💥Saks: High Fashion, Low Liquidity💥

Plus: Sailormen Inc., Luminar Technologies Inc. ($LAZRQ), and RunItOneTime LLC (a/k/a Maverick Gaming)

We all know what the big story was this past week so let’s just get on with it ….

🛍️New Chapter 11 Bankruptcy Filing - Saks Global Enterprises LLC🛍️

Wowwwwwww. WOW. Johnny just witnessed a public robbery!

Late on January 13, 2026, the “… iconic …, world-famous …” Manhattan-anchored Saks Global Enterprises LLC (“SGE”) and 112 affiliates (collectively, together with SGE, the “debtors” and together with their non-debtor affiliates, the “company”) filed freefall bankruptcy cases in the Southern District of … Texas (Judge Perez).

Presumably the debtors, represented by Willkie Farr & Gallagher LLP (“Willkie”),* chose Texas over a jurisdiction that would actually make sense for the company — like New York or even Delaware — because there’s one thing they could count on there …

… a court that gives absolutely zero f*cks about due process, fairness, or the rule of law … like, again, it bears repeating … Z.E.R.O. F.*.C.K.S … and will not only watch, but actively participate in, brazen theft in front of, what was it again?, 500 people. That’s not an exact count, but there were so many spectators that Judge Perez had to open up Judge Isgur’s conference line after his maxed out at 250.

As you all know, we here at PETITION expect nothing from the Southern District. Still, its bench keeps finding new ways to lower the bar.

So. What happened?

For starters, the January 14, 2026 first-day hearing lasted 7.5 long (and very billable) hours — which, for those keeping count, is roughly two hours longer than the period between the time when the debtors’ filed their credit-agreement-free DIP motion and the start of said hearing.** Beyond that exemplar of due process, 🙄, there were a number of objections including, among others …

📍Service-provider and pref-equity-bagholder Amazon.com Services LLC ($AMZN), represented by Latham & Watkins LLP (“Latham”), which filed a motion to adjourn the DIP prior to the hearing and, when that went nowhere, a DIP objection mid-hearing,

📍Vince brand operater V Opco, LLC and (once-bankrupt) Centric Brands, represented by Ropes & Gray LLP (“R&G”), and

📍Secured creditor Axonic Coinvest II, LP (“Axonic”), represented by Sidley Austin LLP (“Sidley”), which filed its own objection …

… none of which prevented Judge Perez from unabashedly letting an ad hoc group of noteholders (the “ad hoc group”) represented by Paul, Weiss, Rifkind, Wharton & Garrison LLP (“PW”), FTI Consulting, Inc. ($FCN), and Lazard Frères & Co, LLC ($LAZ), walk in, out, and away with the entire house.

That’s what happened, but before we can get to that part of the story, we need to lay the now-nabbed foundation.

A little over a year ago, in December ‘24, this press release 👇 dropped …

… marking the conclusion of SGE’s ~$2.7b acquisition of fellow-luxury-retailers (once-bankrupt) Neiman Marcus (“NM”) and Bergdorf Goodman.

Per CRO Mark Weinsten (of Berkeley Research Group LLC), the combined powerhouse was an instant success (🖕) …

“Following the Acquisition, the Company faced immediate liquidity challenges and the capital structure became unsustainable.”

… that created substantial returns (🖕🖕):

“During the Debtors’ fiscal year ending February 1, 2025—which included the Debtors’ acquisition of Neiman Marcus and Bergdorf Goodman—consolidated total revenue declined by 13.6% year over year, largely driven by lower retail sales across all channels.”

Vendors were, naturally, living the high life …

“… [the debtors’] immediate-term liquidity position … made it difficult for the Company to pay vendors on time.”

… and loving every moment …

“The inability to timely pay vendors exacerbated the payables balance and further strained relations with brand partners. In turn, vendors were less willing to ship goods to the Company, leaving the Company unable to build an adequate amount of seasonal inventory leading into Spring of 2025.”

…. which set the company up for future prosperity:

“Sales performance was also softer than expected in the second quarter of 2025. These headwinds led to an unsustainable level of aged trade payables and related reductions in the availability of goods for sale.”

The deal of a lifetime! Hopefully the then-C-suite, depicted 👇, was handsomely rewarded for their “vision.”

Okay. Enough sarcasm. The acquisition was obviously an unmitigated disaster. But 2Q’25 wrapped over half a year ago, and despite running on fumes back then, the debtors only filed last week. Clearly, they bought time.

Cue the inevitable: a good and proper, intentional pilfering of the capital structure. Or as we’ve all come to know it, a “liability management” exercise (“LME”).

