🚘Special Edition for Non-Members: It Hertz So Good (Long Predatory Legal/Financial Innovation)🚘

Show us a free-association test where, upon prompt by the word “bankruptcy,” the response is “cool” and we’ll show you a PO Box in Wyoming where you can ship us the sh*t you’re smoking. But even the sun shines on a dog’s a$$ some days. Turn on the the tv and the talking heads are blathering on about $HTZ and $VAL and $CHK and $WLL. Open up Twitter and there’s all kinds of chatter about the newly formed Bankruptcy Stocks ETF (Ticker: $EFFED). Just kidding, folks, bankruptcy is everywhere these days but we haven’t hit that level of ludicrousness. Yet.

Still, restructuring pros ARE popular right now. Bask in it because it really is pretty amazing. Think about the things that had to occur to get us to the very point that we are at today … right now … as you read this … wherever the hell you are … which is most assuredly not the office on Park Avenue.

Twelve years ago the world’s financial markets collapsed on account of financial shenanigans encapsulated by an onslaught of acronyms like CMBS and CDO and CDO-squared and the Fed met the challenge with an unprecedented QE push coupled with lower interest rates.

Within a year stocks were firing away again and, frankly, haven’t stopped. When maaaaaaaany years later the Fed attempted to taper and introduce some interest rate discipline — because, like, conventional wisdom of the time was that a healthy economy shouldn’t, like, need zero-level interest rates to function — the market threw a tantrum. The Fed has been handcuffed ever since.

Of course, with interest rates so low it didn’t make sense to save money and bonds showed no yield baby yield so if you’re looking for something to do with your money and earn a return greater than the rate of inflation why not push money into indexes/ETFs? There was no alternative (that is, unless you had access to private equity or venture capital funds). And so people pushed money into these vehicles hand over fist precipitating a need for brokerages to create ever more index/ETF products. Once every possible strategy got covered and there was, like, the “Procure Space” ETF (Ticker: $UFO…we sh*t you not), brokerages had to further differentiate. At that point Robinhood came around and said, “Hey, these brokerage fees are BS. What if we differentiated via a slick mobile app with some solid millennial-friendly UX and offer to effectuate trades for free…brah?” (Sorry but we’re pretty sure the founders had to be high AF when they come up with this idea). And the rest is history. Shortly thereafter, every brokerage under the sun offered free trades.

Except the rest wasn’t history. History wasn’t even getting warmed up yet. Fast forward to when a pandemic struck the world economy, hitting China and Italy hard before moving its way across the globe and descending upon American shores. Not long after, concepts like “social distancing” and “shelter in place” entered the vernacular while millions of people collectively thought “holy sh*t I actually have to … like … spend time with my douchey husband?” and “what are the prison sentences for murdering my own children?” Simultaneously, the Fed undertook an unprecedented monetary accommodation program, flushing money into the system like crazed lunatics, unceremoniously ending their futile attempts to level out rate policy, and hitting the red button with big white lettering “free fall” pushing interest rates to near-zero. The US economy closed, businesses shut, travel ceased, people got stuck at home, and to alleviate the economic pain that this would all cause, the federal government started sending people free money. In some cases, more money than they were making while actually working. Meanwhile, Hollywood stopped making movies and movie theaters closed — along with all other forms of experiential entertainment. Major league sports shut down. Flush with some cash — albeit short-term cash — people needed to find something to do with it. Buying Mac n’ cheese on Amazon lost its appeal after a week. Likewise streaming Ozark and The Office on Netflix ($NFLX).

At the same time, a bunch of companies started going bankrupt. Most of these companies would’ve gone bankrupt regardless but the pandemic provided what we call “COVID Cover.” First Valeritas filed. It had supply chain issues emanating out of the trade war with China (remember when that was a thing?) and COVID was the cherry on top because workers in China couldn’t … well … work. The dominos fell from there. The most painful one’s, as we’ve said before, weren’t on any distressed radars prior to March — like those poor airlines that didn’t get bailed out by their respective governments (Avianca and LATAM). While federal governments could — and in many respects did — provide (practically) no-strings-attached grants to airlines, they couldn’t conjure up people willing to fly. Business travel was dead. Nobody in their right mind was vacationing (if resorts were even open). And so, derivatively, Florida-based Hertz Global Holdings ($HTZ) collapsed into bankruptcy court; its business was far too dependent upon air travel and its airport rental segment.

