💥FAT AF💥

FAT Brands International + Updates: TPI Composites Inc. ($TPICQ), Office Properties Income Trust ($OPI) + Alachua Government Services Inc. & More.

The month of October is a third over and there ain’t much to show for it in RX circles. We reckon that’s why there’s a First Brands-related article published somewhere in the MSM literally every gawddamn minute — there’s nothing else to do.

Don’t you worry, we’ll be back on that beat too but not today: let’s let the dust settle for a second, shall we?

Instead, today we’ll be revisiting some previously covered situations (including a non-First Brands Weil-led sh*t show) and initiating on a new one. Let’s dig in.

⚡Update: TPI Composites Inc. ($TPICQ)⚡

Recall that, on August 11, 2025, TPI Composites Inc. ($TPICQ) (“TPIC”) and its 21 affiliates (collectively, together with TPIC, the “debtors”) filed bankruptcy cases sans any clear exit path but aspirations, 🥲, to one day confirm a chapter 11 plan.

Aspirations because, holy hell, who knows. The wind blade manufacturer’s cases have already spun much further adrift than the debtors had hoped.

But probably not any more than, once safely tucked away behind closed doors at 767 Fifth Ave.* and being honest with themselves, debtors’ counsel Weil Gotshal & Manges LLP (“Weil”) (Matt Barr, Gabriel Morgan, Lauren Tauro, Clifford Carlson, Theodore Tsekerides, Christine Calabrese, Ryan Rolston, Ashley Anglade, Courtney Wright, Joe Sullivan, Kieran Graulich) fully expected.

The debtors’ 3Q’23 prepetition deal with Oaktree Capital Management (“Oaktree”) — which exchanged $436mm in pref equity for a then-$393mm secured term loan (which grew to $472mm by the petition date) + some common stock and leapfrogged it over unsecured folks — practically begged for messy, expensive litigation. Which if you bill by the hour …

And in fairness to Weil, this ain’t them double dippin’. The creator of that cap stack, at least on the legal side, was TPIC’s ‘23 deal counsel, Goodwin Procter LLP. The Oaktree-provided $82.5mm DIP (which rolls up $55mm of Oaktree’s “prepetition debt”) on the other hand? Perhaps some blame is warranted there because Weil had its fingers all over the credit agreement and getting the last $20mm of new money funding has been a real PITA on account of its conditions precedent. In fact, the debtors still don’t have the cash.

For example, before getting access to it, the debtors are required to have inked and executed agreements with their intended go-forward and supes important OEMs GE Vernova International, LLC ($GEV) and Vestas Wind Systems A/S ($VWDRY) (“Vestas”). But Vestas was none too keen on that requirement and filed a pending limited objection that asked for it to be stricken entirely on account of “ … plac[ing] unfair pressure on Vestas to enter into go-forward agreements, which will likely contain onerous and off-market terms, in order to keep the Debtors alive.”

And, the PETITION team didn’t think much of this one,** but the official committee of unsecured creditors (the “UCC”) got right pissed the debtors need to have delivered an “Acceptable Plan” to Oaktree. One “… in form and substance satisfactory to the Majority Lenders in their sole discretion,” which is just a vague-a$$ way of saying a plan that respects the seniority of Oaktree’s pref-equity-replacing secured loan.

But aside from requiring some poor associate to draft a potentially pointless and otherwise shelved chapter 11 plan, making delivery ain’t much of a challenge. Here’s Mr. Barr explaining the decision to leave in the CP and potentially waste dozens of hours of said associate’s life:

Anyway, the UCC’s beef with the then-100-day, November 19, 2025 confirmation milestone was understandable. Mostly because these cases are going to go well beyond that and may take a different form altogether. On September 24, 2025, the debtors pushed the final DIP hearing out to October 14, 2025 at 3pm CT — over a month after its original September 9 date — and reset the plan’s confirmation outside date to … this can’t be a coincidence … December 24, 2025.

Like, why? Other than a deep desire to ruin Xmas and gin up unnecessary misery. When asked to comment, Mr. Barr responded:

Like Weil’s Mr. Holtzer, he lives for that sh*t.

