💥"Efficiency"? Lol.💥

Updates: PosiGen PBC + Leslie’s Inc. ($LESL)

The storm lived up to the hype this past week and the PETITION team has fallen a wee bit behind in its content production schedule. Mostly because Johnny was too busy shoveling snow — not recommended in Lego Brick Clogs by the way — and entertaining school-free kids to get this edition done in time for a standard a$$-kicking Wednesday edition.

But better late than never.

Today we dream of sun and revisit with two names we’ve previously covered ….

⚡Update: PosiGen, PBC⚡

Staying on theme (‘16 vibes") …

… with solar-related bankruptcies …

… let’s check in on the the once-raging dumpster fire(s) of solar energy and energy “efficiency” co. PosiGen, PBC (“PosiGen”), PosiGen Developer LLC (“Developer”), and eight affiliates (collectively, with PosiGen and Developer, the “debtors” and together with their non-debtor subsidiaries, including PosiGen Backleverage, LLC (“Backleverage”), the “company”), which filed on November 24, 2025 in Houston (Judge Lopez residing). We wrote about it in early December ‘25:

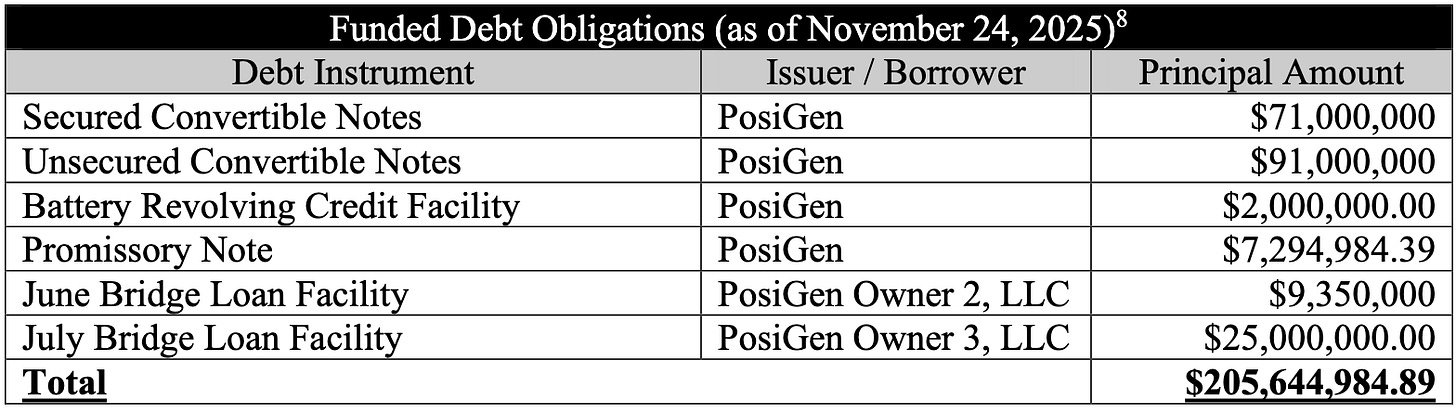

To recap the blaze, (i) in June ‘25, the company asked Backleverage’s lenders under a $600mm 1L term loan, including Brookfield Asset Management (“Brookfield”), for additional cash to build out new solar systems and capture market share considering all their competitors were in bankruptcy, (ii) Brookfield said “hell no,” (iii) the company said “screw you” and did it anyway, using its own working capital to finance development, (iv) feces hit the fan PDQ, (v) causing the company to take on emergency bridge financing …

… and skip an interest payment owing to the lenders, (vi) the company retained counsel (White & Case LLP) and a financial advisor (FTI Consulting, Inc. ($FCN)), who discovered that the new financings violated non-debtor financing and org docs and the company had commingled cash and pledged or sold the same assets to different parties, (vii) in August ‘25, and in response to all that crappola ☝️, Brookfield, through its affiliate-agent BID Administrator LLC (“BID Admin”) declared a default, froze cash, accelerated payment, and exercised proxy rights to install Neal Goldman and take control of Backleverage, hence its non-filer status, (viii) from October to mid-November ‘25, Brookfield funded the debtors under a secured promissory note (listed in the chart above) while they developed a plan to transition Backleverage’s servicing needs from the debtors to Omnidian, Inc. (“Omnidian”), and (ix) on November 13, 2025, Brookfield delivered the final transition plan and a notice of its intent to foreclose on ~75% of the company’s 40k customer contracts, leaving everything else behind.

