtor affiliates, the “company”)? We wouldn’t fault you if you didn’t — they’re Internet antiquities after all — but they filed chapter 11 sale cases in the District of Delaware (Judge Stickles) back on June 24, 2025. You can refresh yourself here.

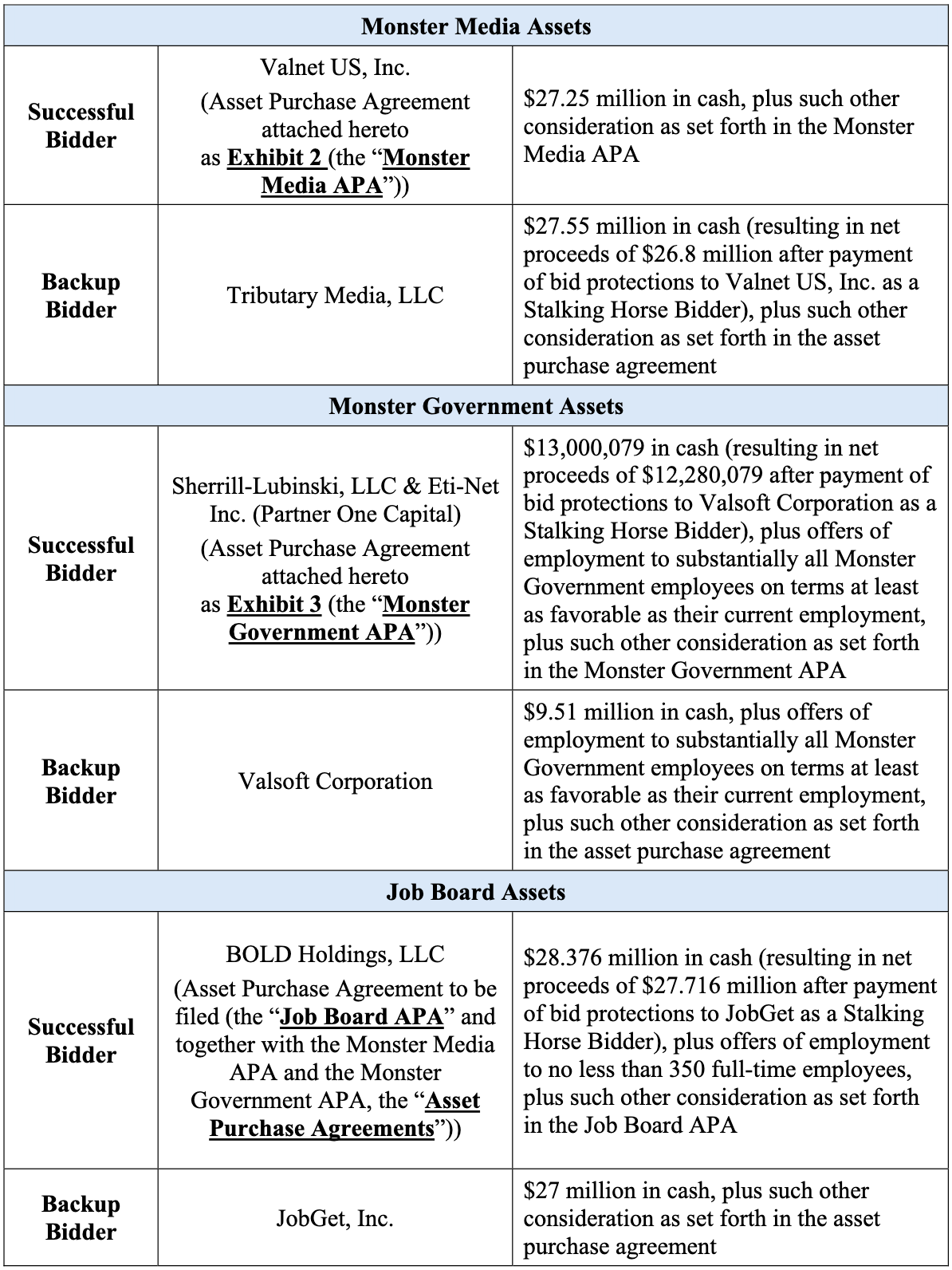

When we last checked in, the debtors were gearing up for a July 8, 2025 hearing on their bidding procedures and the designation of Valnet Inc. (“Valnet”), Valsoft Corporation (“Valsoft”), and JobGet, Inc. (“JobGet”) as stalking horses for their three business segments:

