💥Fraud-tastic💥

Lugano Diamonds & Jewelry Inc., First Brands Group LLC, Luminar Technologies Inc. ($LAZR), Klöckner Pentaplast GmbH & More.

Fitch Ratings released its “U.S. Corporate Distressed and Default Monitor” (paywall) and TTM default rates remain steady at 5% for leveraged loans ($3.8b) and 3% for high yield ($657mm). Still, the agency warns that “…stable top-line rates mask intensifying pressure from re-defaulters, policy-linked cost shocks, and persistent liquidity constraints.”

In that spirit, it does feel like things are starting to get a bit busier, even in the face of this week’s wall-to-wall and bar-to-bar packed industry networking events — usually an indication that people have faaaaaaaar too much time on their hands.

The markets certainly helped feed the feels as, Friday notwithstanding, investors largely took risk off as concerns spread about AI-oriented irrational exuberance. Even a stellar earnings report from Nvidia Inc. ($NVDA) couldn’t stem the tide. The S&P 500 closed down 1.6%, the Dow Jones Industrial Average dipped 1.75%, and the Nasdaq Composite fell 2.26%. The bitcoin bros suffered the worst of it with BTC down 8% as of midday Saturday. By one measure, consumer sentiment fell 5%.

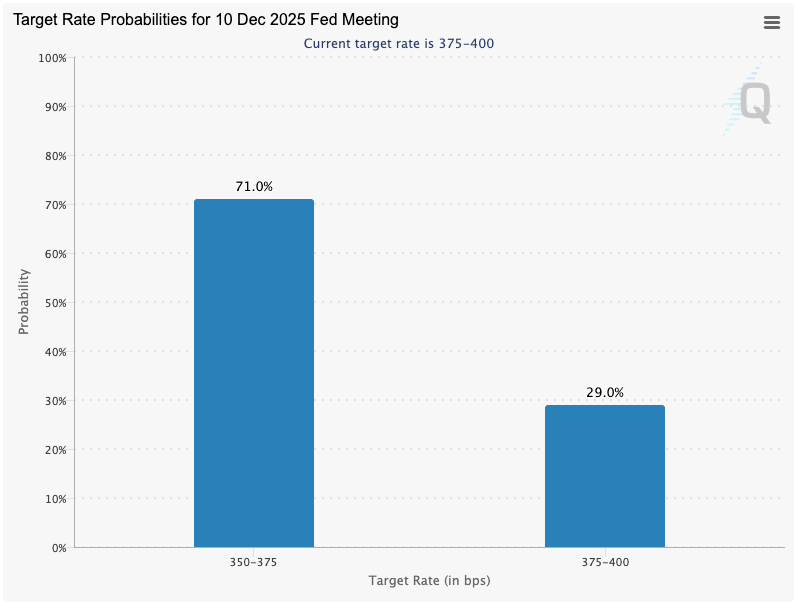

Not that any of that really matters. What matters is that the labor market is sending mixed signals and Jerome POW-ell & the Gang were therefore all over the f*cking map with their commentary this week — now somewhat convincing markets that a mid-December rate cut is back in the cards.

Note that a month ago the market had a rate cut pegged at 98% and, in contrast, on Thursday November 20, at just 39%! So, 🤷♀️.

Like everyone else we’ll wait and see. Besides, who needs a market correction when you’ve already got heaps and heaps of f*ckery to keep RX professionals busy? In that vein, let’s delve into this weekend’s fraud restructuring coverage!

💥New Chapter 11 Bankruptcy Filing - Lugano Diamonds & Jewelry Inc.💥

On November 16, 2025, Lugano Diamonds & Jewelry Inc. (“Lugano Diamonds”) and four affiliates (collectively, together with Lugano Diamonds, the “debtors”) filed chapter 11 cases in the District of Delaware (Judge Shannon). The debtors are designers, manufacturers, and retailers of “high-end” jewelry and are all-in trope as far as the wealthy go. We mean …

📍The name itself. The debtors take it from the luxurious Lake Lugano, which straddles the border of Switzerland and Italy … despite calling Newport Beach, CA home, which is, uh, 6k miles, ~1/4th of the way around the globe, away to the south and west.

📍The products. They scream for a paper bag to be dropped over ‘em.

Good g-d, is that sh*t ugly. This is their first day declaration best?

📍Their philanthropic endeavors. The debtors sponsor equestrian events and … holy hell … started an entire division of 🐎-inspired jewelry back in ‘08. Maybe the ultra elite have more in common with (a subset of) us than we ever imagined.

📍Their social scene. The debtors own Lugano Privé, an “… exclusive private social club …” where trust-fund kids can get hammered while pretending to be “… committed to philanthropic endeavors and giving back to and supporting the community,” without ever, you know, interacting with that community. Although founders and ~40% minority owners, Mordechai Haim “Moti” Ferder and Idit Ferder, may get the chance before long because …

📍Their finances. Nothing was amiss until spring ‘25, when the debtors’ parent, Compass Diversified Holding ($CODI), which had acquired a majority interest in the business from the Ferders in ‘21,* found out that the debtors’ financials were held up by … well …

Keep reading with a 7-day free trial

Subscribe to PETITION to keep reading this post and get 7 days of free access to the full post archives.