💥New Chapter 11 Bankruptcy Filing - Pretium Packaging, L.L.C.💥

Packaging company packages itself into a quickie chapter 11, GUCs to ride through

On January 28, 2026, STL-HQ’d Pretium Packaging, L.L.C. and nine affiliates (collectively, the “debtors” and together with their non-debtor affiliates, the “company”) filed prepackaged chapter 11 cases in the District of New Jersey (Judge Gravelle).*

“Prepackaged” makes sense for these debtors. Founded in ‘92, they design and manufacture rigid packaging — plastic bottles, jars, closures, trays, and “… other …” containers too.

It simply doesn’t get more exciting than this, folks. Just 👀 these fine products:

Okay, maybe this excites only Clearlake Capital Group, L.P. (“Clearlake”). It bought the company in ‘20, by which time, it was already up to its elbows in an acquisition tear.

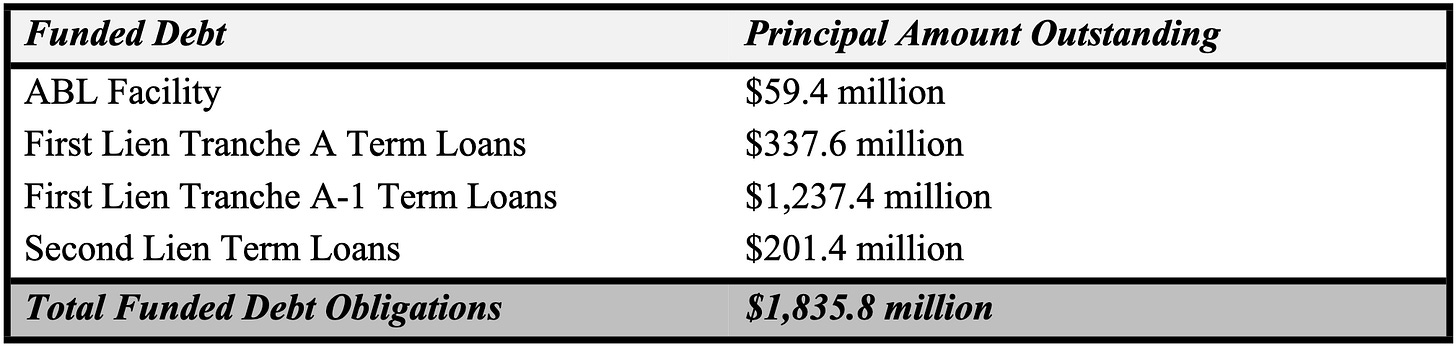

Acquisitions that created a lot of debt. Per CFO Federico Barreto, here’s the petition-date cap stack …

… and here’s a live shot of what is going to happen to the bottom half.

By choice.

Before we turn to that, the debtors are in bankruptcy for all the hallmark reasons that’ve been peddled ad nauseum by management teams for years: (i) a COVID-caused shortage of materials, supply chain disruption, and extended-a$$ lead times which led customers to over-order packaging, (ii) a return to normalized demand in ‘22 and ‘23, resulting in an order-volume decline at the company as customers burned through COVID-era excess inventory, (iii) inflation, and (iv) naturally, a liability management exercise (“LME”).

That last one occurred, consensually, in October ‘23. The company raised $325mm (the first lien tranche A loans ☝️), and 99.8% of legacy term loan holders exchanged into the first lien tranche A-1 loans (the “A-1 loans”) at a 6.4% discount to face. The lingering 0.2% was addressed, and no antics came out of it. Subsequently in ‘24, the company took out some of its second lien term loan at deeply discounted levels.

However, the LME’s additional runway didn’t have much runway.

By the end of January ‘25, the A-1 TL was already pricing distressed; it was the second worst performing leveraged loan the week of January 31, 2025, dipping into the mid-60s. By mid-’25, liquidity was once again a challenge, so — after Clearlake took the uber-aggressive posture of expanding the disqualified lender list to nearly 100 firms affirmatively blocking a third-party from scooping up a meaningful and influential position in the cap stack …

… and plunging the A-1 TL even deeper into distress (low 50s by early June ‘25, sub 40c by October ‘25, etc.) … Clearlake has a HUGE boner for packaging, apparently — the company and its stakeholders gathered back round the table. On December 30, 2025, they arrived at a deal.

What kind of deal? The kind that slashes a whole lot of that LME debt 👆 (and second lien) and is memorialized in a restructuring support agreement (the “RSA”) that carries the support of Clearlake and lenders holding 91%+ of the A-1 loans and 81%+ of the second lien loans. We’d be remiss, however, if we didn’t also point out that while the debt reduction figure is meaningful ($900mm!), the remaining post-reorg debt will also be meaningful. The RSA, which is attached to Mr. Barreto’s declaration, and the corresponding plan and disclosure statement, provide:

📍DIP ABL. The prepetition ABL will roll into a $100mm, SOFR + 3.5% DIP ABL, and on the effective date of the debtors’ plan, will either be paid in full in cash or refinanced.

