💥T-Boned💥

First Brands Group LLC Crashes into BK, Beyond Meat Inc. ($BYND), CommScope Holding Company Inc. ($COMM) + More

🛞New Chapter 11 Bankruptcy Filing - First Brands Group LLC🛞

Surely, you saw. It was f*cking everywhere.

Heck, a good bunch of y’all are probably working on the sh*tshow: there were 380+ folks dialed into the October 1, 2025 first-day hearing, and Judge Lopez had to ask office-bound desk jockeys to huddle up together in conference rooms to make room for others to dial in.

In any event, after a tumultuous few weeks, on September 28, 2025, Cleveland-based First Brands Group LLC (“First Brands”) and 98 affiliates (collectively, together with First Brands, the “9/28 debtors”) slammed hard into chapter 11 in the Southern District of Texas,* joining 13 affiliated companies (the “initial debtors” and, together with the 9/28 debtors, the “debtors” and, together with their non-debtor affiliates, the “company”) which had filed earlier in the week on September 24, 2025.

We first mentioned First Brands back in September** when Fox Rothschild LLP (“Fox Rothschild”) inadvertently sh*t the bed and disclosed a bunch of confidential info regarding the company’s dispute with fellow automotive supplier and chapter 11 debtor Marelli Holdings Co. Ltd. (“Marelli”).

But for a mountain of (good) reasons, Fox Rothschild ain’t debtors’ counsel on the $6.1b bankruptcy. Or is it $9.3b? … or $11.6b?

Depends on whether you’re going off purely funded debt (#1) or including “off balance sheet” SPV arrangements and supply chain financing (#2) or tacking on the company’s factoring liabilities (#3). Regardless sorry Fox-y, whichever debt load, it’s clearly a job for heavier hitters. In this case, Weil Gotshal & Manges LLP (“Weil”),*** Lazard Freres & Co. ($LAZ), and Marelli’s own financial advisor Alvarez & Marsal LLC (“A&M”).

