💥No "TPI"💥

TPI Composites Inc. ($TPICQ) + iRobot Corporation ($IRBT) + Bloomin’ Brands, Inc. ($BLMN)

⚡Update 2: TPI Composites Inc. ($TPICQ)⚡

We decided to check in again on the chapter 11 cases of Scottsdale, AZ-based, wind blade manufacturer TPI Composites Inc. ($TPICQ) and its 21 affiliates (collectively, the “debtors” and together with their non-debtor subsidiaries, the “company”).

When we last left off, the debtors, represented by Weil Gotshal & Manges LLP (“Weil”), were gearing up to brawl with the Lowenstein Sandler LLP (“Lowenstein”)-led official committee of unsecured creditors (the “UCC”) over the $27.5mm new-money DIP provided by Oaktree Capital Management (“Oaktree”), which, in the two years prior to bankruptcy, had traded up, via an exchange, its $436mm in pref equity for a petition date, $472mm secured term loan.

In addition to beefing with the uptiering itself, the UCC had gripes. Namely, the debtors’ being able to access all of the DIP’s proceeds. Under the interim order, Oaktree funded $7.5mm, but to get the last $20mm, the debtors were required to sign up go-forward deals with OEMs GE Vernova International, LLC ($GEV) and Vestas Wind Systems A/S ($VWDRY) (“Vestas”), which collectively account for ~60% of the company’s yearly revenue.

Lofty, but not realistic. Terms weren’t forthcoming, so neither was the cash, and even Vestas objected to the requirement.

But come the October 14, 2025 final DIP hearing, Judge Lopez didn’t have any alternative. At all. The debtors’ and their banker Jefferies LLC’s (“Jefferies”) prepetition marketing process never got off the ground. To explain, here’s Lowenstein’s Michael Kaplan questioning Jefferies’ Michael O’Hara at the hearing:

Mr. Kaplan: Am I correct that none of the 14 parties that Jefferies contacted was willing to lend the [then-requested] $50 million, right?

Mr. O’Hara: That is correct.

Mr. Kaplan: In fact, none of them were even willing to execute a non-disclosure agreement, right?

Mr. O’Hara: That is correct.

Mr. Kaplan: And I think you’d agree with me that it’s unusual that not one party is even willing to execute an NDA, right?

Mr. O’Hara: It’s a priming fight. It’s really hard. So it’s not – I mean, yes, in most financings, you’re able to get parties to sign NDAs. In this particular case, the facts and circumstances, people didn’t necessarily want to dig in … None of the parties were willing to enter into a priming fight with Oaktree.

Or, more likely, the parties already knew an equity-leapfroggin’ 💩-storm was brewing and decided to give it a wide berth. We would’ve too.

Anyway, without another option, the court approved the final DIP, strings and all, but simultaneously ordered the debtors, the UCC, and Oaktree to go mediate their differences and the cases’ resolution. Here’s how that played out:

Though, we’re sure everyone enjoyed their time with Judge Isgur. Things got dicier heading into November ‘25 because, still not having the final $20mm, the debtors expected to dip below $1mm in available cash late that month.

To put a band-aid over the liquidity emergency, the debtors entered into agreements in mid-November with customer GE Renewables North America, LLC to advance cash to pay for the construction of its goods, which the court quickly approved.* Last week, they employed the same strategy with Vestas.

All the while, (i) cash has remained tight, (ii) the debtors’ sale process has plodded along, and (iii) the UCC’s motion for derivative standing and adversary complaint to recharacterize, subordinate, and other just get rid of Oaktree’s claim has played out on the docket.

Let’s tackle those last two in turn. On the sale process … welp, if any of y’all are interested in owning wind blade assets, you still have plenty of time. Even though Judge Lopez approved bidding procedures on September 30, 2025 and set an October 22, 2025 bid deadline …

… on October 20, 2025, the debtors kicked it to November 12, 2025 …

… and, on November 12, 2025, they kicked it again to November 19, 2025 …

… and, on November 20, 2025, they kicked it a third time to December 11, 2025 …

…AND, on December 12, 2025, except with respect certain assets to be sold to Vestas,** the debtors kicked it a fourth (and final?) time to January 20, 2026.

