💥Another Failed Liability Management Exercise (Del Monte)💥

Del Monte + Wolfspeed + Careerbuilder file chapter 11 cases.

On July 1, 2025, CA-based Del Monte Pacific Limited (“DMPL”)-owned* Del Monte Foods, Inc. (“DMFI”), Del Monte Foods Corporation II Inc. (“DMFC”), and 16 affiliates (collectively, together with DMFI and DMFC, the “debtors” and together with their non-debtor subsidiaries, the “company”) filed chapter 11 sale cases in the District of New Jersey (Judge Kaplan). If you’ve ever visited a US grocery store (and aren’t Dr. Oz), you should already be familiar with the company’s offerings:

The company is a “… producer, distributor, and marketer of plant-based packaged food products …” and “… has been a cornerstone of American grocery stores for more than 130 years,” tracing its roots back to 1886 San Francisco.**

During the pandemic, like so many other businesses, the company experienced a big pop in business, so, again like so many others, it planned for that business to endure pretty much indefinitely and committed to high production volumes, funded by indebtedness, for its ‘23 “pack season” — the June through October period during which the company purchases inventory and packs products it then sells over the next 12-18 months.

The ‘23 pack season gamble paid off, so the company bet on ‘24 to be more of the same.

No, it was not.

Demand fell off as folks returned to the office, leaving the company with more canned veggies and fruit than it knew what to do with. To rid itself of excess inventory, it increased promotions and sold at a loss, while simultaneously paying additional warehousing and logistical costs to manage the junk it couldn’t move. Bundled with rising interest rates, which pushed annual cash interest expense to ~$125mm (more than the company’s current projected EBITDA), the biz was in a world of hurt.