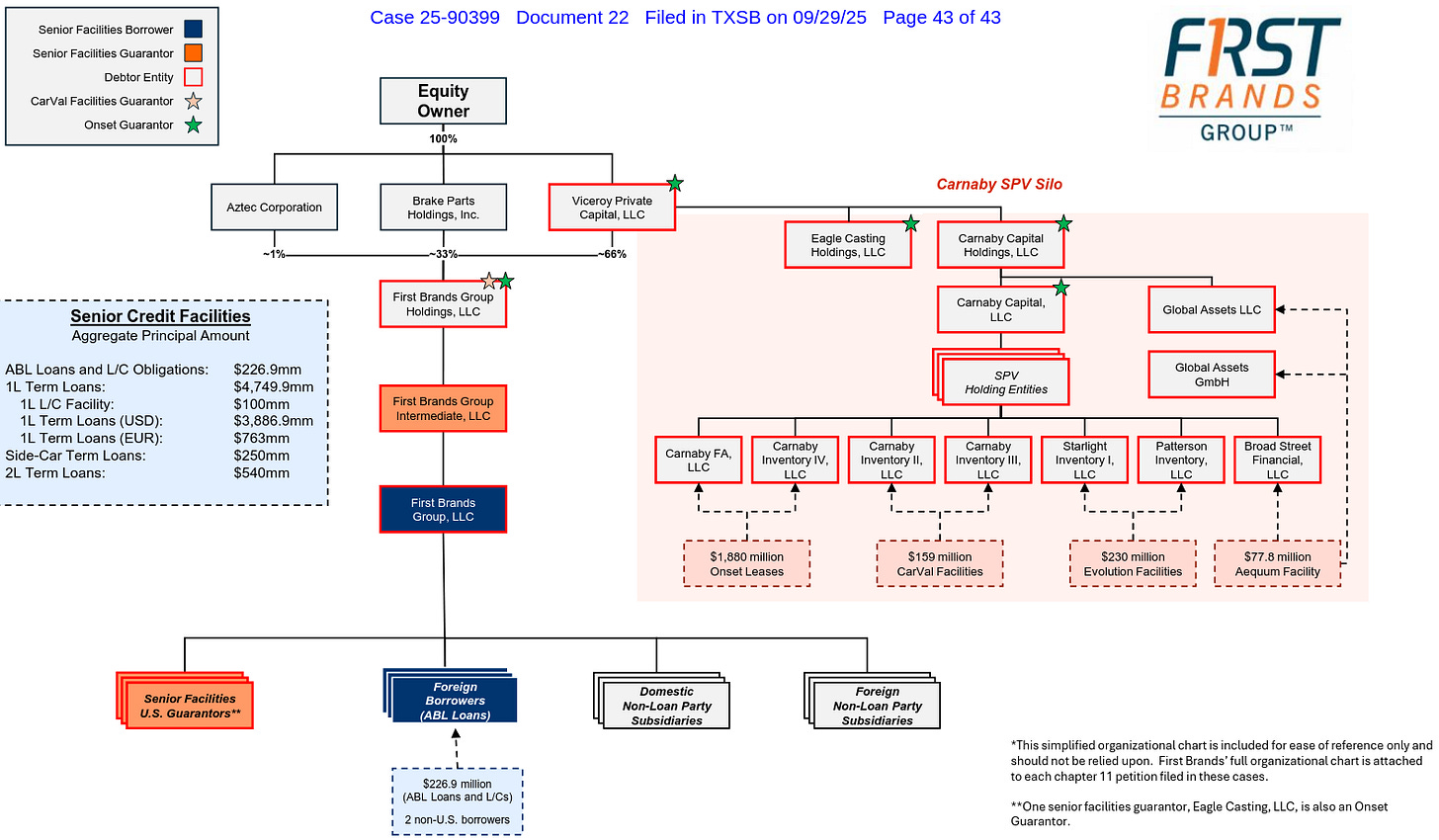

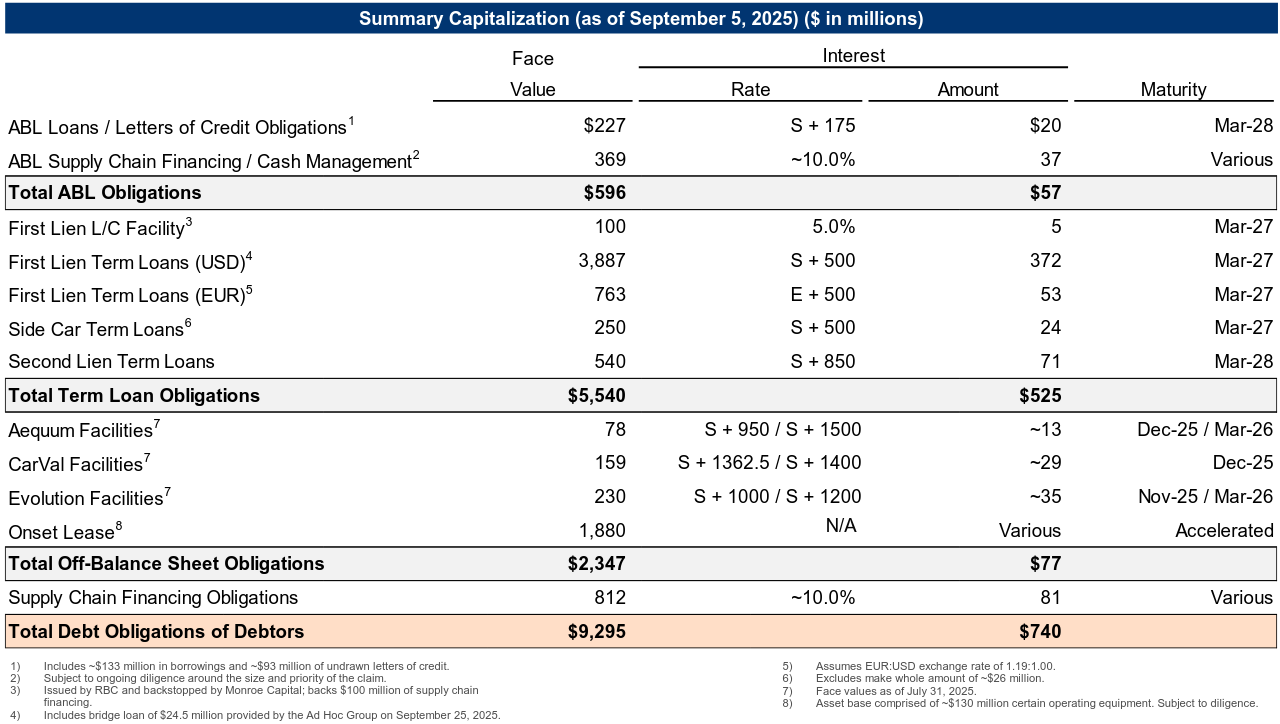

For reference, here’s Weil’s ginned-up debt chart:

… which omits 100% of the company’s factoring liabilities.