All of which screams no “third party interest” (see what we did there? … yes, 🙄, Johnny is hitting the early triple-spiked eggnog).

Anyway, the standing motion and adversary have similarly been a slow burn. After a couple of status conferences and an initial November 24, 2025 hearing, Judge Lopez took the matters up again on December 2, 2025. From the start, his excitement was palpable:

“I’ll call TPI and everything that comes along with it.”

That set the tone for the hearing, which initially didn’t get any better for the judge. After ~3.5 hours of argument and testimony, including from transaction committee member Neal Goldman and CEO William Siwek, Judge Lopez openly wanted the whole damn thing to be over:

“If I were to kind of ballpark where I think y’all are, and the reason I’m saying this is I think y’all need to really figure out what you really want to do. Because I’m not sure what we’re doing here. Um, I know that I’m being asked to, to rule on certain matters. But I … it’s … you’re going to leave me with an Everyone Hates Chris moment …”

“… because I’m not sure anyone’s going to really like the results for everything that I, kind of the way, I think all this shakes out.”

He then forced a settlement. For real this time:

“I think professionals should get together and figure all this out because I think the option of judges ruling. Judges will give you an answer, but it’s not going to fix this problem, and I think we’re going to find ourselves with a much different kind of problem… But if someone thinks I’m gonna allow a $5mm litigation to go forward with no understanding as to how it’s gonna get funded, this case will just come to a screeching halt until I know the answer to that question… I think the Committee and Oaktree are gonna have to figure this out. And if you don’t, I’ll figure it out for you – I got no problems with it – but I’m not sure anybody’s gonna really like my answers as I sit now.”

Roundabouts then, Weil asked for a break and, upon returning ~45 minutes later, announced that peace broke out and the parties had tentatively agreed to a framework, subject to sign-offs and documentation.

Those came a few days later. On December 10, 2025, the debtors filed a motion for approval of the settlement. Under it, Oaktree will turn over to GUCs a percentage of cash received (when and if that happens) on account of (i) its claims, directly or (ii) any reorg debt or equity it receives if the sale process doesn’t produce a buyer (spoiler alert: it won’t).

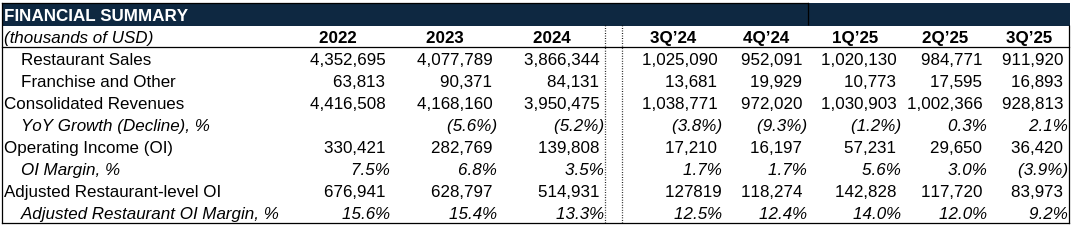

Think GUCs get a good slice? LOL, they did not. Here’s the ratio:

Plus, it bakes in a $1.25mm cap on post-December 3 UCC professional fees, includes mutual releases across the board, and deems the UCC’s standing motion and complaint withdraw with prejudice.

… if you’re Oaktree, we mean. And, well, UCC professionals will make it out alright. They’re capped going forward, but they can now put the pen down.**** To arrive at the GUCs’ pennies-on-the-dollar, at-best ~$18.3mm settlement, the UCC’s profs billed ~$5.5mm from late August through October ‘25.***

In any event, the incentives for sponsors are clear.

The court will take up the settlement and the Vestas funding tomorrow at 9am CT, where we have no doubt both will be approved.

*The quantum and timing of funding wasn’t disclosed on the docket.

**Those assets are (i) the equity in reorganized TPI Mexico V, LLC and TPI Mexico VI, LLC and (ii) hard assets of TPI Composites, Inc. and non-Debtor TPI Composites India Private Limited. The purchase agreement hasn’t been filed, so we can’t be more specific than that.

***Composed of ~$3.0mm for Lowenstein and $100.3k for Munsch Hardt Kopf & Harr, P.C. as counsel and $2.4mm for Berkeley Research Group, LLC as financial advisor. Uncapped November fees to come.