Their military-and-college-prep-focused business Monster Media Properties, for which Valnet agreed to pony up $22.5mm,

Their state-and-federal-government-human-capital-management biz Monster Government Services, for which Valsoft was willing to toss in $6mm, and

The “iconic” (😂) CareerBuilder + Monster job boards, for which JobGet rustled up $7mm …

… for an aggregate $35.5mm purchase price.

The hearing went off without a hitch, but that ain’t all too surprising. Because the official committee of unsecured creditors (the “UCC”), repped by Cole Schotz P.C. (Justin Alberto, Seth Van Aalten, Sarah Carnes, Melissa Hartlipp, Elazar Kosman) as legal counsel and M3 Advisory Partners, LP (Robert Winning) as financial advisor, objected to the only truly controversial grab: “superpriority” stalking horse bid protections. And, believe it or not, Johnny was invited into debtors’ counsel Latham & Watkins LLP’s offices while the lawyers and the stalking horses deliberated on the right response. The conversations started like this:

… which, over time, pivoted to …

… before landing on the “consensual” outcome …

Because, like, of course they did. Ain’t no Bankruptcy Code authority for superpriority bid protections,* and despite what debtors peddle at the podium, no one’s walking if they can’t get ‘em. All three stuck around.

And not just that. By the time the debtors held their July 17, 2025 auction, another nine folks had popped in to express interest.

And. Not. Just. That. By the time it ended, only Valnet won its biz. Valsoft and JobGet settled for second.

AND NOT. JUST. THAT! To win, Valnet had to up its purchase price nearly $5mm. Here are the final outcomes for each segment.

Hot damn, the debtors netted ~$67.2mm, up nearly double! Way to go, PJT!! It’s … LOL … still a hair or two away …

… from satisfying the debtors’ $361.3mm in prepetition funded debt. Plus, you know, $31.2mm in GUC claims.

In any event, that didn’t bother Judge Stickles, who had zero problems approving the sales at a July 28, 2025 hearing and entering the orders (1, 2, 3), which closed on July 31, 2025 (1, 2, 3).

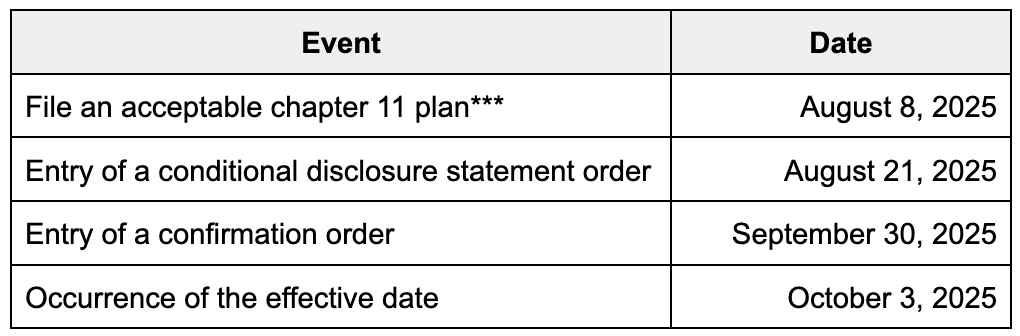

So, with the main event in the books, what’s next for the debtors? Glad you asked. That hearing ☝️ also addressed the final DIP order, which provides the framework. Under the order:**

The debtors will (a) pay off the $20mm, JMB Capital Partners Lending LLC-provided DIP (although the budget suggests only $14.7mm was actually drawn), (b) deposit ~$12.1mm on account of the debtors’ ~$135.2mm in prepetition secured term loans (the “TL reserve”), pending resolution of the challenge period, and (c) deposit ~$21.5mm on account of the debtors’ ~$226.1 in prepetition secured notes, subject to the same caveat,

The term loan lenders will waive adequate protection, while the prepetition term noteholders declined to be so kind,

The UCC will get its investigation budget upped from $25k to $75k,

The challenge period will be kicked to, at most, October 10, 2025 (unless extended by agreement or ordered by the court), and

The debtors will push forward on the following timeline:

Good enough? It better be. As a Latham partner put it at the hearing:

“… the gross proceeds are a fraction of the debtor's secured debt. That's the reality that we are just facing, and it is what it is.”

