🚗New Chapter 11 Bankruptcy Filing - PrimaLend Capital Partners, LP🚗

Yet another auto industry participant files chapter 11

When it rains, it pours. On October 21, 2025, Dallas-based, “buy here, pay here” lender PrimaLend Capital Partners, LP (“PCP”), Good Floor Loans LLC (“GFL”), and LNCMJ Management, LLC (the “Manager” and together with PCP and GFL, the “debtors” and together with their non-debtor affiliates, the “company”) filed what’ll likely be chapter 11 dumpster fires in the Northern District of Texas (Judge Mullin).*

For those of y’all who’ve kept up with your PETITION reading, 🙏, “buy here, pay here” needs no introduction; for the less regular, it means dealerships that both sell vehicles and finance their customers’ acquisitions. This company finances the dealers, making them the most recent auto industry participant to join their brethren … First Brands … Tricolor Holdings … 😮💨, Marelli … in bankruptcy over ‘25.

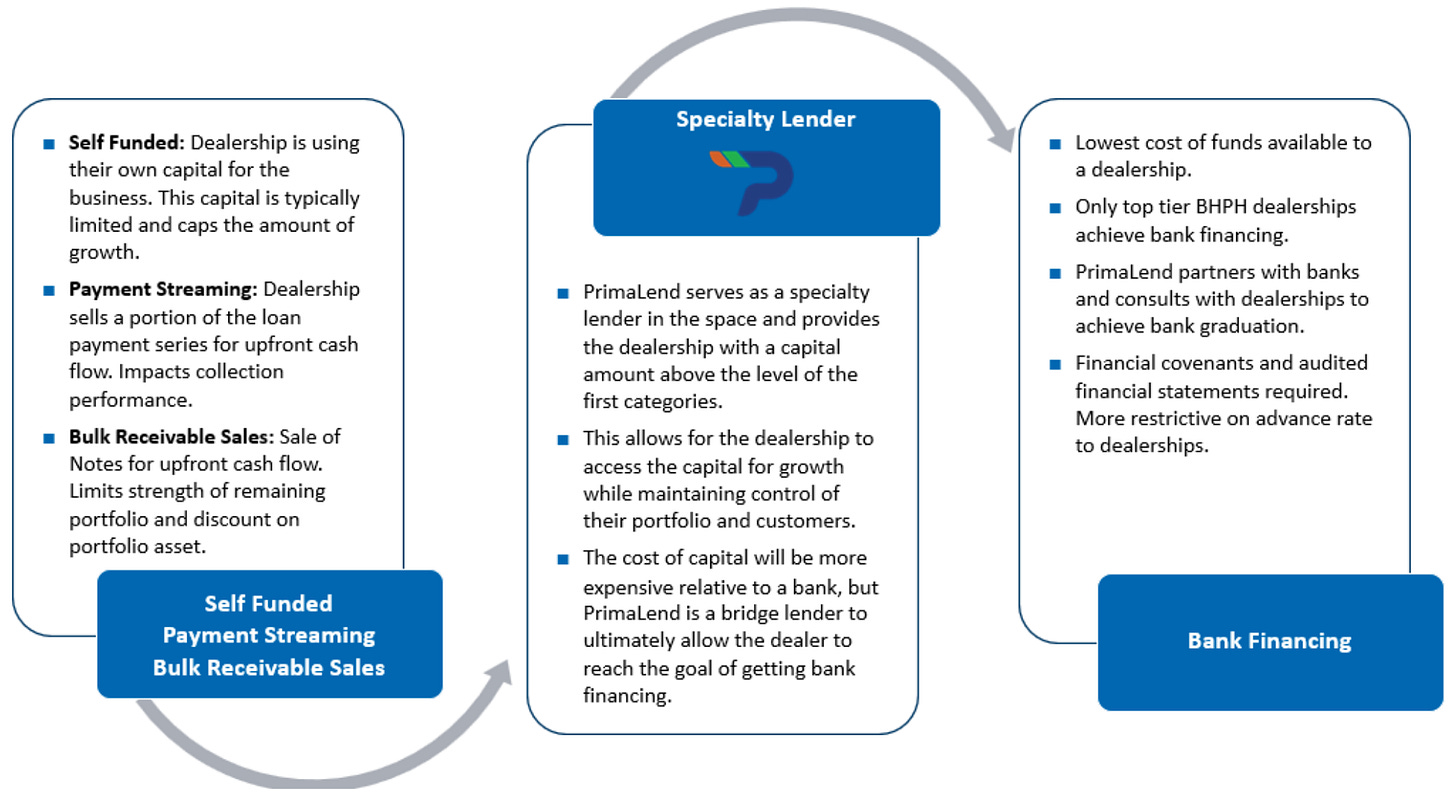

The dealership-finance piece of the industry falls into three buckets. Dealerships have three options: self-fund, use a specialty lender, or borrow from a traditional bank. The last option is the best for the dealership, but it’s hard to qualify, and for the many that don’t, the company steps up, placing it in the second column:

Breaking the biz segments down further, here’s first day declarant and FTI Consulting, Inc. ($FCN) (“FTI”)-provided CRO Tanya Meerovich:

“PCP concentrates its lending practice on loans to BHPH dealers based upon the dealer’s portfolio of RISCs …”

AKA, “retail installment sales contracts,” the docs that govern the consumer payment obligations to the dealership and serves as PCP’s collateral. Ms. Meerovich goes on:

“As of September 30, 2025, the amount of the loans in PCP’s loan portfolio was approximately $233.8 million. The overwhelming majority (90%) of the loans in PCP’s loan portfolio are first-lien revolving lines of credit made to Dealer-Borrowers based upon the Dealer-Borrower’s portfolio of RISCs. PCP’s loan portfolio also contains approximately $23.5 million of subordinated loans to Dealer-Borrowers.”

GFL’s ops ain’t dissimilar, but instead of focusing on RISC portfolios, it “… makes loans to dealers based upon the dealer’s vehicle inventory.” To bring it full circle, let’s go back to Ms. Meerovich one more time:

“When a Dealer-Borrower sells a vehicle it financed on its line of credit with GFL, it borrows money from PCP (pledging the RISC it received related to the sale of the vehicle as collateral to PCP) to pay down the amount the Dealer-Borrower owed to GFL related to the vehicle sold. As of September 30, 2025, the amount of the loans in GFL’s loan portfolio was approximately $24.6 million.”**

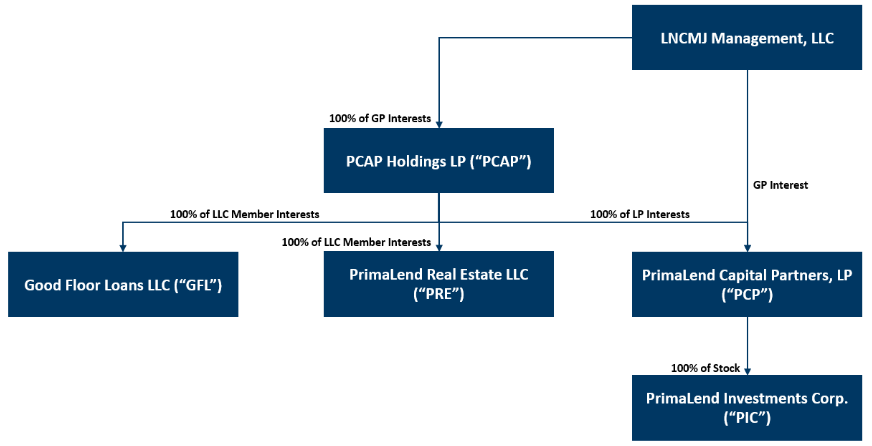

Meanwhile, the Manager’s role is self-explanatory: it, uh, manages the business, aided, since July ‘25, by independent director Matthew Kahn, who takes home a tidy $20k/month and composes its special committee. However, there are more entities comprising the corporate structure:

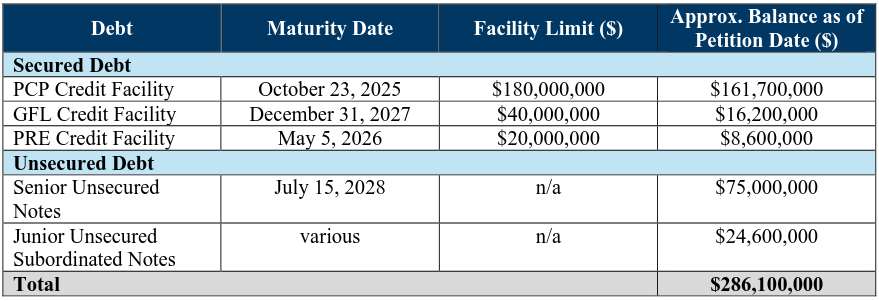

None of which filed.*** That’s part of the clusterf*ckery because here’s the siloed prepetition capital structure:

PCP is liable on the PCP credit facility, and the same is true for (i) GFL on the GFL credit facility and (ii) non-debtor PrimaLend Real Estate LLC (“PRE”), which, as you might guess from the name, finances real estate owned by dealerships (or their affiliates or principals), on the PRE credit facility.****

Except that non-debtor holdco PCAP Holdings LP (“PCAP”) guaranteed all that sh*t too and, in addition, has $75mm of unsecured notes it issued back in July ‘21 before it turned around and lent the proceeds down to PCP ($61.5mm), GFL ($7.5mm), and PRE ($6mm).

Though it did not file.

Monkey business.