💥BK Buddy💥

FAT Brands Inc. ($FAT) + Urban One, Inc. ($UONE) + American Signature Inc. updates, Buddy Mac Holdings LLC files & More.

We all know that the biggest financial news story this past week was that Instacart ($CART) is f*cking you and helping drive inflation.

Ok, just kidding, that’s obviously not it.

It’s that, despite its amazing NYC holiday display, Saks Global Enterprises is sh*tting the bed big time and could end up missing a $100mm interest payment due at month’s end and tumble into chapter 11 bankruptcy shortly thereafter — mere months after completing an LME deal (🙄).

Ok, FINE. Not that either.

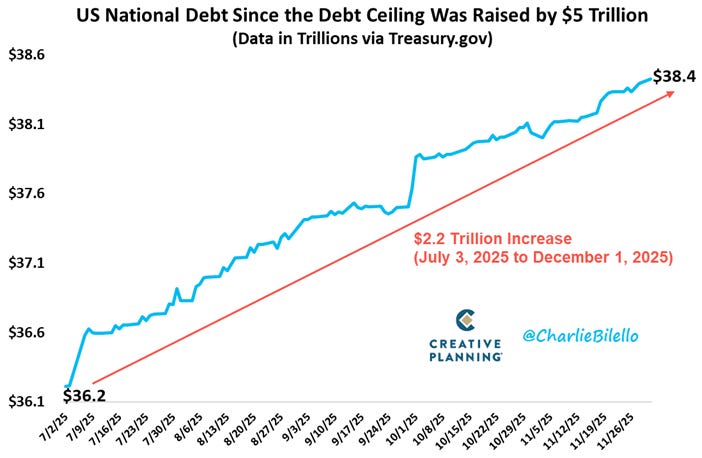

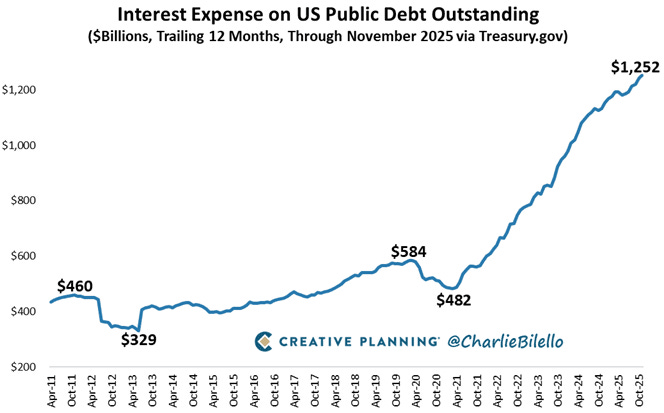

While those are both interesting-albeit-not-completely-surprising stories, the biggest news this week came from Jerome POW-ell & the Gang as the Fed once again ignored inflation data, focused on employment data, and lowered rates by another 25 bps (with some dissension in the ranks … recall that two months ago this cut was a certainty and a month ago it was decidedly less so). The S&P 500 Index and the Nasdaq Composite both ripped before giving it all back on Friday and ending the week down 0.70% and 1.87%, respectively (in contrast, the Dow Jones Industrial Average rose 1%). The bond market, meanwhile, went bananas, sold off, and demanded higher rates for the 10Y and 30Y after reading loud and clear POW-ell’s hawkish position about future rate cuts. For those of you perplexed by 10Y/30Y ⬆️ when the Fed funds rate ⬇️, you’re not wrong, they should both venture in the same direction. It seems people once again remembered that inflation still exists and this country is compounding national debt like crazy, 🤷♀️.

Anyway, the market now seems to think there’ll be one more 25 bps cut in ‘26 and another in ‘27. “Higher for longer,” indeed.

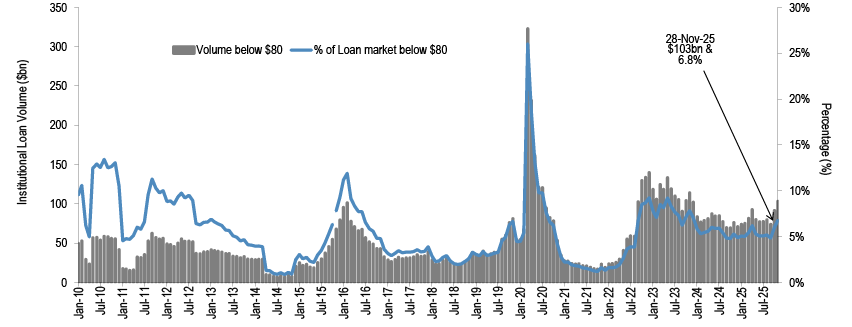

Which is … good? … for the RX community. We mentioned previously that things seemed to be picking up a bit and we stand by that statement.*

