💥Meet You Half Way💥

Echostar Corporation ($SATS), IG Design Group Americas, Inc., Marin Software Incorporated + More

In our a$$-kicking Wednesday July 2nd briefing entitled “💥Tariff Derangement Syndrome?💥,” we ran through a number of macroeconomic trends to “…take stock of … as we kick off the second half of ‘25.” But we didn’t delve into where the capital markets stood as of midyear. So, where?

In a nutshell, the capital markets don’t seem to give a flying f*ck about any of the macro mumbo jumbo. Notwithstanding some volatility earlier this year, financial conditions have eased considerably since early April ‘25.

USD investment grade gross supply is at a new post-pandemic record (> $1 trillion as of July 2, 2025) as issuers opportunistically availed themselves of open “windows” and tapped the primary debt markets — albeit at somewhat elevated interest rates. Mitigating factors include tight spreads and shorter-dated maturities with approximately 50% of gross supply clocking in at seven years or less. Demand has been ...

For its part, USD high yield issuance is only incrementally behind ‘24 (-9%, give or take), and tracking higher than ‘22 and ‘23. Most of the action has been in the repayment and refinancing category (ask your M&A buddies why): we’re talking, as of the beginning of July, approximately 72% of all issuance, which is consistent with ‘24. Spread tightening has been a big part of this story too, especially over the last two months.

If you think that spread story is any different in the leveraged loan space, well:

New leveraged loan issuance, like IG and HY bond issuance, rebounded after the April system shock but nevertheless remains approximately 23% below ‘24 levels. Things are rebounding, though: in June, total primary market action hit $65b, a four-month high, led in large part by repricings.

Through it all, private credit providers plowed through low key unfazed — even beating out a bunch of retrenched banks and getting their hands dirty on a double digit amount of large LBO deals (yes, there’ve been a few) amounting to billions of dollars. The private credit train ain’t a-slowin’ either. YTD origination is, similar to leveraged loans, only incrementally down from ‘24 (~$100b vs. $109b YOY). Interestingly, a meaningful use of proceeds is dividends. Nothing like a direct value transfer from insurance companies into private credit into PE sponsors’ pockets! Anyway, a lot of structural tailwinds exist going into the second half of the year — that is, unless more tariff-related policy-making spooks everyone.

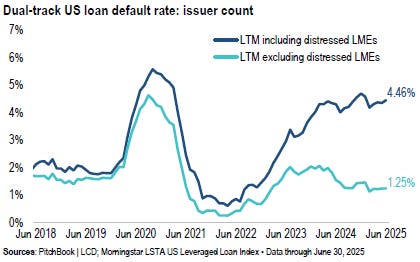

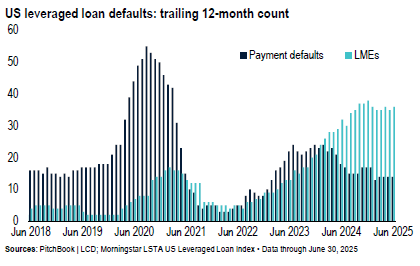

Default rates remain depressed, with — ⚡️ surprise, surprise ⚡️— much of the figure overwhelmed by liability management activity (and Clearlake Capital, 😜).

Fitch Ratings pegs the TTM default rate on leveraged loans and high yield debt at 4.5% and 2.3%, respectively, as of May ‘25. S&P Global Ratings noted that the YTD default count in the US totals 30, down 25% YOY. Per Pitchbook:

“Consumer-oriented sectors led May’s defaults, with consumer products, media & entertainment and healthcare each recording two defaults in the month. Those three sectors now account for 43% of 2025’s total defaults, S&P said.

***

May’s defaults included eight distressed exchanges and eight missed debt payment defaults, although distressed exchanges dominate YTD, being responsible for 58% of 2025’s defaults so far, S&P said. The agency noted that 40% of 2025’s defaults were among repeat defaulters, greater than the 28% at May’s month-end in 2024.

By dollar amount, defaults in May totaled $13.8 billion, S&P computed, with 74% coming from US defaults. By cause, 63.7% of the defaulted debt amount was attributed to distressed exchanges, followed by 23.6% from missed payments and 12.7% from bankruptcy filings.”

On point, data from Epiq AACER showed that “…[t]he 3,576 total commercial chapter 11 bankruptcies filed during the first six months of 2025 represented a 15 percent decrease from the 4,205 filed during the same period in 2024.”

S&P Global Ratings (“S&P”) paints a somewhat different picture based on its particular data set:

The fast pace of monthly US corporate bankruptcies extended into June and put 2025 on track to be one of the busiest years for filings in more than a decade.

S&P Global Market Intelligence recorded 63 new bankruptcy filings from certain public and private companies in June, down from a revised count of 64 in May. The data includes companies with public debt and assets or liabilities of at least $2 million or private companies with assets or liabilities of at least $10 million at the time of filing.

Still, 371 bankruptcy filings have been recorded throughout 2025, the highest total for the first half of the year since 2010.

Call us crazy but it doesn’t feel like things are as gangbusters as S&P makes it seem, 🤔. Indeed, if you zoom in, sure you’ll see some big names like these …

… but you’ll also see a bunch of dogsh*t names like these:

CaaStle Inc.? That was a chapter 7 for f*ck’s sake. We here at PETITION promised to move farther down into the lower/middle market this year — a promise that, to be clear, we’ve kept, 👍 — but we’re not going SO far down market that we’re covering chapter 7s and all cases with just $10mm of liabilities. Johnny would literally f*cking shoot himself.

Don’t worry. Johnny is safe. We confiscated his .22LR.

But all of this makes us wonder: where will things go from here? Will things seriously pick up in a way that involves serious companies (and not jokers like Charter School Capital)?

Well, on one hand …

… maybe…? There’s the tariffs, of course. Mixed signals about their effects on corporate America and, in turn, the US consumer, abound.

For instance, Delta Airlines Inc. ($DAL) reported surprising earnings that featured record second quarter revenue and stabilized demand; it reinstated full-year guidance (at a level that exceeded analysts’ expectations). DAL’s stock finished up nearly 12% this week.

Then there’s Levi Strauss & Co. ($LEVI). It too reported surprising earnings, powered in part by gross margin expansion. IN YO FACE tariffs. This is a textile company, ladies and gentlemen — THAT SOURCES FROM OVERSEAS. The company raised its full year net revenue and EPS guidance and the stock closed the week up over 15%.

On the flip side, there’s Helen of Troy Ltd. ($HELE), the company behind Vicks Vaporub, OXO, Hydro Flask, Braun and other consumer products, which got absolutely napalmed this week (⬇️ 29.7%) after reporting disappointing Q1’26 numbers. Sales missed by nearly $25mm and operating margin got chopped in half. The management commentary was R.O.U.G.H:

“Moving on to the quarter, our Q1 results were well below our expectations. Tariff-related disruption on our shipments was greater than we originally expected in April. There are three tariff-related impacts making up approximately 8 percentage points of the 10.8% consolidated revenue decline. One, cancellation of direct import orders from China in response to higher tariffs. Two, tariff-related pull forward of orders into the fourth quarter of fiscal '25, leading to elevated inventory and lower replenishment in the first quarter of fiscal '26, which we expect to continue into the second quarter as demand continues to soften. And three, China softness driven by a shift from cross-border e-commerce, the localized distribution models, and increased competition from domestic sellers driven by government subsidies. In addition to tariff-related impacts, we also saw weeks of supply adjustment at certain key retailers as shifting consumer demand curves are being reflected in retailers inventory management practices. Finally, we are seeing clear evidence of the consumer trading down with average price compression of 3% to 4% in our US business, which impacted first quarter revenue and profitability. You may have seen other companies recently calling out trade down behavior, including the Dollar stores, which are a beneficiary of this trend.”

Tariffs affect the Fed too, of course and Jerome POW-ell and his friends continue to keep interest rates higher for longer, which has stretched a number of companies, especially in the lower/middle market band.

Also, ratings agencies have been downgrading companies into and within the C ratings categories. According to Bloomberg's Tracy Alloway, who cited Citigroup's Michael Anderson and Steph Choe, the number of 'fallen angels' (bonds downgraded from investment-grade to junk) has now exceeded the number of 'rising stars' (junk bonds upgraded to investment-grade) so far this year, marking a significant shift.

On the other hand, regardless of success rate, liability management exercises (“LME”) continue to be all the rage (e.g., Quest Software, E.W. Scripps, Selecta, Better Health, Wellness Pet, Saks, and most recently, Superior Industries International Inc.)(and we’re loving all of the drama swishing through the system with respect to disqualification lists and threats of antitrust action and anti-cooperation agreement language).

Why so much LME? C’mon, you know the answer: because bankruptcy continues to be expensive as all holy f*ck.

And so you’ve got the LME. And you’ve got a lot of out-of court deals (e.g., Solo Brands Inc. and potentially Gabe’s). You’ve got the uptick in chapter 7s and article 9s and blah blah blah “bankruptcy alternatives.”

Speaking of the latter, you’ve also got a lot of private credit marks that are complete and utter horsesh*t. Even if they were legit, these lenders don’t want to own these POS companies; therefore, lenders are working with sponsors and accepting PIK interest in lieu of cash payments all over the place (PIK inflation!). These trends are contributing to the deflation of in-court activity.

That said (and in S&P’s defense), there has been a slight uptick in serious case filings of late: just look at the list 👆 of the large cases that filed in June versus all other months of ‘25. And there are some decent-sized names still kicking around out there too — whether that be Echostar Corp. ($SATS)(see below), TPI Composites Inc. ($TPIC)(discussed previously in PETITION here), Claire’s Stores (22!), and/or Lifescan Inc.

There’s also been a slate of serious filings (e.g., Del Monte Foods Corporation II Inc., Genesis Healthcare) and a wave of not-so-serious filings so far in July (some of which we cover below, more on Wednesday). Putting them all together, by our count July already has more filings (large enough to retain a claims agent) than the months of January and April and one more will put it on par with February. And we’re still a few days shy of midway through the month! Things are picking up, indeed!!

Where things go from here is anyone’s guess. All eyes, therefore, on those who may have the most dramatic effect on serious case filings: President Trump and Jerome POW-ell.

🛰️ One to Watch: Echostar Corporation ($SATS)🛰️

We confess: Echostar Corporation ($SATS)(“Echostar” or the “company”) is a big name we previously knew absolutely nothing about.

Keep reading with a 7-day free trial

Subscribe to PETITION to keep reading this post and get 7 days of free access to the full post archives.