💥Docketpiercer💥

Claire's + Avant Gardner File. Plus Echostar, Exactech, and Corvias Updates

We made a big deal of how busy the first half of July was …

… only to have to walk things back after things fizzled out in the latter half of the month:

Now the official numbers for the month are in and … 🥁 drumroll please 🥁 … they … weren’t … great. There were only sixteen bankruptcy filings that kinda sorta moved the needle in the month (and we’re being EXCEEDINGLY generous and overly-inclusive with that figure).

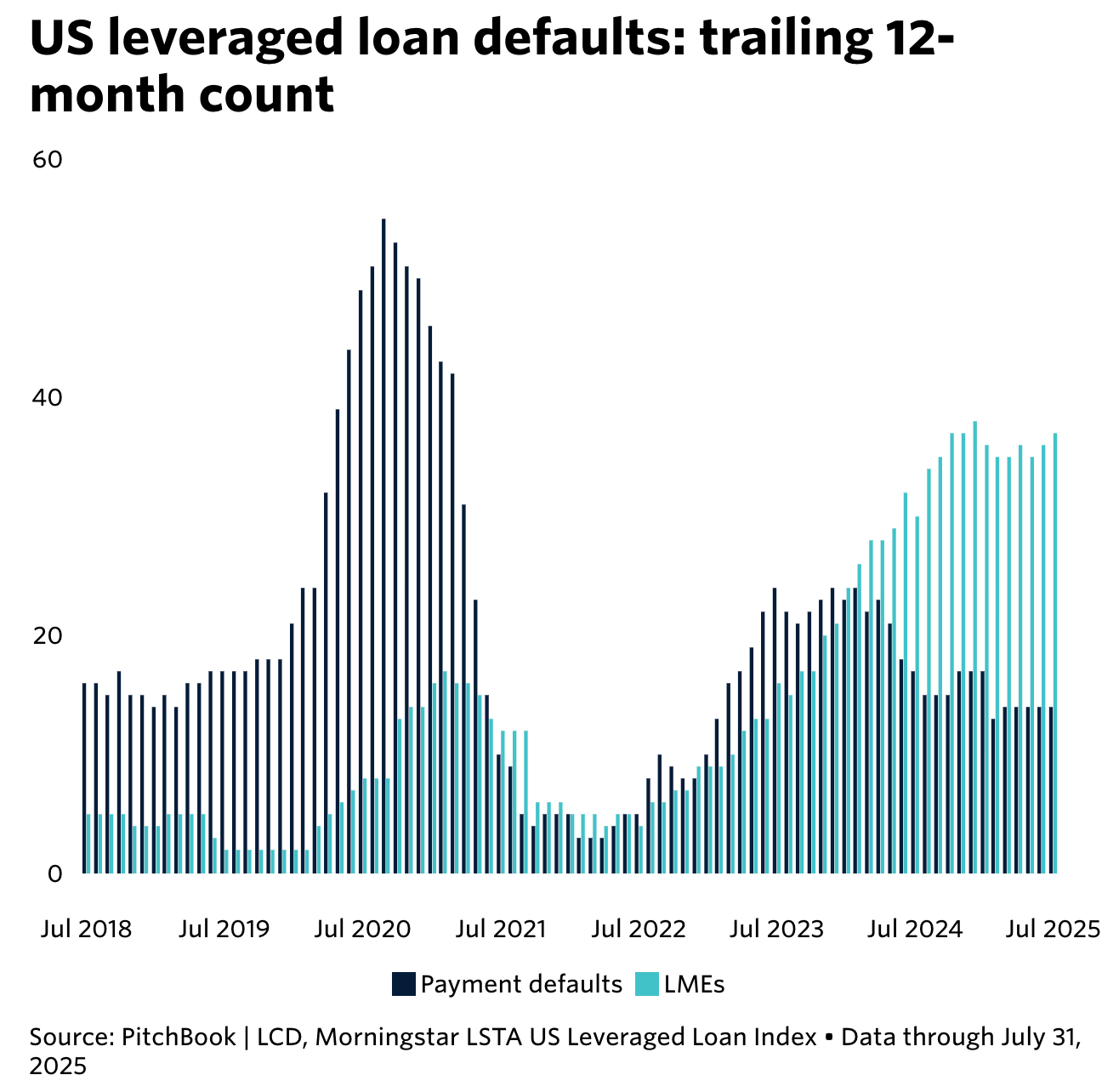

As far as defaults and liability management activity (“LME”) are concerned, the month was dead. In fact, July marked a 31-month low in defaults/LME. Per our friends at JPMorgan Chase & Co. ($JPM):