Indeed …

Best of luck with the liquidating plan.

*We’d still bet our bottom dollar an associate or two was tasked with “researching” it.

**There are also budget, fee sharing, etc. provisions not worth mentioning, other than to note, (i) post-close the debtors’ and UCC’s profs will be living on $500-800k per week (combined) and (ii) there appears to be $2mm earmarked for a wind-down trust.

***An “acceptable” plan must (i) be approved full stop by the prepetition noteholders and agent and (ii) except as agreed by the prepetition term loan lenders or ordered by the court, (a) provide the term loan lenders with the TL reserve (in satisfaction of their secured claims), (b) preserve their unsecured deficiency claims, and (c) release them. If those boxes are checked, the term loan agent and lenders will vote in favor of the plan.

⚡️Update: Everstream Solutions LLC⚡️

Recall that, back on May 28, 2025, Everstream Solutions LLC and 13 affiliates (collectively, the “debtors”) filed chapter 11 sale cases in the Southern District of Texas (Judge Lopez).*

By the time the debtors graced Houston with their ginned-up presence, they had locked up Macquarie Asset Management (“Macquarie”)-affiliate Bluebird MidWest, LLC (“Bluebird”) as their $285mm-paying stalking horse bidder for all of their assets except unwanted refuse located in the Quaker State.**

And folks, do we have news for you. Bidders came to …

On July 21, 2025, the debtors filed their starting bid … and it wasn’t from Bluebird. Each of Fiber TopCo LLC and Metro Everstream Bidco, LLC (“Metro”) topped it with a juiced-up $300.4mm bid, and for one reason or another, the debtors oped to go with Metro’s bid to start the July 22, 2025 auction.

The price skyrocketed from there. Bluebird really wanted those assets. In fact, to reign supreme once again, Bluebird upped its price nearly $100mm to $384.6mm.*** Hot diggity damn — PJT Partners LP ($PJT) in the houuuuuuuuuuse yet again! How y’all feel about that, ad hoc group of prepetition opco and holdco loans (“AHG”)?

We sure as sh*t hope so. Although, after paying off the $55mm-new-money DIP, related fees, and taking care of the profs,**** the debtors’ $1.06b in prepetition funded debt is still going to be left holding a multi-hundred-million-dollar bag, 😬.

The court held a 24-minute sale hearing on August 1, 2025, and because the only objections were cure and adequate assurance-focused (and all of ‘em resolved or carried forward), Judge Lopez didn’t think twice before inking his name to the sale order.

But there’s still some time to burn ahead of a closing. Macquarie is an Aussie institution …

… so those blokes and sheilas will experience attendant CFIUS delay. And while the parties are heaps keen on putting the deal to bed by December 12, 2025, they’ve pre-baked mechanisms to extend as needed into the purchase agreement.

In the interim, the debtors will presumably continue trying to rid themselves of their PA assets, which garnered zero standalone bids during the sale process, and “… expect to be in a position to file a plan of distribution in the near term.”

*On June 11, 2025, the US trustee appointed a seven member official committee of unsecured creditors (the “UCC”). As of August 1, 2025, it’s represented by McDermott Will & Schulte LLP (f/k/a McDermott Will & Emery LLP) (Kristin Going, Darren Azman, Charles Gibbs, Gregg Steinman, Ethan Dover, Joshua Lee) and M3 Advisory Partners, LP (Robert Winning).

**Pennsylvania, for the unfamiliar.

***Metro now riding shotty with a $366mm back-up bid.

****Including PJT Partners LP’s ($PJT) $7.5mm restructuring fee.

💰How Are the Investment Banks Doing?💰

Enough about PJT Partners LP ($PJT), let’s turn our gaze towards Houlihan Lokey Inc. ($HLI). Long time PETITION readers know we love us some HLI because it continues to be the only IB on the street that actually breaks out its RX earnings. So, let’s get into it.

