💥Wait, First Brands filed?💥

Updates: First Brands LLC, Spirit Aviation, The Franchise Group, Beyond Meat & More.

Talk of cockroaches and upped loan loss reserves infused a bit of caution into capital markets this past week as the aftershocks of First Brands Group LLC (see below) continue to reverberate.

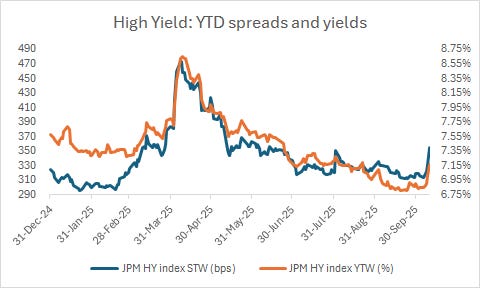

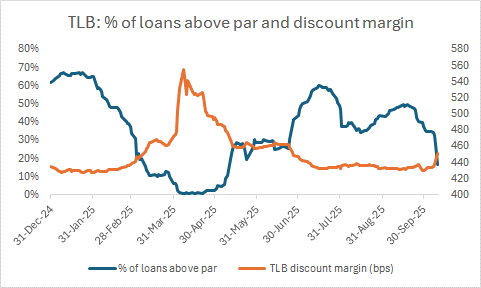

A few highlights from this past week: (i) spreads widened, (ii) loans priced above par in the secondary dropped precipitously, (iii) a pair of credits were pulled from syndication, (iv) a trio of BSLs had to increase credit spreads to entice investors, and (v) if you blinked you’d miss the scant new issuance that came to market.

You could keep your eyes taped wide open and you still wouldn’t see any major chapter 11 activity lately. The First Brands effect was, believe it or not, back in September and so far October has been D.E.A.D. While there are a number of situations percolating — and knowing our luck, something massive will file tonight just to make us look stupid — the biggest news this week had very little to do with any particular companies nearing or filing for bankruptcy but rather a large law firm, Latham & Watkins LLP (“Latham”), making a (presumably) major financial investment in expectation of companies nearing or needing to file for bankruptcy. And we are, of course, all for it; we’re hoping that Latham’s savage pillaging of Ropes & Gray’s bankruptcy group is a leading indicator of things to come. If nothing else, it appears to be ushering in the RX industry’s very own “super team era” with Lebron James (Ray Schrock, both jacked and bald) and Chris Bosh (Ryan Dahl, both super tall, super athletic and super lean, 😉) bringing their talents to Latham to join Dwayne Wade (Andrew Parlen) (PETITION Note: yes, we’re taking massive liberties with this analogy but you get the idea). There’s been an insane arms race in private equity for years now: are we in the midst of one in RX? Will Kirkland & Ellis LLP counter these moves with an impactful lateral?*

Most importantly, what will the money used to finance this war mean for billable rates? 🤔

*Note that Latham topped Debtwire’s Q3’25 league tables though we’re 1,000,000% certain Sass, Suss & Co. would argue that’s only because Mr. Schrock is padding his stats with some drecky cases.

⚡️Update: First Brands Group, LLC⚡️

As alluded to above, the bankruptcy boner for brands … First Brands (Group LLC) … bangs on.

It’s been roughly three weeks since First Brands Group LLC and its 111 affiliates (collectively, the “debtors”) landed in Judge Lopez’s lap in the Southern District of Texas (on September 24 and 28, 2025) …

… but it feels like it was yesterday … or the day before yesterday … or the day before that … because the coverage has been absolutely relentless. Typically bankruptcy coverage dies down after the initial filing but not this puppy. To the extent you’ve been living under a rock or, like, have a life and don’t necessarily feel like reading 5,429 daily articles about these particular debtors, we’ll endeavor to get you caught up in a few short minutes.

To kick off, after the filing, there was a mad dash to figure out who was exposed to the debtors’ “irregularities” … which flushed out several bagholder business development companies (“BDCs”). Per Pitchbook:

“Several BDCs marked debt positions in ailing auto company First Brands Group LLC above 90 cents on the dollar as of June 30, according to PitchBook data.”

Surprise!

“Goldman Sachs Private Credit Corporation, Monroe Capital Income Plus Corporation, AGL Private Credit Income Fund, Kennedy Lewis Capital Company, Palmer Square Capital BDC, Prospect Capital Corporation, and FS Specialty Lending Fund were among the BDCs holding First Brands’ debt as of June 30.

Most of the BDC debt is first lien and priced at S+500 with a March 2027 maturity. A few lenders also held junior positions that were priced between S+850-876.

First Brands’ largest creditors are banks, but BDC filings show that private credit firms had also built positions in the company.

Monroe Capital Income Plus Corporation marked a senior secured loan investment in First Brands Group at 101 cents on the dollar as of June 30, with $46.5 million of principal marked at a fair value of $47.1 million. The debt is priced at S+700 and matures in March 2027. Monroe also held a junior debt position that was marked at 90 cents on the dollar and priced at S+876, with $14.4 million of principal marked at a fair value of $13 million.