That last item prompted the debtors to pull the trigger on filing. Purportedly because they and their “… fiduciaries [were] unwilling to disadvantage their other stakeholders for no consideration.”

An ugly lead-up, but at least the debtors had ~$13.4mm in unencumbered cash to fund the cases while they figured out what to do.

Nope, that doesn’t appear to be the case.

On December 9, 2025, the debtors’ own project-company subsidiaries, which sit below Backleverage and are repped by Weil, Gotshal & Manges LLP (“Weil”), sued.* Proxy exercises be a b*tch, amirite? Per the complaint:

“Rather than segregate [] lease and other project-related revenues as they were expressly obligated to do, Defendants instead operated an illicit, unauthorized centralized cash collection system. It is now clear that Defendants systematically deposited revenues belonging to Plaintiffs in an account in the name of the parent company, Defendant PosiGen, PBC …

Remarkably, the Debtors have represented to the Court that they have $13.4 million in’ ‘unencumbered’ cash. This is false. The cash with which the Debtors seek to finance these cases belongs to others, including Plaintiffs.”

But you need not dip into the adversary docket to enjoy the sh*tshow.

The “main” docket has also been one. Objections to cash management and the use of said cash to fund a postpetition KEIP + KERP poured onto it. Filed by agents (here, here, here, here), by subsidiaries (here, here, here, here, here, here), by duped investors (here, here), by the official committee of unsecured creditors (the “UCC”)** (here, here), and by the US trustee (here). Apparently folks don’t like having their cash stolen (🤷♀️)? And to date, there’s not been a final hearing on either motion.***

But there was a … bright? … less dim? … spot. On the same day the Weil complaint dropped, the debtors announced their game plan by filing a combined chapter 11 plan and disclosure statement (as later amended, the “plan/DS”). The idea behind it? Per the first-filed plan/DS:

“The Plan is a liquidating plan. The Consolidated Debtors will transition their servicing operations and provide transition services to participating non-Debtor Project Companies (‘Participating Project Companies’) … The Debtors also intend to sell substantially all of their assets, which primarily include (1) inventory, (2) “work in progress” Solar Systems, and (3) indirect equity interests in Project Companies that own Solar Systems. The Debtors intend to negotiate such a sale transaction with affiliates of Brookfield Asset Management, LLC [] other consenting non-Debtor entities.”

LOL, ain’t that tantamount to Brookfield’s pre-filing intentions? The ones that caused the filing because the debtors and their “… fiduciaries [were] unwilling to disadvantage their other stakeholders for no consideration.”

Indeed. But we’ll circle back to the plan/DS because the hits kept on coming.

On December 16, 2025, Connecticut Green Bank (“CGB”), a lender under the debtors’ revolver, demanded the appointment of a chapter 11 trustee, because, in addition to all the skulduggery above, there were even more games being played. On October 30, 2025, CGB had sued the debtors in Connecticut federal court (the “CT court”) to prevent them from entering into the Brookfield promissory note in the first place. CGB’s argument was simple: the debtors hadn’t obtained its very-required consent.

But the CT court didn’t issue an injunction. Why? Because the now-debtors cried poverty. Here’s their counsel, White & Case LLP, at a November 7, 2025 TRO hearing:

“Without the money -- We don’t have access to any other source of funds, so the alternative is [to] shut down… I can’t play chicken with the life of the company. And I have no reason to believe I have any alternative source of funding.”

Huh? But two weeks later, the debtors had $13.4mm in freely-available cash?

We dunno, y’all. Seemed like Weil might be onto something.

Regardless, CGB ain’t the only party that begged for a trustee. On December 22, List Government Receivables Fund, LLC (“Legalist”), as the Fried, Frank, Harris, Shriver & Jacobson LLP-repped collateral agent to the lenders under the July bridge loan Facility (the “bridge lenders”), filed its own.**** The gist? That in extending the bridge loan, which would be used to fund the development and construction of ~4.7k solar systems, the company agreed to sell said systems to SPV-debtor PosiGen Owner 3, LLC (the “bridge debtor”) to serve as collateral for the loan.