For 1Q’26, HLI reported revenues of $605mm, up 18% YoY, adjusted operating income of $138.6mm, up 18% YoY, and adjusted net income of $148mm ($2.14 per share), up 76% YoY. Financial restructuring revenues came in at $128mm, up 9% YoY. Citing “…persistently higher interest rates, macro uncertainty and overleveraged companies,” CEO Scott Adelson credited diversification across industry and geography, a balanced mix of debtor and creditor work, and both in-court and out-of-court liability management activity for the firm’s quarter. Most importantly, he said this:

“We expect to continue to see elevated restructuring revenues throughout fiscal 2026.”

Hold up! The market is risk on AF and interest rates may be coming down soon which only means that the market is gonna be even more risk on AF. Won’t that be “credit negative” for the RX-oriented IBs? Here’s CFO Lindsey Alley, dripping with enthusiasm:

“I think 3 years ago, we would have told you, yes, we would expect to see restructuring decline as M&A started to pick up, and that had happened many times in the past for us. Look, in this environment, restructuring has shown real resilience. And I think there are a whole bunch of factors for … that resilience. And so yes, I don't want to sound too optimistic. But look, this may be the new trough for restructuring. And when we see interest rates come down a little bit, which I think most people expect over time, if we see an improving economy with less volatility in the macro environment, I mean, shoot, we may see restructuring revenues kind of where they are today and waiting for the next cycle. So we've stopped kind of guessing what the trough might look like for restructuring based on just how well it's performed over the last couple of years.”

🤔.

📚Resources📚

We have compiled a list of a$$-kicking resources on the topics of restructuring, tech, finance, investing, and disruption. 💥You can find it here💥.

📤 Notice📤

Ashley Gherlone (Associate) joined Latham & Watkins LLP from Simpson Thacher & Bartlett LLP.

Clint Carlisle (Associate) joined Richards Layton & Finger PA from Morris Nichols Arsht & Tunnell LLP.

Evan Hill (Partner) joined Cravath Swaine & Moore LLP from Skadden Arps Slate Meagher & Flom LLP.

Scott Pinsonault (Senior Managing Director) joined Accordion from AlixPartners LLP.

🍾Congratulations to…🍾

Greg Gartland and Jon Levine for being named Co-Chairs of the Financial Restructuring Practice at Winston & Strawn LLP.

M3 Advisory Partners, LP (Robert Winning) for securing the financial advisor mandate on behalf of the official committee of unsecured creditors in the Zen JV, LLC chapter 11 bankruptcy cases.

Morrison & Foerster LLP (Lorenzo Marinuzzi, Doug Mannal, Theresa Foudy, Benjamin Butterfield, Raff Ferraioli) for securing the legal mandate on behalf of the official committee of unsecured creditors in the RunItOneTime LLC (a/k/a Maverick Gaming) chapter 11 bankruptcy cases.

Paul Hastings LLP (Kris Hansen, Erez Gilad, Gabriel Sasson, Charles Persons, Alexander Bongartz) for securing the legal mandate on behalf of the official committee of unsecured creditors in the LifeScan Global Corporation chapter 11 bankruptcy cases.

Proskauer Rose LLP (Brian Rosen, Ehud Barak, Timothy Karcher, Daniel Desatnik) and Stinson LLP (Nicholas Zluticky, Zachary Hemenway, Miranda Swift) for securing the legal mandate on behalf of the official committee of unsecured creditors in the Genesis Healthcare, Inc. chapter 11 bankruptcy cases.

Province LLC (Daniel Moses) for securing the financial advisor mandate on behalf of the special committee of disinterested directors in the Ascend Performance Materials Holdings Inc. chapter 11 bankruptcy cases.

Province LLC for securing the financial advisor mandate on behalf of the official committee of unsecured creditors in the Mosaic Companies, LLC chapter 11 bankruptcy cases.

Stinson LLP (Robert Kugler, Edwin Caldie, Logan Kugler) and Fennemore LLP (Jackson Waste) for securing the legal mandate on behalf of the official committee of unsecured creditors in the Roman Catholic Bishop of Fresno chapter 11 bankruptcy case.