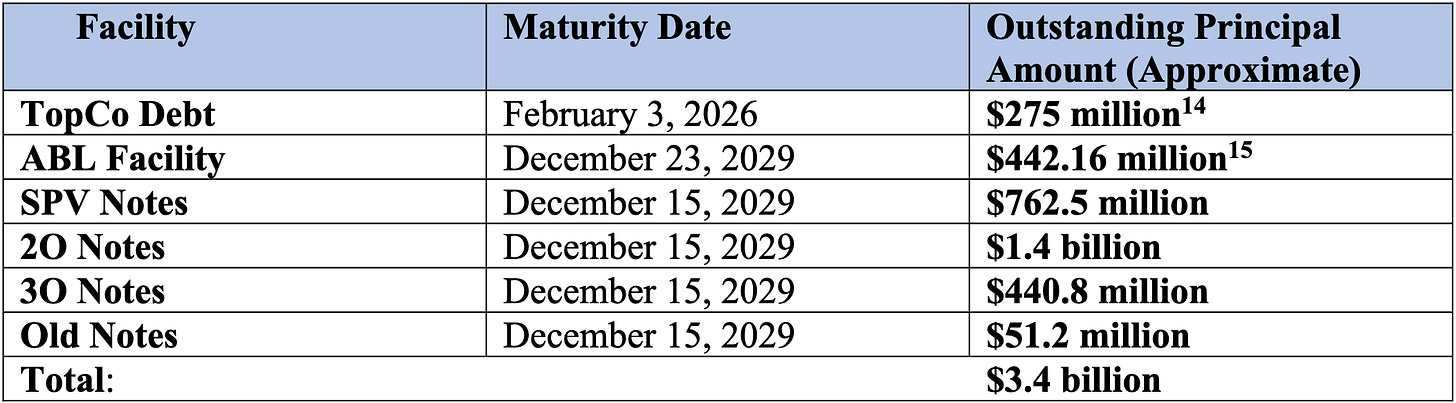

Prior to the LME, the company’s cap stack was dead simple. It owed (i) $275mm to the suckers sellers under the NM acquisition, boxed at parent-level debtors, (ii) some amount under its Bank of America, N.A.-agented ABL revolver, with priority on current assets, and (iii) ~$2.2b under notes (the “old notes”) assumed in connection with the NM acquisition, with priority on everything else.

The notes’ covenants were lax, ergo the LME entry point. SGE created a wholly-owned special-purpose-vehicle, SGUS LLC (“SGUS”), in June ‘25, and in August ‘25, they closed on the LME, under which:

1️⃣ SGUS issued ~$762.5mm in secured notes (the “SPV notes”),

2️⃣ SGE issued ~$1.4b in second-out notes (the “2O notes”) and ~$440.8mm in third-out notes (the “3O notes,” together with the 2O notes and the old notes, the “opco notes”) in exchange for old notes at various prices depending on how early the noteholder tendered, whether it funded the new SPV notes, and, duh/lol, whether it was a member of the ad hoc group,

3️⃣ SGUS on-lent the SPV note proceeds to SGE. $400mm in the form of a first-in, last-out (“FILO”) intercompany loan and $362.5mm in the form of an intercompany on-loan (collectively, the “interco loans”), each of which has payment priority over the opco notes.

In other words, the new financing pushed its way to the top of the non-ABL cap stack.***

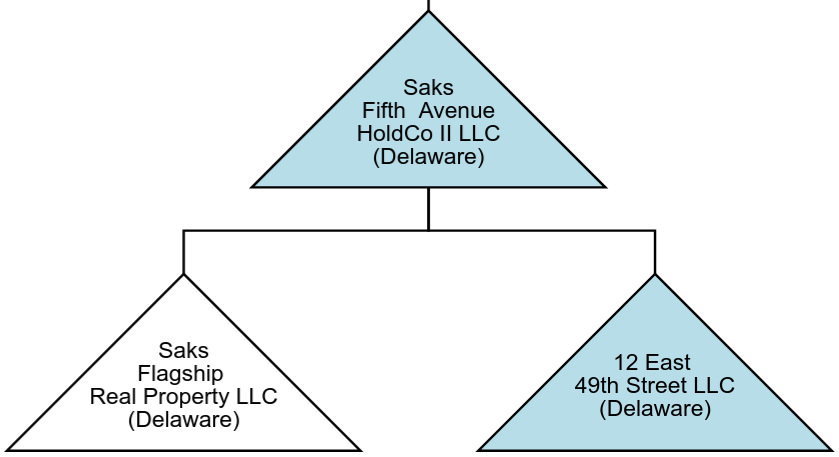

Except at the siloed debtor Saks Fifth Avenue HoldCo II LLC (“holdco II”) and its non-debtor sub Saks Flagship Real Property LLC and debtor sub 12 East 49th Street LLC (collectively, together with holdco II, the “flagship debtors”), which are, respectively, the landlord and tenant of the company’s uber-valuable flagship store at 611 Fifth Ave, NYC. There, the SPV notes only got a guaranty at holdco II, capped at $200mm.

