💥Data Shock💥

Updates Galore: Diamond Comics, Azul, Planta & Prospect + More

Buckle your seat belts, folks, there’s some turbulence ahead.

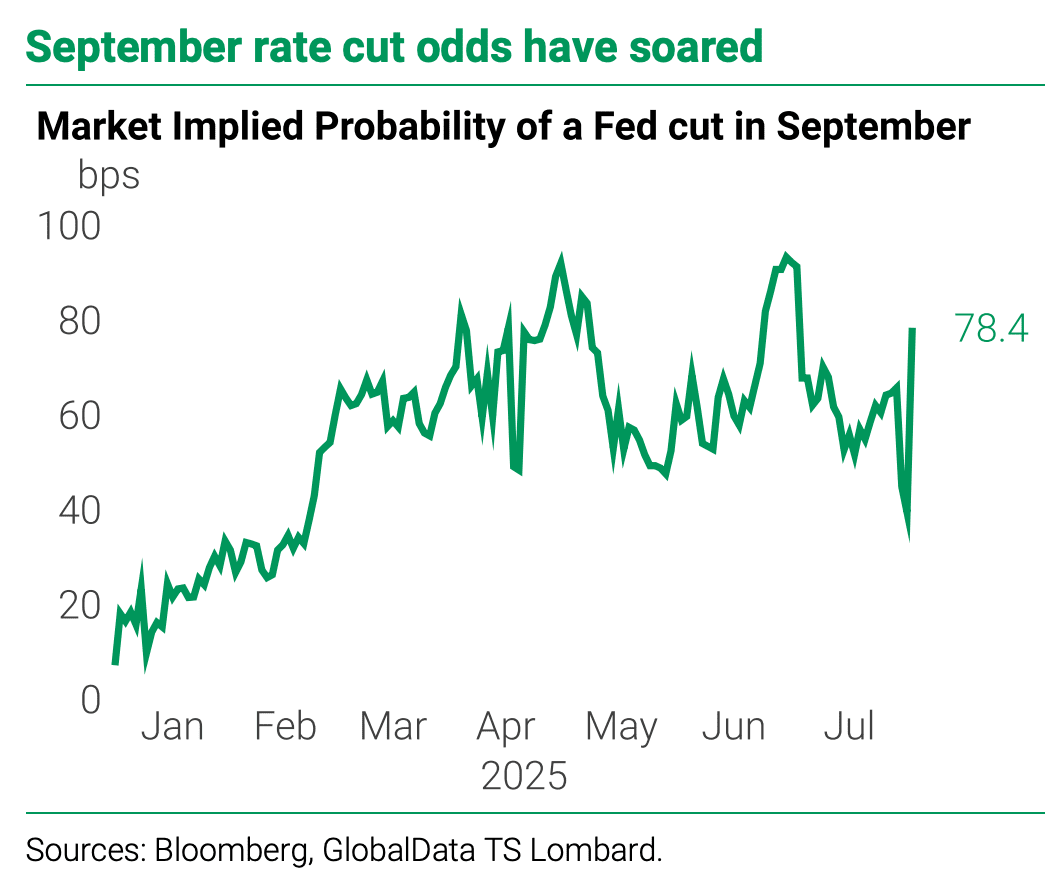

Mere days after the rate-setting Federal Open Market Committee led by Jerome POW-ell opted to hold the Fed funds rate steady, two separate-yet-significant events transpired that may meaningfully shake up the status quo.

