💥It's Risk On, Baby!💥

Midseason Awards + Some Sh*tco Filings

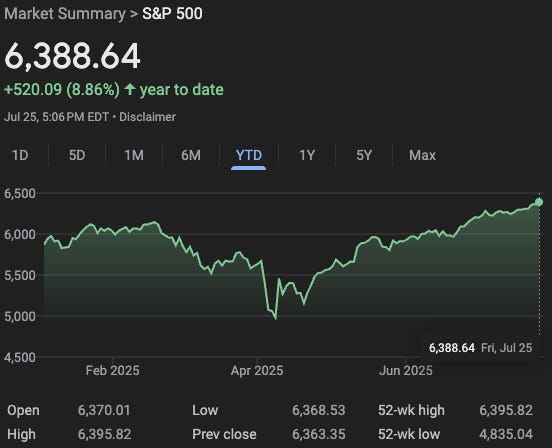

Trade deals are getting cut, the stock market is ripping, SPACs and meme stonks are back, BTC is hitting all-time highs, sh*tcoins are back in vogue, the credit markets are WIIIIIIIIIDE open, and nobody seems to give a flying f*ck about tariffs, Jerome POW-ell, deteriorating CPI data, political scandals, deficit-inducing legislation, upticks in inflation, wonky consumer confidence, environmental disasters, pedophilia … you name it … who cares? … it’s risk on, baby!

Regarding those capital markets, wow! Investors have become so enthusiastic that most CCC-rated high-yield bonds now yield less than 10%, with a third yielding under 8%. We may set a record for the most amount of volume ever in the month of July.

The leveraged loan space is acting similarly, with an increasing pool of CCC and B3 loans trading at relatively tighter spreads versus the end of ‘24. Repricing activity this past week was en fuego, with over $62b in the market (though new volume was muted). And the bank-based broadly-syndicated loan market is striking back, winning over some notable recent refinancings from the world of private credit.

According to Fitch Ratings (“Fitch”), TTM default rates for HY and LLs through June came in at 3.1% and 5.1%, respectively — figures that, ⚡️surprise to literally no one⚡️, are inflated due to distressed debt exchanges. Per Fitch:

“[Distressed Debt Exchanges] accounted for approximately 95% of default volume in LLs and 87% in HY bonds, while Chapter 11 filings made up the remainder. Fitch calculates the June TTM Chapter 11 default rate for LLs at 0.7% and the DDE default rate at 4.1%.

Nine issuers defaulted on their LL or HY debt in June … Three LL issuers accounted for large loan defaults: Altice France Holdings ($5.7 billion), Quest Software US ($3.5 billion) and Radiate Holdco ($3.3 billion). On the HY side, significant defaults included Altice France ($7.8 billion) and Radiate ($1.9 billion). June’s total default volume was about $27 billion: $15 billion in LLs and $12 billion in HY bonds.”

Regarding chapter 11 activity, we commented merely a week ago in these pages that…

… noting that “…the month of July has already produced as many (notable) cases as the entire month of June: Johnny has been dimples deep in dockets.” Well, it seems somebody broke out the extinguisher because there’s only been one “notable” filing since then — Wag! Group Co. ($PET), with its whopping $16.3mm of funded debt, lol (Johnny rejoice)!

$16.3mm of debt? “Notable”? Surely you can’t be serious, Johnny?

Of the cases that have filed thus far in July, only four of them have over $300mm of funded debt: in order of filing date, Del Monte Foods Corporation Inc., Genesis Healthcare Inc., RunItOneTime LLC, and Lifescan Global Corp. The remainder are bona fide sh*tcos, truth be told, which leaves plenty of time for the golf course(s).

And for some catch-up.

Today we’ll dedicate time to a flurry of early-summer activity we previously passed on. Grab yourself a beach chair, a Corona, a fresh lime, and try not to embarrass yourself with a spit-take while reading. Let’s dig in ⬇️.

🏆Midseason Awards. Part I.🏆

But first ….