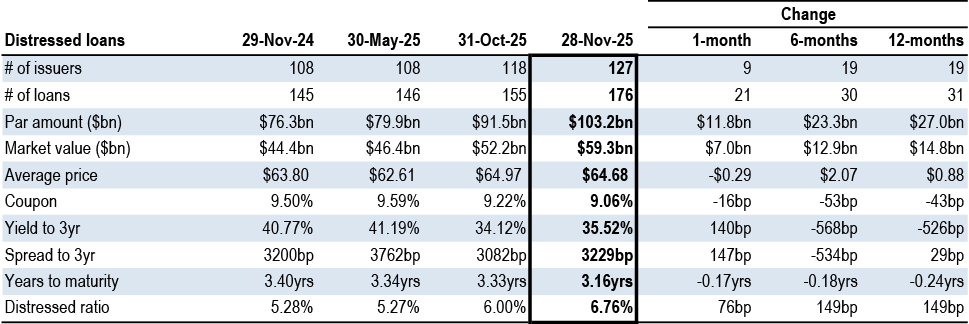

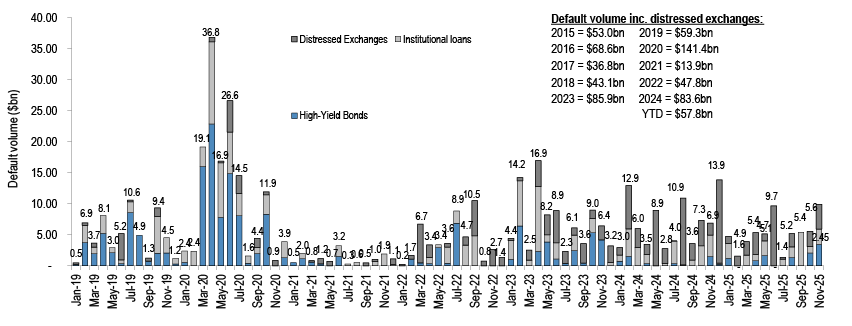

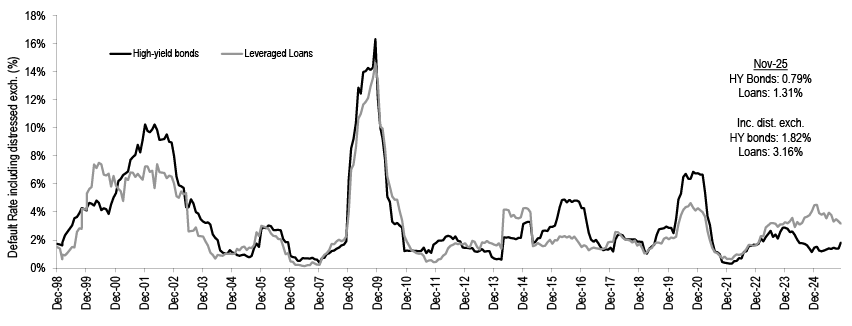

JPMorgan Chase & Co. ($JPM) validates it too — sort of. This week they put out some data that showed that November, despite having only three default/LME actions, marked a 21-month high for payment default volume and a 5-month high for distressed exchanges/LME volume. JPM’s Daniel Pombo noted that “...the universe of distressed debt is growing; a sign of busy times ahead. The combined distressed universe of bonds/loans (STW 1000bp+/sub-$80) grew by $16bn in November to a 7-month high of $175bn or 6.0% of leveraged credit. We’re still a ways from the recent peak of $282bn (or 9.8%) at YE22, or even the YTD peak on April 7th ($210bn) reached just after Liberation Day, but the direction of travel is up.” Technology leads the way.

That said, they also highlighted how ‘25 YTD has been a down year, citing 54 defaults/LMEs (worth $57.8b) versus 76 (worth $69.8b) in ‘24. Clearly we were not wrong when we asked our own panel of department heads about the great LME slowdown of ‘25 (here, here and here).

As we wait to see what the end of ‘25 brings to bear and look forward to ‘26, today we’ll home in on a couple of situations we’ve previously visited with and dabble in some new ones. Tee up your practice eggnog and let’s dive in.