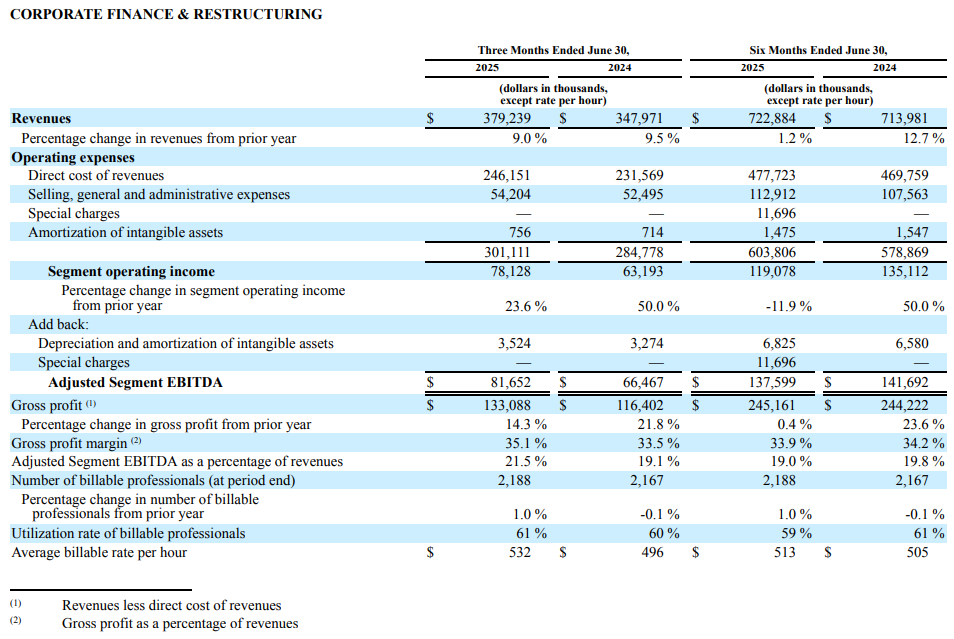

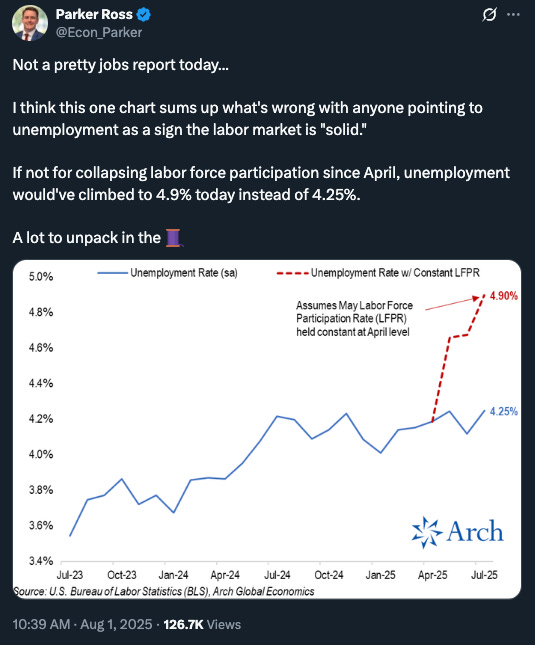

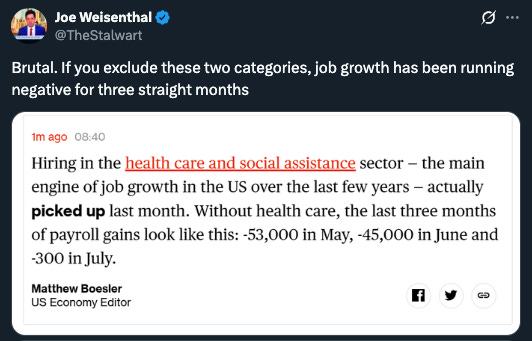

First, the US Bureau of Labor Statistics (“BLS”) released its July nonfarm payrolls report and the unemployment rate rose from 4.1% to 4.2% — nothing terribly surprising there* — but job growth came in at merely 73k versus expectations of 104k.

Y’all know that these BLS reports always come with revisions to prior months as more data comes in and the BLS can refine its numbers but … whoa boy … the revisions in this report were …

The BLS revised May to 19k jobs from … wait for it … the previously stated 144k. June was even worse: the BLS revised it down from 147k to 14k. Nothing like a 258k aggregate delta!