****Well, not “now now.” Whenever the cap encroaches.

💥New Chapter 11 Bankruptcy Filing - iRobot Corporation ($IRBT)💥

On December 14, 2025, MA-based iRobot Corporation ($IRBT) and two affiliates (together, the “debtors”) filed basic-as-all-f*ck prepackaged chapter 11 bankruptcy cases in the District of Delaware (Judge Shannon). We’ve covered this turd four times already … most recently here …

… so there’s really no need to delve deep here: this horse bot has been sufficiently beaten.

That said, we last left off with Shenzhen PICEA Robotics Co., Ltd. (f/k/a Shenzhen 3irobotix Co., Ltd.) (“Picea”) taking out The Carlyle Group ($CG).* This turn of events left Picea as not only the debtors’ primary contract manufacturer but also its sole prepetition secured creditor. Which, as prefaced, sets up a basic-as-all-f*ck equitization via a prepackaged plan.

Pursuant to the proposed plan of reorganization, Picea is the sole impaired voting creditor; it has already approved the plan; and it will end up taking this puppy private. General unsecured creditors will ride through and equity will get a big and fat and not-particularly sufganiyah-quality 🍩.

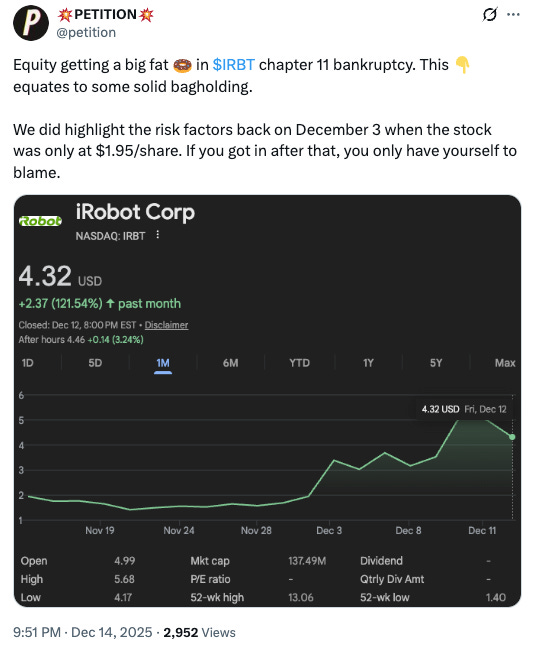

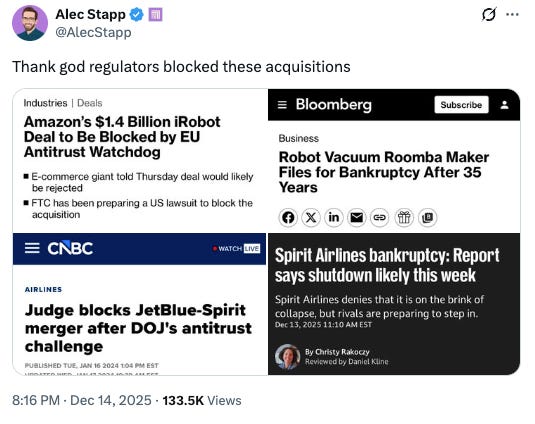

Blame? For what? Well, this 👇:

All of which has people a wee bit salty:

They’re not wrong.

Anyway, the debtors — powered by the consensual use of Picea’s cash collateral — intend to make quick work of these cases; they intend to have the plan confirmed and disclosure statement approved at a combined hearing on January 22, 2026 and be out of bankruptcy no later than February 21, 2026.

This one should be as clean as a Roomba’d floor.

The debtors are represented by Paul Weiss Rifkind Wharton & Garrison LLP (Paul Basta, Alice Eaton, John Weber) and Young Conaway Stargatt & Taylor LLP (Sean Greecher, Andrew Magaziner, Shella Borovinskaya, Kristin Cardoza) as legal counsel and Alvarez & Marsal LLC as financial advisor. Picea is represented by White & Case LLP (David Turetsky, Roberto Kampfner, Fan He) and Richards Layton & Finger PA (John Knight, Amanda Steele, Alexander Steiger).

*According to Bloomberg, Carlyle lost over $100mm on the debt after selling to Picea at a deep discount.

⏩One to Watch: Bloomin’ Brands, Inc. ($BLMN) ⏩

Because we’ve recently been on the topic of restaurant brands, let’s dive into Tampa, FL-based Bloomin’ Brands, Inc. ($BLMN), a restaurant holding company with several casual — and one fine dining — brands under its belt. The most notable of the bunch is Outback Steakhouse (“Outback”), the Australia-themed casual chain for folks who have never been to Australia. Its signature dish is a carved-up, deep-fried “Bloomin’ Onion” …

That joey clocks in at 1.9k calories, so, speaking of belts, you might want to loosen yours before digging in. In addition to steaks, Outback serves up numerous other dishes — Kookaburra Wings (they’re chicken), Aussie Fries, and the Outbacker Burger — that bear no resemblance whatsoever to the cuisine of Down Under.

The other brands are composed of Carrabba’s Italian Grill (“Carrabba’s”), which looks as Italian as Outback is Australian, the pescatarian-friendly Bonefish Grill, and the “upscale” Fleming’s Prime Steakhouse & Wine Bar. For any of y’all in NYC looking to elevate your prime steakhouse experience, the nearest one is … never mind … across the river in Edgewater, New Jersey.

Outback, though, is by far the largest piece of the company pie. As of December 29, 2024, the company owned 1,172 restaurants and franchised another 291 locations across the globe, and 954 of the total (65.2%) were Outbacks (736 owned, 218 franchised). Strangely, none are in Oceania, 🤷♀️.

As the millennial crowd and older will probably remember, Outback was super popular stateside in the 90s and early 00s. When he was a youngster, Johnny’s parents would drag him there to guzzle Foster’s and exercise their then-g-d-given right to open and finish a pack of Marlboro’s inside a dining establishment.

He’s wheezing just thinking about it. Or maybe it’s the emphysema. Either way, he hasn’t stepped foot in one since.

Based on the company’s share price, we’d guess none of you have either. To bring you up to speed, over the past several years, the company has been experiencing issues; namely, and to borrow from CEO Mike Spanos at the November 6, 2025 Q3’25 earnings call: “… overly complex menus, unclear brand positioning, inconsistent guest experiences, a gap in steak quality and diminishing value perception.”

After peaking at $31.60/share in April ‘21 — presumably because folks were desperate to get out of their homes and, therefore, weren’t picky about cost or quality — the stock ebbed and flowed, mostly in the mid-$20-range, until roundabouts March ‘24 when it started a year-long slide down to the single digits.

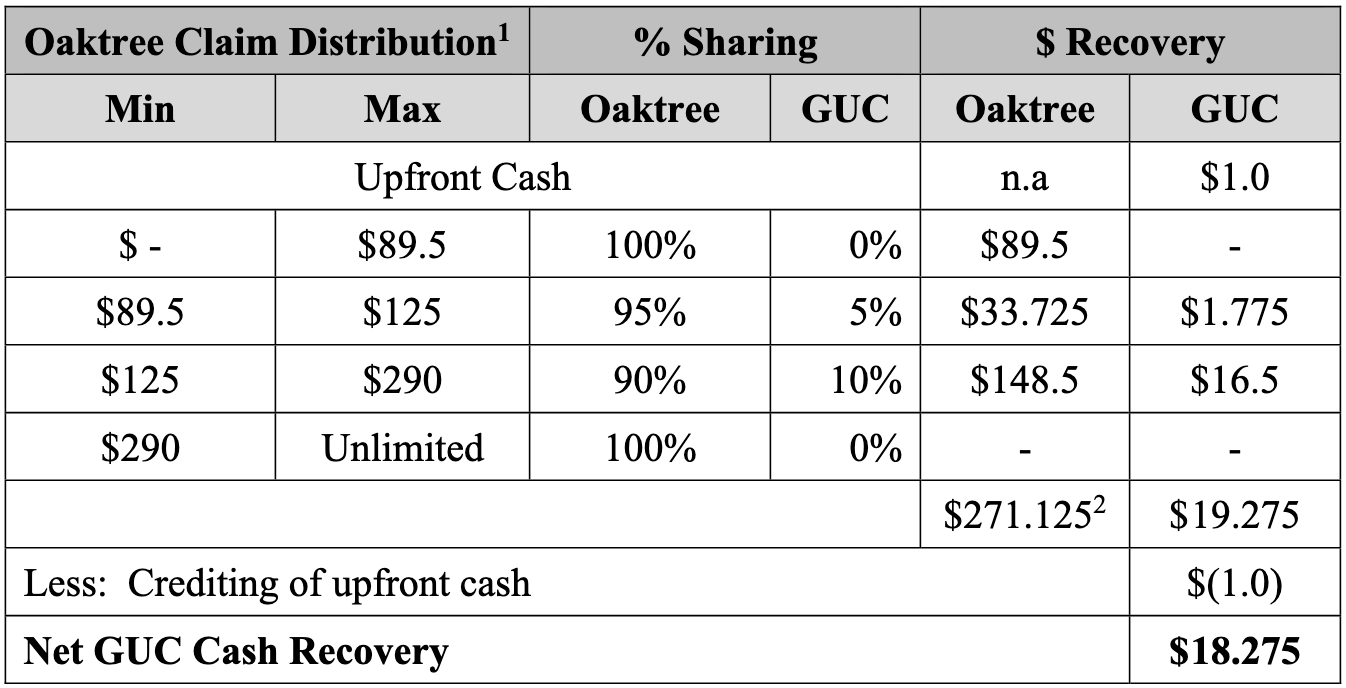

Performance has, up until recently at least (see below), made folks heaps skeptical.

But the prior two quarters have seen small, but positive, YoY revenue growth.

Are we witnessing the beginning of a real turnaround? Hedge-fund and activist investor Starboard Value LP (“Starboard”) sure is hoping so. It acquired a ~9.7% stake in the business in August ‘23 when prices were still firming in the $25+-range, seeing it as undervalued even then.

Then, in January, ‘24, the company announced it had entered into a cooperation agreement with Starboard and appointed two new board members designated by the latter. The newly-infused board wasted no time getting to work:

📍 The next month, BLMN announced it would be closing forty-one locations, composed of thirty-six underperformers and five of its now-defunct Outback spinoff, Aussie Grill, with a plan to replace them with 40 to 45 new restaurants during the year.

📍In May ‘24, twelve-year-company-veteran, then-CEO David Deno, announced his “retirement.”

📍In early September ‘24, Mr. Spanos took the helm to tackle the core issues ☝️. By BLMN’s February 26, 2025 year-end earnings call, there was progress and the company was ready, after axing ~100 folks at corporate, to enter the testing phase of its plan to simplify menus and ops.

📍In November ‘24, the company entered into a deal to sell 67% of its Brazil operations to Brazil-based, PE firm Vinci Partners, for which the company would receive $243mm at the then-prevailing exchange rate. The deal closed on December 30, 2024, and the company has the option to sell its remaining 33% stake in ‘28 (for a price TBD).

📍Then, throughout ‘25, the company shook up its other leadership positions. In February ‘25, Carrabba’s got a new president, in June ‘25, the company brought on a new CIO, and, finally, in August ‘25, damn near everybody in management got replaced (aside from, naturally, the new hires).*

📍During 2Q’25, the company decided to close another twenty-one stores immediately and not renew the leases on another twenty-two expiring over the next four years. As of the end of September ‘25, the company’s owned-restaurant count fell to 987 (⬇️ ~15.8%).

📍In October ‘25, the company suspended payment of dividends.

📍Finally, concurrent with 3Q’25 results, on November 6, 2025, the company officially announced its comprehensive turnaround strategy, focused on Outback. On its face, it’s nothing ground-breaking:

But to unpack it a bit, the company has already, or will continue to, get rid of unnecessary corporate overhead and layers, reduce menu sizes, make the surviving food items better and more consistent, “… meet the guests where they are …” on pricing, and, for ground-level execution at restaurants, embrace technology and K.I.S.S., all of which the company will make happen by investing $75mm over the next three years, two-thirds of which will be deployed in ‘26.

