PETITION SURVEY FEEDBACK

We appreciate those of you who took the time to share feedback with us. We love having you all as part of our community and so we're happy to share some highlights with you:

- 73% of you said that we should "keep the level of snarky commentary as is." Next? 15% of you said we should "add more snark."

- 67% of you said PETITION should "remain just the way it is" length-wise and, to our surprise, 14% of you asked that we make it longer (because you're CLEARLY "not billing enough"!).

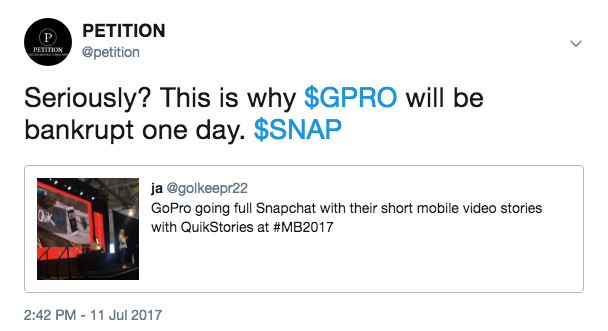

- 27% of you said our screenshot of a Tweet is your least favorite aspect of PETITION. Good, we were getting ready to scrap that anyway!

- A supermajority of you gave us "five stars." Which makes sense. If you hated us you probably wouldn't fill out a survey that helps us. Thanks though.

This is a representative sampling of some other feedback we received (edited in certain instances for clarity):

1. "What is the thing you like MOST about PETITION?"

- "I love that Petition comes on the weekend. I look forward to it and if I’m swamped read it first thing Monday morning. Great way to end or start the week for someone who is keen to keep up with the industry."

- "The laser focus on distress and disruption."

- "That your mailing address is a payday lender shop in the middle of Wyoming. Also, love the breadth."

- PETITION Note: Haha, funny guy.

- "Trends - giving the big picture meaning of the deals I'm working on or hearing about. Also more focused. Cuts out the fluff from other similar publications I (sometimes) read. And love the snark."

- "I really appreciate the insights and the snarky tone. Petition stands out from all of [the] other alerts, newsfeeds, etc., I get everyday."

- "I love the snarky tone. Also, the focus on disruption puts things in context from a big picture perspective. And there are great links."

- "Easy and quick to read. Highlights key news and provides links for further reading. Feels like you’re getting the highlights from a buddy."

- "Smart and smarta$$."

- PETITION Note: We see what you did there.

- "Very well sourced and covering a range of topics at an angle that I can't get from standard sources like NYT/WSJ."

2. "What is it that you like LEAST about PETITION?"

- "Broken links" & "A link to a provider I don't subscribe to or a link without enough information to make it clear what the article I'm going to (or cannot) access is actually about."

- PETITION Note: We hear you on the links and we're working on making this better. And with increased resources, we'll be even stronger here. Thanks for your patience.

- "We get it - Amazon is disruptive and retail sucks. How about a little variety?"

- PETITION Note: Show us variety of filings and we'll show you variety of content! Kidding. We'll endeavor to be more diverse.

- "Only once a week."

- PETITION Note: Awwww. Would love to do more. Too lean at the moment!

- "Delay between filings and Sunday."

- PETITION Note: Fyi, our case summaries are usually - not always, but usually, posted on our website petition11.com on the date of filing.

- "Subject Line - emojis are terrible and look like spam."

- PETITION Note: Most studies show that emojis increase open rates. Believe it or not. So, that's that.

- "The eventual commercialization"

- PETITION Note: Sorry, broheim, as Mother told us, "Nothing in life is free."

- "Haphazard format sometimes. Maybe there is an easier way to title topics and sort the reads rather than blanket paragraphs. Maybe some bullets or numbered sections"

- PETITION Note: We agree. We made some formatting changes and have applied them to the last two newsletters. Still a problem? We'll revisit. Please email us to let us know: petition@petition11.com. And thanks for the feedback.

3. "What else would you like to see PETITION do?"

- "Move to a platform that beautifies the product."

- PETITION Note: This is coming. We think.

- "Inside views of particular markets/firms i.e. a "college" guide to various firm reputations. One week you could do law firms, the next week FA firms, the following week, SF-focus, the week after Chicago focus, etc."

- PETITION Note: Oh man. This could be quite a slippery slope.

- "More call-outs of bad actors/lights shone on shady parties or plays. Like you've done with the PE playbook. Most who know what's going on in this world are too busy treading water to question the larger impact of what's going on or who is (repeatedly) benefiting."

- PETITION Note: OH MAN. THIS COULD BE QUITE A SLIPPERY SLOPE.

- "As an undergraduate student interested in the field of restructuring, I personally would genuinely appreciate a more thorough job-listing section. This newsletter has helped me tremendously in terms of staying abreast of the news and networking."

- PETITION Note: You're right. Working towards this.

- "More frequency"

- PETITION Note: Awwww, quality over quantity, friend, quality over quantity.

- "Accept bitcoin. F*ck start your own crypto. Perhaps call it 363bitcoin. Used to pay unsecured claims and first year associates"

- PETITION Note: PETcoin is coming...(no its not).

- "Magazine. Podcast. World disruption."

- PETITION Note: MAGAZINE? Hahaha, someone needs to read more of our "disruption" commentary! Podcast is a possibility.

- "Spell y'all correctly. Only a non-Southerner would spell it ya'll."

- PETITION Note: Busted.

- "Host a conference in New York or Boston"

- PETITION Note: Good idea. But who would host it?

Thanks everyone. If you have additional feedback, please email us at petition@petition11.com.