📍DIP Term Loan. The debtors will raise up to $533.5mm in new money from holders of A-1 loans through a fully-backstopped, syndicated DIP term loan facility, which, under the plan, will roll into a first-lien, first-out exit facility. The DIP term loan carries interest at SOFR + 5.25% and features, to entice lenders to participate and fund their share, a 10% fee, payable in reorg equity and, for backstoppers, another 11.5% fee, also payable in reorg equity, which fees will dilute the plan recovery of A-1 holders (👇).

📍Tranche A Term Loans. The debtors’ ~$337.6mm in tranche A term loans, plus accrued interest and premiums, will be paid in full in cash.

📍Tranche A-1 Term Loans. Under the plan, the A-1 term loans will receive ~$500mm in first-lien, second-out term loans and, prior to the DIP’s dilution, 72.5% of the reorg equity.

📍Second Lien Term Loans. Second lien holders will receive ~$5.7mm in cash and 5.6% of the reorg equity.

📍New Money Investment. Clearlake wants to stay in the packaging game … like we said …

… so it will make a new money investment of $50mm to receive 21.9% of the reorg equity. Normally, we’d expect to see someone b*tch about that — absolute priority and all that — but we doubt it’s going to happen here because …

📍GUCs. GUCs are riding through the bankruptcy entirely.

The court held the first day hearing on January 30, 2026, at which, obviously, all requested relief was granted, and scheduled the second day and confirmation hearing, which should be a total non-event, for February 23, 2026 at 11am ET.

The debtors intend to exit within thirty days of the confirmation date, so we’ll get the clock started on PETITION’s “Two-Year Rule” soon.

The debtors are represented by Kirkland & Ellis LLP (Anup Sathy, Steven Serajeddini, Jordan Elkin, Yusuf Salloum) and Cole Schotz P.C. (Michael Sirota, Warren Usatine, Felice Yudkin) as legal counsel, FTI Consulting, Inc. ($FCN) (Lee Sweigart) as financial advisor, and Evercore Group LLC ($EVR) (Daniel Lakhdhir) as investment banker. An ad hoc group of first lien and second lien holders is represented by Milbank LLP (Evan Fleck, Matthew Brod, Jason Kestecher) and Chiesa Shahinian & Giantomasi PC (Thomas Walsh, Sam Della Fera) as legal counsel and Moelis & Company ($MC) as investment banker. An RSA-supporting minority lender group is represented by Glenn Agre Bergman & Fuentes LLP as legal counsel. Wilmington Savings Fund Society, FSB ($WSFS), as DIP term loan agent, is represented by ArentFox Schiff LLP (Jeffrey Gleit, Matthew Bentley, Justin Kesselman) and Porzio Bromberg & Newman, P.C. (Warren Martin Jr., Christopher Mazza) as legal counsel, while Wells Fargo Bank, National Association ($WFC), as prepetition and DIP ABL agent, is represented by Morgan, Lewis & Bockius LLP (Jennifer Feldsher, Ryan Hibbard, Christopher Carter) as legal counsel.

*We think? The docket and case captions show Judge Gravelle, but Judge Hall signed the first-day orders.

Company Professionals:

Legal: Kirkland & Ellis LLP (Anup Sathy, Steven Serajeddini, Jordan Elkin, Yusuf Salloum) and Cole Schotz P.C. (Michael Sirota, Warren Usatine, Felice Yudkin)

Financial Advisor: FTI Consulting, Inc. ($FCN) (Lee Sweigart)

Investment Banker: Evercore Group LLC ($EVR) (Daniel Lakhdhir)

Claims Agent: Stretto (Click here for free docket access)

Other Parties in Interest:

Ad Hoc Group:

Legal: Milbank LLP (Evan Fleck, Matthew Brod, Jason Kestecher) and Chiesa Shahinian & Giantomasi PC (Thomas Walsh, Sam Della Fera)

Investment Banker: Moelis & Company ($MC)

RSA Party and Minority Lender Group

Legal: Glenn Agre Bergman & Fuentes LLP

DIP Term Loan Agent: Wilmington Savings Fund Society, FSB ($WSFS)

Legal: ArentFox Schiff LLP (Jeffrey Gleit, Matthew Bentley, Justin Kesselman) and Porzio Bromberg & Newman, P.C. (Warren Martin Jr., Christopher Mazza)

Prepetition and DIP ABL Agent: Wells Fargo Bank, National Association ($WFC)

Legal: Morgan, Lewis & Bockius LLP (Jennifer Feldsher, Ryan Hibbard, Christopher Carter)