💥New Chapter 11 Bankruptcy Filing - Shannon Wind LLC💥

Wind farm spirals from Texas winter storm, filed chapter 11 to pursue a sale

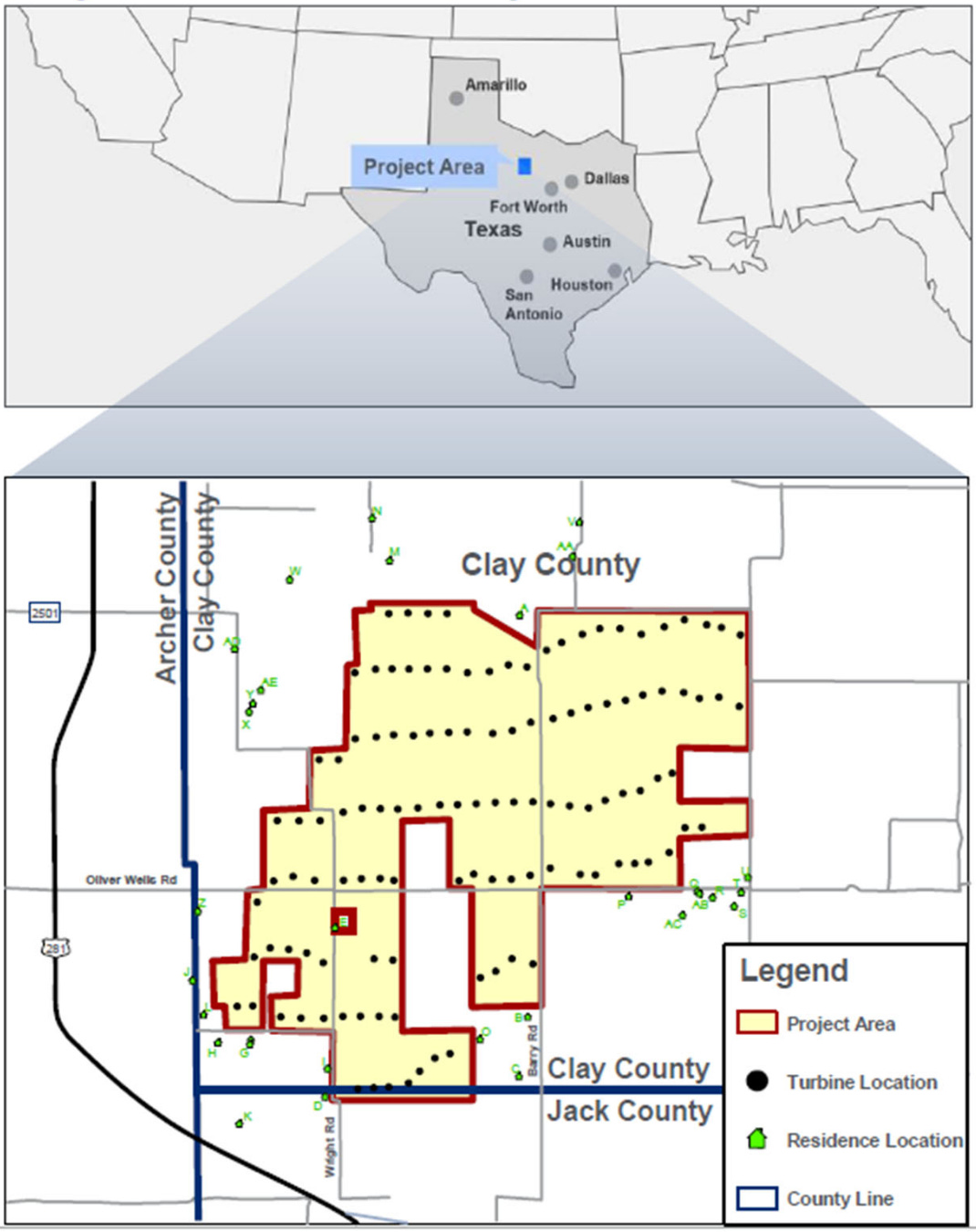

On January 25, 2026, Dallas-based, Lotus Infrastructure Partners (“Lotus”)-owned Shannon Wind, LLC (the “debtor”) filed a chapter 11 sale case in the Southern District of Texas (Judge Perez). The debtor owns a 119-wind-turbine, 204.1 mW wind farm in Clay County, Texas (the “project”). Per CRO, Accordion Partners, LLC (“Accordion”) senior MD, and first day declarant John Shepherd, it’s an ideal spot because North Texas is “… one of the strongest wind resource regions in the United States.”

We’ll take his word for it because Johnny ain’t vacationing in North Texas any time soon.

Anyway, the project began commercial ops in ‘15 and feeds into the Electric Reliability Council of Texas’ (“ERCOT”) grid, which manages power for ~90% of the state’s electric load. Aficionados of sh*tshows will recognize the name from a vintage ‘21 debacle.

Five years later, the show … 😔 … marches on.

But let’s head back to ‘21. That ERCOT debacle is the source of the debtor’s woes too. Tell us about it, Mr. Sheperd:

“In February 2021, during Winter Storm Uri, Texas experienced extreme conditions, including freezing temperatures and dangerous weather, which prompted state and federal disaster declarations and caused widespread power outages. The wind turbines at the Project suffered significant blade icing that impeded energy production during the winter storm.”

Uh-oh, that’s bad. Like nearly all energy producers, the debtor had locked up pricing and delivery obligations via hedges. Here, the counterparty was Citigroup Energy, Inc. (“CEI”), and under the power hedge agreement, the debtor had agreed to sell to CEI “… a fixed quantity of electricity in exchange for a fixed price of $26.20 per megawatt-hour [].” If you’re not producing, you’re not delivering.

Here’s where it goes from bad to unmitigated disaster. Take it away, Mr. Shepherd:

“As a result of the intense storm conditions and widespread outages, ERCOT and the Public Utility Commission of Texas (‘PUCT’) issued orders, the effect of which was to raise the market price of electricity to the regulatory ceiling of $9,000/MWh … [to] incentiviz[e] generators capable of adding supply to do so and large industrial users to reduce their demand …

Because the Debtor was producing little or no energy, it could not fulfill its obligations to deliver electricity at the low, fixed hedge price. Instead, under its hedge agreements, the Debtor was liable to purchase the required electricity at the price that was set at the regulatory ceiling of $9,000/MWh …

Notwithstanding [force majeure] notices from the Debtor … on or around March 11, 2021, CEI issued an invoice to Shannon Wind under the Energy Hedge Agreement – Power in the amount of $39,486,641.34, which was primarily calculated for alleged delivery shortfalls at or by reference to the imposed $9,000/MWh pricing during Winter Storm Uri.”

Here’s a shot of the debtor’s response: