💥Turnarounds, Triumph & (Bio)Tech Turds💥

Fossil Group Inc. ($FOSL), Beyond Inc. ($BYON), 23andMe ($ME) + Busted Biotech

That 👆 — our amazing headline today — sums up today’s edition. The team is scattering later this week for the holiday so there’ll be no edition this Sunday. We wish you all a safe holiday and, as always, we appreciate your readership … thank you. 🙏

⚡Update: Fossil Group, Inc. ($FOSL)⚡

And we’re back with our favorite (not … at … all) watch brand, Fossil Group Inc. ($FOSL). You can revisit our initiation here …

… and our follow up pieces here:

So, what’s the latest and greatest?

FOSL reported 1Q’25 results on May 14, 2025 and booked revenues of $233.3mm, a 8.5% YoY decline! Lovely!!

But take a closer look 👇. Squint just enough and you’ll note that amidst the declining revenue and other drops (e.g., gross profit of only $143mm, and adjusted EBITDA of $9.1mm), there’s actually some improvement to speak of (👀 61.3% gross margin, operating income of only, lol, negative $6.7mm).

FOSL attributed 520 bps of the revenue decline to weak smartwatch sales and the closure of 28 retail stores.* Should we — and by “we,” we mean you … we couldn’t give a f*ck — be worried?

Management would tell you that the revenue decline is just noise; after all, their turnaround plan had much slimmer revenue numbers forecasted for the future. Check it ⬇️:

And credit where credit is due, by all metrics, FOSL is (thus far) hitting its profitability goals. Here’s CEO, Franco Fogliato, on the 1Q’25 earnings call:

“We're pleased to report another quarter of exceptional progress under our Turnaround Plan. Our teams delivered results ahead of our expectations, both operationally and financially. We recorded a significant improvement in sales performance on a sequential basis, drove another quarter of meaningful gross margin expansion and generated a second consecutive quarter of profitability.”

In response, the stock has taken a bit of a breather after hitting a low of $0.90 in April:

FOSL still has $150mm outstanding in 7% unsecured notes due ‘26 (last priced at $17 on $25 par), but there’s also $78.3mm in cash and $21.2mm available under its revolver. To further bolster liquidity, management is also working on closing a sale leaseback transaction of a distribution center that’ll bring in $20mm in proceeds.

The company will have to deal with a refi on the 26s in the near-term but, all things considered, CFO Randy Greben, is optimistic:

“The company has been acting with urgency to address its liquidity position and I can share that we're making meaningful progress towards refinancing our debt, selling non-core assets and further reducing costs.”

While we’re not supportive enough of Mr. Fogliato’s and Mr. Greben’s efforts to sport a Fossil branded watch any time soon, we’re all in for the occasional turnaround story.

We’ll continue to monitor their progress.

*FOSL originally forecast 50 store closures for FY’25 so the rationalization is well on its way.

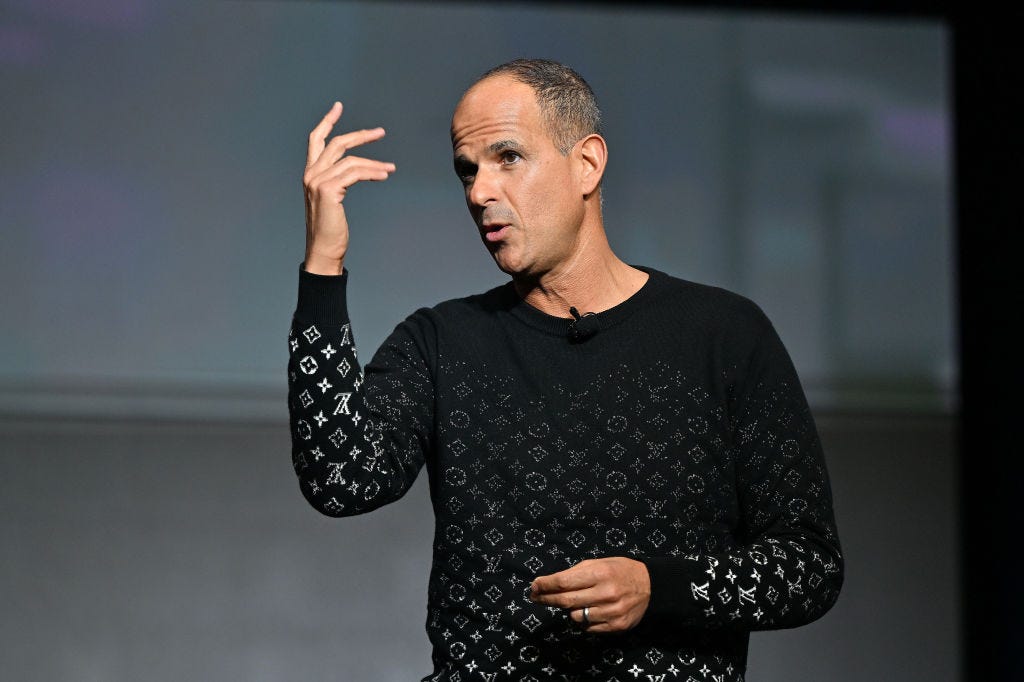

⚡️Update: Beyond Inc. ($BYON)⚡️

We last covered Beyond Inc. ($BYON)(“Beyond”) here in late March, mere weeks after self-styled “Fixer,” CEO Marcus Lemonis, took over as CEO* and shortly after the company released its 4Q24 earnings. We noted that Lemonis had plans to ✄, ✄, ✄. And cut he did. Specifically, he set his sights on (i) eliminating unprofitable SKUs and vendors, (ii) shedding SG&A, and (iii) minimizing inefficient marketing spend. So, we bet you’re wondering: has the Fixer come through?

Good news! We can find out now with the benefit of another quarter of earnings!! Let’s dig in.

The company’s 1Q25 revenue fell 39% YOY to $232mm with a 46% drop in orders. Beyond highlighted that it had indeed stopped selling unprofitable SKUs, dropped unprofitable vendor relationships, and reduced sales and marketing spend — all of which contributed to the decline. In the 1Q25 10-Q, the company also pointed to lower website traffic (which makes sense in light of decreased marketing), a poor macroeconomic backdrop, and shifting consumer preferences. Here’s what 1Q25 revenue looks like sequentially and YOY:

Gross profit declined 22% YOY to $58mm due to lower sales, but the Company’s merchandising actions boosted gross margin by 560bps YOY and 210bps QOQ to 25.1%.

Adj. EBITDA was still negative, but much improved YOY at ($13mm) in 1Q25 compared to ($48mm) in 1Q24. The improvement was due to the gross margin expansion noted above, a 53% YOY reduction in marketing expense, and a 21% YOY decline in G&A and tech expenses from headcount reductions. The “Fixer” is slashing like a horror film.

Keep reading with a 7-day free trial

Subscribe to PETITION to keep reading this post and get 7 days of free access to the full post archives.