Lo and behold, the LME fixed less than jack sh*t — per Mr. Weinsten, the debtors weren’t able to fully catch up stretched vendors and, after breaching freshly agreed-upon terms with them, “… the benefits of the … vendor paydown were negated.” But hey, professionals got paid.

At least someone did.

The SPV Notes — which carry a juicy 11% interest rate (and were oversubscribed at issuance) — never paid out even a single cent of interest, lol. That’s right: the capital structure plunged deeeeeeeeeeeeep into distress within mere months after the LME got done.

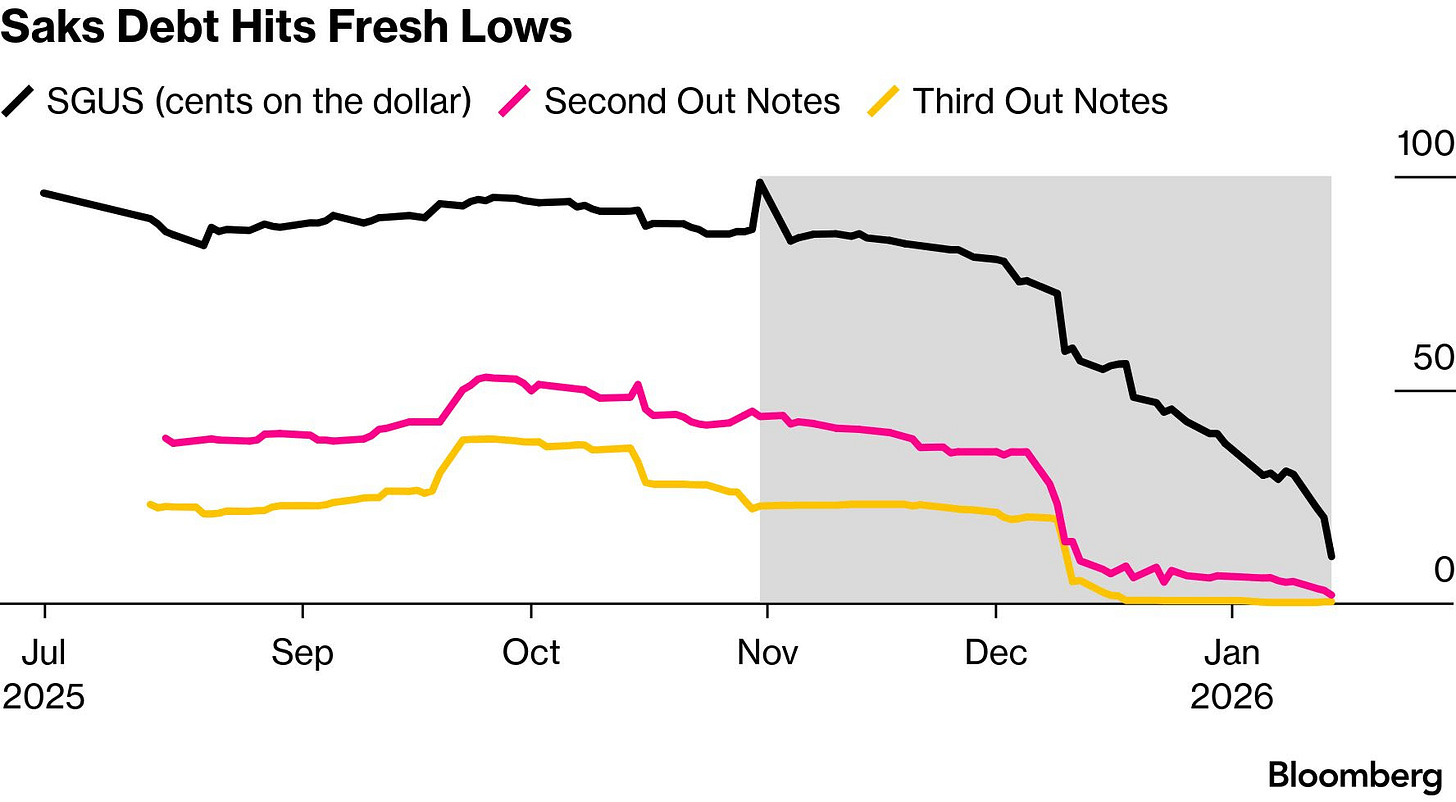

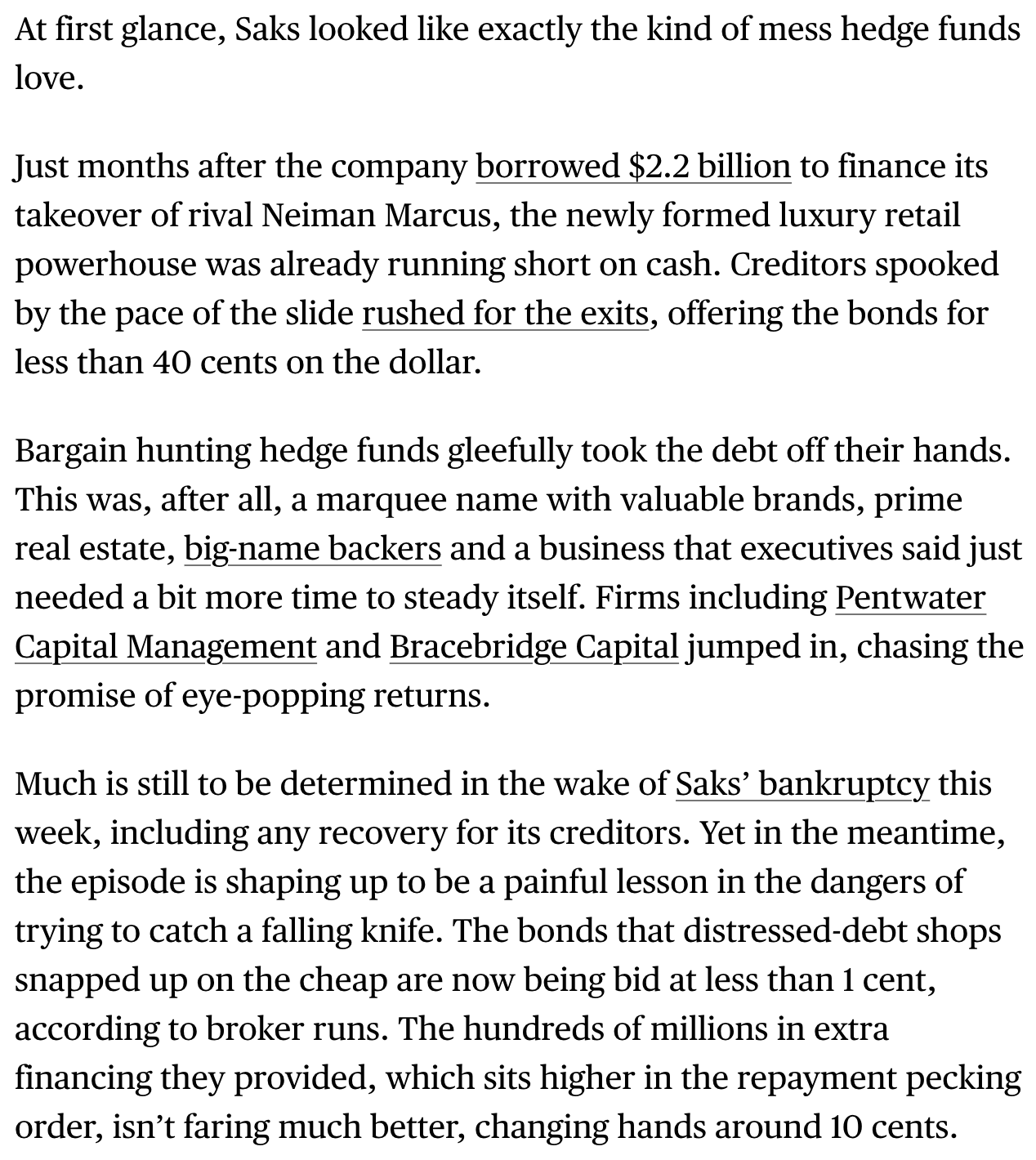

Cue Bloomberg to throw some salt in some deeeeeeeeeeep wounds:

OUCH. At least misery loves company. Remember those vendors? Yeah, they’re also getting f*cked. Big name brands like Chanel, Kering and LVMH now find themselves in the ignominious position of being a top unsecured creditor (owed $136mm, $59.9mm and $26mm, respectively).