Goldman Sachs Private Credit Corp. marked a senior secured position at 94 cents on the dollar as of June 30, with $7.1 million of principal marked at a fair value of $6.7 million. The debt was priced at S+500 and matured in March 2027.

Prospect Capital Corporation held both a first lien and second lien position in First Brands Group, with the first lien position valued at 95 cents on the dollar as of June 30, as $21.8 million of principal was marked at a fair value of $20.7 million. The loan was priced at S+500.

The second lien position held by Prospect was marked at 93 cents on the dollar as of June 30, as $37 million of principal was marked at a fair value of $34.5 million.

FS Specialty Lending Fund marked a senior secured position at 94 cents on the dollar as of June 30, with $14.6 million of principal marked at $13.7 million.

Palmer Square Capital BDC Inc.’s senior debt investment in First Brands was marked at 95 cents on the dollar as of June 30, with $8.6 million of principal marked at a fair value of $8.1 million.

AGL Private Credit Income Fund held a first lien position in First Brands that was marked at 91 cents on the dollar as of June 30, with $40 million of principal marked at a fair value of $36.5 million.”

Others’ pain was also out there for public consumption. There’s UBS Group AG ($UBS) …

… and Jefferies Financial Group Inc. ($JEF) …

… which “…sank nearly a quarter of its $3 billion trade finance portfolio into receivables tied to auto parts supplier First Brands Group Inc,” 😬, mostly held through Point Bonita, a division of JEF’s Leucadia Asset Management. But $715mm of exposure doesn’t even top the list. For those honors, we go to Bloomberg.

“Norinchukin [Bank] and Japanese trading house Mitsui & Co. are the biggest shareholders in JA Mitsui Leasing Ltd., whose wholly owned unit Katsumi Global extended $1.75 billion in trade financing to First Brands[.]”

We don’t know how Norinchukin is navigating the waters, but JEF’s investors came up with a plan: cash out and … uh … uhhhhhh … bail.

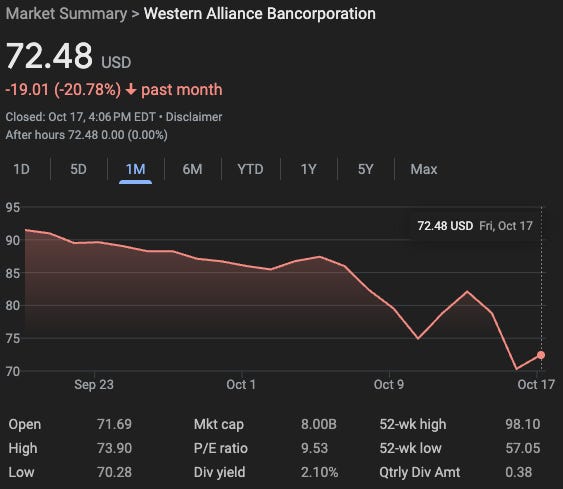

Well, apparently, not everyone has (openly) pursued that plan. Here’s the view of Point Bonita-exposed Western Alliance Bancorporation ($WAL), per Bloomberg:

“‘Western Alliance Bank has multiple secured lending facilities with Leucadia Asset Management secured by accounts receivables purchased by LAM from a diverse group of underlying account debtors (not solely First Brands),’ Western Alliance said in an emailed statement. ‘Presently, we have no reason to believe the events from the First Brands bankruptcy create a material risk of loss in connection with the credit at this time.’”

We admit, we don’t have any insider baseball on WAL or its investment allocations – but with everyone else racing for the door and WAL initiating an entirely separate lawsuit against Cantor Group V, LLC back in August alleging “… fraud by the borrower in failing to provide collateral loans in first position…” …

Double checking couldn’t hurt because the market def wasn’t convinced …

… and it sure as sh*t wasn’t sold on JEF.

Anyway. What followed was the next logical step: minimizing the impact and CYA’ing (and plugging the BK wherever possible).

… not that it’s out of the hot seat yet and questions linger regarding its business judgment in the lead-up to the debacle, which only brought about more CYA.

Opening up your books, however, is only one way to minimize the downside. BDO took a different, more draconian approach: crack a cold one and pour it out for its employees …

Man, the absolute hustle over at Apollo Global Management Inc. ($APO). Here’s a live shot of founder and CEO Marc Rowan:

Meanwhile, Cantor Fitzgerald (“CF”) put the situation to a productive use of its own. You see, in May ‘25, CF had agreed to acquire UBS’ O’Connor, an alternatives investment platform that was in the debtors’ supply chain finance … errr … chain. But even then, the deal wasn’t expected to close before Q4’25 (and hadn’t by the time the debtors filed). So CF went back to the table:

Cutthroat. We high-key love it. As Winston Churchill once said:

But going back to CYA’ing, firms not even in the cap stack have let everyone know they’re in the clear — very reminiscent of the crypto world’s response to SVB’s ‘23 implosion (e.g., here and here). Per Reuters:

“Morgan Stanley Chief Financial Officer Sharon Yeshaya told Reuters in an interview that the bank has no exposure to recent bankruptcies and does not focus on consumer credit.”