Will it work? It’s early stages, but Mr. Spanos has reasons to be excited. Recall the testing phase. That kicked off in early ‘25 at fourteen locations before expanding, both by footprint and incremental strategy deployment, in September ‘25 to forty-two restaurants. Here’s Mr. Spanos on the November 6, ‘25 3Q earnings call:

“Our focus this past year on our operational priorities is translating into improved guest metrics and sales and traffic gains, putting us in a strengthened position to execute our turnaround strategy. We believe our Q3 momentum is reflective of these foundational efforts.

Our Q3 sales comp was up 120 basis points, which was 130 basis points better than Q2. And U.S. traffic was negative 10 basis points, which was 190 basis points better than Q2. While our focus has been primarily on Outback over the last year, all brands achieved positive comp sales growth this quarter for the first time since Q1 2023… Outback comp sales were up 40 basis points with traffic flat. This was the first quarter of positive comp sales for Outback since Q2 of 2023… We’ve also seen a significant improvement in Outback’s brand trust by plus 6 points year over year and improvements in guest scores across food, service, value, and atmosphere.”

However, we said it’s early … and it didn’t stop the headlines …

… or S&P Global (“S&P”) from downgrading BLMN from BB- to B+ because (i) as of September 28, 2025, the company had $965mm in debt outstanding, composed of $665mm** under a senior secured credit facility maturing September ‘29*** and $300mm in senior unsecured notes due April ‘29, (ii) the credit facility has a covenant that BLMN’s total net leverage ratio cannot exceed 4.5:1, and (iii) BLMN is currently sitting right at that threshold LTM, although, if needed, it can temporarily bump the ratio to 5:1.

Markets have been more optimistic than S&P. Zoom in, and the stock is up ~5.3% since the earnings call.

Perhaps Mr. Spanos is onto something. That said, Johnny still ain’t making plans to go to Outback.

*Even one person that made it through August didn’t get very far. The company canned former-CFO, then-EVP of Strategy & Transformation Michael Healy in September ‘25 — no relation, as far as we’re aware, to the one currently employed at FTI Consulting Inc. ($FCN).

**Down $45mm from FY’24 from the application of proceeds from the Brazil sale.

***The credit agreement has commitments up to $1.2b.

📚Resources📚

We have compiled a list of a$$-kicking resources on the topics of restructuring, tech, finance, investing, and disruption. 💥You can find it here💥.

📤 Notice📤

Allyson Smith (Partner) joined Willkie Farr & Gallagher LLP from Kirkland & Ellis LLP.

Andrew McClain (Counsel) joined Troutman Pepper Locke from Dentons LLP.

Emily Andrews (Associate) joined Faegre Drinker from Richards Layton & Finger PA.

🍾Congratulations to…🍾

Adam Searles on his promotion to Partner and Managing Director at AlixPartners LLP.

Ameneh Bordi on her promotion to Partner at Sidley Austin LLP.

Bevis Metcalfe and Doug Mintz on being named Co-Chairs of Cadwalader Wickersham & Taft’s Financial Restructuring practice.

Jeri Leigh Miller on her promotion to Partner at Sidley Austin LLP.

Kate Scherling on her promotion to Partner at Quinn Emanuel Urquhart & Sullivan, LLP.

Moshe Fink on his promotion to Partner at Simpson Thacher & Bartlett LLP.

Patrick Venter on his promotion to Partner at Sidley Austin LLP.

Kane Russell Coleman Logan PC (Casey Roy, Mark Taylor) for securing the legal mandate on behalf of the official committee of unsecured creditors in the Buckingham Senior Living Community, Inc. chapter 11 bankruptcy cases.

Province LLC (Boris Steffen) for securing the financial advisor mandate on behalf of the official committee of unsecured creditors in the American Signature Inc. chapter 11 bankruptcy cases.

Province LLC (Sanjuro Kietlinski) for securing the financial advisor mandate on behalf of the official committee of unsecured creditors in the Groff Tractor Mid Atlantic, LLC chapter 11 bankruptcy cases.

Stinson LLP (Thomas J. Salerno, Anthony Cali, Deborah Deitsch-Perez) for securing the legal mandate on behalf of the official committee of unsecured creditors in the F-Star Socorro, L.P. chapter 11 bankruptcy cases.