The Florida bit is important because were Hertz based somewhere else they may not have ended up with White & Case LLP as counsel. And everyone in the bankruptcy business knows that if there is one firm that ain’t afraid of being creative and/or throwing a huge bomb into the ether, it’s White & Case LLP.

All of this lunacy is transpiring and, yet, oddly, the stock market, after only a VERY brief yet brutal dip in March, began firing on all cylinders. “The Fed put” was in play and people saw limited downside and unlimited upside. All of those folks with newfound Fed-provided funds and all of those folks WFH had an epiphany: there are no sports and no casinos and trading is — thanks to Robinhood striking fear into all of the major online brokerages — free. Like everywhere. TD. E*Trade. Fidelity. You name it.

Enter Dave Portnoy, founder of Barstool Sports. He is the perfect mascot for the moment. Plenty of disposable income. No sports to throw it at. And totally authentic about what he does and doesn’t know. Why wouldn’t he open up an e*trade account and mess around in the market and livestream it for his 1.5mm fanboys on Twitter to follow? And why wouldn’t they want to share in the fun and potentially make money? Bloomberg’s Matt Levine calls this the “boredom markets hypotheses” (BMH).

Only, unlike Portnoy, his stans suffer from a liquidity problem. With limited funds — albeit in some cases … thank you Fed … more funds than usual — Barstoolians aren’t exactly going to be buying up shares in Amazon Inc. ($AMZN), trading at $2500/share. Obviously the best way to “play the market” and potentially make money is to buy up cheap stocks and/or pandemic-induced beaten down stocks and hope that one of them ends up crushing it. And as “exaplined” in this video ⬇️, that’s precisely what, at one point (after getting burned by Boeing), Portnoy did:

As more and more people copied, it all became a self-fulfilling prophecy because (a) Portnoy was completely transparent about what he was doing and (b) Robinhood happens to show you what the most popular trades are. And what were they? A bunch of dogsh*t companies — some of which were already in bankruptcy and some of which are no doubt headed there. Nevertheless, the volume was so strong that prices soared. HTZ stock went up like 900% for f*ck’s sake.

Meanwhile, back in bankruptcy court, fights broke out left and right between proposed DIP lenders and (previously) pari passu lenders who were locked out of the dance and forbidden from participating in new DIP loans. Why? Because the rates on these loans were through the roof. J.Crew. J.C. Penney. Neiman Marcus. You name the company and they’re paying through the nose on their DIP facility. Of course lenders wanted in on those fees and those rates. Nothing like double-digit interest rates. Remember: YIELD, BABY, YIELD! Bankruptcy is generally costly: in the age of COVID, however, with DIP facilities at double-digit mid-teens interest rates, it’s gotten even nuttier.

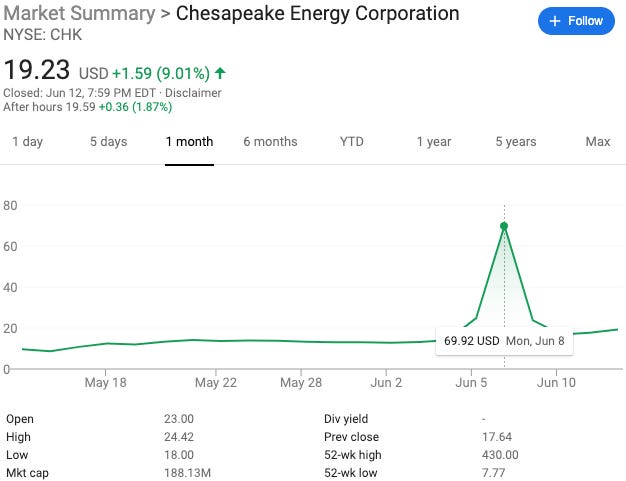

Except these are crazy times and crazy things needn’t be confined to zoom-bombed (virtual) bankruptcy court hearings. The market continued to go berserk and stocks of nearly-bankrupt companies like Chesapeake Energy ($CHK) went from $15 to $70-ish back down to the teens.

That’s a real chart people. And there’s a lot more where that came from.

