💥LMEverywhere💥

IBs + FTI report earnings. Planta + Accelerate Diagnostics File. Plus a DocuData Update.

Repeat: we … are … SO … back … baby (ICYMI on Wed👇).

By week’s end the Dow Jones Industrial Average leapt 1.8%, the S&P 500 Index closed up 2.6% and the Nasdaq Composite jumped ~2.9%, the latter propelled in part by Nvidia Corp’s ($NVDA) 11% pop. The US BSL also reawakened, tempered somewhat by continued price discovery.

Around $13b of new issuance came out this week — a mix of KKR’s pricey and low-rated leveraged buyouts (OSTTRA), some refinancings (Alera Group Inc.), and a smattering of M&A (“smattering” doing a lot of heavy lifting there). Investors piled back into loan funds after 2.5 months of outflows.

The high yield market joined in the fun and enjoyed its most active week since late January. As spreads continued to slim, a number of issuers priced sub-6% paper, including Crown Americas LLC ($CCK), Seagate Data Storage Technology Pte. Ltd. ($STX), and Carnival Corporation ($CCL).

Since we last spoke, 😉, on Wednesday, the data for April kept pouring in. So grab your pocket protectors, you nerds, because we’re about to dive into some relatively fresh macroeconomic news:

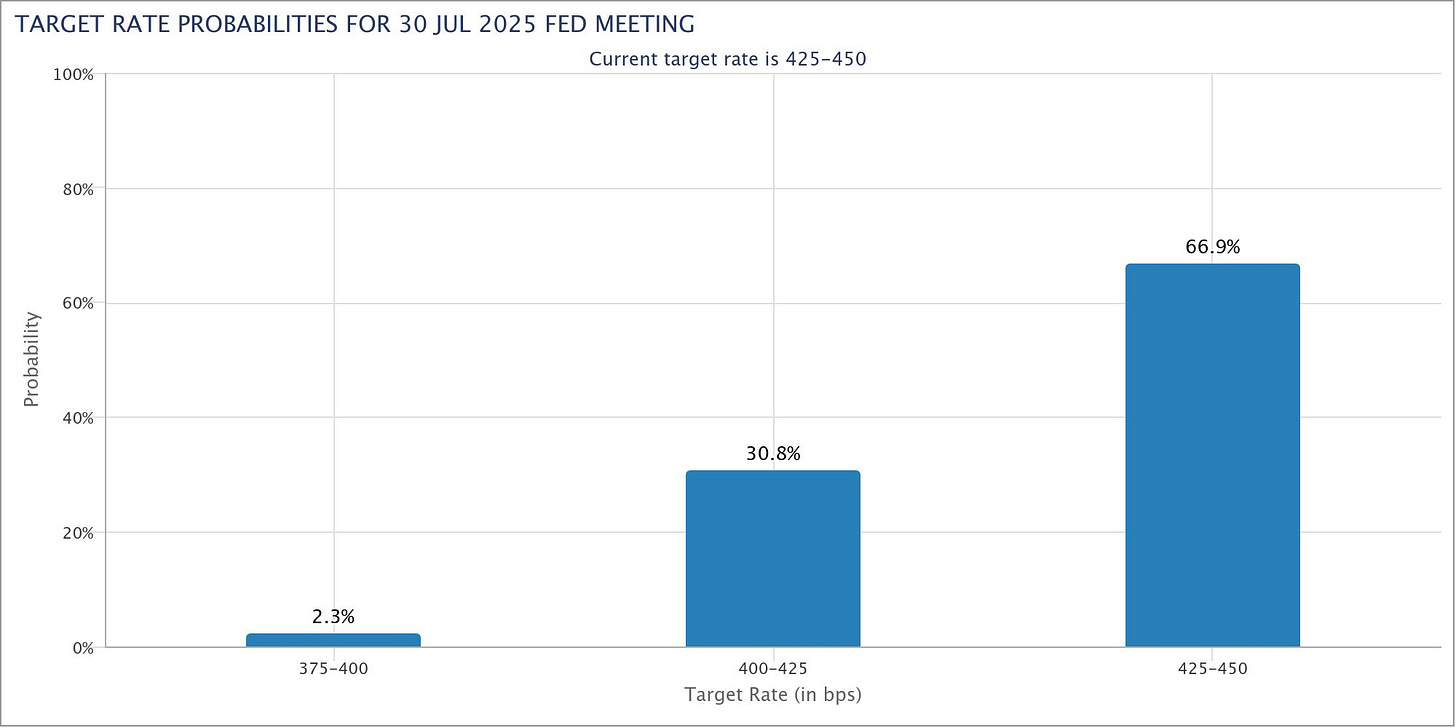

📍”One Big Beautiful Bill”. The sucker is sending many big ugly shivers through bond markets. The prospect of deficit-ballooning tax cuts as part of the package has bond investors rattled (the 10Y was at 4.45% at market close on Friday, May 16, and the 30Y at 4.9%) — further feeding the notion that Jerome POW-ell and the Fed ain’t doing sh*t in June (note: the probability of 425-450 back in mid-April was 29%, 😳) …

…and maybe not in July either:

The probability of rates holding in July was merely 5.7% in mid-April, 😳😳.

Interestingly, Federal Reserve Bank of Atlanta President Raphael Bostic said on Wednesday (5/14), that he sees only one cut for the … wait for it … year.

Moody’s Ratings (“Moody’s) dropped a bomb after hours on Friday, May 16, downgrading the United States’ credit rating a notch to Aa1, effectively citing a decade of f*cked up government hackery chock full of self-aggrandizing bloviators, spenders, and grifters (bipartisan comment). Ok, fine, they didn’t say that but, like S&P Ratings and Fitch Ratings before it, Moody’s did highlight the ballooning federal budget deficit. Per CNBC, “[t]he benchmark 10-year Treasury yield shot 3 basis points higher in after hours trading, trading at 4.48%.”