“There were two payment defaults totaling $1.1bn in loans and two distressed transactions totaling $288mn in loans … [y]ear to date, there have been a total of 36 defaults/LMEs totaling $32.8bn, down meaningfully from activity over the first 7 months of the last 2 years:

2024: 46 defaults/LMEs totaling $41.1bn (-20%)

2023: 53 actions totaling $57.6bn (-43%).”

Or in chart form:

The folks at JPM added:

“The Leveraged Loan default rate (including distressed exchanges) eased modestly to 3.86%, while the High Yield default rate is down to 1.37%. For context, the 25-year average HY and LL default rates are 3.4% and 3.1%, respectively, and the post-GFC average is 2.5% and 2.4%. the JPM forecast of 2025 high-yield bond and leveraged loan default rates of 1.50% (HY) and 3.25% (LL), respectively, is looking pretty good so far.”

Using a slightly different methodology, Pitchbook pegs the syndicated leveraged loan default rate slightly higher, but also parses out LME/distressed-exchange-triggered defaults:

These charts make it clear that LME continues to be a dominant theme in ‘25, even if things did tail off in July (and are down YOY).

What about going forward? For this we turn back to JPM:

“As of the end of July, the combined distressed universe of bonds/loans (STW 1000bp+/sub-$80) was $146bn or 5.0% of [the] leveraged credit universe.

YTD peak: $210bn on April 7th

YE22: $282bn (or 9.8% of total outstanding[])”

This breaks down into (a) $77.5b of distressed leveraged loans outstanding (or 5.1% of issuance) compared to $99b as recently as April 7 and (b) $68.7b of distressed high yield bonds outstanding (or 5% of issuance), down meaningfully from the peak of $111b on April 7.

Distressed investors need another “Liberation Day”-type shock to make things interesting again.

💥New Chapter 22 Bankruptcy Filing - Claire's Holdings LLC 💥

On August 6, 2025, Hoffman Estates, IL-based Claire's Holdings LLC and 13 affiliates (collectively, the “debtors” and together with their non-debtor affiliates, “Claire’s”) filed chapter 22 bankruptcy cases in the District of Delaware (Judge Shannon).* No doubt, a lot of y’all remember these guys from your mall-filled youth … or their ‘18 bankruptcy (when PETITION was still in its infancy, 🥹) … or their opportunistic-but-failed ‘21 IPO.**

But on the extremely remote chance you’re not familiar, Claire’s is “… a global brand powerhouse …,” 😂, “… for self-expression, creating exclusive, curated, and fun fashionable jewelry and accessories” targeted at “… girls between the ages of 3 and 18 years old.”

And they pierce ears too — over 100mm lobes since ‘78, including Kirkland & Ellis LLP’s (“K&E”) own Josh Sussberg. That’s, lol, not a joke: K&E’s Alex Schwarzman made sure to mention it at the August 7, 2025 first day hearing.*** And Josh knew we’d follow suit, so he got ahead of it and sent Johnny a pic:

Claire’s offer its brands — Claire’s® and Icing®, which is aimed at an older 18-35 demo — through four business lines: (i) 2.3k global brick and mortars, including 210 “store-in-store” (“SiS”) locations inside Walmart Inc. ($WMT), (ii) ~9k concessions, where folks like WMT, Kohls Corp. ($KSS), and CVS Health Corp. ($CVS) are paid a commission on the sale of debtor goods, (iii) e-commerce, and (iv) ~230 franchises across Asia, Latin America, and EMEA.