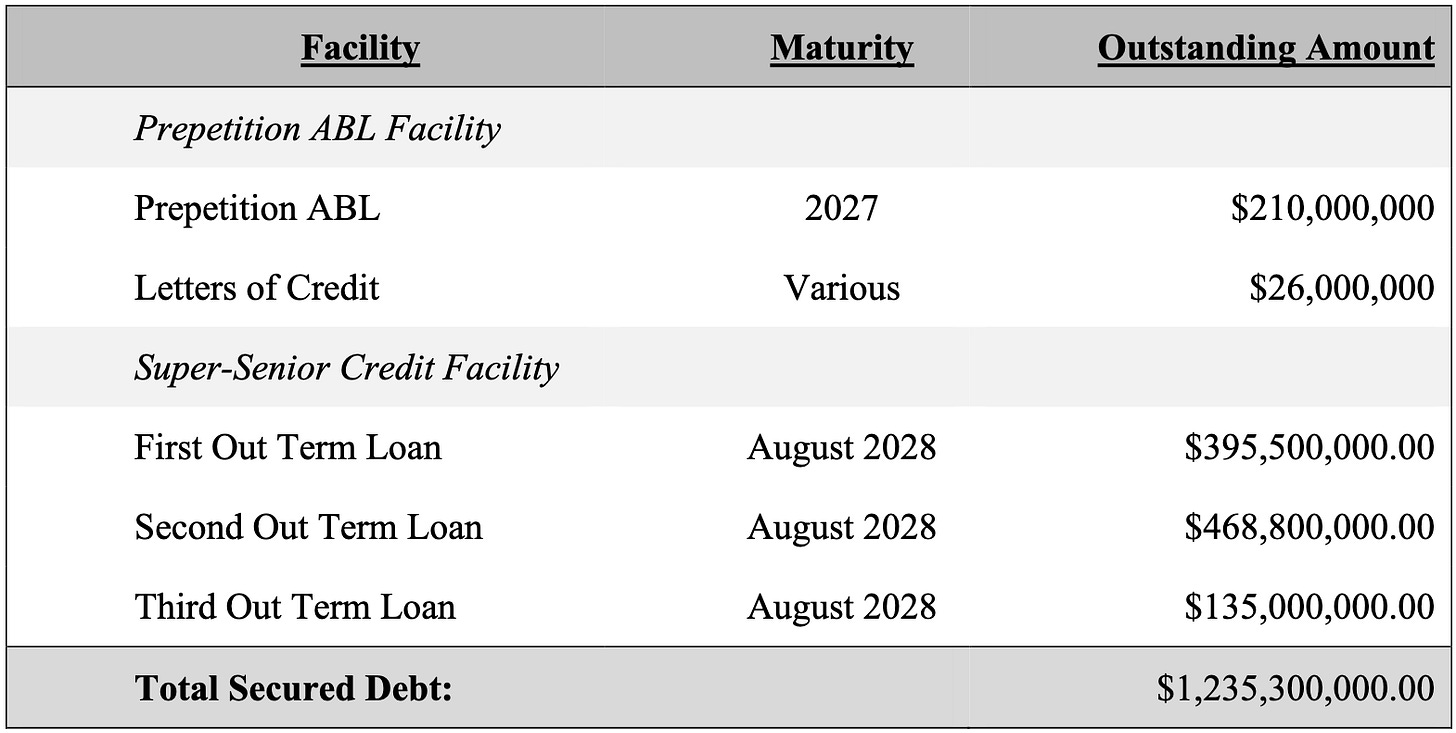

Which brings us to its petition-date cap stack:

Well, not really. There’s a lot of build-up to get to those figures ⬆️. Backing up, in May ‘22, the debtors entered into a $600mm secured term loan to pay off $500mm in notes maturing in ‘25. A little less than a year later, in February ‘23, the term loan’s lenders threw in another $125mm to partially pay down the company’s then-existing ABL and increase the company’s commitments by the same amount, no doubt to fund the upcoming pack season.

But by then, things had already peaked, and in early ‘24, the ABL lenders reappraised their collateral, which resulted in lower advance rates and requests to impose additional reserves. In February ‘24, the company hired Alvarez & Marsal North America, LLC (“A&M”) and phoned up ordinary course counsel HSF Kramer (f/k/a Kramer Levin Naftalis & Frankel LLP)*** to help out. A couple of months later, in April ‘24, the ABL lenders and the company agreed to a standstill to allow the latter time to examine paths forward, for which the company also engaged PJT Partners LP ($PJT).

Following a quarter of path examination, in August ‘24, (i) the company, (ii) an ad hoc group of ‘22 term loan lenders (the “ad hoc group”),**** represented by Gibson, Dunn, & Crutcher LLP and Houlihan Lokey, Inc. ($HLI), and (iii) the ABL lenders, agented by JPMorgan Chase Bank, N.A. ($JPM) and represented by Simpson Thacher & Bartlett LLP and FTI Consulting, Inc. ($FTI), agreed on and executed a liability management exercise (the “LME”).

It gets complicated, so before we go on, here’s the post-LME org chart:

To kick the LME off, the ABL lenders agreed to amend the then-existing ABL facility to (i) provide a $125mm first-in, last-out bridge loan funded by the ad hoc group (the “FILO loan”) and (ii) create an unrestricted subsidiary, non-debtor DM Escrow Corp., to which the ad hoc group lent, in escrow, another $155m (the “escrow loan”).

Then, (i) DMFI cascaded substantially all of its assets down to DMFC and issued a super-senior-credit-agreement-governed first-out term loan to the ad hoc group in exchange for the FILO loan and the escrow loan, and (ii) the then-existing ABL facility was converted into the current ABL facility. Concurrently, DMFI repurchased the “… vast majority …” of the ‘22 term loan under “… open market and exchange agreements,” the consideration for which was the issuance of the second out term loans to the ad hoc group (at a 100% clip for backstopping the new money) and any other new money participants (with relatively more oppressive economics versus the first-out term loans) and, thereafter, third out term loans to non-new money lenders (with relatively more oppressive economics versus the first-out and second out term loans), which, at the end, left only $105mm of the ‘22 term loans outstanding (the “stub term loan”) and gave the company the liquidity it needed to make it through the ‘24 pack season.***** Notably and significantly, however, the company didn’t capture any discount in the LME process.

The holders of the stub ‘22 term loan weren’t thrilled that all their collateral dropped out of DMFI.

In the fall of ‘24, the holders, led by always friendly Black Diamond Capital Management (“Black Diamond”), replaced the admin agent under the ‘22 term loan, directed the new agent to declare events of default and exercise voting rights to replace DMFI’s board, and sued in Delaware’s chancery court.

Keep reading with a 7-day free trial

Subscribe to PETITION to keep reading this post and get 7 days of free access to the full post archives.