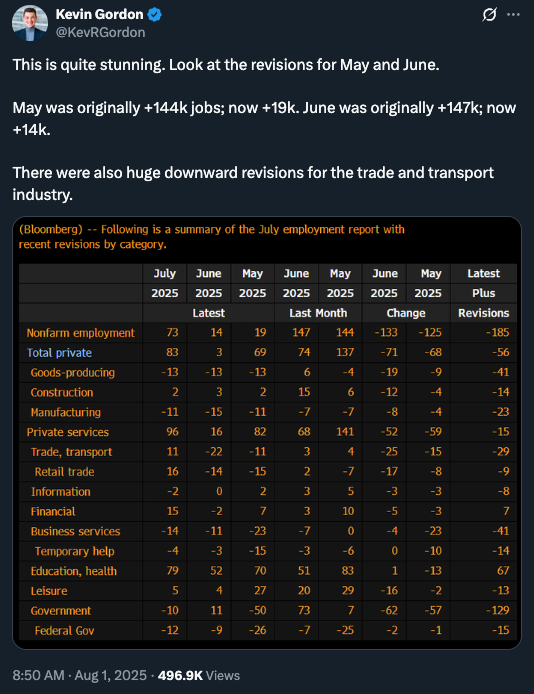

President Trump was … shall we say … a wee bit displeased — the new BLS stats reflect a horrendous three-month stretch that contradicts his boasts of a robust economy. In fact, these figures amount to the worst three-month average since June ‘20. President Trump wasted no time sh*tcanning the BLS commissioner, Erika McEntarfer, a move that prompted near-immediate (political) criticism** and sparked concerns about market faith in government data going forward, 😬.

Outside of that drama came additional news that Fed Reserve Governor and former President Biden-nominee Adriana Kugler is stepping down from her role at the central bank, opening up a vacancy for a new Trump appointee who could have strong influence on rate policy.*** President Trump has long been on record that rates should be lower, often using choice words to express his views of POW-ell’s leadership.

Taken together, President Trump may get his way: all signs point to lower rates coming soon to a Fed meeting near you:

Moreover, the probability of three rate cuts by the end of the year rose dramatically, up to 46% from 7%.

“Higher for longer” has been a b*tch for a lot of companies — especially those in the lower to middle market. At long last perhaps there’s some (interest) relief on the horizon for all of those sh*tcos out there.

*Except:

**Ms. McEntarfer is a Biden appointee who reports to a Trump appointee. Her term was set to expire at the end of January ‘26 so this resignation pulls forward a new Trump candidate by half a year.

***President Trump’s two prior appointees have both been in favor of rate cuts.

🏆Midseason Awards. Part II (FTI Consulting + Earnings).🏆

We kicked off our ‘25 Midseason Awards in Sunday’s a$$-kicking briefing, naming … 🥱 … Kirkland & Ellis LLP the “Company-Side Law Firm MVP of the half-year” here:

We really went out on a limb with that call, 🙄!

And now, for our next category …

*****

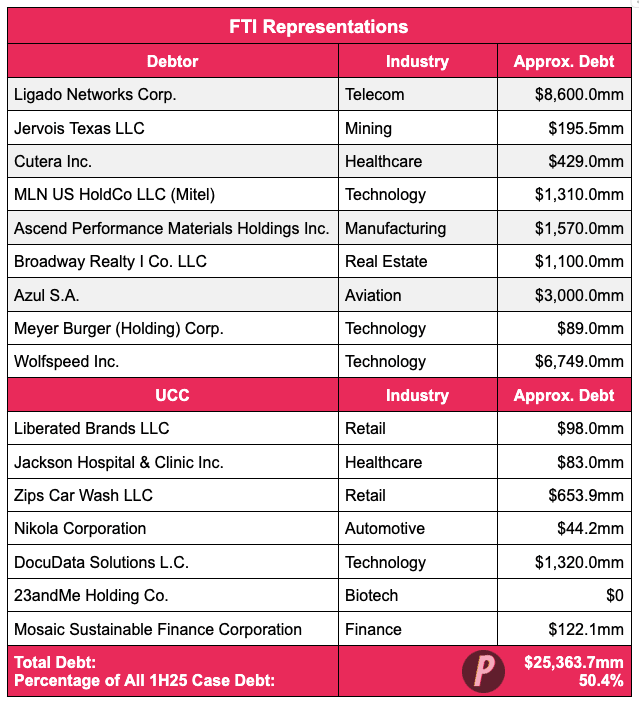

Financial Advisor MVP of the half-year: FTI Consulting Inc. ($FCN)(“FTI”)

PETITION readers know that we’ve given FTI a lot of sh*t this year which is, in part, just a curse of FTI being a public company. We subsequently ate some crow and for good reason: FTI has actually crushed it this year in RX circles, topping all financial advisors in 1H’25 with 16 total company and UCC mandates (not to mention a healthy number of first lien lender and other reps). Take a gander 👇:

Robust! The question is, though, did all of these wins meaningfully impact the firm’s financials?