But whoops, in September ‘25, newly-appointed CROs Bob Del Genio and Justin Pugh discovered that ~1.6k of ‘em never made it; the company never executed a bill of sale.

They also, lol, never made it right either. Instead, the company pledged those very same systems to Brookfield to secure its promissory note.*****

The one the CT court declined to TRO. CEO Peter Shaper sure knows how to make a mess.

At least the debtors made headway. On the very same day Legalist made its request, the debtors filed a settlement motion with Brookfield. If approved, under it:

📍The Weil-led adversary proceeding would be adjourned and ultimately dismissed, and Backleverage’s objection to cash management would be withdrawn,

📍The debtors would assist Backleverage in transitioning to new service-provider Omnidian (as, 🙄, Backleverage has been requesting for months and as contemplated by the plan/DS),

📍Brookfield and project company investor G-I Energy Investments, LLC (“G-I”) would fund a $41mm DIP, composed of (i) all project company proceeds received by the debtors, capped at ~$17.7mm,****** (ii) a roll-up of the prepetition promissory notes, and (iii) ~$14.5mm in new money available after transitioning to Omnidian (of which $2mm will be reserved for GUCs, which explains the UCC support). The DIP proposes a 15% PIK interest rate, a 7.5% PIK funding fee, a 7.5% exit fee, and a one-time $100k agency fee and a marketing process for the debtors’ assets, including work-in-progress solar projects and causes of action, but excluding the ambiguously-drafted “… collateral pledged to secure …” the June bridge loan and revolver and the equity interests in the bridge debtor (as well as various pieces of equipment and other undesirable odds and ends) …

📍… For which Brookfield and G-I will credit bid the full DIP amount, and

📍Procedures would be established to settle with parties regarding the completion of debtor-owned projects.

Naturally, there would have been objections — there was already a preliminary one on the docket by December 30, 2025.

Probably because of Judge Lopez. That same day, at a status hearing, he shared his concerns:

“… [I]n terms of kind of where this case is, it screams for mass mediation to kind of resolve the issues, because it seems to me that y’all need to get in front of, like, a Shelley Chapman or someone and just figure this out … I’m thinking about the litigation risks, the appellate risks that are inherent in any … regardless of how I rule on anything, I think this case comes to a screeching halt.”

In other words, afraid the cases would topple under their own weight.

Fair take.

Regardless, crisis averted. In late January ‘26, the debtors brokered a “global” settlement. Naturally, “global” doesn’t mean everyone (🙄). But it includes nearly all. Only the US trustee, with its classic opt-out release objection, East West Bank, a purchaser of tax credits that is still confused as to what the hell happened, and CGB are on the outside looking in.

Anyway, under the deal, per a 583-page January 27 filing, the debtors will transition all their project companies to servicers of the applicable lenders’ choosing and, with Brookfield’s assistance, pay off or enter into agreements with f*cked-over bridge lenders to minimize the harm caused by the debtors’ non-contribution of projects, including establishing a new development company for Brookfield and Legalist to finish off the ~1.6k projects that the latter never received.

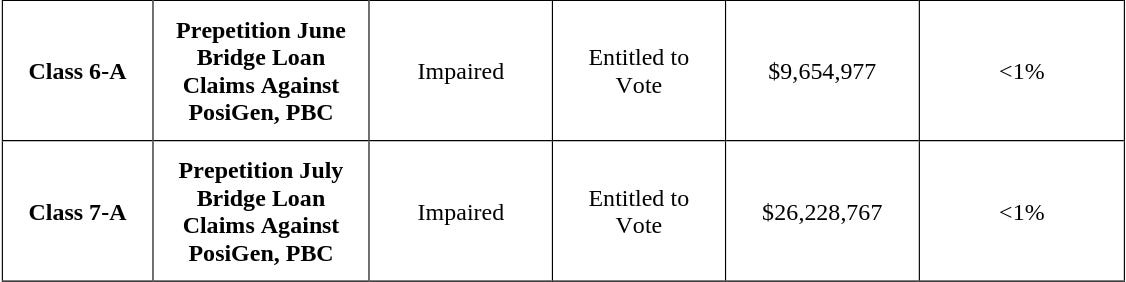

We hope it works out for Legalist and fellow-lender/bag holder ECI 2024-2025 LLC (“ECI”) because their agreed plan recovery, for loans entered into in June and July ‘25, is sad as sh*t. Per the latest version of the plan:

Regardless, a deal is a deal, so on January 26, 2026, the court conditionally approved the DS******* and scheduled confirmation and final approval of the DS for February 23, 2026 at 2pm CT. In the interim, on February 5, 2026 at 1pm CT, the court will take up the settlement, the DIP, the final cash collateral order, the final KEIP and KERP, and, presumably, GCB’s chapter 11 trustee motion.

*The plaintiffs are Rooftop Solar I, LLC, Rooftop Solar II, LLC, Rooftop Solar III, LLC, Rooftop Solar IV, LLC, Rooftop Solar V, LLC, PosiGen Marengo Project Company, LLC, and PosiGen Owner, LLC.

**The UCC is represented by McDermott Will & Schulte LLP (Darren Azman, Nathaniel Allard, Jared Mezzatesta, Joshua Lee) and Pachulski Stang Ziehl & Jones LLP (Michael Warner, Maxim Litvak, Bradford Sandler, Robert Feinstein, Shirley Cho) as legal counsel and Province, LLC (Paul Navid) as financial advisor.

***The court approved a non-insider KERP on December 9, 2025. But with all the disputes about whether the debtors even own the cash sitting in their accounts, would you have been comforted by it? We sure as sh*t wouldn’t be.

****A week later, on December 29, 2025, Legalist filed its own adversary complaint against the debtors for fraudulent inducement, conversion, and declaratory judgment.

*****ECI, the largest lender under the June bridge facility, made a similar assertion – that the systems intended to secure their emergency loan had, in fact, been sold a month earlier in May ‘25.

******Under the later-described settlement, the DIP was upped to $43.9mm, with the proceeds caps being increased to soak up the delta.

*******As of writing, the DS order had not yet landed on the docket.

⚡️Update: Leslie’s Inc. ($LESL)⚡️

Ok, so we were not the only ones dreaming of heading to warmer climes while snowed in earlier this week:

If we, like Senator Ted Cruz, can’t be by a pool somewhere warm, we thought we could at least check in on pool supply retailer Leslie’s Inc. ($LESL) (“Leslie’s” or the “company”), which last month reported 4Q25 (ended 10/4/25). We’ve been covering the company’s sinking performance for a while now:

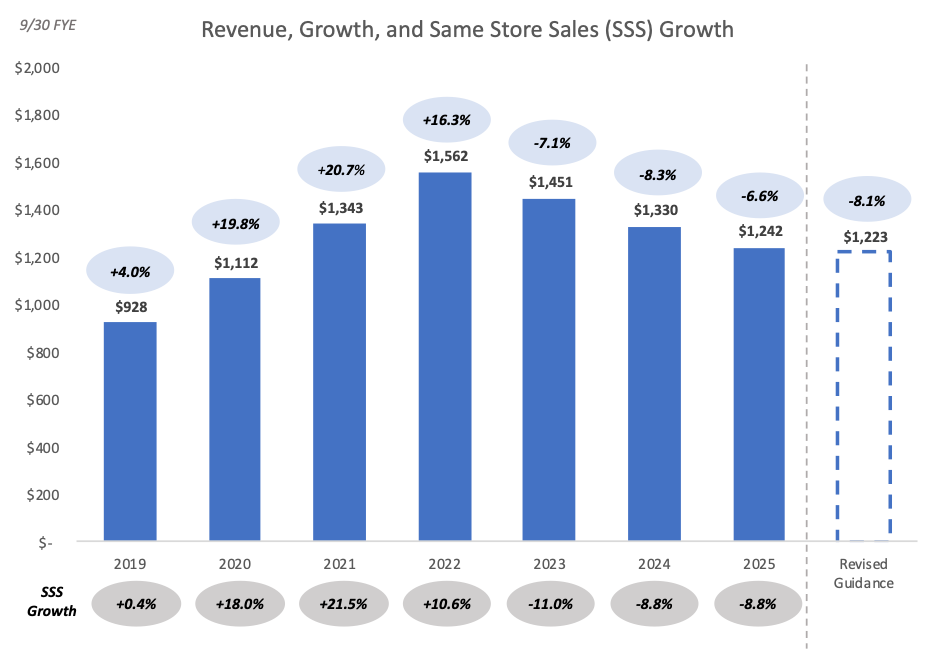

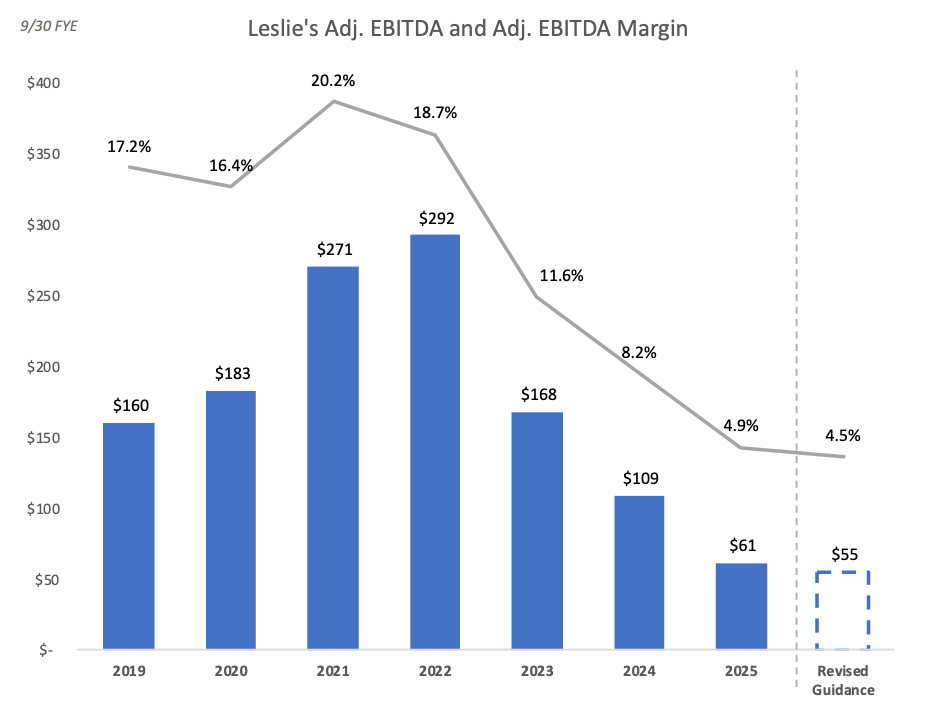

As a refresher, back on August 6, 2025, one month into 4Q and four months into the critical “pool season,” Leslie’s cut its full year revenue guidance by 9% to $1.2b at the midpoint and Adj. EBITDA by 48% to $55mm also at the midpoint.

The company did clear the lowered bar it had set for its 4Q performance. 4Q25 revenue came in at $389mm, down 2% YOY but 5% better than the full year guidance implied. 4Q25 gross margins improved by 260 bps due to favorable vendor rebates and reduced freight costs due to improvements the company has implemented for its distribution network. 4Q25 EBITDA was $45mm, down 5% YOY but 16% above the revised guidance. 4Q25 EBITDA margins improved 80bps YOY, as improvements in gross margins were partially offset by higher labor costs. Leslie’s increased store staffing levels to ensure they were adequately staffed during peak selling times, reversing a decision they made during 3Q to reduce labor hours because of lower traffic and demand.

After blaming bad weather for bad performance for most of the year, management offered a bit more insight into why Leslie’s had underperformed its initial expectations and the rest of the industry on the 4Q earnings call:

“As we look at the past at Leslie’s, we’ve experienced market share loss, and the main driver is price-value challenge on some of our key items. In specific national research we’ve conducted, we’ve found that pricing on our key items was often out of step with our competitors.

And as the customer environment continues to be more value-focused during these macroeconomic conditions, it is critical that we act and invest in our customer value proposition. While we believe the weather was also a factor leading to our softer sales, our price-value equation has been a major contributor to a net loss of over 160,000 residential customers this year and a decline in residential traffic in 2025 of 8.6%. Key value item pricing sets price-value perception with our customer, and we need to improve here.”

In short, the prices were just too damn high, and many customers naturally went elsewhere. It probably didn’t help that the customers who did still come in found the stores understaffed when they got there, 🤷♀️.