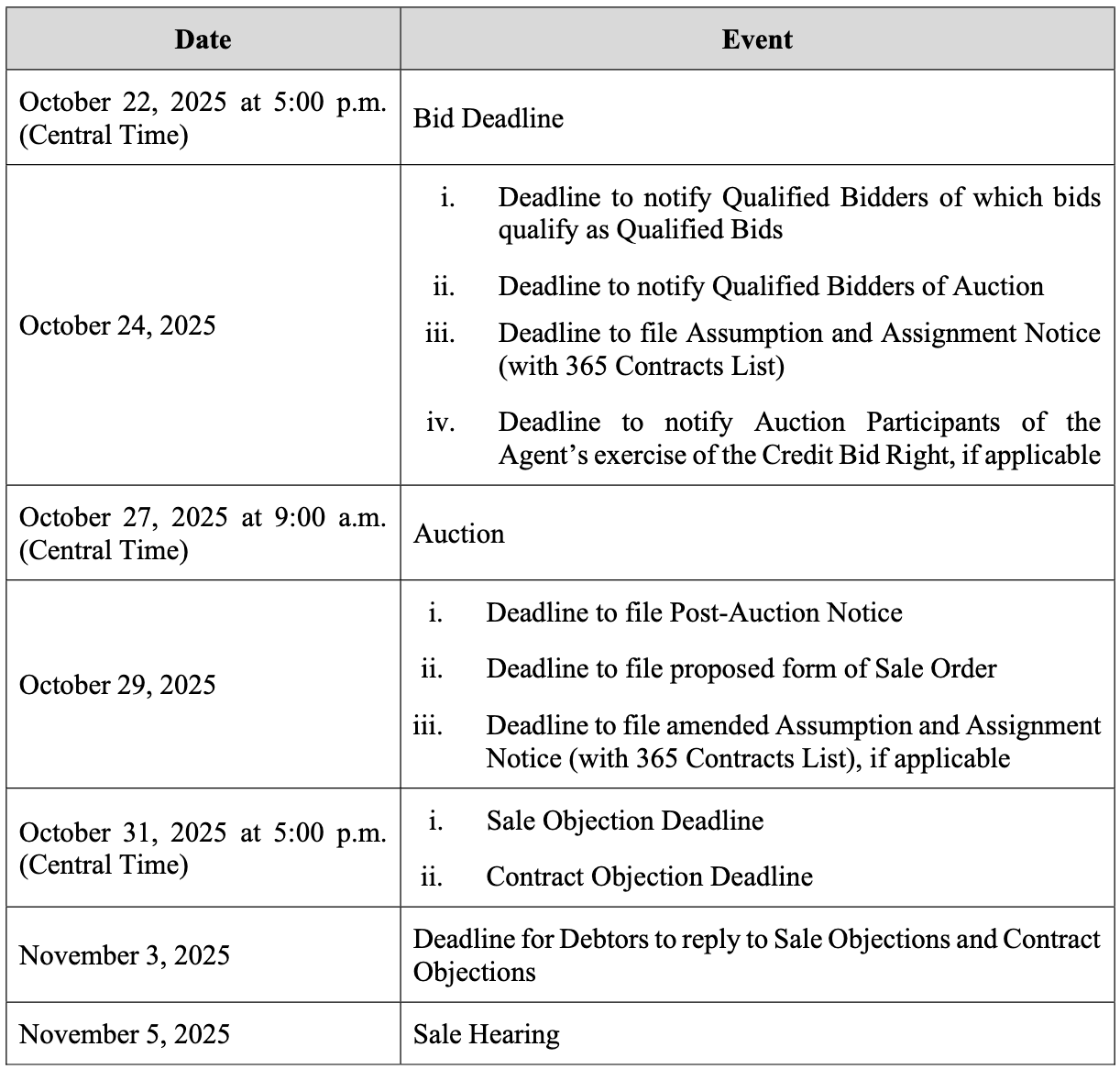

Anyway, on the same day, the debtors also filed stalking horse-free bidding procedures, which the court approved six days later to provide some agreed optionality:

But the pushed out DIP hearing and sale process won’t be the reason for the delay. It’s this …

… under which the UCC seeks, in the first instance, to recharacterize Oaktree’s claim and subordinate it and, in the second instance and after obtaining derivative standing (a another pending work in progress), to “… overturn[] its virtually unprecedented equity-for-secured debt swap” (emphasis in original).***

Keep reading with a 7-day free trial

Subscribe to PETITION to keep reading this post and get 7 days of free access to the full post archives.