As luck would have it, the firm announced its Q2’25 results on July 24, 2025. The upshot? The firm reported lower YOY revenue, EPS, net income and adjusted EBITDA, 😬. And to make matters worse, the firm narrowed its full-year ‘25 outlook, trimming both revenue and earnings potential at the upper end of its previous guidance. The stock is down ~4.5% since the announcement and over 12.8% YTD:

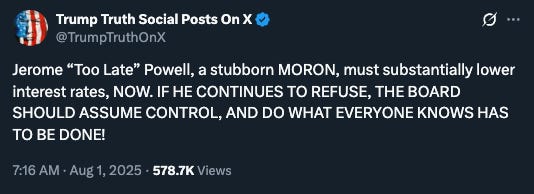

Zooming in, however, the corporate finance and restructuring segment grew! Here is CFO Ajay Sabherwal on the firm’s earnings call, homing in on the business segment most relevant to us:

“In Corporate Finance & Restructuring, record revenue of $379.2 million increased 9%. The increase in revenues was primarily due to increased demand for restructuring and transaction services and higher realized bill rate, which was partially offset by lower demand for transformation and strategy services. Record adjusted segment EBITDA of $81.7 million or 21.5% of segment revenue compared to $66.5 million or 19.1% of segment revenues in the prior year quarter. The increase in adjusted segment EBITDA was primarily due to higher revenue, which was partially offset by an increase in compensation.” (emphasis added)

Now we’re talking. Keep going, Mr. Sabherwal:

“In the second quarter, restructuring represented 49%. Transformation and strategy represented 26% and transactions represented 25% of segment revenues. This compares to a split of 43% for Restructuring, 32% for Transformation and strategy and 25% for transactions in the prior year quarter. Year-over-year restructuring revenues grew 25% and transactions revenues grew 10%, while transformation and strategy revenues declined 13%.” (emphasis added)

Boom! A record revenue quarter driven by increased contribution by the RX side!! Encouraging for all of us wondering whether the July uptick in activity is a blip or a sign of things to come, there’s also sequential improvement:

“Sequentially, Corporate Finance & Restructuring revenues increased $35.6 million or 10.4%, primarily due to an 18% increase in Restructuring revenues and a 12% increase in Transactions revenue, which was partially offset by a 3% decline in transformation and strategy level.”

Asked what’s driving the 25% YOY RX revenue growth, Mr. Sabherwal offered this explanation:

“In terms of the details, look, last time, I remember I talked about tariffs, right? So there’s been some matters from tariffs. If you have 60% of your cost of goods sold coming from overseas and you get 10%, 20% rise in the cost and you’re over levered to begin with, you’re in trouble. So there’s some of that.”

The other much bigger element is LME cases. Remember the old liability management exercises, well, a whole bunch of them have come back for a second round of bankruptcy. And that is even though spreads are tight, and you would argue that well, why is restructuring strong? There is a huge amount of LME and even prior to LME liquidity that was in the market and not all of those companies are going to turn around with the time that they were given with the LME exercises. So we are even seeing matters that had LME happen in the fourth quarter of 2024. So that’s the second piece.

And the third piece is we are — we have built a lot of vertical lines of expertise, which is giving us a lot more of company-side work. That proportion has gone up a lot. And those matters start earlier and usually have longer — that take longer and have larger fees. We’re absolutely delighted.”

We bet they are. Whoever led the strategic pivot from creditor-side to company-side work deserves credit. Just look at all those company-side mandates 👆. You wouldn’t have seen that from FTI, say, 15 years ago.

One more thing: we’d be remiss if we just skated right past that “higher realized bill rate” bit. Note, from the firm’s 10-Q, that very last line.

Every CFO loves this dynamic duo: ⬆️ market share + ⬆️ average billable rate per hour (at twice the current rate of inflation!), 😎🤔.

Honorable Mention(s): Alvarez & Marsal LLC, which continues to dominate on the company side with 10 reps so far this year and Province LLC, which is absolutely annihilating the competition in the UCC space.

⚡️Update 4: Prospect Medical Holdings, Inc. ⚡️

Y’all, we were simply spoiled by those early July bankruptcy filings. Not because all of ‘em were all that interesting but because we got to pretend Prospect Medical Holdings, Inc. (“PMH”) didn’t exist. But Johnny is reluctantly back on the beat after our last update.

We genuinely didn’t know this dumpster fire could get more dumpster fiery.