Anyway, here’s A&M’s Charles Moore, the debtors’ CRO and first day declarant, to tell us the rest of the story for the filing:

“ … several factors have contributed to the commencement of these chapter 11 cases, including significant liabilities related to (i) tariffs [and] (ii) capital expenditures related to both the Company’s acquisitions and integration costs ...”

But are ya sure that’s all, Mr. Moore? Because …

… and we couldn’t help but notice you peppered in some incredibly couched phrasing (emphasis added):

“According to the Company’s audited consolidated financial statements for the year ended 2024, total net sales were approximately $5 billion.”

“Over the past 12 months, based on the Company’s estimates, approximately 82% of the Company’s revenue has been derived from sales of aftermarket parts, 13% from sales to OEMs, and approximately 5% from sales to specialty and industrial customers.”

“The Company’s estimates indicate approximately 75% of the Company’s revenue is generated by the sale of products sourced from North America, while the remaining 25% is generated by the sale of products sourced from outside North America.”

“As of the Petition Date, according to the Company’s financial statements, the Company was levered approximately 5 times based on total on-balance sheet funded debt of $6.1 billion and reported EBITDA of $1.133 billion.”

And there’s, um, this:

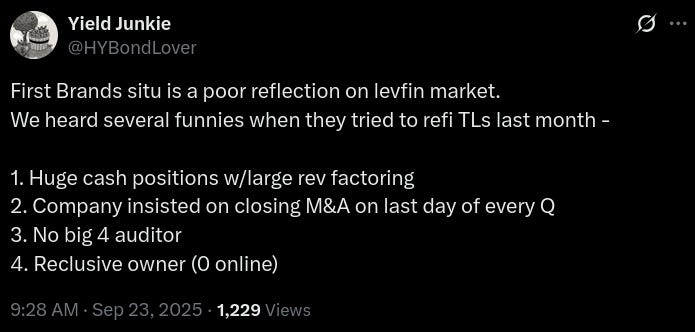

Clearly, the debtors’ advisers don’t trust in the company’s books and records. Not that we will blame them after they found $2.3b in “… Third-Party Factoring irregularities …” and collateral “may” have been commingled and double-counted across separate, siloed facilities.**** Certainly smells like more than just a regular-way “irregularity,” but we’re sure it’s just a mixup, 😉.

Okay. Sarcasm aside, there’s a 💯% chance owner Patrick James, who also serves as the debtors’ CEO, will find himself in the hot seat as these cases play out.*****