In the last month people piped into American Airlines ($AAL) (even though one analyst predicted the over-levered airline would dip to $1/share), Luckin Coffee ($LK)(even though the management team got caught engaging in literal fraud), Norwegian Cruise Line ($NCLH)(even though those things are floating petrie dishes), Whiting Petroleum ($WLL)(even though it’s already in bankruptcy and there’s a plan of reorganization on file indicating precisely what equity will get), Oasis Petroleum ($OAS)(even though it’s been well-documented that the company is headed towards chapter 11), Valaris ($VAL) even though it’s currently in the midst of a 30-day grace period for failing to make an interest payment on its debt and, therefore, it’s well-documented that the company is headed towards chapter 11), Callon Petroleum ($CPE)(even though it’s been reported that the company has retained restructuring professionals), Azul Airlines ($AZUL)(even though its debt is well into distressed territory and there hasn’t been much appetite amongst Latin American countries to bail out airlines), AMC Entertainment ($AMC)(even though it’s having liquidity challenges AFTER obtaining a $500mm lifeline, there are no movies to screen, and summer fare like Wonderwoman keeps pushing farther into the calendar) and GNC Holdings Inc. ($GNC)(even though it’s staring down the barrel of a near-term springing maturity).*

Undeterred, barstoolians and others susceptible to BMH, leapt into the breach.

All of which created an opportunity for one of the more ludicrous — albeit creative — maneuvers by a chapter 11 debtor in bankruptcy history. Welcome back Hertz and White & Case LLP.

In a special edition earlier this week, we wrote about Hertz’ emergency motion seeking to enter into an agreement with Jefferies LLC and engage in an at-the-market issuance of authorized-but-unissued equity into this frenzied market. White & Case +bombs = par for the course. We wrote:

Proponents of efficient markets have been apoplectic. None of this makes any sense to them. For good reason.

But you know what does make sense? Basic supply and demand. And if there is enough demand for something as asinine as acquiring a portfolio of HTZ stock and HTZ alone can quench that demand, why wouldn’t and shouldn’t it issue those shares? Isn’t that efficient markets playing out in their harshest and most savage form?Isn’t it more efficient for the debtors to issue more stock than pay some usurious coupon on a DIP credit facility? Why get ripped off by lenders when you can rip off aspirational equityholders?

The HTZ debtors have a duty to maximize the value of their estates.[] To use or sell property of the estate, the debtors merely need to show that the use/sale is an exercise of sound business judgment.

On Friday afternoon, the bankruptcy court for the District of Delaware held a hearing on the motion and Judge Walrath, as predicted, granted the motion on the basis of the business judgment standard. In an article that encapsulates the hearing while also identifying the risks of the court’s ruling, The Wall Street Journal reported:

Hertz Global Holdings Inc. won a bankruptcy judge’s approval to raise up to $1 billion in new equity from a counterintuitive stock rally, a seemingly unprecedented move for a large bankrupt company eager to capitalize on market anomalies.

Judge Mary Walrath of the U.S. Bankruptcy Court in Wilmington, Del., authorized Hertz to seize the opportunity to raise money from a stock market that has shown strong interest in the company’s shares despite its severe financial strain.

With U.S. securities regulators watching, the judge said in a hearing held remotely that Hertz can ask the public to buy shares, supplying money the company needs for its restructuring efforts and won’t have to pay back.

Hertz lawyer Thomas Lauria acknowledged in court the company’s shares “might ultimately be worthless, although it’s impossible to know this as a point of certainty.” As long as the public markets are informed of the risks, Hertz is in compliance with securities laws, he said. (emphasis added)

The Financial Times added:

Tom Lauria, the company’s attorney from firm White & Case, said Hertz may try to tap the market as soon as late Friday or Monday.

At the court hearing, held by video, he acknowledged that while travel had slowly picked up in recent weeks, the trading price of Hertz shares was disconnected from fundamentals.

“New platforms for day traders may be facilitating this,” Mr Lauria said, referring to Robinhood, the stock trading app popular with young retail investors. “There are forces at work that us non-financial people, that we can only observe.”

Whoa boy.

CLEARLY recognizing an opportunity to potentially avoid getting primed by additional senior debt, the official committee of unsecured creditors — which is made up of the likes of the International Brotherhood of Teamsters, the Pension Benefit Guaranty Corp., Sirius XM Radio Inc. ($SIRI), Southwest Airlines Co. ($LUV), U.S. Bank ($USB) and Wells Fargo Bank ($WFC) — fully supported the new equity sale. Uneducated day traders getting screwed over by the unions, a federally chartered corporation, the airlines AND the big banks ALL AT THE SAME TIME…you certainly don’t see THAT every day. 😎

Recall that in our special edition, we also wrote:

And so where does this leave us? It’s not a bankruptcy court’s jurisdiction to protect the Robinhood bros. They’re not parties in interest in the cases. The debtors will likely get authority pursuant to their motion and Jefferies will try and push shares into the market and, in turn, the market will prove whether there’s continued demand. If there’s more demand, the debtors will then have an option to sell more shares on the basis of that demand.[ ]

As to whether there is some mysterious way that the equity ultimately has value in the future? Not to cop out on the question but we simply don’t have enough information to opine on that. Likely, neither do the debtors. Nor the Robinhood traders. Will travel recover? Will the used car market sh*t the bed? In a pandemic, anything goes. And that’s the point of the debtors’ motion and precisely why, all the furor notwithstanding, it actually makes sound business sense for them to move forward with it. (emphasis added)

Clearly Judge Walrath agreed. Per The Financial Times:

“The cost [of equity financing] is significantly less than a loan . . . and the dollars that come in will go to the value of the enterprise as a whole,” said Judge Mary Walrath of the US bankruptcy court in Delaware.

Hertz did a victory lap:

In a statement provided to the Financial Times, the Hertz lawyer, Mr Lauria, said: “Through vigilance and creativity, Hertz has now gotten the opportunity to turn things around a bit. If successful, it may be able to reinforce its balance sheet by actually capitalising on the truly extraordinary set of circumstances that have followed in the wake of Covid-19.”

Similarly, debt holders are happier today than they were even a few days ago. In an article titled, “Bankruptcies Like Hertz Are a Great Investing Opportunity, Hedge Fund Head Says. He’s Not Talking About Its Stock,” Barron’s writes about Avenue Capital Group’s Marc Lasry excitement for distressed debt these days. He, too, is cool again. Why?

Hertz selling shares is better for debtholders, Lasry said. Hertz wouldn’t need to pay interest on the equity the way it would for a debtor in possession, or DIP, loan, he said. “We own bonds and debt, any equity that is put in is beneficial because its always junior to me,” Lasry said. “That means I get paid first.”

Investors in funds like Avenue certainly like to hear that. And, indeed, check out the price action on Hertz’ 6.25% Senior Secured Notes due 10/22 (up 7.8!):

And the 5.5% Senior Notes due 10/24 (up 13!):

And the 8.125% senior notes due 8/26 (up 5.2!):

The equity market was understandably a bit more sanguine:

Just wait until the debt and equity markets start seeing this tactic pulled one after another. Pssst…read the next segment below…

*In truth, retail investors haven’t merely propped up penny stocks. Top trading stocks include Penn National Gaming ($PENN), Moderna Inc. (MRNA) and Tesla Inc. ($TSLA) among many others.

⚡️Update to the Update: GNC Holdings Inc. ⚡️

In an update baked into May 20’s briefing, we noted how GNC Holdings Inc. ($GNC) entered into an agreement with it lenders….

To read this segment, you must be a PETITION Member. And you’re in luck: for one day only, we’re offering a 10% discount on annual Membership. Join our community today!

👍Leverage, Leverage, Leverage👍

Man. Things are wildly uncertain these days and Darwinism is really kicking in. Those with power due to massive scale and leverage are wielding it: sh*t is definitely rolling downstream these days. We appear, as a society, to be well past quaint notions of “relationship maintenance” and “optics.”

Take, for instance, a few different reports that came out this week…

To read this segment, you must be a PETITION Member. And you’re in luck: for one day only, we’re offering a 10% discount on annual Membership. Join our community today!

🍔The Cascading Effects of COVID-19 (Short Bullishness)🍔

Sooooooo…this is a different one. Maines Paper & Food Service Inc. and 12 affiliates (the “debtors”) filed for chapter 11 bankruptcy in the District of Delaware early this week and for a company with a 100-year history — starting with the sale of “nickel candy” to local grocers on through an expansion into fountain supplies, toys and paper products in the 40s and then further expansion into foodservice in the 70s — it seems safe to say the last two years have been as active as any. Indeed, this bankruptcy filing marks the culmination of a two-year roller-coaster process.

Let’s talk about the foodservice business…

To read this segment, you must be a PETITION Member. And you’re in luck: for one day only, we’re offering a 10% discount on annual Membership. Join our community today!

Want to tell us we're morons? Or praise us? Cool, either way: email us at petition@petition11.com

📚Resources📚

We have compiled a list of a$$-kicking resources on the topics of restructuring, tech, finance, investing, and disruption. 💥You can find it here💥.

Nothing in this email is intended to serve as financial or legal advice. Do your own research, you lazy rascals.