💥Are we being melodramatic?💥

A Prospect Medical Holdings Inc. update + Apple Tree Life Sciences Inc., Ample Inc. & Flipcause Inc. File

It’s the holiday season y’all which means (a) Johnny hasn’t had a single drink-free day in over six weeks, (b) we’re burned out as all holy f*ck, and (c) we’re ready for some detox vacay. Today we slap with an update, cover three recent filings in a December chock full of sh*t stain cases, and ride off into the sunset for ‘25. Our next drop before the year end will be our annual survey of people who actually work deals rather than just talk sh*t about them. Otherwise, we’ll see you in ‘26.

We do, however, want to take a pause and thank you, our dear readers, for your attention/support this past year, 🙏.

And we wish you all happy and healthy holidays and a wonderful New Year, ✌️🥳.

⚡Update 7: Prospect Medical Holdings, Inc.⚡

Congrats, we suppose, to Prospect Medical Holdings, Inc. (“Prospect”) and its 66 … no, 91 … wait, still not right … 94 … yeah, that’s the count these days …. affiliates (collectively, together with Prospect, the “debtors”). On December 12, 2025, they finally confirmed a chapter 11 plan. A liquidating one anyway, under which GUCs are nigh certain to receive nothing under a litigation trust, and only four months after the debtors’ initially — and foolishly — envisioned August 7, 2025 confirmation hearing.

If you’re a regular reader of PETITION LLC, you’ll know we have covered these depressing-as-f*ck dumpster fires extensively, most recently here:*

So, what changed to turn the debtors’ fate from near-or-actual administrative insolvency to confirmation? Let’s dig in.

In mid-November ‘25, the debtors received court approval to dispose of their last Connecticut-based hospital to the University of Connecticut’s UCHCFC Robbins Street Corp., which will give the debtors, which filed bankruptcy with $2.3b in funded debt obligations … another thirteen million bucks, 😂, in cash to play with.** That, obviously, is not what turned the tides.

The proposed sale of the debtors’ Rhode Island hospitals to non-profit The Centurion Foundation, Inc. (together with affiliated do-gooders, “Centurion”) though?

The sale is very much up in the air. Here’s Judge Larson sharing her thoughts at a November 18, 2025 hearing:

“[Y]ou know, as I expressed last time, I’m beyond frustrated with Centurion. You know, I approved a sale, as I said, February of this year… So it’s very upsetting, but eventually, you know, I hate to say something so callous, but fish or cut bait.”

Frustration aside, the purchase agreement contains a Her-Honor-blessed financing condition, and Centurion is still working to get that in place, for which it’s enlisted the assistance of Bank of America Securities as co-placement agent. It has until January 15, 2026 to “fish” for funding, and if a close doesn’t occur by January 30, 2026, “… the RI Hospitals shall be transferred out of the Debtors’ Estates in a manner to be agreed between the RI Attorney General and the Debtors…” Perhaps to non-profit Prime Medical Foundation, which has been diligencing in the background, although terms and price remain as-of-yet undisclosed.

Okay. But surely the debtors have figured out the ~$25-30mm in administrative-priority WARN claims, right?*** The claims they created by shuttering their Pennsylvania hospitals, for all intents and purposes, overnight.

At the all-day December 12, 2025 confirmation hearing … and in an obvious ploy not to stand in front of confirmation … the court decided there’s a de facto WARN Act exemption for health care companies …

“Because, you know what, I’ll just tell you, I’m willing to make case law if I need to.”

… and estimated them at $1.5mm, which, conveniently enough, was the amount the debtors’ budget could afford. Even so, the debtors’ former employees still have the right to assert and litigate the full $19mm amount and, if they land at even a fraction of that, the debtors’ plan is 💀.

The judicial activism to force an outcome in these cases. It’s remarkable. But the debtors had other help in getting through too. Namely, DIP lender, landlord, and largest unsecured creditor Medical Properties Trust, Inc. ($MPW) (“MPT”) has continued throwing cash into a bottomless pit.

On November 18, 2025, the debtors filed, and, on December 5, 2025, the court approved, a motion to upsize the DIP by $25mm, composed of a single-draw, new-money $15mm term loan and a multi-draw, new-money $10mm term loan “… if their cash is projected to fall below …” $5mm.

If? Bold assumption. Because on the eve of the confirmation hearing, the debtors requested more. Another $5mm to be funded from the proceeds of the Connecticut sale, and an effective date facility composed of, in addition to the $30mm MPT already committed in August ‘25 to pay off admin claims, (i) a delayed draw $25mm term loan, (ii) a single draw, $3mm term loan (the last two funded from cash MPT would otherwise be entitled to), and (iii) “… a secured term loan in an amount equal to …” all DIP loans, interest, and fees.

So now, the DIP itself isn’t certain to be repaid. Here’s Wachtell, Lipton, Rosen & Katz’s Emil Kleinhaus describing MPT’s path to getting back its postpetition cash:

“The way that DIP loan works, it’s essentially a loan that may get paid out of cause of action recoveries in the future.”

Basically, lawsuits against former owner Leonard Green, former CEO Samuel Lee, co-CEO David Topper, and others not worthy of mentioning on the record.

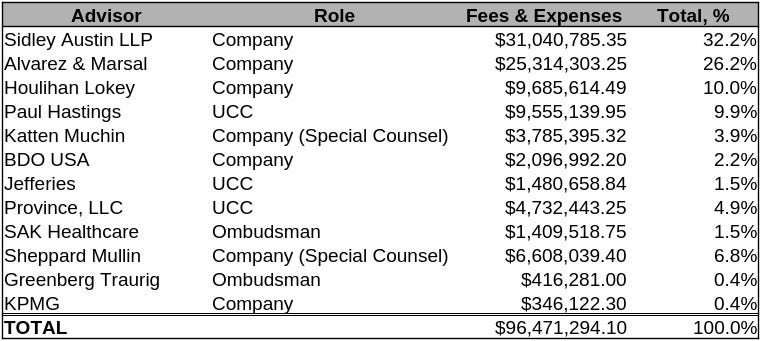

Anyway, the DIP funds have been put to good use. Funding professional burn.**** Here’s the on-docket damage to date:

Profs runnin’ amok. That backs us up, briefly, to a November 18, 2025 hearing. Judge Jernigan doesn’t like it when estate fiduciaries receive heat. In response to Houlihan Lokey’s agreement to walk away from a $500k fee, she interrupted the hearing to say:

“… I try not to pay attention to media articles in cases in which I’m involved in, but if it’s, for example, the Steward case, which I’m not involved in, boy, I read all that stuff. And, you know, I hate to use a phrase like ‘there’s a target on the professionals,’ but there’s a lot of negative press, shall we say, about professional fees. But I just kind of want to pause and let everyone who might be paying attention out there, let that soak in. That this case has gone on now 10 months. It has been super complicated, super complicated.”

Perhaps … the cases are “super complicated” because of the professionals? Time and time (and time) again, we’ve watched them fumble the ball and shoot the estates in the foot. Incompetence or intent? Do we have to pick? Recall we said this nearly a year ago:

“It’s only January, and we already have a contender for the sloppiest bankruptcy of the year.”

The docket now bears some 4.3k entries three weeks ahead of the first anniversary of the

Keep reading with a 7-day free trial

Subscribe to PETITION to keep reading this post and get 7 days of free access to the full post archives.