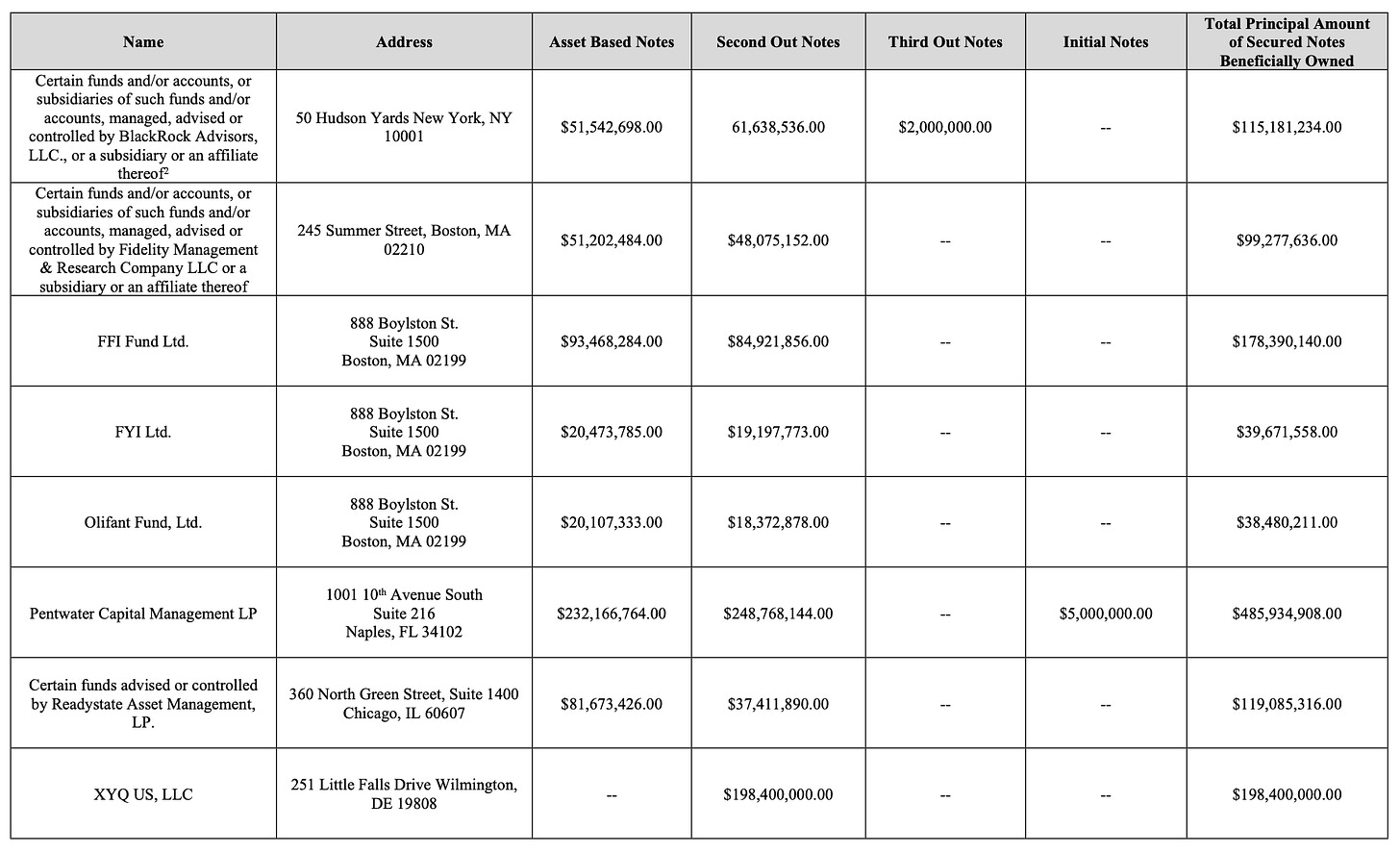

Anyway, with bankruptcy on the horizon, the debtors and the ad hoc group, which holds ~72% of the SPV notes and ~50% of the 2O notes, and is comprised of these funds …