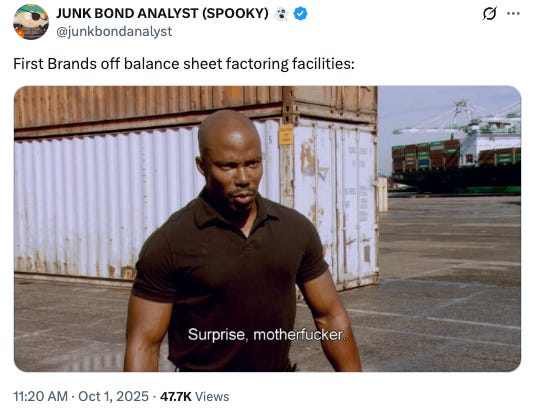

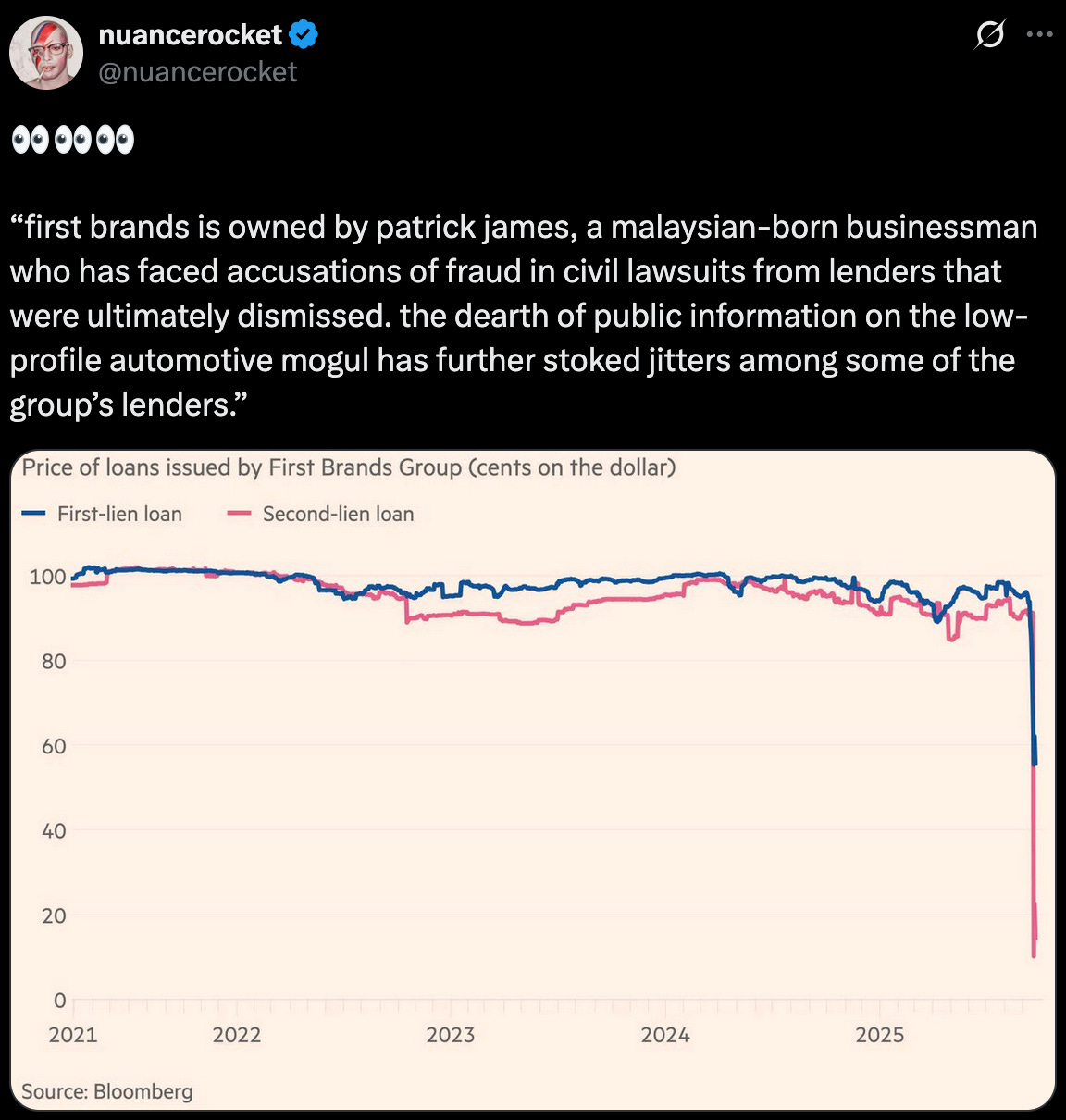

The debtors’ downfall was jumpstarted after an ill-fated June ‘25 refinancing process led by then-banker Jefferies Finance LLC ($JEF). It didn’t get very far though because, in August ‘25, potential lenders had already been spooked …

… and requested a quality of earnings report (which is reportedly due sometime this month).

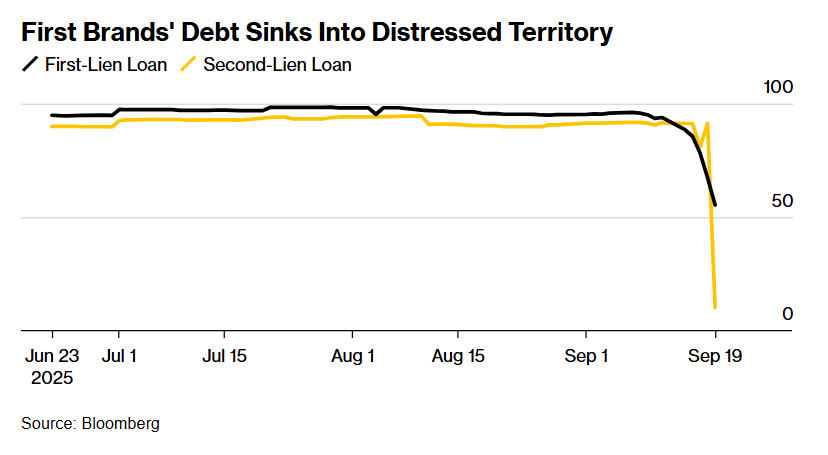

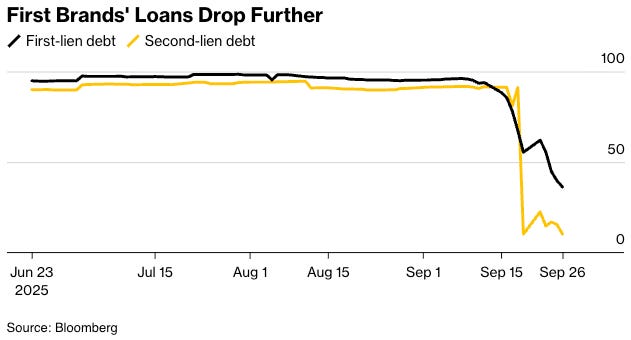

Then September rolled around and sh*t hit the fan pretty damn quick … here is the debt pricing as of September 23, 2025 …

… and here it is as of September 27, 2025 …

… all of which took place after lenders started sending termination notices, Southstate Bank nabbed $27mm — the debtors’ “… last remaining liquidity …” — from an account maintained with the bank to set off debts owing to it, and Apollo Global Management Inc. ($APO) (“Apollo”) and Diameter Capital Partners (“Diameter”) closed out shorts on the company’s loans, which included, LOL, Apollo savvily sidestepping the credit agreements’ DQ lists by using a bank to front the trade, 🥃.******

And while Apollo and Diameter probably raked in cash, others lost a sh*tload … we mean … just take a look at those 👆debt prices … that sh*t collapsed fast … and hard … IN … A … WEEK.*******

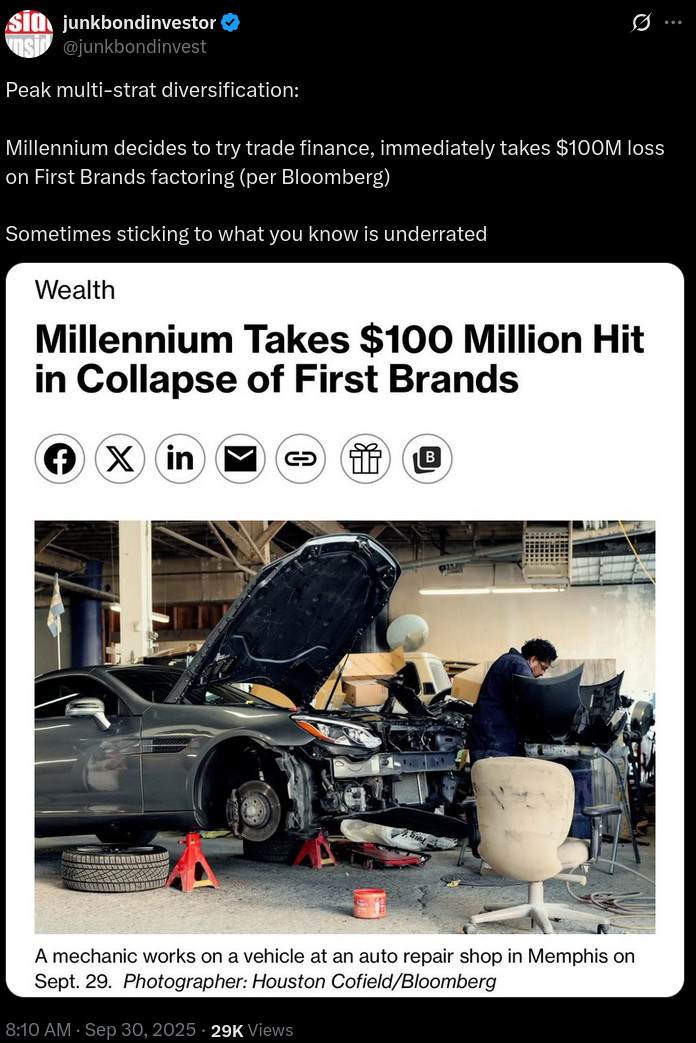

Hahahahaha, better luck next time, Millennium Management.

In any event, any fallout from the ⬆️ or Mr. James’ “leadership” will come at a later date. Because notwithstanding one two three four five SIX SEVEN EIGHT first-day DIP and cash management objections and blunt threats to seek dismissal of cases or the appointment of a chapter 11 trustee or examiner, Judge Lopez wasn’t interested at all in doing anything other than ramrodding through a to-be-syndicated $4.4b DIP term loan backstopped by “certain” members of an ad hoc group of 1L and 2L crossholders******** and approving — and overruling all objections to — the other first-day relief.********* The DIP is comprised of (i) $1.1b in new money (technically $500mm interim, but $325mm is funded into escrow) and (ii) a 3:1 bifurcated “creeping” roll-up of the 1L term loans ($1.5b interim, $1.8b final). The new-money DIP bears interest at SOFR + 10%, of which 1.55% is cash-pay and the balance PIK,********** and features a 5% PIK new-money upfront fee, a 10% new-money backstop “anchor” premium, and a 5% exit premium.***********

After an hour of delay …