While we look forward to what the rest of the summer and ‘25 have in store, let’s take a pause and reflect on 1H’25 and start doling out some midseason awards starting with:

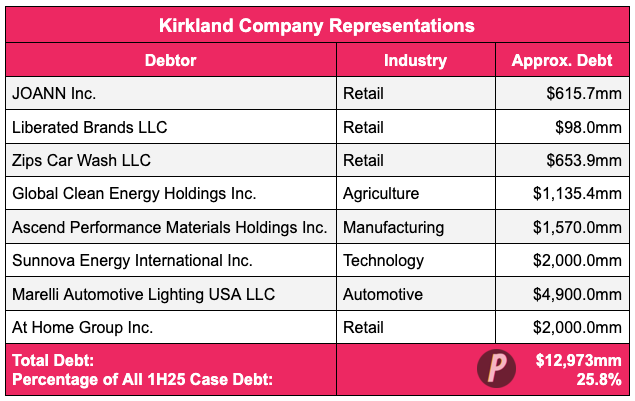

Company-Side Law Firm MVP of the half-year: Kirkland & Ellis LLP (“Kirkland”).

With eight company-side reps in 1H’25, Kirkland, like the Yankees’ Aaron Judge, has distanced itself from the rest of the pack, making sure, even in a relatively “down” year for them, this competition wasn’t even close; it captured over 25% of the funded debt that ended up in bankruptcy through June with this lineup of cases:

Now, sure, we could point out that three or four of those cases are dogsh*t liquidating cases, and that would be a fair assessment. But you don’t actually think liquidating cases can’t be lucrative, do you?

Take a look at JOANN Inc.’s (liquidating chapter 22). Kirkland generated roughly $10.2mm in three and a half months. Repeat, $10.2mm … in three and a half months. Here’s a live look at the management committee of Latham & Watkins LLP (“Latham”) — the firm which served as counsel to the company in its first filing — upon reading that figure*:

Not that we should really feel that sorry for Latham. Sure, losing $10mm in revenue is kinda like receiving a steady dose of this …

… but these guys didn’t exactly make out so poorly in the first go-around.

That’s right, for the record, the first JOANN filing was a prepackaged retail case (lol) that lasted just six weeks in bankruptcy. For its (in-court) effort, Latham billed a tad over $3mm. Of course, a prepack necessarily entails a lot of front-loaded work and front-loaded work there was! Latham received advances of $6.75mm in the 90 days preceding the filing date and only had a remaining credit balance of $565,260.55 as of the petition date. Ok, Johnny, go to work:

Oh boy.

The math be mathing on this one.

$6.75mm minus $565,260.55 = $6,184,739.45 incurred prepetition + $3mm post-petition = approximately $9.2mm.

Nice work JOANN! Now that is a total of $19mm (just on legal fees) well spent!

But we digress.

Getting back on track, JOANN wasn’t the only cash machine for Kirkland. The firm also raked in approximately $5.9mm on the Liberated Brands LLC matter (liquidated) and another $5.4mm for the Zips Car Wash LLC mandate (liquidated). Not. Too. Shabby. Something tells us Weil — okay, not just Weil, literally everyone — would absolutely kill for a $5mm liquidating sh*tco case in this LME-and-”bankruptcy-alternative”-laden environment.

For good measure, the fine folks at Kirkland threw in reps of varying kinds in five other matters that filed too (e.g., the Ad Hoc Group of Crossholders in Ligado Networks Corp., Special Lit Counsel in Village Roadshow Entertainment Group USA Inc., the sponsor in Everstream Solutions LLC and Powin LLC, etc.).

And we won’t even get into their LME volume. Beasts, 🏆.

Honorable Mention: None.

💥New Chapter 11 Bankruptcy Filing - Bedmar, LLC💥

Speaking of Latham & Watkins LLP (“Latham”) …

Way back on June 9, 2025, Bedmar LLC (the “debtor”) filed a prepackaged chapter 11 bankruptcy case in the District of Delaware (Judge Stickles), which pissed a lot of folks right the f*ck off.

Not what you expected for a prepack? To explain, we’ll need to back up.