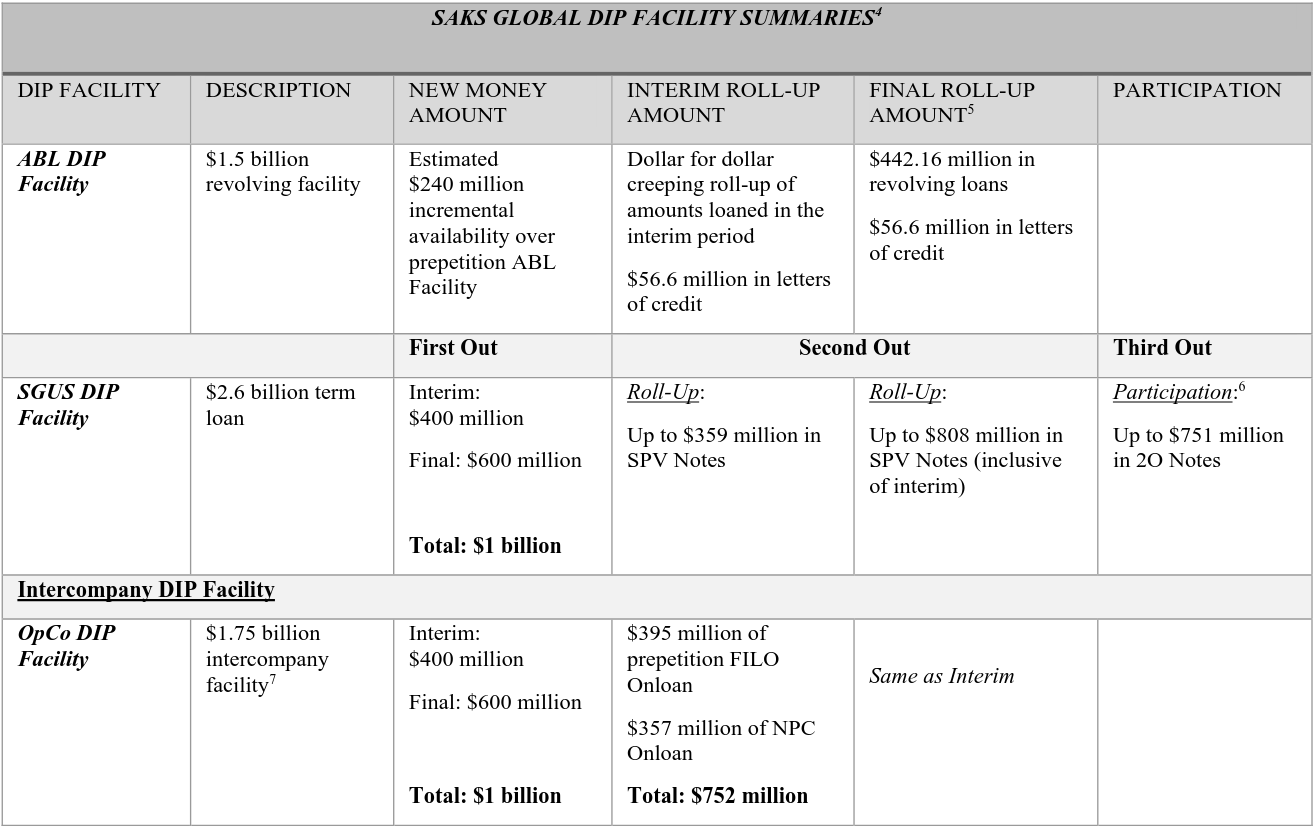

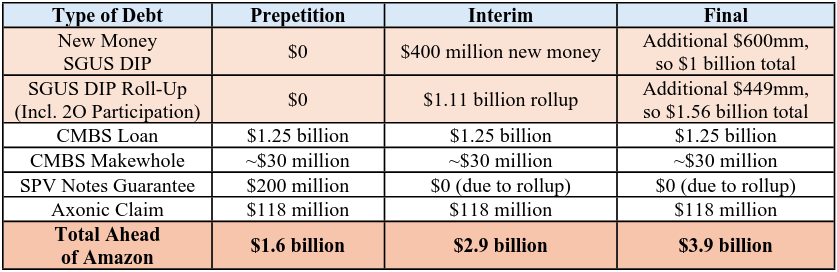

… devised a three-part DIP 👇 to take care of that guaranty “problem” and soak up all of the value there too.****

Let’s pause for a moment. See where the debtors’ chart says “roll-up”? That implies the conversion of prepetition debt into postpetition debt. Which is true for every entity that ain’t a flagship debtor.

For the flagship debtors, it’s “cross-collateralization” AKA pilfering the pockets of holdco II’s unique creditor blend. Latham’s Caroline Reckler and Chris Harris made that exceedingly clear. From Amazon’s objection:*****

“The following table depicts the current and additional liability that would be imposed at HoldCo, on an interim and final basis:”

But it was worse than that. Even the new money was pointless. Holdco II didn’t need an interim DIP. Maybe no DIP at all. Johnny, roll the tape on Mr. Harris’ cross of Mr. Weinsten:

“Mr. Harris: Does holdco II itself have any expenses in the next thirty days?

