💥¡Qué padre!💥

The Dolphin Compnay, OTB, Liberated Brands, Wellpath + Li-Cycle Holdings Corp ($LICYF) Updates

Jerome POW-ell must be reading Apollo Global Management’s Torsten Sløk because he be dropping the dreaded “s” word.

Simultaneously President Trump be dropping the “f” word.

The Fed surprised nobody — well, maybe other than the President — by keeping the Fed Funds Rate stuck at 4.25-4.5%; it is acting cautiously in the face of a whole bunch of market volatility. Per the FOMC statement:

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. Uncertainty about the economic outlook has increased further. The Committee is attentive to the risks to both sides of its dual mandate and judges that the risks of higher unemployment and higher inflation have risen.

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 4-1/4 to 4-1/2 percent. In considering the extent and timing of additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks.

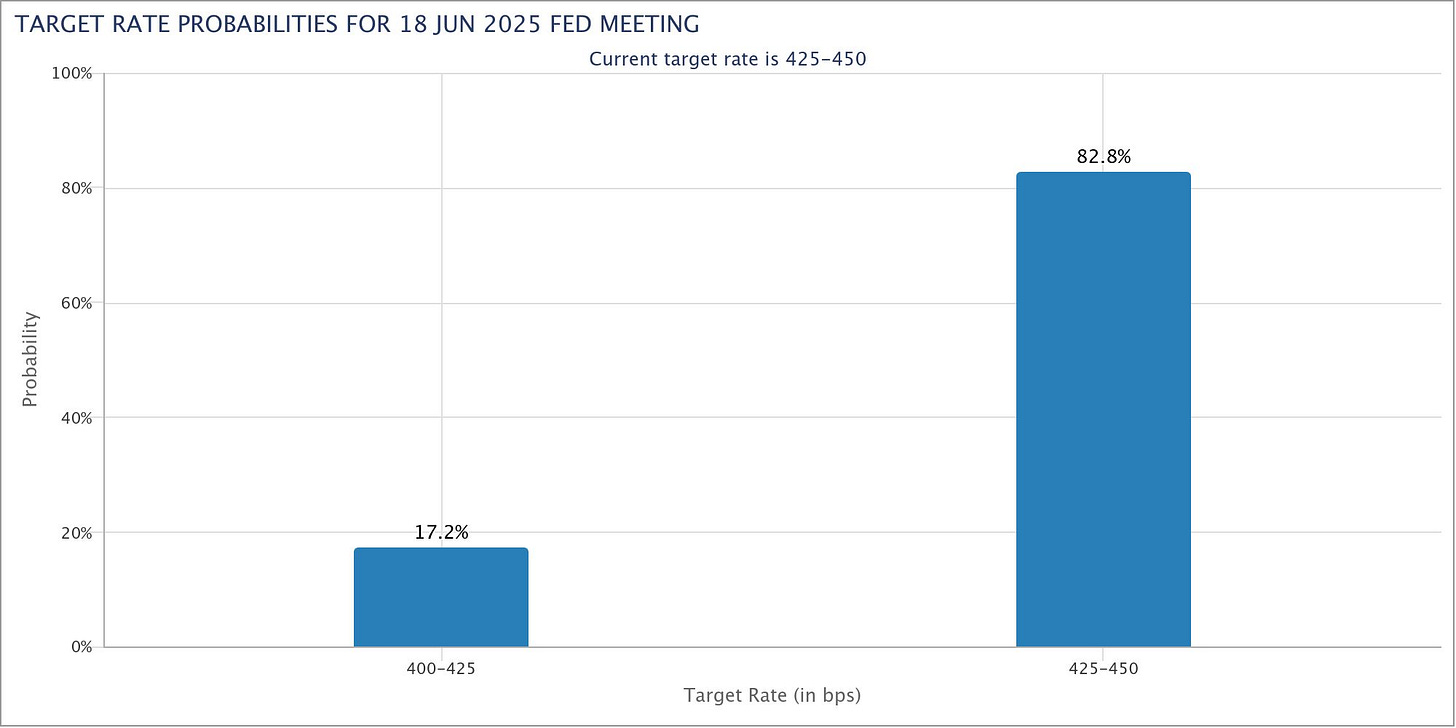

The market doesn’t seem to think the June meeting will be any more eventful:

82.8% probability of a Fed hold! Note that the probability of the target rate being 425-450 by June was merely 26.7% nine months ago and just 65.1% back on May 2, 2025.

Higher for longer, baby.

Enter, once again, a red hot Dr. Sløk, dropping more negative news along with the dumbest graphic of all time:

The US is no longer importing cheap goods from China. As a result, the rest of the world will likely see a significant increase in imports of cheap Chinese goods that China can no longer sell in the US.

This creates a highly unusual macroeconomic situation, with upward pressure on inflation in the US and downward pressure on inflation in Europe, Canada, Australia, and Japan.

The consequence for markets is that rates will be higher in the US and lower in the rest of the world. (emphasis in original)

The question, though, especially with tariffs as an x-factor, is how much longer?

Guess we’ll see.

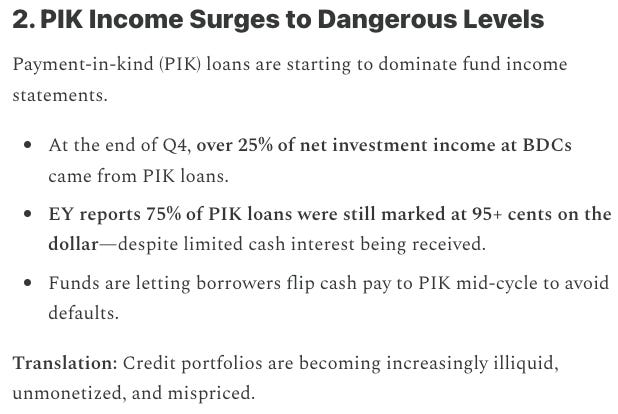

With all of this possibility of “higher for longer,” one thing did catch our eye. Specifically … this 👇:

Riiiiiight … higher for longer ain’t gonna help that.

For now, though, caballeros and caballeras, pour yourself some cerveza and let’s get into some updates.

Keep reading with a 7-day free trial

Subscribe to PETITION to keep reading this post and get 7 days of free access to the full post archives.