Goldman Sachs Group Inc. ($GS) CFO Denis Coleman said the same, about the debtors and fellow Texas bankruptcy resident Tricolor Holdings, LLC. So did SilverPoint Capital. Bluntly. Per the FT:

“Asset manager Silver Point this month began the marketing of its first euro CLO by highlighting one point in investor materials seen by the FT.

It said: ‘Silver Point has zero First Brands exposure.’”*

In any event, the debtors’ plunge of a cliff has also precipitated primers on factoring and pontification on private credit more broadly, which generated its own responses and spinoffs, etc., etc. The Xverse (f/k/a the much better Twitterverse) is pushing out something new … every … single … day.

But as the debtors wade through the mess, one man won’t be in the trenches. On October 13, 2025, their mysterious** CEO Patrick James clocked out permanently.*** We can only speculate on his motives …

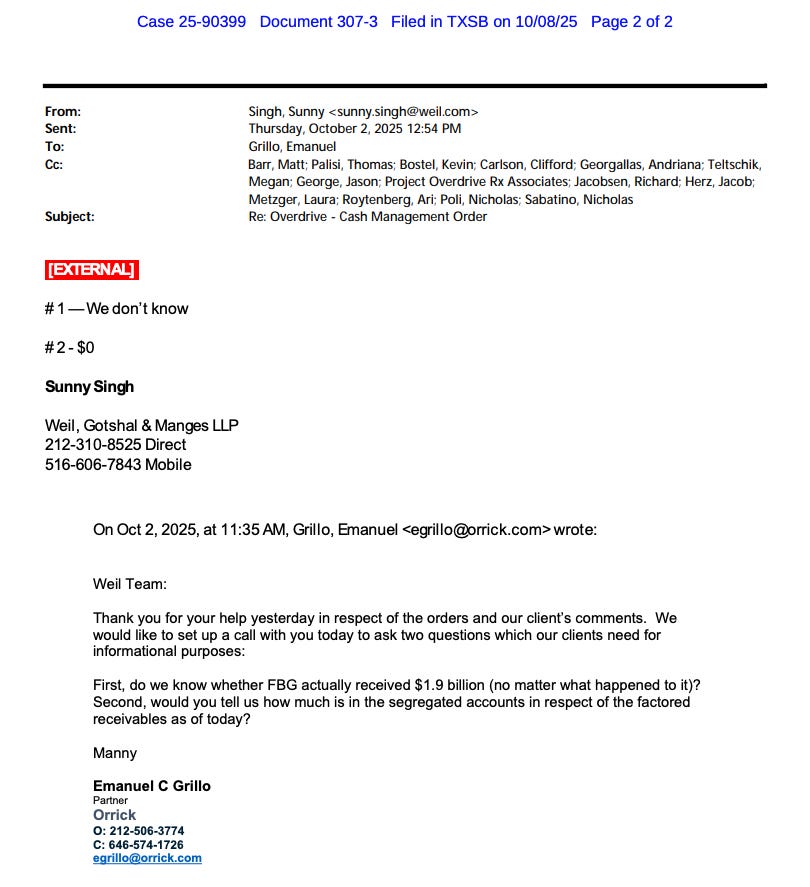

And you may have noticed, all the preceding 💩 happened off the court’s docket. Which kinda makes sense because, with three exceptions, the docket has been as quiet as a mouse 💨.**** Y’all know the first exception; it gave us the most infamous email of ‘25 (so far!):

F*ckin’ hilarious. And responsive! Well, mostly. There was one part debtors’ counsel, Weil, Gotshal & Manges LLP’s (“Weil”) Sunny Singh, breezed right over …

But amusement aside, the response found its way to being an exhibit to, and source of material for, the October 8, 2025 emergency examiner motion filed by Raistone Capital LLC (“Raistone”) — Manny Grillo’s client and a member of the official committee of unsecured creditors (the “UCC”).***** We’ll leave it to y’all to ponder whether there’s any deeper significance to take away from that.

Beyond taking a shot at Mr. Singh’s succinct reply, the motion raises its crosshairs at the debtors’ special committee’s (made up of William Transier and Neal Goldman) use of, um, Weil, as legal counsel in its investigation into the debtors’ pre-petition activity, which … *checks notes* … yeah, we’ll call that an unforced error, and requests a certifiably independent body to look into (i) the “vanishing” $2.3b, (ii) the debtors’ third party factoring arrangements, and, (iii) naturally, any claims that may have arisen. But we’re all gonna have to be patient and wait. While Raistone wanted the motion heard on an emergency basis, Judge Lopez scheduled the hearing for ~one month out on November 17, 2025 at 1pm CT.

The second exception will likely get the same treatment.

Keep reading with a 7-day free trial

Subscribe to PETITION to keep reading this post and get 7 days of free access to the full post archives.