Mr. Weinsten: Holdco II, I do not believe, has any specific expenses in the next 30 days?

Mr. Harris: How about annually? Does it have any expenses, holdco II?

Mr. Weinsten: I’m not sure…

Mr. Harris: Can you tell the court any specific expenses you know that holdco II has, period?

Mr. Weinsten: I can’t speak to specific expenses of holdco II.”

A few moments later, Mr. Weinsten elaborated:

Mr. Harris: So … and why is holdco II in bankruptcy?

Mr. Weinsten: Holdco II is in bankruptcy because, at the end of the day, we needed to get a DIP. In order to get a DIP, we needed to pledge certain assets, and that was required in order to get the lien to satisfy the DIP lenders.”

Shhhhhhh, 🤫, Mr. Weinsten …

Smash and grabbing holdco II’s assets was, after all, the whole point.

Latham, however, wasn’t the only firm driving that home. In his closing, R&G’s Gregg Galardi concisely conveyed how truly eff’d up it was:

“This [financing] could not be done outside of bankruptcy. It would be a classic fraudulent conveyance. What you are actually asking for, whether this company is solvent or insolvent, is to put on, a separate subsidiary, over $1.5 billion of debt. And what is it getting in exchange? It doesn’t need the cash. It doesn’t need money. It’s not getting reasonably equivalent value … So our objection really is, they haven’t carried their burden to show immediate and irreparable harm.”

Immediate and irreparable harm, Mr. Galardi?

Judge Perez does not give a single sh*t about that.

He didn’t even take a short break before approving the DIP on the spot:

“… a lot of what was discussed today really doesn’t go to the debtors’ burden … to obtain the financing … Based on the evidence, I find that the testimony has been that this is the only actionable DIP …”

… which, um …

Judge Perez knows it too. Anyway, he went on:

“… that the premise that anyone could finance this company without the flagship debtors is just simply not borne out by the facts. So then the question becomes, is that a proper exercise of the debtors’ business judgment?”

We can stop there. It is the S.D. Texas.

Obviously the debtors’ collective business judgment had been satisfied, and therefore, the complicit-as-all-hell court authorized one debtor, having (i) a distinct creditor body, (ii) no cash need, and (iii) no independent decision-makers, to incur a net 1.3 billion dollars of new-to-it, senior liabilities on, effectively, zero notice.****** To grow another $900mm on final.

Like we said, it was a public robbery.

But to offer up a consolation prize, Judge Perez left holdco II’s stakeholders with this:

“I also think that it’s a false narrative to say that the [holdco II] debtors are going to have a $1.5b in additional debt. I mean, they will incur that amount, but they will also have contribution rights from all the other subsidiaries.”

Debtor-on-debtor contribution rights, eh? Ones that sit behind the $2.6b DIP and unrolled prepetition secured debt? Yeah, we know how to value those, judge.

On second thought, we’ll give ‘em 🖕 dollar.

The second day hearing will take place February 13, 2026 at 9am CT. G-d willing, 🙏, a notice of appeal will hit the docket before then.

The debtors are represented by Willkie (Ryan Bennett, Debra Sinclair, Robin Spigel, Allyson Smith, Betsy Feldman, Jessica Graber, Jennifer Hardy) and Haynes & Boone LLP (Kelli Stephenson Norfleet, Kenric Kattner, Arsalan Muhammad, Kourtney Lyda, David Trausch) as legal counsel, Berkeley Research Group LLC (Mark Weinsten) as financial advisor and CRO, and PJT Partners LP ($PJT) (Jamie Baird) as investment banker. Their special committee is composed of Paul Aronzon, William Tracy, and Scott Vogel. The SO5 digital debtors******* are represented by Bradley Arant Boult Cummings LLP (Jarrod Martin, Michael Riordan, James Bailey) as legal counsel and Accordion Partners, LLC (Andrew Hede) as financial advisor and CRO of just the SO5 digital debtors. Their independent director is Gary Begeman. The ad hoc group is represented by PW (Andrew Rosenberg, Robert Britton, Christopher Hopkins, William Clareman, Jeffrey Recher, Paul Paterson, Douglas Keeton, Karen Zeituni, Martin Salvucci) and Porter Hedges LLP (John Higgins, Shane Johnson, Megan Young-John, James Keefe, Joanna Caytas) as legal counsel, FCN as financial advisor, and LAZ as investment banker. U.S. Bank Trust Company, National Association, as DIP term loan agent, is represented by Seward & Kissel LLP (John Ashmead, Ronald Hewitt, Catherine LoTempio) as legal counsel. Bank of America, N.A., as prepetition ABL and DIP agent, is represented by Otterbourg P.C. (Daniel Fiorillo, David Castleman) and Norton Rose Fulbright US LLP (Robert Bruner, Maria Mokrzycka, Tony Gerber, Kristian Gluck) as legal counsel and M3 Partners, LP as financial advisor. Callodine Commercial Finance, LLC, as prepetition SO5 digital debtor agent, is represented by Morgan, Lewis & Bockius LLP (Christopher Carter) and Bracewell LLP (William “Trey” Wood, III) as legal counsel. Amazon is represented by Latham (Caroline Reckler, Christopher Harris, Andrew Sorkin, Michael Reiss, Jonathan Gordon, Beau Parker) as legal counsel. V Opco, LLC and Centric Brands is represented by Ropes & Gray LLP (Gregg Galardi, Michael Wheat). Axonic is represented by Sidley (Ameneh Bordi, Jim Ducayet, Nathan Elner).