The result: FY25 revenue was down 7% YOY to $1.2b. FY25 gross margins stayed relatively stable, contracting only 40 bps YOY to 35.4%, but FY25 Adj. EBITDA fell 44% YOY to $61mm with margins contracting 320 bps YOY to 4.9%.

With the 4Q earnings release, Leslie’s announced that it would close 80-90 underperforming stores out of 950+, as well as one of six distribution centers, by the end of 1Q26. CEO Jason McDonnell and new CFO Jeff White (as of September ’25) provided more detail on the company’s turnaround plans on the 4Q earnings call. In addition to closing stores and a distribution center, Leslie’s plans to adjust its pricing strategy, continue to reduce inventory levels by a further 10%, cut more than 2k SKUs, renegotiate all of its major contracts, and review non-core assets. They estimate that these initiatives will reduce costs by $7-12mm per annum and be fully implemented in the first half of FY26.

Leslie’s offered the following guidance for FY26, noting that the majority of sales and earnings will be back-end loaded due to seasonality.

Leslie’s FCF for FY25 was ($17mm) compared to $60mm in FY24 due to declining cash flow from operations and despite cutting CapEx in half from $47mm to $25mm. Leslie’s ended the year with $64mm of cash on hand and $168mm of ABL revolver availability (undrawn except for $12mm of LCs). Leslie’s $250mm ABL revolver (S+125-175) has a springing maturity and is due three months inside of its term loan due March ‘28. The senior secured term loan (S+250-275) due March ’28 has $757mm outstanding. With the decline in cash and EBITDA, Leslie’s gross and net leverage have shot up to 12.3x and 11.3x, respectively. Last we checked the TL was sitting not-so-pretty at around 46c on the dollar with a YTW of 46%, 😬.

The stock, therefore, keeps getting hammered as well. There was a tiny blip in December ’25 on the day of the could’ve-been-worse 4Q earnings report, but the stock has fallen by half since then.

There is no near-term maturity for Leslie’s, nor is it likely to breach (or even test) its springing 1.0x minimum fixed charge coverage ratio covenant. However, management repeatedly noted on the 4Q earnings call the urgency with which they were approaching this turnaround.

To that end, the company appointed John Hartmann as an independent director on January 7, 2026. Hartmann has spent a lot of time with companies in need — including some associated with Kirkland & Ellis LLP (hint, hint). He was most recently CEO of Ascend Wellness Holdings ($AAWH) (“Ascend”) and before that, COO of Bed Bath & Beyond ($BBBY); he was also previously on the board of Franchise Resource Group.

Something tells us there’s an out of court solution here but we, like Mr. Hartmann, will be monitoring go-forward performance very closely.

📚Resources📚

We have compiled a list of a$$-kicking resources on the topics of restructuring, tech, finance, investing, and disruption. 💥You can find it here💥.

📤 Notice📤

Alexandra Rahn (Associate) joined Thompson Coburn LLP from Gutnicki LLP.

Jochen Schmitz (Managing Director) joined Lincoln International from Greenhill & Co.

Justin Winerman (Partner) joined BCLP (a/k/a Bryan Cave Leighton Paisner LLP) from Skadden Arps Slate Meagher & Flom LLP.

Max Freedman (Associate) joined Willkie Farr & Gallagher LLP from Kirkland & Ellis LLP.

🍾Congratulations to…🍾

Joseph Goldschmid on his promotion to Partner & Portfolio Manager at Oak Hill Advisors.

Justin Cunningham on his promotion to Counsel at Milbank LLP.

Manpreet Khehra on her promotion to Counsel at Milbank LLP.

Ryan Moon on his promotion to Director at Perella Weinberg.

Tess Cross on her promotion to Director at Monroe Capital LLC.

Cole Schotz, P.C. (Justin Alberto, Patrick Reilley, Jack Dougherty, Carol Thompson) for securing the legal mandate on behalf of the official committee of unsecured creditors in the Apple Tree Life Science, Inc. chapter 11 bankruptcy cases.

Novo Advisors LLC (Claudia Springer) for securing the financial advisor mandate on behalf of the official committee of unsecured creditors in the Conscious Content Media, Inc. d/b/a Begin chapter 11 bankruptcy cases.