💥OyRobot💥

Updates: Chegg Inc. ($CHGG), iRobot Corporation ($IRBT), Beyond Meat Inc. ($BYND), Prospect Medical Holdings, PrimaLend Capital Partners LP Files + More

We’ve spent a good amount of time recently letting others do the “talking.”

ICYMI, we had Paul Hastings LLP’s Jayme Goldstein and Davis Polk & Wardwell LLP’s Damian Schaible reinvigorate our stagnant “Notice of Appearance” franchise by chiming in about the state of liability management — a topic that everyone is sick and f*cking tired of, yet needs to not be sick and f*cking tired of (because it’s not going anywhere).

In case you were questioning whether you were crazy, yes, yes indeed … we asked Jayme and Damian pretty much the same exact questions. And, no, they didn’t have the benefit of each other’s answers: even though Damian’s came second, he and Jayme had the same submission deadline. So we’ll leave it to you do decide which one was more on the mark, 🎯.

Anyway, good news today. We take a break from LME to dive back into some previously covered situations (and finally get to PrimaLend). Let’s dig in ⬇️.

⚡️Update: Beyond Meat Inc. ($BYND)⚡️

For f*ck’s sake, this 💩 keeps coming back.

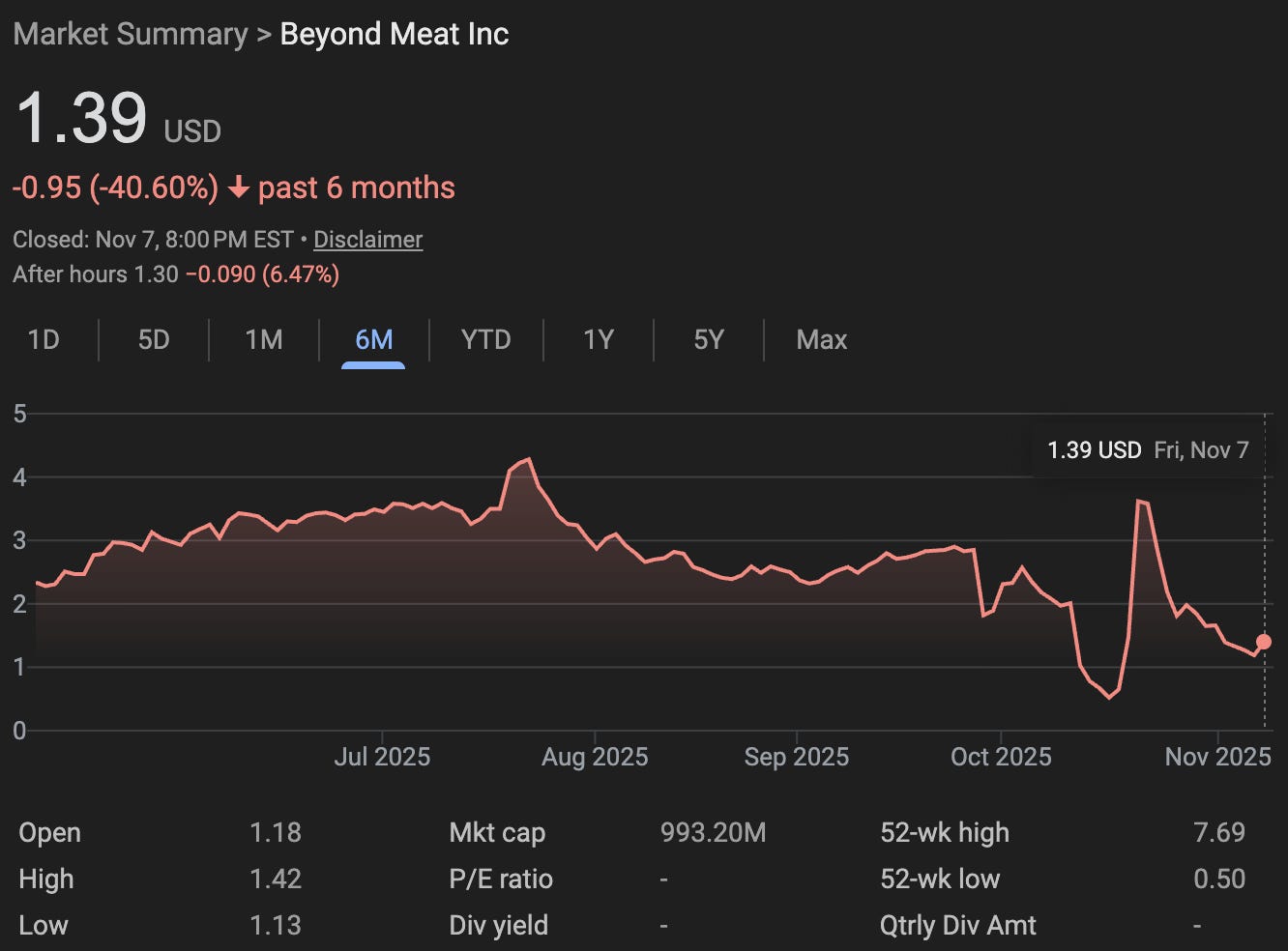

It was merely two weeks ago that Beyond Meat Inc. ($BYND), Johnny’s favorite purveyor of fake meat, was a meme stonk, 🙄.* Now? Not so much:

Look closely enough and that most recent formation sure looks like a meaty 🖕.

Ok, sure: BYND is still up a staggering 167% off its October 16th low.

But it’s also down 62% off its October 21st high.

So what on G-d’s great earth is up with this sh*tco now? Well, this (from a November 3, 2025 press release):

“As previously disclosed on Form 8-K filed on October 24, 2025, the Company expects to record a non-cash impairment charge for the three months ended September 27, 2025 related to certain of its long-lived assets. Although the Company expects this charge to be material, the Company is not yet able to reasonably quantify the amount, and requires additional time, resources and effort to finalize its assessment, and therefore is rescheduling its previously-announced conference call to Tuesday, November 11, 2025.”

Clearly the recently-highly-diluted-stock didn’t react well to the news, and on November 7, the company delayed its 3Q25 10Q to an expected date of “… no later than Wednesday, November 12, 2025,” disclosing it …

“… expects to report that a material weakness in the Company’s internal control over financial reporting existed as of September 27, 2025, related to controls associated with the accounting for non-recurring and complex transactions. Management has preliminarily concluded that inadequate technical resources are currently in place to effectively evaluate and determine the proper recording of such transactions, and the Company has begun to work on a remediation plan. As a result of the expected material weakness, the Company believes that its internal control over financial reporting was not effective, and its disclosure controls and procedures were not effective, as of September 27, 2025. Notwithstanding this determination, management does not anticipate making any adjustments to its previously issued financial statements.”

We’ll be back to you after the company ascertains the extent of the damage.

*You can find a raft of prior coverage here.

⚡️Update 2: Chegg Inc. ($CHGG)⚡️

We’ve been watching Chegg Inc. ($CHGG) get slapped by the anthropomorphized hands of AI for a while now:

As a reminder, Chegg’s main offering is a $14.95/month subscription service for college students seeking homework/exam “help” (read: immediate answers). Unfortunately for Chegg, AI tools like Open AI’s Chat GPT and Google’s Gemini and AI Overview have proved cheaper and better options for college students looking to skate through their classes. While both provide step-by-step solutions to homework or exam problems, Chat GPT and its large language model peers can do even more of a student’s work, like writing essays … or apologies to professors like this bunch of model students:

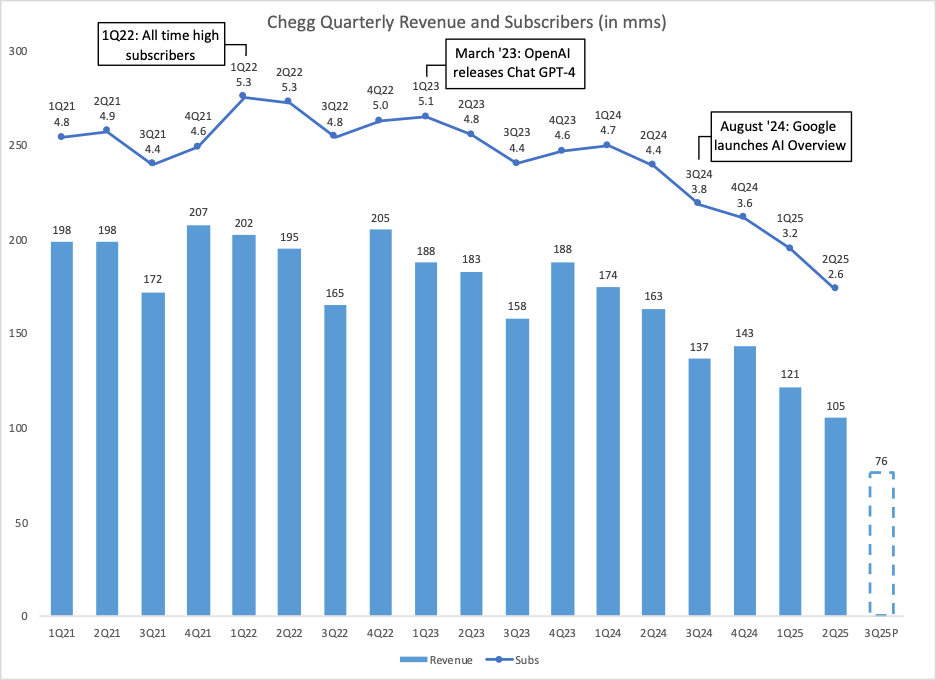

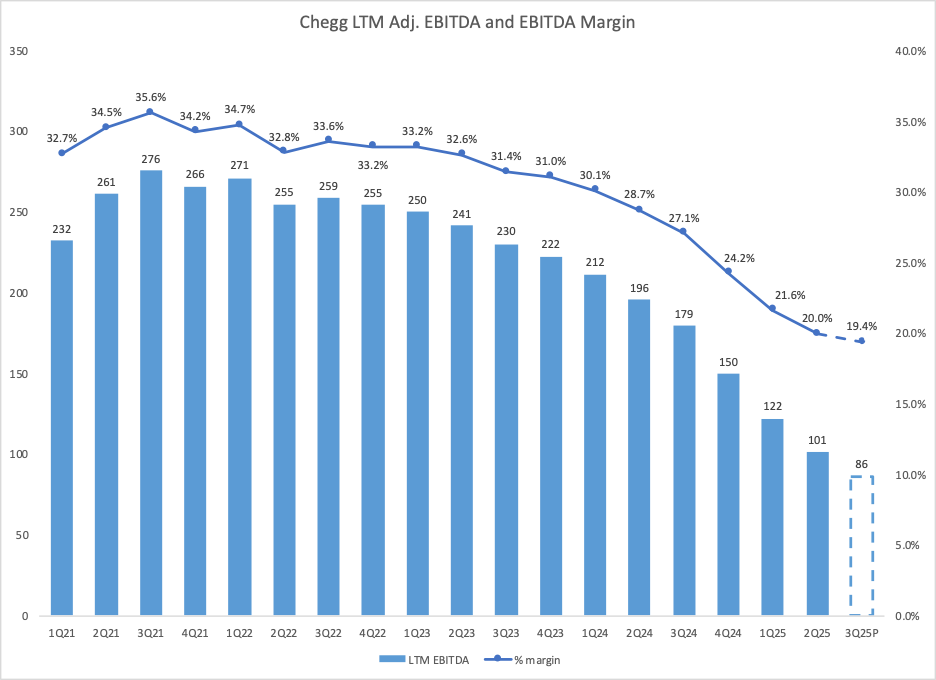

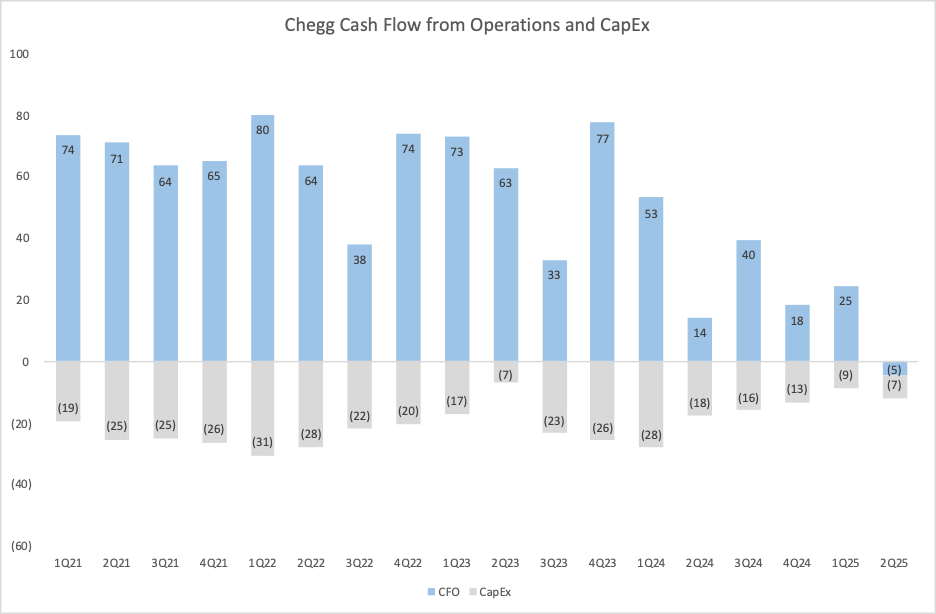

With so many cheap or free tools available, it’s no wonder students have been abandoning their Chegg subscriptions at an increasing rate. The company’s second quarter had more of the same steep declines — subscribers down 40% YOY, Revenue down 36%, and Adj. EBITDA down 48% with 500bps of margin compression as the company loses more and more operating leverage. Cash Flow for Operations (CFO) was negative for the first quarter since 4Q19, and FCF was negative for only the second time since then. The company is forecasting even greater declines in its seasonally weak third quarter.

When we last covered Chegg, it was in the midst of a strategic review, launched in February ’25 with the help of Goldman Sachs ($GS), to explore any and all options for the company’s future.