*Oh and because debtors’ counsel, Willkie Farr & Gallagher LLP, is also likely still licking its wounds from the last time it FAFO’d in Delaware.

**The debtors filed the DIP credit agreements, an aggregate ~459 pages in length, about twenty minutes before the hearing started.

***The payment priorities of the interco loans vis-a-vis the ABL revolver are squirrelly and depend on the balance of the FILO loan and whether the collateral used to pay it is revolver or notes priority collateral. There are similar-ish dynamics as between the interco loans too.

****The ABL DIP carries interest at term SOFR + 2.75%, the SGUS DIP carries interest at term SOFR + 10-12.5%, depending on the applicable tranche, and the intercompany OpCo DIP carries interest at term SOFR + 10% PIK. The non-ABL DIP fees are also a massive grab: there is (i) a 2% PIK commitment fee, a 10% structuring fee, and an 8% backstop fee on the SGUS DIP and (ii) a 2% PIK commitment fee, a 6% structuring fee, and an 8% backstop fee on the intercompany OpCo DIP. The DIP will be syndicated to other SPV noteholders, again on materailly worse terms.

*****A real estate holdco is a strange place to have vendor claims, right? Amazon’s objection explains too:

“In the months leading up to the Petition Date, the Debtors induced Amazon and other retail partners to extend credit and other accommodations by offering recourse to the purported ‘equity cushion’ in the Debtors’ iconic, Fifth Avenue flagship store …”

AKA credit support for already-stretched vendors.

******Deducting $200mm on account of the prior, already-senior $200mm guaranty.

*******Before we go, there is a set of debtors in the structure — the so-called “SO5 digital debtors” — which operate Sak’s OFF 5TH’s e-commerce business (i.e., the discounted side of the company’s biz). Again, just e-commerce, no brick and mortar. We didn’t have the space to fully address them here, but they (i) are effectively a standalone company, 80% owned by SGE, 20% by outside investors, including Insight Partners, (ii) are separately financed, (iii) are consensually living off cash collateral, (iv) will liquidate unless they find a buyer, and (v) their first-day relief wasn’t controversial.

But the prepetition period was. In mid-December, the SO5 digital debtors’ ABL agent, Citibank, N.A., put a block on the ABL and swept their cash to pay it off. Over $7mm in total. Beyond that, they have a ~$20mm principal-amount term loan agented by Callodine Commercial Finance, LLC. We’ll circle back to them in a future update, but if you’re itching to learn more in the interim, here’s their tailored first day declaration.

💥New Chapter 11 Bankruptcy Filing - Sailormen Inc.💥

On January 15, 2026, FL-based Sailormen Inc., a franchisee of 136 Popeyes restaurants scattered throughout Florida and Georgia,* clearly failed to eat its spinach and therefore filed a chapter 11 bankruptcy case in the Southern District of Florida (Judge Mark). Numbers like these are far from a flex:

Keep reading with a 7-day free trial

Subscribe to PETITION to keep reading this post and get 7 days of free access to the full post archives.

![url_upload_696932ae78e45.gif [add-text output image] url_upload_696932ae78e45.gif [add-text output image]](https://substackcdn.com/image/fetch/$s_!U3LW!,w_1456,c_limit,f_auto,q_auto:good,fl_lossy/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fa6317add-4a64-4edd-8e42-2c15bc7aad30_500x280.gif)