📍Retail Sales + PPI. The U.S. Census Bureau announced advance estimates of U.S. retail and food services sales for April 2025 and at $724.1b in April, or 0.1% growth over an upwardly revised March, the figure surprised to the upside. But the result was WAY below the 1.7% increase from February to March. Excluding auto and gas, sales role 0.2%, 0.1% below consensus. Sporting goods, hobby stores, departments stores and specialized retail all took it on the chin.

Meanwhile, The U.S. Bureau of Labor Statistics’ The Producer Price Index (unexpectedly) fell 0.5% in April. Have producers been absorbing the hit from higher tariffs? How long can they suffer from margin compression before passing the cost of tariffs through to consumers?

Enter Walmart Inc. ($WMT). The bigbox retailer reported beats on revenue and EPS for its Q1’26 on Thursday, May 15, 2025 — all part of a report that was largely positive (including gross margin expansion, operating income growth, and first time profitability at the e-commerce segment). The stock — which is up 7% YTD — nevertheless dropped 0.5% on the report. The spook? CEO Doug McMillan saying outright that “…the higher tariffs will result in higher prices.” CFO John David Rainey added:

“Should more progress on trade in the next several weeks be favorable, there could be upside. If elevated tariffs remain in place for an elongated period, there would be downside risk. We will know a lot more in a couple months, but we are equipped to manage this as well or better than other retailers. Turning to the second quarter. The operating environment is highly fluid, and it makes the very near term exceedingly difficult to forecast.

The level and speed at which tariff impacted prices could go up is more extreme than in normal periods. The US is, by far, our number one market for sourcing. For the less than a third of what we sell in the US that’s imported, China, Mexico, Canada, Vietnam, and India are our largest markets. As Doug noted, we’re encouraged by the recent trade negotiations, especially concerning China. The level of tariffs that result from those discussions and the timing of when they ultimately become final may cause larger swings in our financial performance from one quarter to the next.”

All of which led to Mr. Rainey pulling the company’s Q2’26 forecast (while affirming full-year guidance of 4% growth). Hmmm, 🤔, pulling Q2 but maintaining the forecast, huh? “Higher tariffs will result in higher prices,” indeed. And if WMT passes through to consumers, you can bet your a$$ that others will too. 👍

Unless, that is, Mr. Free Market President Trump, “truths” stuff like 👆 at the top, 🤷♀️, and corporates get cold feet.

📍Consumer Sentiment. You wouldn’t know it from this week’s stock market rally, but people be worried. The University of Michigan’s consumer sentiment index declined 1.4 points to 50.8, the second-lowest reading ever behind June 2022. The reason? Consumers fear a dramatic rise of inflation. With WMT’s CEO saying what he’s said, it’s kind of easy to understand why.

📍Distressed Debt & Defaults. Distressed volume captured in the Morningstar US High Yield Bond Index dropped from 129 issuers to 98, representing $23b no longer in the scopes of rabid RX professionals looking for sh*t to do.

Per S&P Global Ratings (“S&P”), despite the market volatility, there were only 8 corporate defaults in the month of April, bringing the YTD total to 34, down markedly from 55 over the same period in ‘24. Highlighting that most defaults were first timers in the healthcare, TMT, and chemicals sectors, S&P also noted that distressed exchanges accounted for almost 90% of defaults in April and 68% YTD, “marking the highest year-to-date proportion since 2008.” Or as we like to say, LMEverywhere … even if there is some LMEvolution. The agency maintained its base-case projection for ‘25 at 3.5%, caveated, of course, by whatever the hell happens with tariff policy.

About that “tariff policy” and the volatility that comes with it: investors are licking their lips. Here is Bloomberg reporting on an interview with Canyon Partners’ Jonathan Barzideh:

“There is plenty of stress below the surface even today,” Jonathan Barzideh, the platform’s co-head, said in an interview. “But to the extent that we see more months like April,” he said, “there’s even more coming.”

***

Investors’ tendencies to push back the due dates on loans that can’t easily be repaid also means that a backlog of barely visible trouble is piling up, according to Sheffield.

“A lot of companies refinanced or extended maturities trying to ‘stay alive for ’25’ — but the things they were trying to bridge past are still at play,” he said. “A lot of these post-LME credits are still over-leveraged and they’re headed towards bankruptcy.”

Interest rates are still the highest they’ve been since 2007, and the pressure of higher rates has now compounded for years.

“Many credits underwritten when rates were zero lost all their free cash flow to interest payments, so those structures became unsustainable,” he said. “It’s just math.”

You know what else is just math? Earnings. And a bunch of RX-oriented pros recently reported….

💥LMEaty and LMEager: Latest Earnings💥

Back in February and March ‘25, we dove headfirst into the 4Q’24 earnings reports of investment bankers and, as a proxy for financial advisors, FTI Consulting Inc. ($FCN) (“FTI”), which, unlike nearly all of its brethren, is publicly-traded.

The results were generally a massive victory lap for banks, while FTI was, relatively speaking, on the outside looking in — in many respects waiting for the next wave of liability management exercises (“LMEs”) to fail and file (albeit increasingly shorter) chapter 11s. With the benefit of another earnings season behind us, it’s time to check back in. Are LMEs fading? Are people busy? Is money being made? Has FTI rebounded? Let’s dig in.

Keep reading with a 7-day free trial

Subscribe to PETITION to keep reading this post and get 7 days of free access to the full post archives.